Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Dec, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

As the world prepares to enter the third year of the coronavirus pandemic, market participants are trying to gauge the short- and long-term effects on the global economy and credit markets.

In the face of uncertainties from the omicron variant and geopolitical, supply chain, price, and inflationary pressures, the market is inundated with questions about what 2022 will bring. Can corporate defaults stay low? Is there a real estate reckoning on the doorstep? Will decentralized finance destabilize financial markets, or will cryptocurrency assets bring forth a market evolution? How will climate policies accelerate change toward achieving net-zero?

What’s evident is that the global economy is entering 2022 with strength, according to S&P Global Ratings’ credit and economic outlooks for next year.

While the pandemic and its aftershocks will remain pivotal to credit prospects, global credit momentum is likely to remain positive. Similarly, while the world is still far from normal macro-credit conditions, global economic growth is returning to a more sustainable pace.

Globally, persistent high inflation poses the strongest risk to both credit and macroeconomic conditions for 2022, according to the outlooks.

“We enter 2022 with largely positive credit momentum, reflecting favorable financing conditions and a powerful economic recovery,” Alexandra Dimitrijevic, managing director and global head of analytical research and development at S&P Global Ratings, said in her team’s global credit outlook for next year. “This could be derailed if persistently high inflation pushes central banks to aggressively tighten monetary policy, triggering significant market volatility and repricing risks.”

“On policy, central banks in key emerging markets are hiking rates, some aggressively; more recently, those in advanced countries are hiking as well, with the Fed and ECB still on hold. Our GDP growth forecasts are broadly unchanged with the U.S. and eurozone hitting multi-decade highs; China has slowed to below 5% as the government prioritizes financial stability,” Paul Gruenwald, S&P Global Ratings’ chief global economist, said in S&P Global Economics’ 2022 outlook. “Persistent high inflation requiring an unanticipated policy adjustment is now the main macro risk for 2022. China's growth path remains our key risk for the next few years.”

Borrowers in the Asia-Pacific region face primary risks from the omicron variant, inflation, and China’s recent real estate defaults, according to the credit outlook. S&P Global Economics believes “the region's vaccination coverage and economic reopening have just recently reached levels that can sustain a recovery that has faltered all year” due to the policies that have prompted the region to underperform the rest of the world.

Of all regions, credit conditions in emerging market economies (EMs) face the greatest risk from higher inflation. As uneven recoveries have unfurled across core emerging markets in the past year, some are stronger than others. S&P Global Economics lowered its growth forecast for EMs, excluding China and India, by 0.1 percentage point from its previous forecast, to 3.5% for 2022. Latin-American economies, many of which are emerging markets, will likely face higher interest rates due to higher inflation.

If European economies can weather cost pressures, monetary policy tightening, and a fourth COVID-19 wave, borrowers in the region are expected to largely enjoy positive credit conditions next year on the back of strong demand and employment. While the eurozone is likely to maintain pre-pandemic levels of activity during the final quarter of this year, rising coronavirus cases could slow the eurozone’s consumption recovery and have resulted in S&P Global Economics’ lowering its 2022 growth outlook by 0.1%, to 4.4%, for 2022. The U.K.’s economic recovery is expected to catapult the country back to pre-pandemic levels in the first quarter of next year alongside high but decelerated GDP growth.

In North America, looming risks from stronger and longer inflation, and supply-chain pressures could threaten largely favorable credit conditions next year. S&P Global Economics lowered its 2022 growth outlook for the U.S. to 3.9% for 2022, from its previous projection of 4.1%, due primarily to the implications of the country’s supply chain disruptions. Comparatively, Canada is likely to enjoy above-potential but still-decreased growth of 3.7% next year, lowered by 0.1% from S&P Global Economics’ previous forecast.

“New COVID-19 variants could also undermine confidence and recovery prospects,” Ms. Dimitrijevic said. “The weakest areas of credit markets—often still highly sensitive to the ongoing impact of the pandemic—are most exposed, particularly highly leveraged corporates and some emerging markets.”

