Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global. The S&P Global Daily Update will take a break over the holidays and return on January 4, 2021.

Looking back on this year may feel like reflecting on a series of unfortunate events. Defined by the once-in-a-century pandemic that has infected nearly 78 million individuals and killed 1.2 million worldwide, the tumultuous events of 2020 are likely to shape the next decade.

Beginning with devastating bushfires that blazed across Australia and ending with millions of acres of the Western U.S. scorched after months of inferno, this year the global community confronted a new era of climate-driven disasters. The crisis in California and surrounding states forced communities, businesses, energy companies, and policymakers to face the immediate physical risks of climate change.

The COVID-19 pandemic created a cascading series of cataclysms, beginning in March, for oil markets. Economic shutdowns led to the sharpest plunge in global oil demand on record as the coronavirus containment measures constricted mobility. Tensions between Saudi Arabia and Russia triggered an oil price war that, combined with the lockdowns’ depletion of demand, ultimately sent the West Texas Intermediate crude oil benchmark price into negative territory for the first time in history on April 20. Following the crash, the Organization of the Petroleum Exporting Countries and their partners curbed crude oil production by 9.7 million barrels per in May and June, then by 7.7 million barrels per day for the remainder of the year. The largest coordinated supply contraction covered by an international deal was lifted this month when the OPEC+ alliance decided to gradually increase global oil production by 50,000 barrels per day in January. The group said it will revisit that amount monthly to determine what quota changes will be made. Now, while vaccine-induced optimism has recently fueled higher oil prices, rising infection rates and new restrictions in colder months have left oil markets in a vulnerable state at year-end.

The pandemic has led to reductions in fossil fuel consumption and emissions—but not enough to put the world on a path to meet the 2-degree global warming target, nor accelerate peak oil demand. More than 10 times the emission reductions resulting from the pandemic’s implications will be needed to meet the 2-degree target through 2050. However, the crisis’ effects will cumulatively lower energy sector CO2 combustion emissions by 27.5 gigatons over 2020-2050—equivalent to almost one full-year of emissions.

Throughout the crisis, while the price of oil plunged and equities benchmarks skyrocketed and sunk, gold emerged as a safe haven for investors. Gold's rising market price, massive secondary supply, and quarter-over-quarter successes largely cemented its shining status as uncertainty prevailed. However, by the end of the year, gold’s status began to waver as positive news regarding COVID-19 vaccines and relative calm surrounding the outcome of the U.S. elections dampened some of the enthusiasm.

Global trade disrupted by a global health crisis revealed systemic weaknesses in the supply chains that bring food to markets. The crisis caused meat, dairy, and other commodity supply chains to experience significant labor shortages, production facility closures, and changes in demand that threatened the successful functioning of such critical infrastructure.

Workplace safety and awareness of human capital were thrust into the spotlight as key environmental, social, and governance (ESG) factors. Companies were forced to make direct decisions that impacted their employees and communities. Many institutions responded to the pandemic by offering more flexible working arrangements for their employees. But the most notable development for ESG came at the start of the summer, when several incidents of police violence against Black Americans sparked protests across the country and world and thrust the U.S. into a reckoning. The ongoing wave of civil unrest prompted corporate leaders to prioritize social justice as a social factor. Pressed to show how their policies are contributing to a more equitable, diverse, and inclusive workplace, many chose to publicly condemn discrimination and commit to changing their internal and external practices. Increased awareness and activism among corporate stakeholders pushed transparency and accountability to unprecedented levels.

The COVID-19 crisis encouraged dramatic innovation to meet global needs. Established pharmaceutical manufacturers and new entrants raced to complete clinical trials of their experimental coronavirus vaccines in record time. Less than a year after the contagion was identified, safe and effective vaccines are already being distributed to the public. Much of the hope of a return to normal is dependent on the pharmaceutical industry’s ability to develop and disseminate effective treatments and vaccines. The widespread availability, distribution, and administration of those vaccines are the next crucial steps toward a new normal and an economic recovery.

