Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 Dec, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Reality Returns to Corporate Credit Markets

In the decade that followed the global financial crisis, central banks around the world maintained interest rates at or near 0%. Even with the modest inflation of that period, lower-for-longer interest rates created a financial incentive for corporations to borrow heavily. If interest rates are lower than inflation, borrowers are essentially being paid to accept money from lenders. While some companies used these favorable financing conditions to build formidable balance sheets, others used cheap capital to fund basic operations and forgo necessary restructuring. This has led to fears of so-called zombie companies: businesses that are mostly dead on their feet but shamble along on cheap credit, susceptible to even modest interest rate increases.

The year 2022 saw corporate credit markets start to turn. Many central banks responded to persistent inflation by hiking rates. Though interest rates remain historically low, the speed of the increases has raised concerns that some companies may be poorly positioned to survive without cheap funding. The zombies might start to topple.

S&P Global Ratings recently published its global credit outlook for 2023 under the ominous title “No Easy Way Out.” Drawing on the work of their global research and analytical teams, the report’s authors — Global Head of Analytical Research and Development Alexandra Dimitrijevic and Chief Analytical Officer of Corporate Ratings Gregg Lemos-Stein — painted a bleak picture of credit markets with “little room for error.” Entrenched inflation, the possibility of recession and geopolitical tensions will create tight and volatile financing conditions. These conditions will weigh most heavily on vulnerable companies that have relied on borrowing to maintain their viability.

Some of these vulnerable borrowers are still benefiting from the financing they secured under the old, lower interest rates. This financing should provide wiggle room for some companies to readjust and restructure. Corporate debt issuance, which was unusually high in 2020 and 2021 when companies attempted to lock in at lower interest rates, has been down this year. However, the time will inevitably come for companies to return to credit markets for a new round of financing, now with higher interest rates.

Ratings are already lower than they were before the pandemic. A total of 29% of nonfinancial corporates are rated B- or below. S&P Global Ratings anticipates that speculative-grade default rates will double in the U.S. and Europe, and that strained financing conditions, global recession risk, price pressures and geopolitical tensions may place substantial pressure on already vulnerable borrowers. There are also structural risks that could weigh on some sectors, including the physical risk from climate change and the worsening risk of cyberattacks. It’s difficult to predict who will navigate these challenging conditions effectively, but rising interest rates have returned a sense of reality to corporate credit markets. Zombies aren’t real.

Today is Monday, December 5, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week of Dec. 5, 2022