“The global economy is in the midst of a robust but uneven rebound from the pandemic, with demand growth outrunning supply growth and inflation rising quickly almost everywhere,” Mr. Gruenwald said. “COVID-19 is still with us, but the economic impact of the virus is weakening, at least for now. The new omicron variant is a wildcard at this juncture.”

Today is Wednesday, December 8, 2021, and here is today’s essential intelligence.

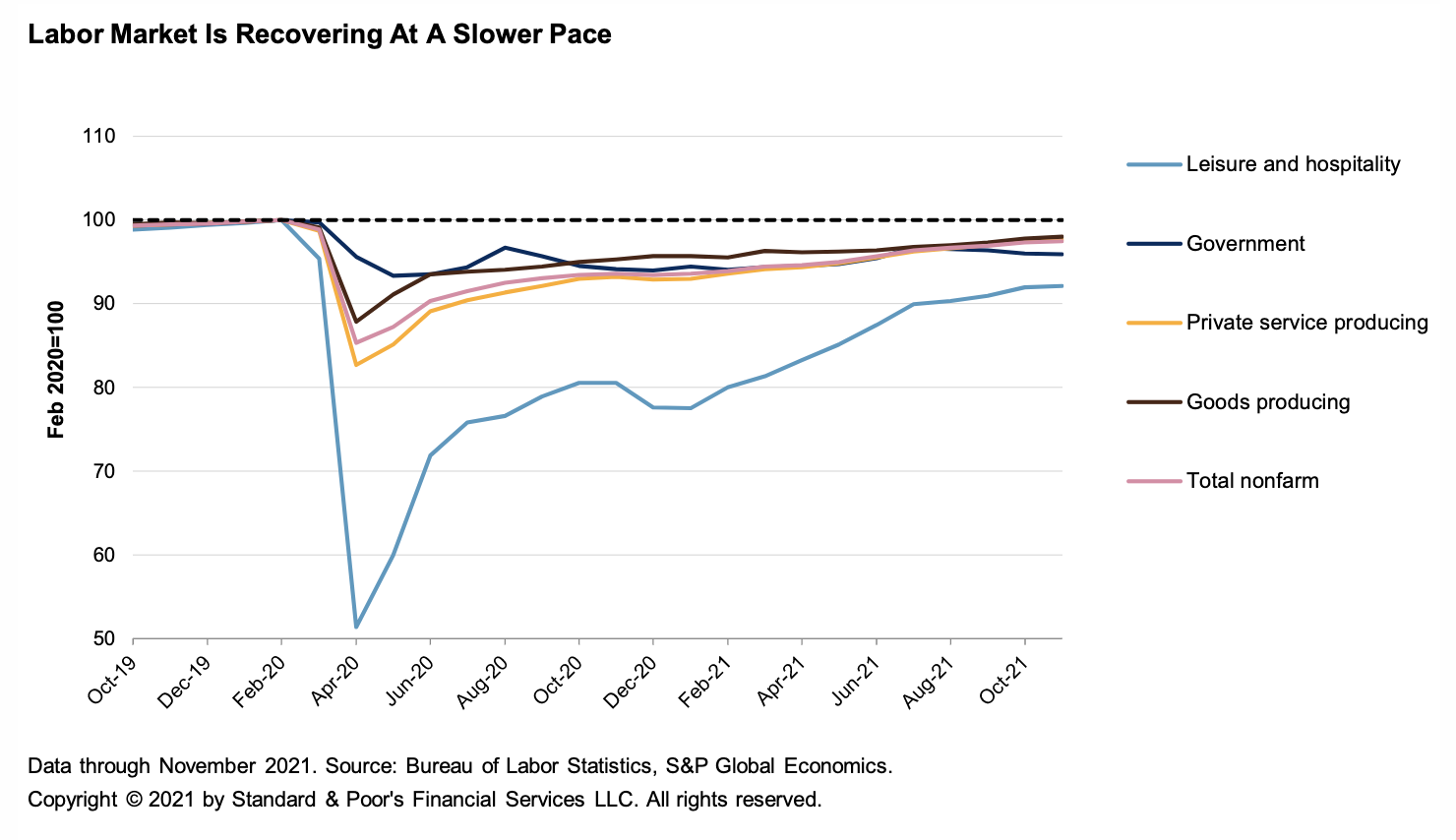

Economic Research: U.S. Biweekly Economic Roundup: A "Half-Full" Jobs Report As Consumers Feel Inflation Pain

The disappointing job gains of just 210,000 in November indicate the labor market is recovering at a slower pace. And although wages are climbing, inflation is eating into households' purchasing power. One bright spot in the November jobs report was that the unemployment rate fell to 4.2% from 4.6%, closer to its pre-pandemic rate.

—Read the full article from S&P Global Ratings

Economic Research: What Is Lost If The U.S. Government Shuts Down In December

S&P Global Ratings estimates a U.S. government shutdown may cost real fourth-quarter GDP growth around $1.8 billion (annualized), or 0.11 percentage points, for every week the government is closed. The shutdown would add to fourth-quarter inflation, which is currently skyrocketing, giving the Federal Reserve another headache to contend with.

—Read the full article from S&P Global Ratings

South Korea's Jet Fuel Demand Recovery May Halt Dec-Jan As Flights Seen Below 10,000/Month