Today is Wednesday, December 22, 2020, and here is today’s essential intelligence.

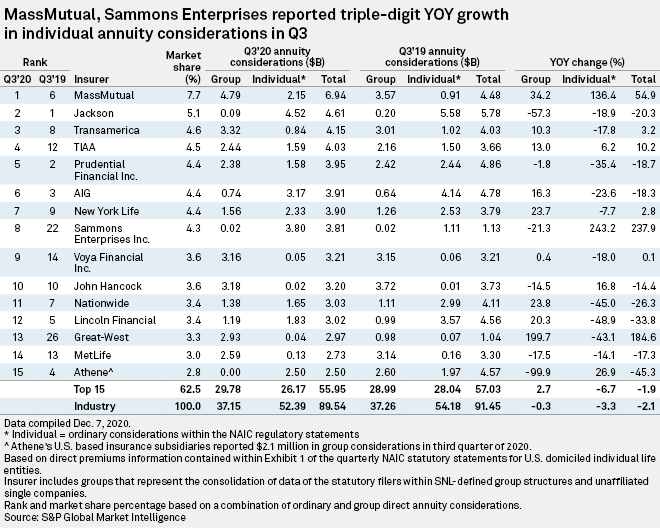

Life, Annuity Premiums Rebound After Seeing YOY Declines In Q2

U.S. life insurers saw year-over-year increases in individual direct premiums and slight declines in group and individual annuity considerations in the third quarter.

—Read the full report from S&P Global Market Intelligence

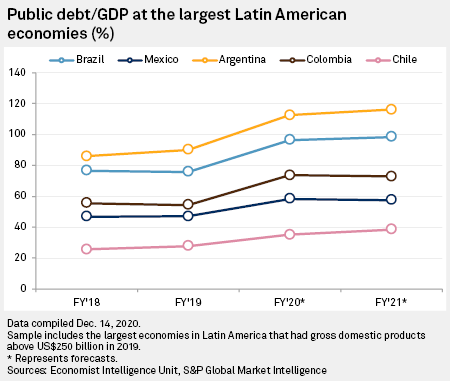

Latin America Faces Years-long Struggle With Pandemic Debt

With medical workers administering the first batches of COVID-19 vaccines, an end to the pandemic appears to be in sight. In Latin America, however, the economic and financial scars left in the disease's wake may never fully heal.

—Read the full report from S&P Global Market Intelligence

U.S. Companies' Liquidity Stabilized at Historically High Levels in Q3

Having shored up liquidity with a dash for cash earlier in the year, U.S. companies allowed their cash ratios to decline marginally in the third quarter.

—Read the full report from S&P Market Intelligence

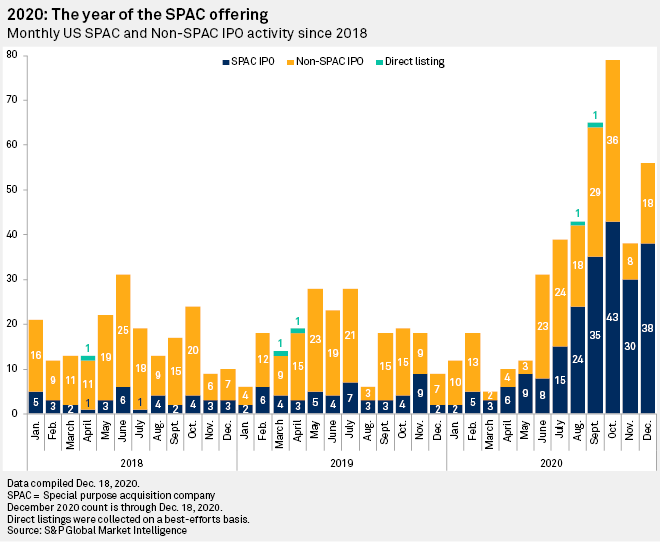

IPO Market in Flux as Alternatives Gain Ground

Gone are the days when the tried-and-true initial public offering was the only route to the public markets.