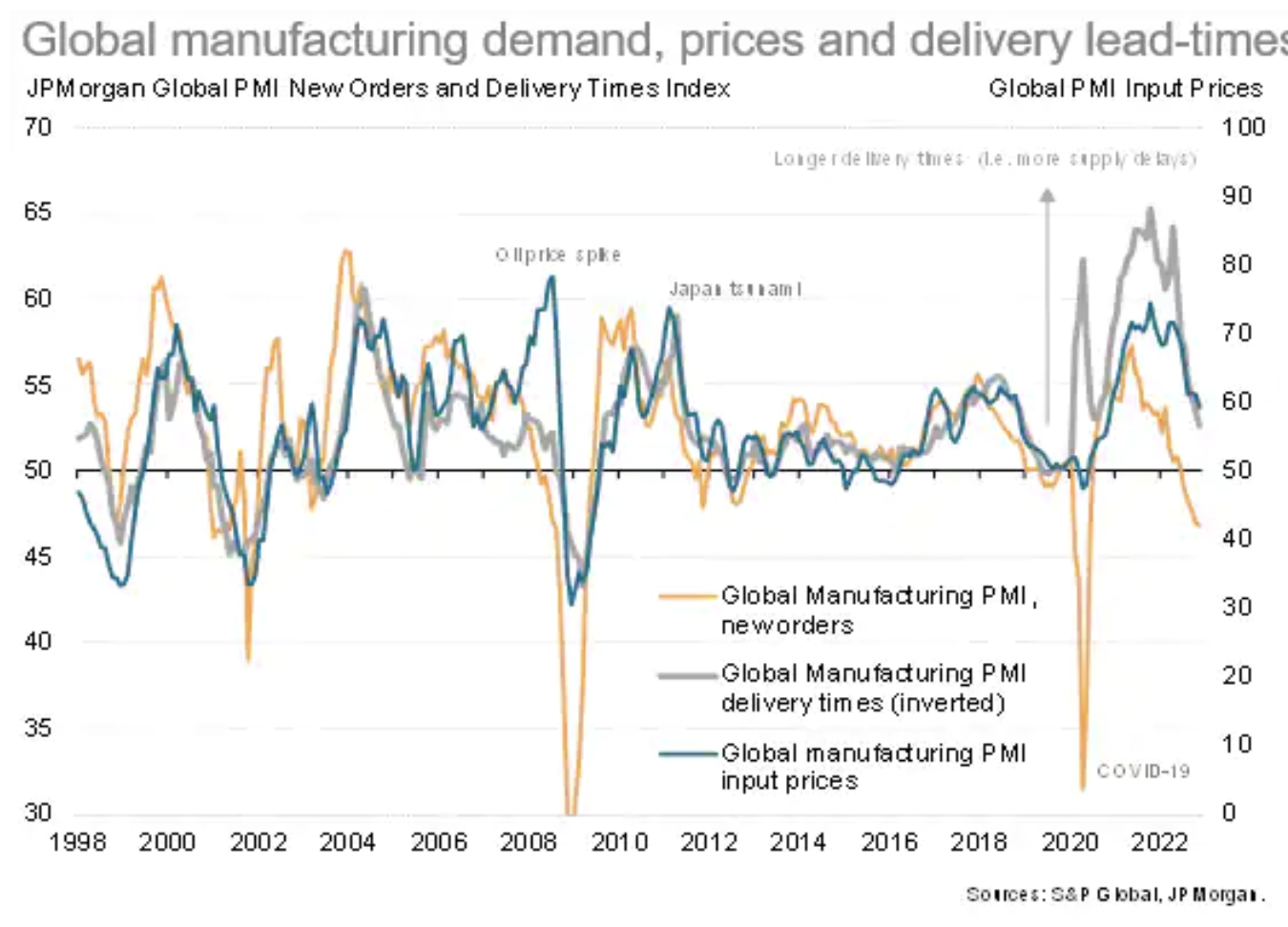

Worldwide services PMI data will be due at the start of a busy week that includes central bank meetings in Canada, Australia and India. Inflation data will also be in abundance from mainland China, the Philippines and Thailand while the U.S. PPI figures are set to be updated. Helping assess the global economic environment, Germany's industrial output and China's trade numbers will also offer deeper insights into conditions within the goods producing sector.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

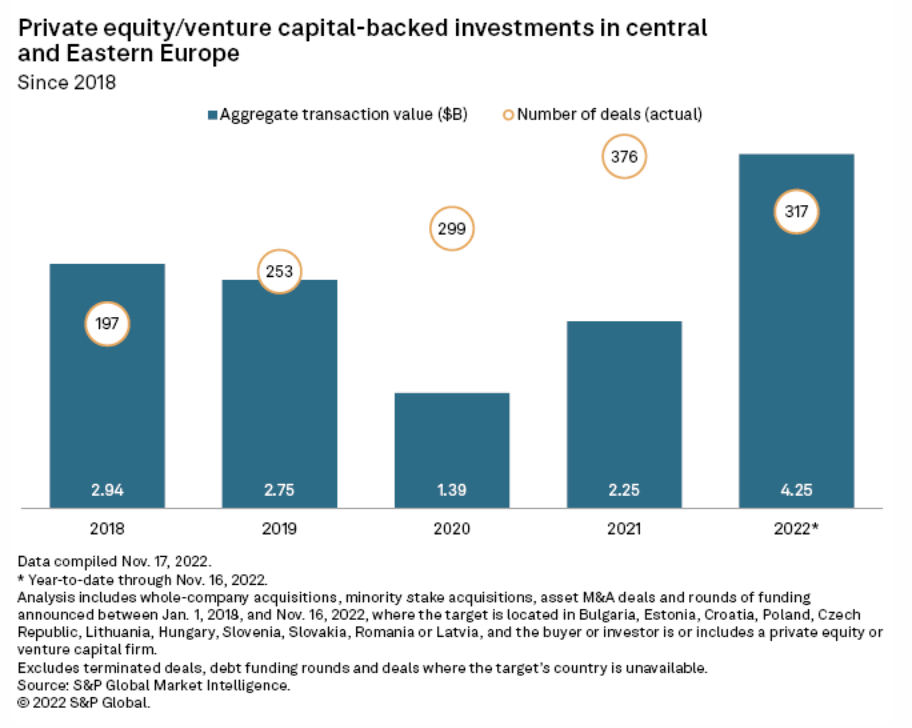

A Tough Year For Valuations; PE Investments In Central, Eastern Europe Jump

Private equity firms working on year-end portfolio valuations have their work cut out for them after a tumultuous 2022. Portfolio company valuations lean on comparisons to the revenue or profitability of similar, publicly traded businesses. But soaring inflation, rising interest rates and geopolitical turmoil scrambled the earnings trajectories and outlooks of companies across wide swaths of the global economy, making it difficult to get a clear read on performance.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