The number of flights, both arriving at and departing from, South Korea's Incheon International Airport could drop during December 2021-January 2022 as Seoul tightens travel restrictions amid fears over the new omicron coronavirus variant, putting the brakes on the country's recent jet fuel demand recovery trend, airline industry sources and oil market participants said.

—Read the full article from S&P Global Platts

Saudi Arabia, Nigeria, Kyrgyzstan Seek Investors To Develop Their Mining GDP

Saudi Arabia, Nigeria, and Kyrgyzstan are seeking new investors to develop their mining GDP, government representatives told the Mines and Money conference in London this week. Saudi Arabia and Nigeria, which both aim to use mining to reduce their economic dependence on oil, plan to proceed with a program of auctions of mineral deposits in the near future; and in the case of Nigeria next year, they said.

—Read the full article from S&P Global Platts

Amazon, E-Commerce Retailers Gear Up To Combat More Inflation In 2022

While the largest retailers were able to provide a hedge against higher prices in the fourth quarter in part by stockpiling high-demand items ahead of holiday sales, market economists say labor and supply-chain constraints are unlikely to abate soon, indicating rising costs will continue into next year. Facing margin pressure, retailers are expected to navigate a challenging environment by reducing supply-chain inefficiencies, selling higher-margin goods, and passing some costs on to consumers.