—Read the full report from S&P Global Market Intelligence

Revisiting Iron Ore Pricing Mechanism Holds Risks and Opportunities For Market

An almost doubling of iron ore prices over the past six months led Chinese steelmakers last week to call for a change in the current pricing mechanism.

—Read the full report from S&P Global Platts

Shell's Latest Massive Write-Down May Hinder Stock Price Recovery – Analysts

Royal Dutch Shell PLC is wrapping up a volatile year with caution as its fourth-quarter financial results may include a write-down that could put the company's total impairment charges for 2020 at close to $22 billion.

—Read the full report from S&P Global Market Intelligence

U.S. Equity Volatility Persists as Credit Markets End Year Calmly – Risk Monitor

With the exception of U.S. equities, the warning signals that were flashing red for investors at the height of the COVID-19 financial market panic have returned to green after a tumultuous year.

—Read the full report from S&P Global Market Intelligence

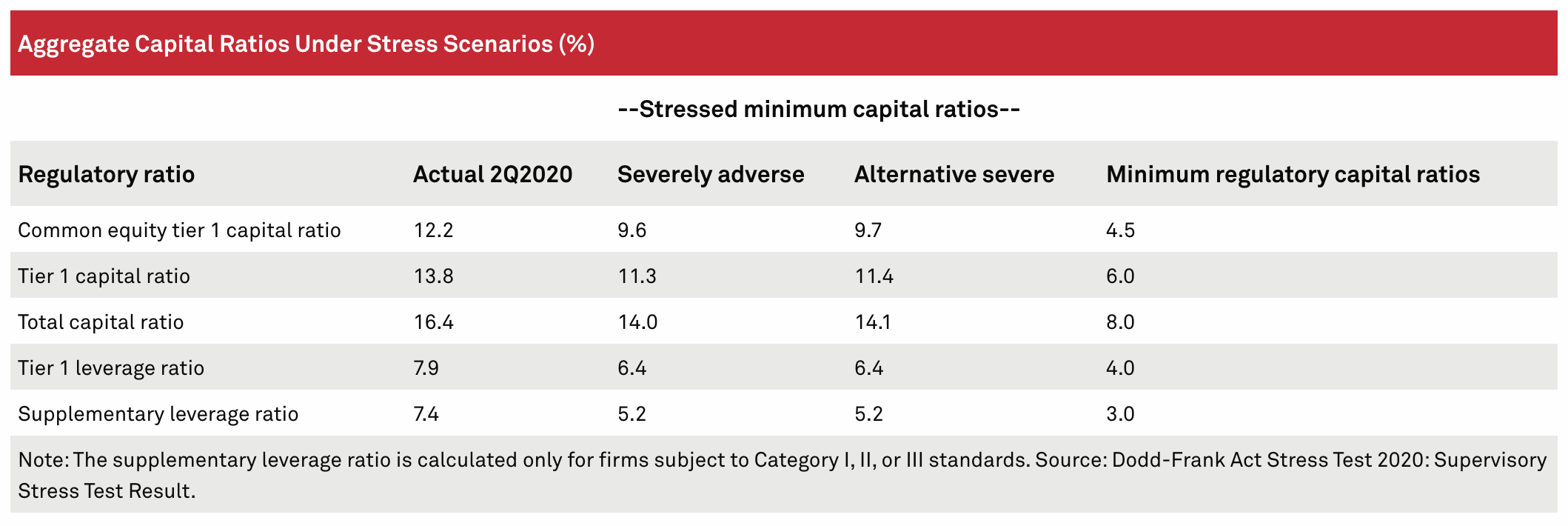

The Fed's Stress Test Results Open The Door For U.S. Banks to Increase Capital Returns in 2021

In an effort to gauge how U.S. banks would perform in the worsening economic conditions due to COVID-19, the Federal Reserve conducted a second stress test in 2020.

—Read the full report from S&P Global Ratings

Megabanks seen as benefiting most from return of share buybacks

Megabanks and some consumer finance companies appeared to benefit the most from the Federal Reserve's surprise decision to relax restrictions on capital distributions.