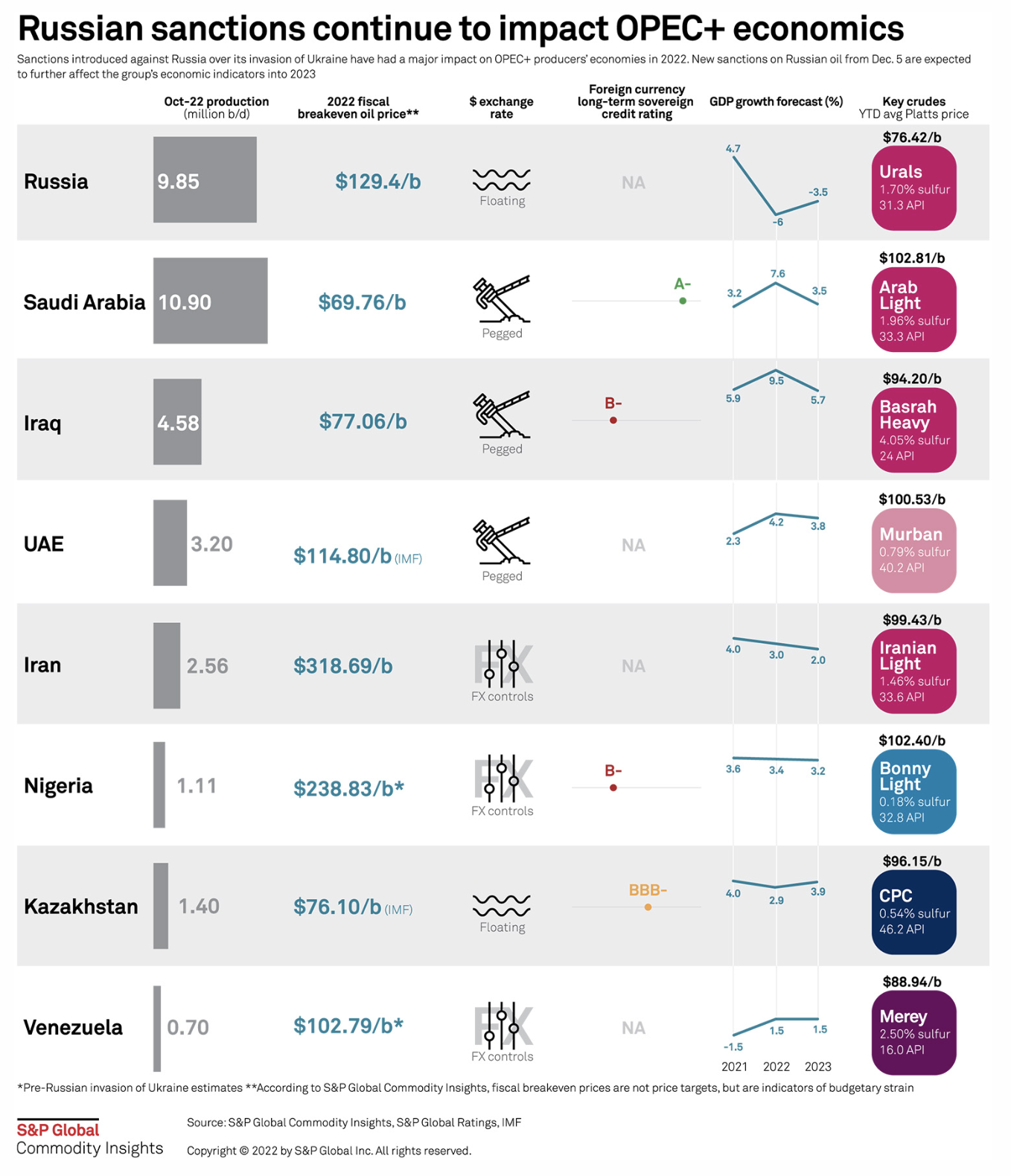

OPEC+ Decision On Oil Quotas Muddled By Russian Sanctions

OPEC and its Russia-led allies are set to meet Dec. 4 to review their production quotas, on the eve of the EU crackdown on Russian crude supplies and the G7's attempt to impose a price cap. The punitive measures figure to scramble crude flows, but with the exact fallout still unknown amid a murky market outlook, the oil producer alliance appears likely to maintain its output cuts, though delegates say a further reduction of quotas cannot entirely be ruled out.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