—Read the full article from S&P Global Market Intelligence

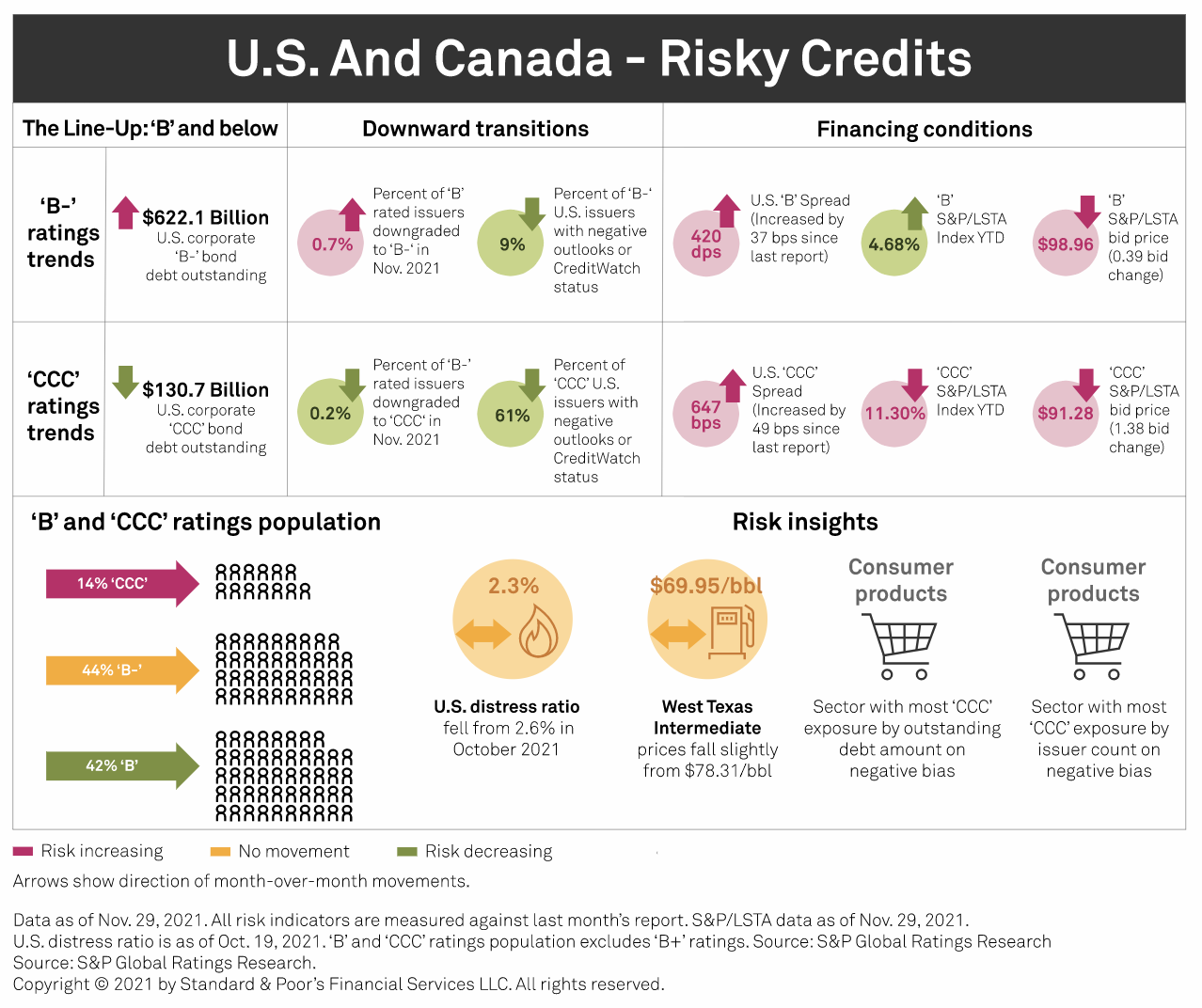

Credit Trends: Risky Credits: Risks Increase For North American 'CCC' And Below Issuers

Despite slowing over the last two months, bond issuance levels remained strong in November for the lower rating categories compared to the same period last year as U.S. speculative-grade bond and loan issuance topped $1 trillion for the first time.

—Read the full article from S&P Global Ratings

Inflation Lifted Gold Prices, But The Party May Be Over Soon

With inflation hitting multi-decade highs this year, investors have started to reconsider gold as an inflation hedge, and some analysts have boosted their near-term forecasts on the back of rising prices. But the supply shocks and shipping bottlenecks that drove up prices are expected to fade in 2022.

—Read the full article from S&P Global Market Intelligence

Omicron Variant, Inflation Talk Put Damper On Insurance Stocks, Broader Market

The S&P 500 Insurance index fell almost 2.5% on Nov. 30 as the variant spread from South Africa to North America. The first confirmed omicron case in the U.S. was recorded in California the following day. Stocks also reacted negatively after Moderna Inc. CEO Stéphane Bancel in an interview with the Financial Times said he expects a "material drop" in vaccine effectiveness against the variant.

