Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Dec, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The global metals and mining industry has an important role in the energy transition. But years of capital constraints and under-investment may pose risks to mining companies that need to meet roaring demand for critical minerals now and in the future.

The mining industry is responsible for sourcing the supply of battery and rare earth metals like cobalt, lithium, nickel, and dysprosium used in solar panels, electric vehicles, and other sustainable solutions. Demand for such minerals is accelerating now as more companies and countries act on their net-zero ambitions, and is likely to increase in the coming years. However, mining companies are confronting new conditions—a global supply crunch of key metals and minerals that has threatened to upend battery supply chains, inflationary pressures, and soaring metals prices—that could pose challenges to the energy transition.

S&P Global Market Intelligence forecasts demand to grow by a compound annual growth rate of 15% for copper, 35% for lithium, 28% for cobalt, and 35% for nickel by 2025, based on S&P Global projections for the global rollout of solar and wind projects and electric vehicles and analyses of the metals intensities of such developments. Similarly, the International Energy Agency projects that over the next two decades, lithium could experience demand growth of 40 times, graphite consumption could see a 25 times expansion, and uptakes of cobalt and nickel could grow by 20 times each.

But the energy transition is likely to pace demand ahead of supply by the end of this decade. Global supply of cobalt has been in a market deficit for months, lithium is in short supply, and the shortfall of current copper projects is set to create a shortage in the short-term. The IEA said in a report earlier this year that global lithium and cobalt supply could meet just half of their forecast demands, and copper production could fall 25% short of consumption.

The mining sector is “wildly underprepared” to meet the needs of the global energy transition, Rhett Bennett, founder and CEO of the energy resources company Black Mountain, told S&P Global Market Intelligence in an interview.

“In metals and mining, you had close to a decade of underinvestment. In general, it feels like markets have been more attracted to tech and kind of new economy themes for, gosh, probably two decades now. But for metals and mining, I would say easily in the last half-decade, it is just really attracting no interest whatsoever. At a certain point, capital starvation really starts to create consequences, which you totally see in metal and mining. But, you’re layering in a generational shift, the energy transition thematic,” Mr. Bennett said. “All of a sudden, you look up, and we've got just drastic under-investment for a half-decade and all of a sudden, now you want to triple, or many times, quadruple demand in a matter of like five years. There's a real physical restraint that is actually coming to fruition.”

Bank of America anticipates that metal producers will need to double their capital expenditure in the coming years to ensure that the supply of resources needed for net-zero can meet demand by 2050. “One of the concerns we have or the reality in the mining industry is that operators need to make sure they don't run out of resources over the coming years," Bank of America metals strategist Michael Windmer said Nov. 30 at the virtual BofA Global Research Metals 2022 Outlook media roundtable, according to S&P Global Platts.

New supply chains could create a solution to the pressing demand problems. Market participants are advocating for localization and regionalization of battery supply chains. International mine developers told S&P Global Platts they are working to materialize new rare earth metals projects outside of China in order to secure supplies against price headwinds.

“I think today, everybody wants to invest in battery manufacturing facilities, sort of the next Tesla Inc.,” Black Mountain’s Mr. Bennett told S&P Global Market Intelligence. “Nobody wants to do the really hard, gritty things such as actually providing the natural resources to make that energy transition occur.”

For playing such an important role in the energy transition, the mining industry must be conscious of their own emissions, as well.

Mine-development companies that don't pursue net-zero plans are “definitely going to be left behind. My general feeling is that, over time, a lot of these commodities going into renewable energy will see pricing essentially bifurcate,” George Ogilvie, president and CEO of the copper mining firm Arizona Sonoran Copper Company, told S&P Global Market Intelligence in an interview. “I see that happening with copper, nickel, and lithium; these metals are going to get a premium if you can actually show that you're carbon neutral. It makes perfect sense.”

“What's the point of producing a pound of copper to put it in an electric vehicle and stop greenhouse gases going up in the atmosphere if, at the end of the day, you're putting even more CO2 up into the atmosphere?” Mr. Ogilvie told S&P Global Market Intelligence. “It's defeating the purpose.”

Today is Tuesday, December 7, 2021, and here is today’s essential intelligence.