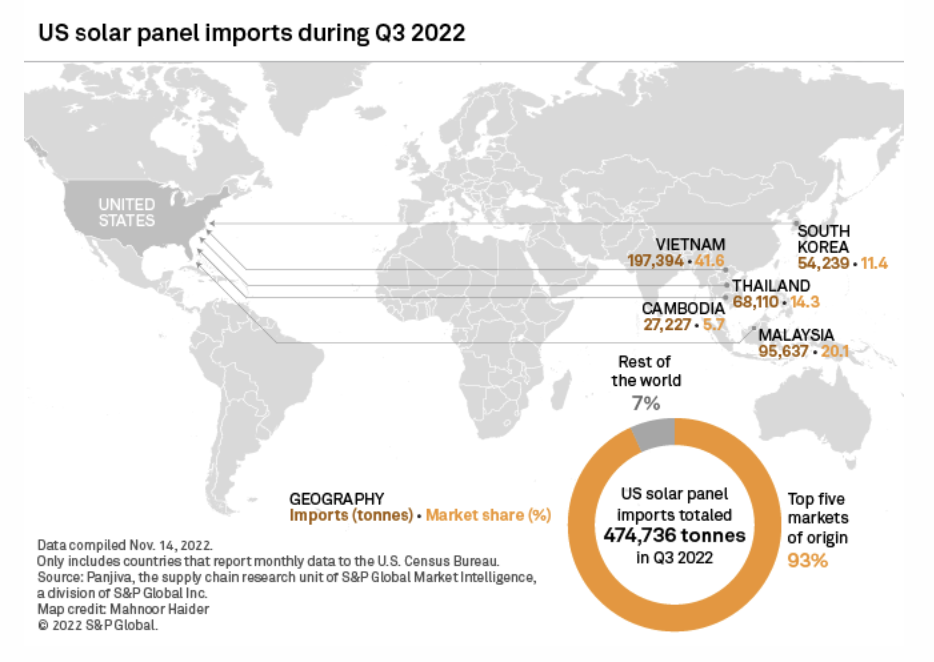

U.S. Finds Solar Imports From Southeast Asia Skirting Tariffs; Industry Alarmed

The U.S. Commerce Department issued a preliminary decision Dec 2. affirming that certain crystalline solar cell and panel imports from four Southeast Asian countries are circumventing decade-old tariffs on China by relying on components from that country. The preliminary decision came after a monthslong investigation into allegations by California-based module manufacturer Auxin Solar Inc. Auxin alleged that Chinese solar photovoltaic, or PV, producers are assembling cells and modules in Cambodia, Malaysia, Thailand and Vietnam with parts and components made in China to avoid antidumping and countervailing duties imposed in 2012 by the Obama administration.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