—Read the full article from S&P Global Market Intelligence

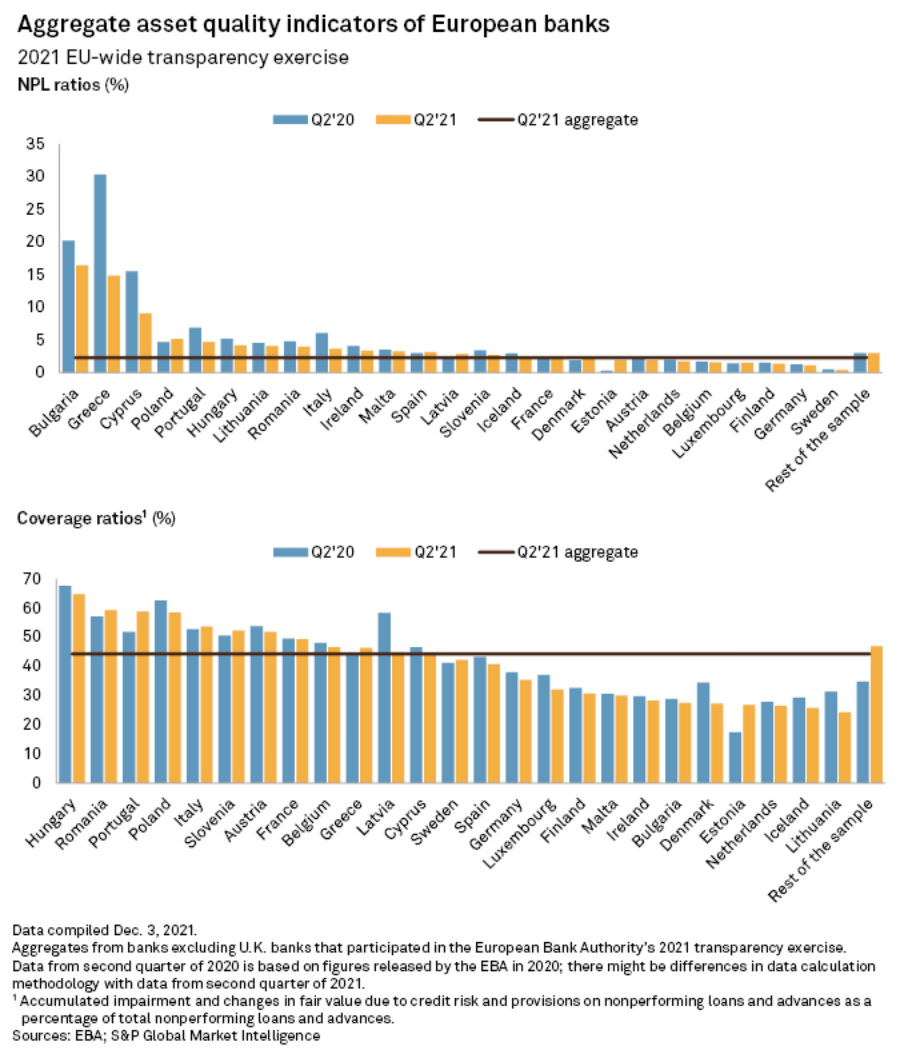

European Banks Record 'Material' Rise In Problem Loans For Pandemic-Hit Sectors

As Europe's banking sector records a significant reduction in problem loans, the European Banking Authority has raised concerns over banks' exposure to hospitality and leisure-related sectors, where nonperforming loan ratios are on the rise. European banks' average NPL ratio decreased to 2.3% at the end of the second quarter from 2.9% a year earlier.