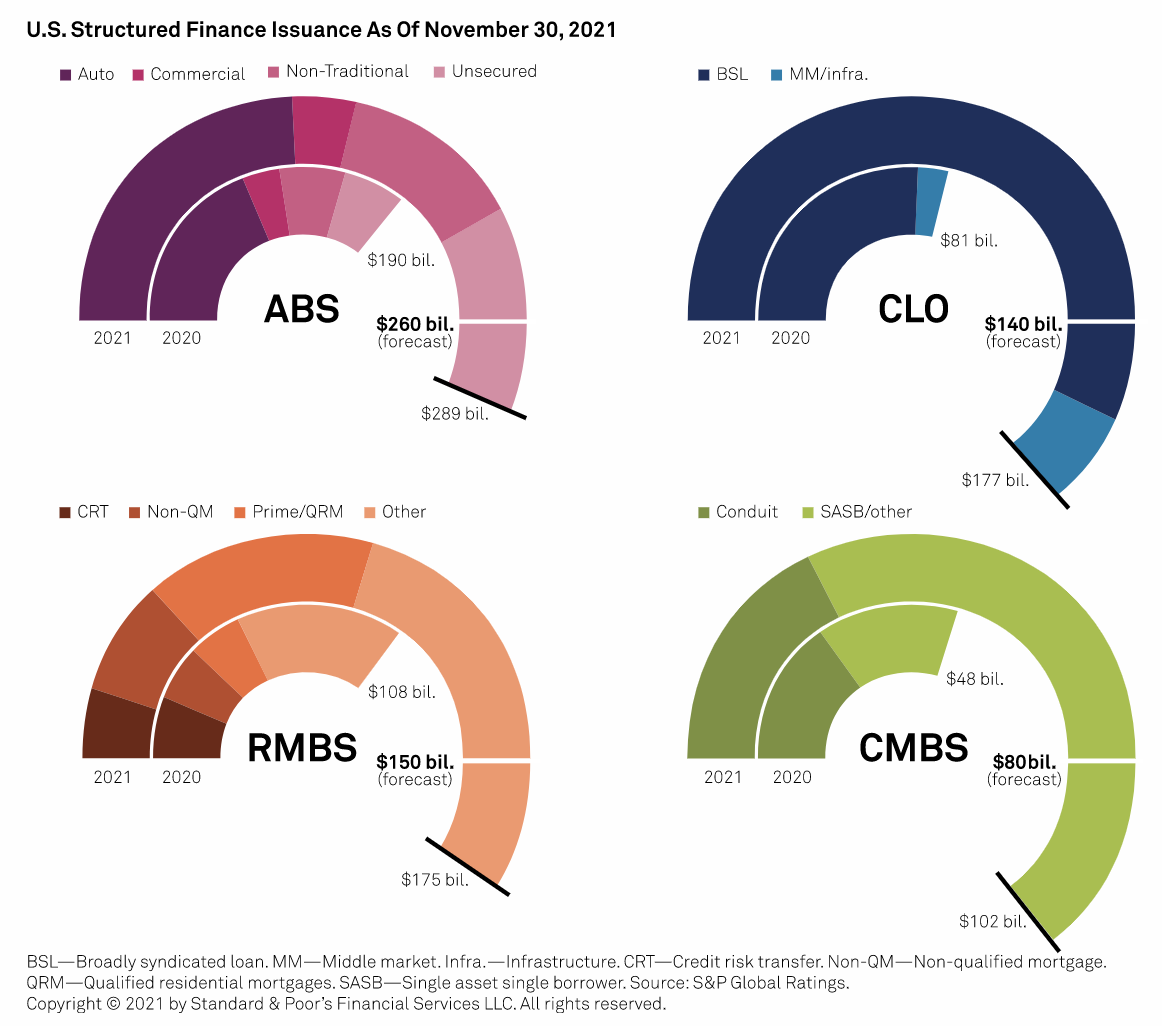

SF Credit Brief: U.S. Structured Finance Issuance Of $97 Billion In November Marks Second Consecutive Monthly Record

U.S. structured finance new issuance totaled $97 billion in November 2021 across the industry's four major sectors: asset-backed securities, commercial mortgage-backed securities, collateralized loan obligation, and residential mortgage-backed securities. November's issuance brought these four sectors' 2021 total to $743 billion—a 75% increase from $426 billion a year earlier.