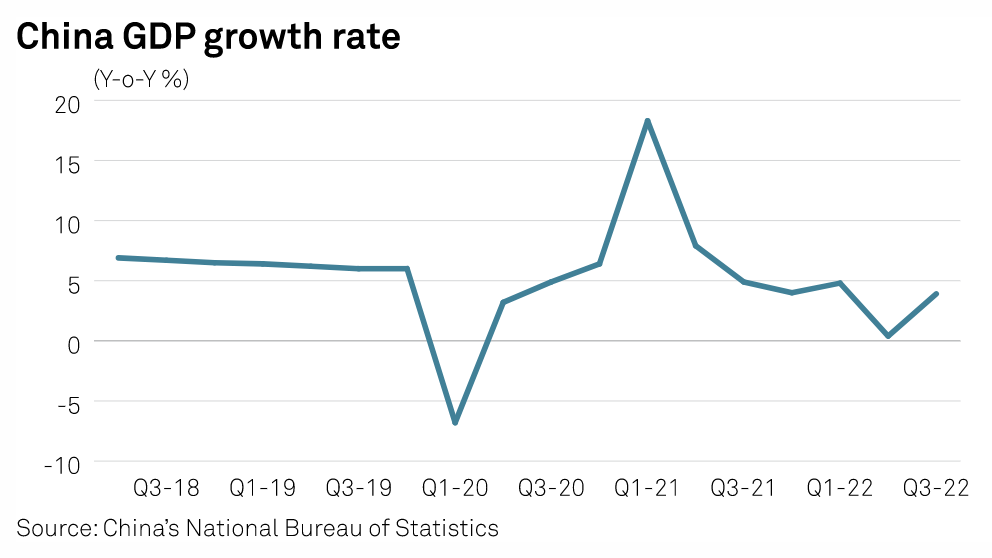

China's Oil Market May Have Something To Cheer After Changes To COVID Measures

China's oil and commodity markets may already be breathing a sigh of relief and hoping for a demand revival following the recent adoption of new measures that could send a strong signal to global markets that Beijing may be starting to ease its stringent zero-COVID policy to revive its flagging economic growth and restore normalcy for its citizens.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Two Big Tech Antitrust Bills Remain Stalled In Last Weeks Of Lame-Duck Congress

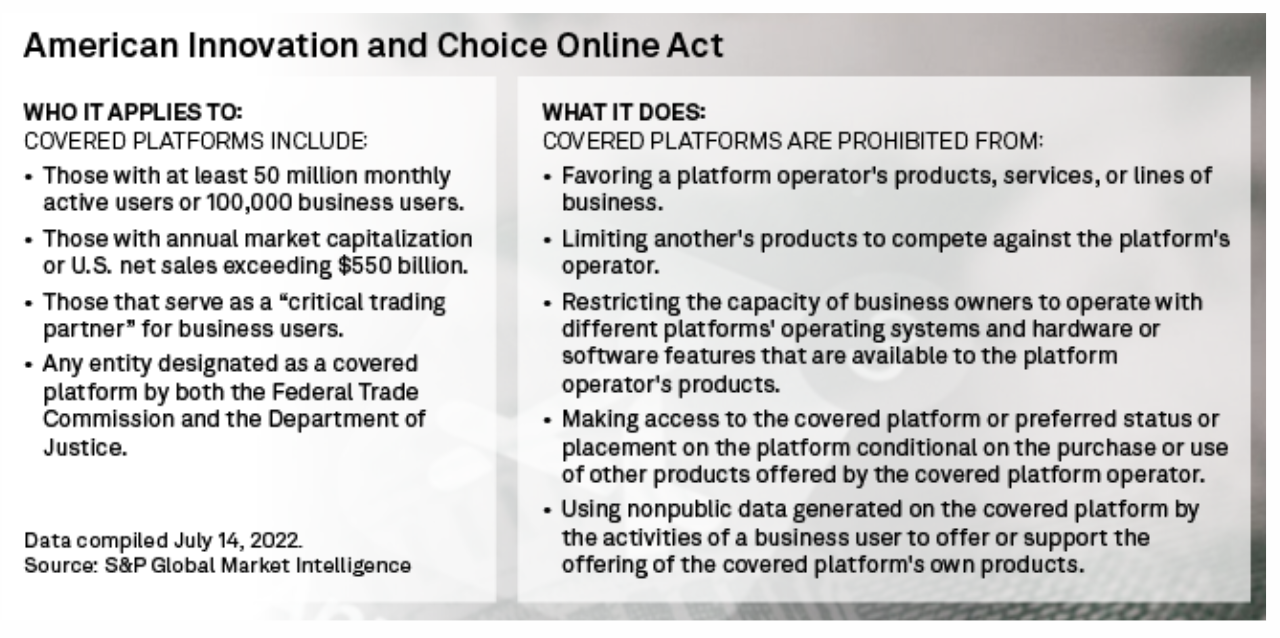

U.S. lawmakers backing legislation that would rein in the power of Big Tech companies are pushing for a vote on a pair of tech antitrust bills in the last few weeks of this Congressional session. The two bills are the American Innovation and Choice Online Act, or AICOA, which would prohibit large tech companies like Amazon.com Inc. from giving preferential treatment to their own products and offerings over third-party competitors; and the Open App Markets Act, which would prevent app stores run by Google LLC and Apple Inc. from requiring developers to directly use their in-app payment systems. The Open App Markets Act would also create rules regarding in-app pricing and fees for developers.

—Read the article from S&P Global Market Intelligence