—Read the full article from S&P Global Market Intelligence

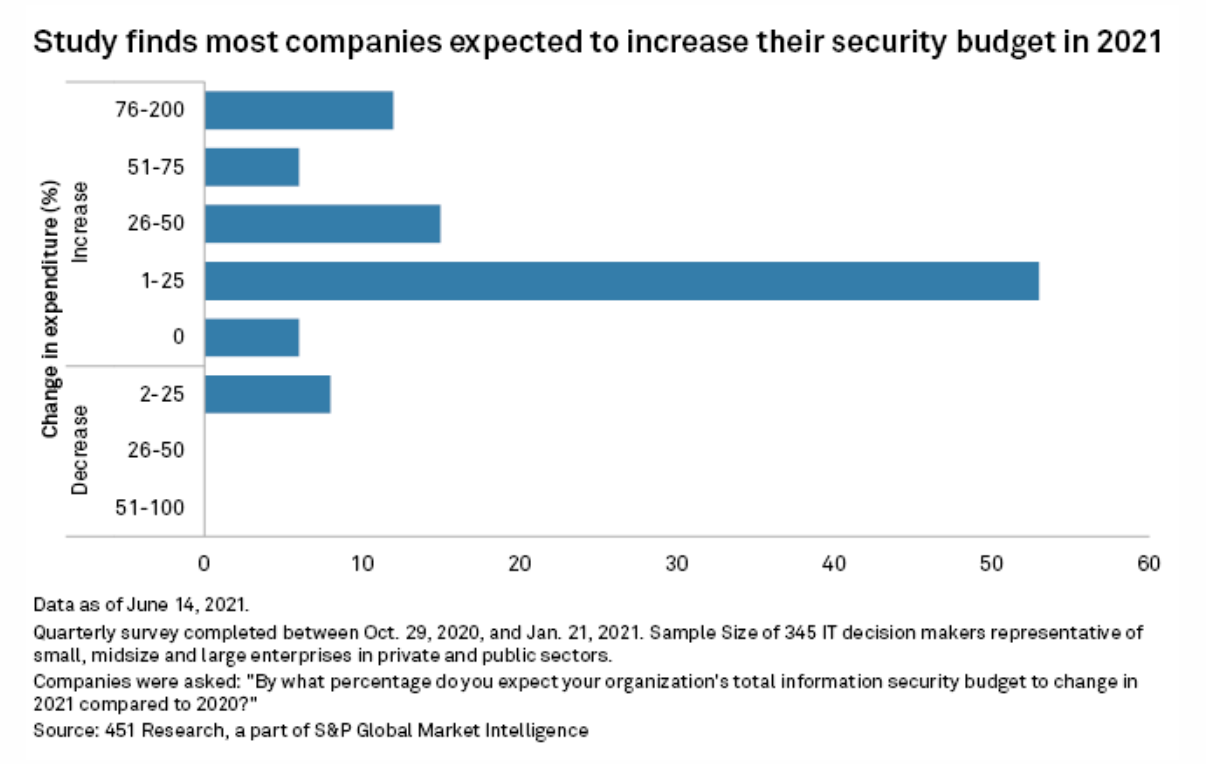

Cyberattacks Threaten Stability Of Interconnected Financial Services

Experts fear that the digital interconnectedness of the financial services industry means that a successful hack of a company could spur a domino effect. The threat is severe enough that multilateral organizations from the IMF to the Bank for International Settlements warn that financial stability is at risk. The surge in remote work during the pandemic has exposed companies' digital infrastructures even more.

—Read the full article from S&P Global Market Intelligence

Global 5G Survey: Operators Push Past COVID-19 To Accelerate 5G Network Upgrades

While the COVID-19 pandemic prompted delays to 5G infrastructure buildouts and associated service deployments, mobile network operators remained firmly committed to 5G network upgrades, according to Kagan's 2021 global 5G survey of 83 wireless operator decision-makers. The annual survey revealed key data points from respondents, including the 51% of the surveyed MNOs that claim to offer 5G services, up from 38% of respondents in a 2020 5G survey.