—Read the full report from S&P Global Ratings

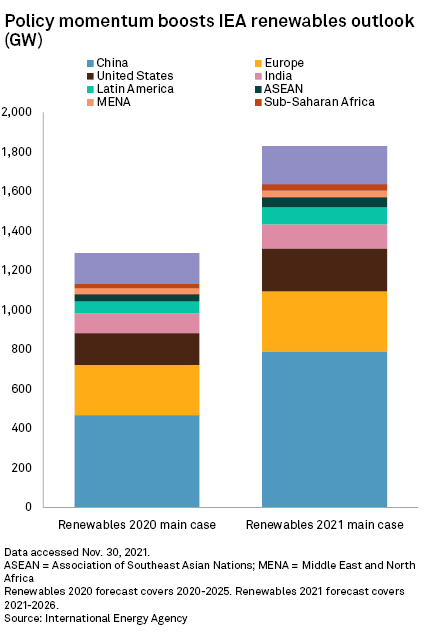

'New Global Energy Economy' Emerging As IEA Ups Clean Power Forecasts

2021 is set to be another record year for renewable energy installations, with 290 GW of new capacity expected to be built globally, the International Energy Agency said Dec. 1 in its annual Renewables Market Report. Despite volatile energy markets and the rising cost of key raw materials used to make solar panels and wind turbines, the record additions are "yet another sign that a new global energy economy is emerging," Fatih Birol, executive director at the agency, or IEA, said in a statement.

—Read the full article from S&P Global Market Intelligence

Rapping ExxonMobil Net-Zero Efforts, Activist Investor Hopes New Board Members Spark Change

A failing governance structure and poor management team had practically doomed ExxonMobil's prospects for success in a net-zero carbon future, activist hedge fund Engine No. 1 founder Chris James said Dec. 2, but added he was hopeful that a recent shakeup of the energy giant's board would set it on a cleaner and more profitable path.

—Read the full article from S&P Global Platts

Feature: COP26 Sets Stage For Hydrogen Market Boom, If Policy Supports Investment

The UN Climate Change Conference at the start of November has paved the way for a rapid, widespread, and large-scale rollout of clean hydrogen, though policies to underpin investment decisions in the coming months will be critical to achieving global climate targets, according to industry leaders. The Glasgow Pact does not mention hydrogen, but the fringe events at COP26 featured the renewable energy carrier prominently.

—Read the full article from S&P Global Platts

Mine Developers Will Be 'Left Behind' Without Net-Zero Emissions Strategy

After a Nov. 16 IPO, Arizona Sonoran Copper Company outlined plans to develop the Cactus copper project in Arizona as a net-zero operation. The company hired Minviro Ltd., a London-based environmental consulting firm, to assess its climate strategy. The climate-focused strategy comes as major mining companies increasingly commit to net-zero emissions and investors scrutinize their impact on global warming.

—Read the full article from S&P Global Market Intelligence

China's Decarbonization Goals Get Boost From Baowu's Carbon Reduction Plans

The world's largest steelmaker Baowu Group recently rolled out a roadmap to reduce carbon emissions per metric ton of crude steel by 30% from 2020 to 2035, and achieve carbon neutrality by 2050, setting a tone for China's steel industry at a time of intensified efforts to meet national decarbonization goals.

—Read the full article from S&P Global Platts

Focus On Single Technology Could Hinder Long-Term Hydrogen Deployment: Panelists

An overcommitment to any single production technology at this early stage of the hydrogen economy could stymie its long-term prospects and hinder its role in decarbonization, government and industry stakeholders warned Dec. 2. "It's crucially urgent that we start to get hydrogen into the system," said Varun Sivaram, senior director of clean energy and innovation under U.S. Special Presidential Envoy for Climate John Kerry, said during an Atlantic Council panel discussion.