—Read the full report from S&P Global Market Intelligence

Community Banks See Opportunity In Huntington-TCF Deal Disruption

The announced merger between Columbus, Ohio-based Huntington Bancshares Inc. and TCF Financial Corp. may create opportunities for community banks to gain customers and employees from the disruption.

—Read the full report from S&P Global Market Intelligence

Saudi Banks Increase Private Sector Lending Amid Robust Demand For Mortgages

Banks in Saudi Arabia, the second-largest banking system in the Gulf Cooperation Council, have shown steady growth of lending to the private sector in 2020 despite the impact of the coronavirus pandemic, with the residential mortgage sector continuing to be a bright spot.

—Read the full report from S&P Global Market Intelligence

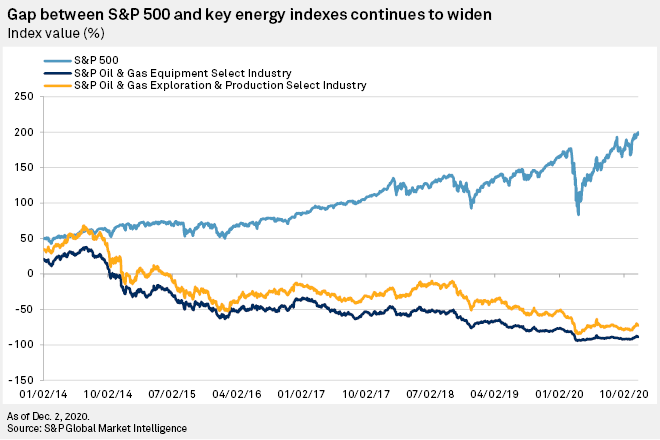

Energy Transition Could Make 2020 'The Beginning of The End' For Oil

Over the past 40 years, the oil and gas sector has dealt with price collapses of massive scale. In the 1980s, low prices nearly brought an entire state to its knees, then between 2008 and 2016, producers dealt with two major crises.

—Read the full report from S&P Global Market Intelligence

Alaska State Agency Mulls Bidding in Arctic Wildlife Refuge Oil Lease Sale

An Alaskan state corporation may bid for acreage in a Jan. 6 federal lease sale in the Arctic National Wildlife Refuge.

—Read the full report from S&P Global Platts

Tesla: Not an Automatic Addition to the S&P 500 ESG Index

Since S&P Dow Jones Indices announced that Tesla would be added to the S&P 500® on Dec. 21, 2020, many investors have contacted us asking when this transformative company will become a member of the S&P 500 ESG Index, the sustainable counterpart to the S&P 500.

—Read the full report from S&P Dow Jones Indices

Listen: CAL-ISO’s New Leader to Focus on Resource Adequacy, Modernizing System

Elliot Mainzer took over as president and CEO of the California Independent System Operator in September as has been focused on recovering from the August rotating outages and preparing for next summer, while also looking ahead to modernize the resource adequacy system for the wave of storage and renewables coming onto the grid.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