—Read the full article from S&P Global Market Intelligence

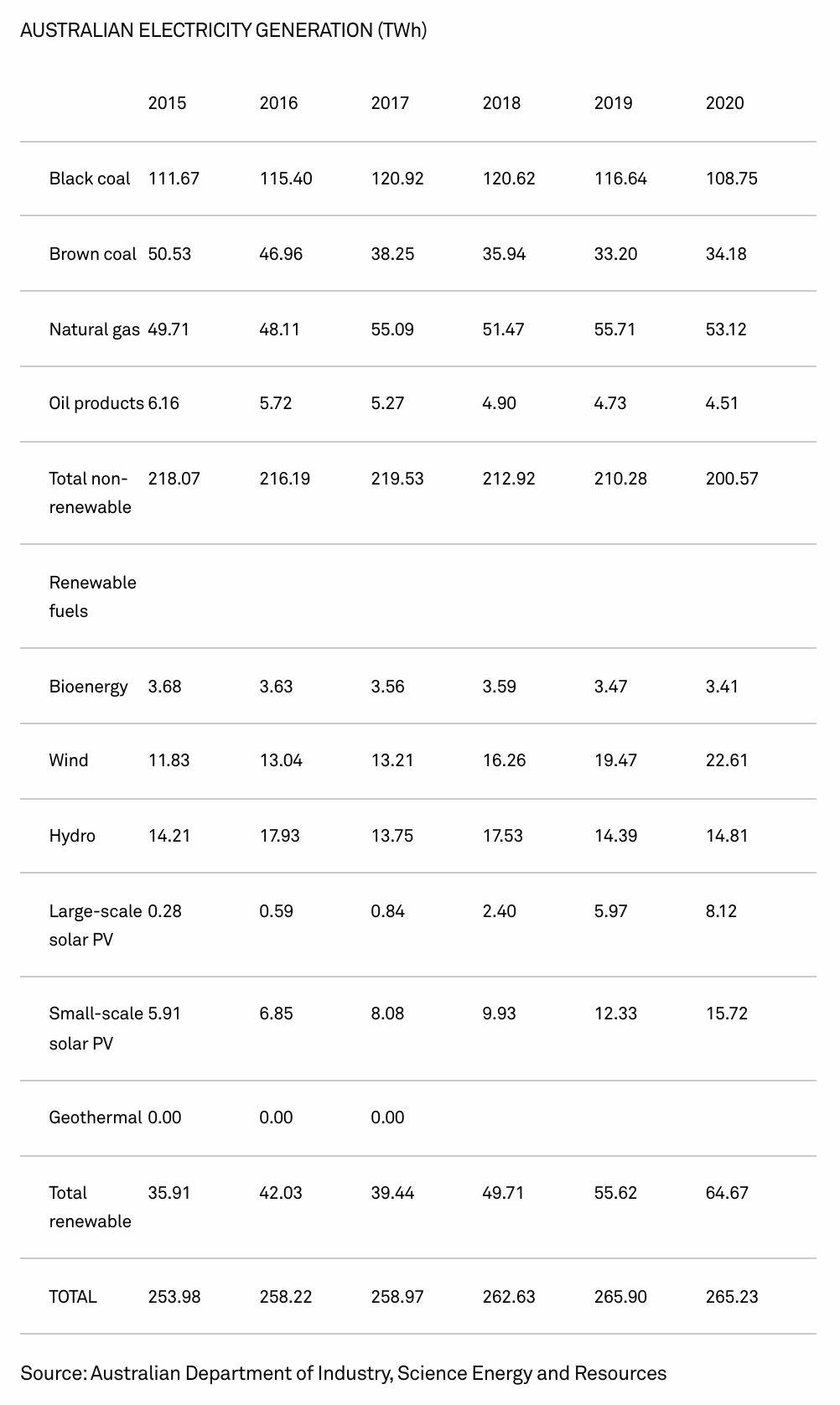

Australia's Opposition Party Outlines Plan To Cut GHG Emissions By 43% By 2030

Australia’s Labor party’s Shadow Minister for Climate Change said a 43% cut in GHG emissions on 2005 levels by 2030 would put Australia on course with the UN Paris Agreement's net zero target by 2050 and was non-negotiable in the event of a coalition with the Green party, which has called for a 75% cut in GHG emissions by 2030.