—Read the full article from S&P Global Platts

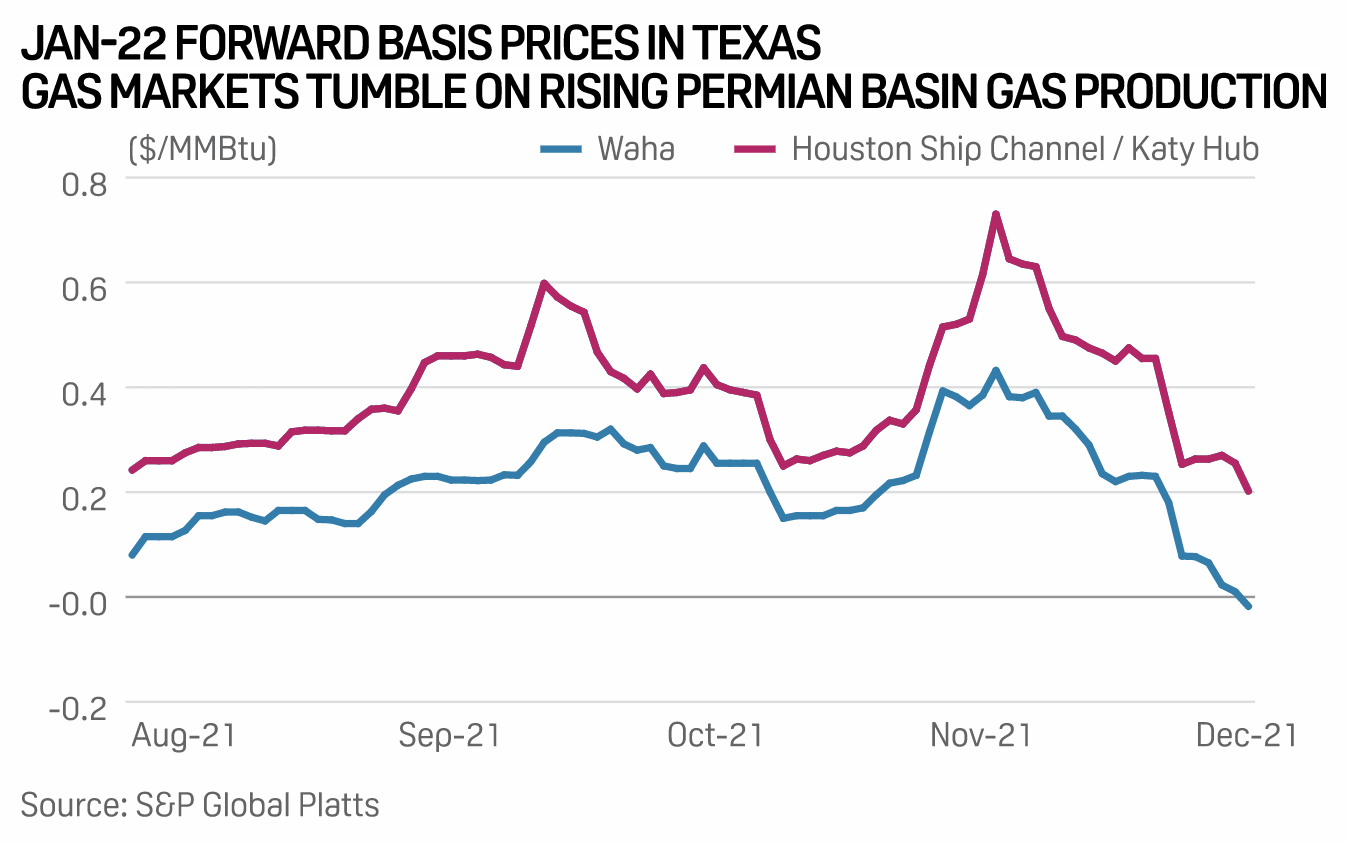

Feature: Permian Gas Production Surge Sinks East Texas Basis As Market Connectivity Grows

Winter forward basis at East Texas natural gas hubs is down sharply since the start of November as rising Permian Basin gas production promises to keep the Texas Gulf Coast market well supplied. Over the past month, January 2022 forwards prices at Houston Ship Channel and Katy hub have fallen from a more-than-70 cents premium to Henry Hub to just 20 cents premium as of Dec. 2.

—Read the full article from S&P Global Platts

South Korea Aims To Further Diversify Crude Import Sources Amid Supply, Price Uncertainties

South Korean refiners cheered OPEC and its allies' decision to continue raising output in January, but the crude importers aim to continue diversifying their supply sources by lowering their dependence on Middle Eastern producers and raising imports from the Americas to tackle uncertainty in global supply-demand balance and price volatility.

—Read the full article from S&P Global Platts

Denmark Calls On Market Players To Store Gas Amid System Vulnerability

Denmark's gas grid operator Energinet warned Dec. 3 that the country's gas system was currently more vulnerable than usual and called on market players to store more gas ahead of the peak winter season. Stocks across Europe are much lower than usual after only modest injections over the summer, with Denmark's two storage sites currently only 76% full, according to data from Gas Infrastructure Europe.

—Read the full article from S&P Global Platts

Interview: China's Magnesium Price Direction In 2022 Hinges On Coal, Says Magontec CEO

Price direction in China's magnesium market in 2022 will hinge on coal prices, as the domestic magnesium sector relies heavily on coal-powered energy, the CEO of key magnesium producer Magontec told S&P Global Platts in an interview. Australia-based Magontec sources pure magnesium from suppliers in Fugu and Xinjiang for its alloy casting in Qinghai, produces magnesium alloys and anodes in China, Australia, and Germany, and recycles magnesium in Romania.

—Read the full article from S&P Global Platts

Commodities 2022: Container Premiums Expected To Continue Through H1

The premium surcharge, which overstayed in the trans-Pacific route and later in other ex-Asia routes for nearly a year, is expected to continue at least through the first half of 2022 due to firm demand and worsening schedule reliability, despite reports of easing in some regions post China's Golden Week holiday.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language