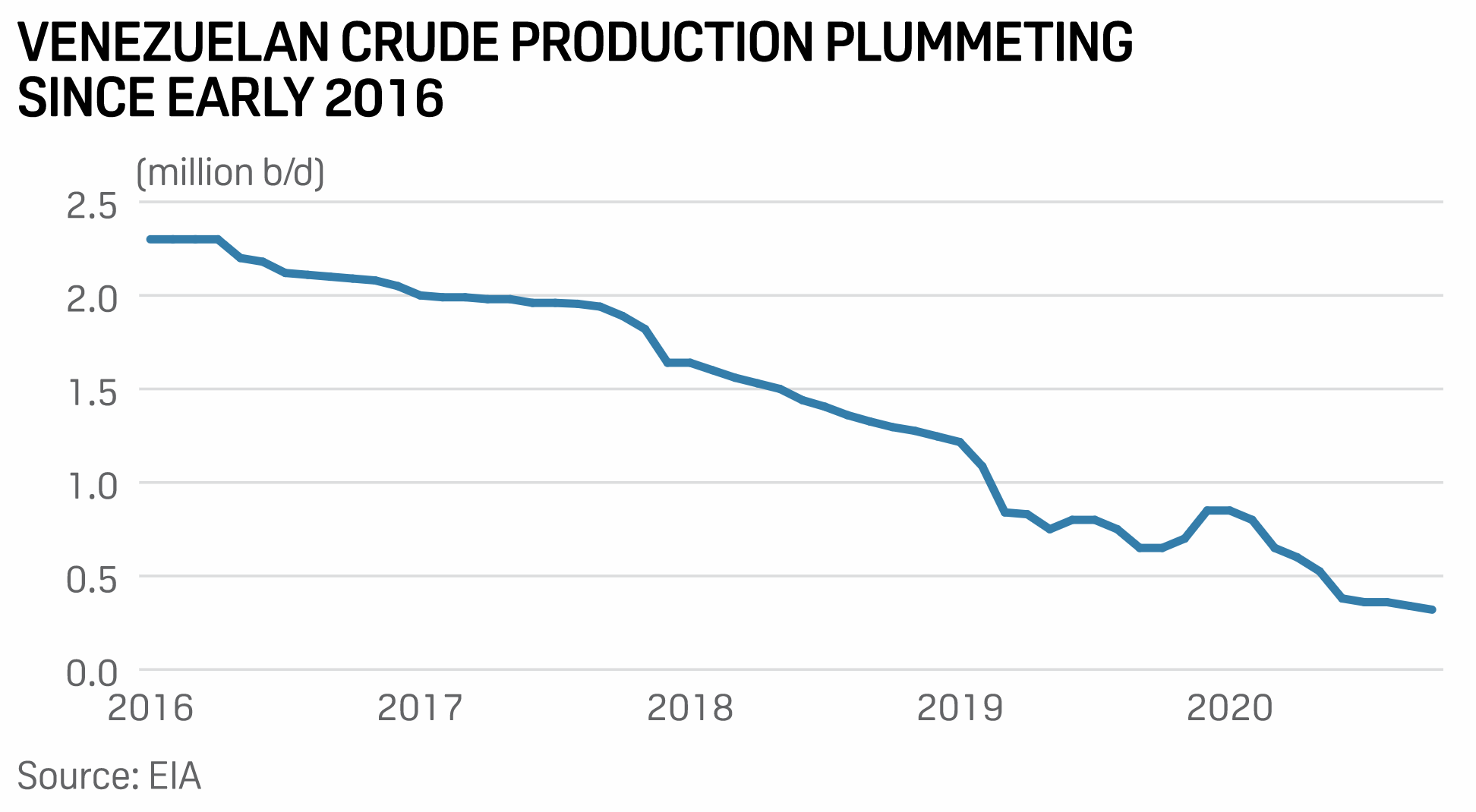

Commodities 2021: Biden's Softer Stance on International Sanctions Unlikely to Trigger Big Waves in Oil Markets

President-elect Joe Biden could take a more lenient approach to heavily sanctioned nations such as Iran and Venezuela, but the timing and impacted volumes of crude are unlikely to have big impacts on the oil markets that will remain dominated by the ongoing coronavirus pandemic.

—Read the full report from S&P Global Platts

Commodities 2021: Nord Stream 2 Uncertainty to Cloud European Gas

Nord Stream 2. Never has a gas infrastructure project generated so much controversy. The almost-complete 55 Bcm/year pipeline remains a major bone of political contention between Russia, Europe and the US, with the threat of sanctions from Washington testing trans-Atlantic ties.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Listen: Freight Markets And Decoding the Crew Change Challenge During a Pandemic

Seafarers are key to keeping the world's supply chain and maritime trade flowing. However, thousands of seafarers have been stuck on board and unable to get ashore due to coronavirus restrictions.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language