—Read the full article from S&P Global Platts

Top U.S. Officials Share Worries Around Climate Progress, Inflation But Remain Hopeful

Top U.S. government officials pointed to significant challenges ahead to get the world on track for a net-zero emissions future and to rein in soaring prices at the pump and elsewhere as inflation no longer looks to be a short-term problem. But they also expressed confidence in the efforts the federal government is taking to address these issues and offered a hopeful outlook for the future at the Reuters NEXT virtual global conference, held Dec. 1-3.

—Read the full article from S&P Global Platts

Oil Companies Must Step Up In Energy Transition Or Fail Financially: U.S. Deputy Energy Secretary

The world's top oil and gas companies must embrace the ongoing energy transition and invest in cleaner solutions— and profit as a result—or face financial failure if they stand pat, said U.S. Deputy Energy Secretary David Turk Dec. 6 at the 23rd World Petroleum Congress in Houston.

—Read the full article from S&P Global Platts

China Was Top Destination For U.S. LNG In November Amid Strong Gulf Coast Netbacks

China was the top destination for U.S. LNG in November, after three consecutive months with Brazil receiving the most cargoes, S&P Global Platts Analytics data showed. The shift in trade flows came as strong U.S. Gulf Coast netbacks incentivized deliveries to Asia even as congestion at the Panama Canal made the voyage longer and potentially more costly.

—Read the full article from S&P Global Platts

FERC Swears In Phillips As Fifth Commissioner Giving Democrats 3-2 Majority

The Federal Energy Regulatory Commission swore in Willie Phillips to start a five-year term as the fifth commissioner on Dec. 3. With Phillips on the commission, Democratic Chairman Richard Glick will have a 3-2 advantage over his Republican colleagues, the first time Democrats have held the majority under the Biden administration. Phillips' term ends June 30, 2026.

—Read the full article from S&P Global Platts

Shell Fends Off Legal Challenge To Explore For Oil, Gas Off South Africa

Shell will be permitted to undertake seismic exploration work off the eastern coast of South Africa after a High Court ruled in favor of the energy major in response to a legal challenge by environmental groups. It comes a day after Shell cancelled its plans for the major Cambo oil project in the U.K. West of Shetland area following a barrage of criticism, saying the economics of the project were insufficiently strong and it was worried about delays.

—Read the full article from S&P Global Platts

Prospects For Iran Deal, U.S. Oil Sanctions Relief Unchanged In Latest Vienna Talks

The latest round of talks over restarting the Iran nuclear deal ended without progress Dec. 3, leaving in place a massive question mark over 2022 global oil supply. S&P Global Platts Analytics expects Iranian oil supply to increase by 1.4 million b/d by December 2022 if a deal is reached and U.S. oil sanctions are removed in the second quarter.

—Read the full article from S&P Global Platts

SPR Exchange Mechanism Central To U.S. Pressure On OPEC: Analysts

The Biden administration pulled off an oil diplomacy win in helping to persuade OPEC+ to stick to its monthly 400,000 b/d production increases in the face of considerable demand uncertainty, analysts said Dec. 3 during an Atlantic Council event.

—Read the full article from S&P Global Platts

Russia And India Sign Oil Supply Deal, See Need For Stable Prices In Talks

Russia and India signed Dec. 6 new energy cooperation agreements including a contract for Rosneft to ship almost 15 million barrels of crude to the world's third-largest consumer of oil in 2022, according to government and company statements. Both countries also acknowledged the importance of dialogue between consumers and producers to ensure stable energy prices.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language