Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Dec, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Hints of a Better 2024 for Private Markets

2023 is the year private markets would prefer to forget. After a blockbuster 2022, private equity and private credit markets had a year of few entries, few exits, missed fundraising targets and down rounds. Dry powder sat on the sidelines, with few deals to tempt private equity firms to reenter the game. However, some industry observers see signs of recovery for private markets in the final months of 2023. Investors hold out hopes for a better 2024 with lower interest rates and better pricing. But concerns remain, particularly on the private credit side of the market, where weaker borrowers may struggle in the months ahead.

Private markets are quiet to end the year, but there are some promising signs. In November, the total value of global private equity and venture capital entries climbed for a second straight month to $47.07 billion, up 34% from October. While this still represented a year-over-year decline, the trend is positive. Deals and deal value were down year over year in November, but that hasn’t spooked private market participants who appear to not expect an immediate return to the high-water marks of 2022.

One bright spot for private equity funds has been investor interest in artificial intelligence companies. Private equity investment has focused on datacenters in a strategy that S&P Global Market Intelligence analyst Dylan Thomas described as a “picks-and-shovels investment amid an AI gold rush.” With datacenter companies hesitant to invest capital in multibillion-dollar expanded hyperscale facilities, private equity funds are eager to invest at the right price. So far, deals have been slow to develop. The value of private equity and venture capital investments in datacenters is on pace for the lowest annual total since 2019.

The proverbial mountain of dry powder grew a little higher in 2023. Global private equity dry powder reached $2.59 trillion this year, up 8% from the end of 2022. The top holders of dry powder constitute a virtual who’s-who of private equity, led by Apollo Global Management holding over $55 billion. Most observers attribute the continued growth of dry powder to an M&A market with high valuation expectations on the part of sellers, who remember 2022’s term sheets.

Private credit looks forward to another year of slow growth in 2024. Although private credit continues to be popular among middle-market borrowers, concerns about inflation, interest rates and recession have temporarily cooled the interest of lenders. Alternative investment funds are challenged by weak or uneven valuations, a slower ramp-up in fundraising and reduced opportunities to exit from investments. Some funds may look to take on additional leverage to complete new deals. S&P Global Ratings estimates the global private debt market to be about $1.75 trillion.

“Looking ahead to 2024, it's natural to think about emerging risks in the private markets — and the key risks associated with private credit are generally the same as those for the public debt markets,” said David Tesher, head of North America Credit Research at S&P Global Ratings. “How these risks manifest depends on where a borrower is in its life cycle and, equally as important, on broader credit conditions.”

Today is Thursday, December 21, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of 18 December 2023

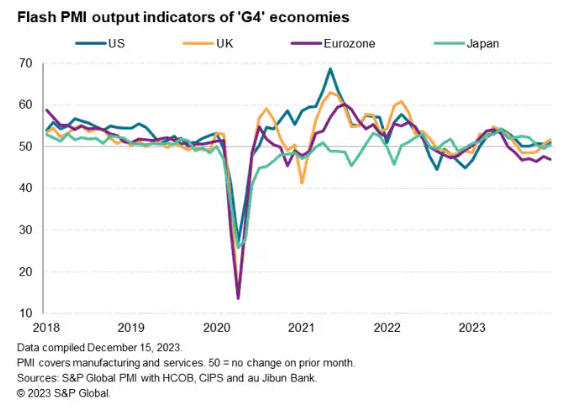

Into the final weeks of 2023, more inflation data will keep the markets occupied with CPI numbers out of the UK, Eurozone, Japan and Canada while the US updates core PCE data. Additionally, final Q3 GDP updates will also be due from the US and UK while central bank meetings in Japan and Indonesia are also anticipated.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit Turnaround Expected In 2024 Even As Card Delinquencies Jump In Q3

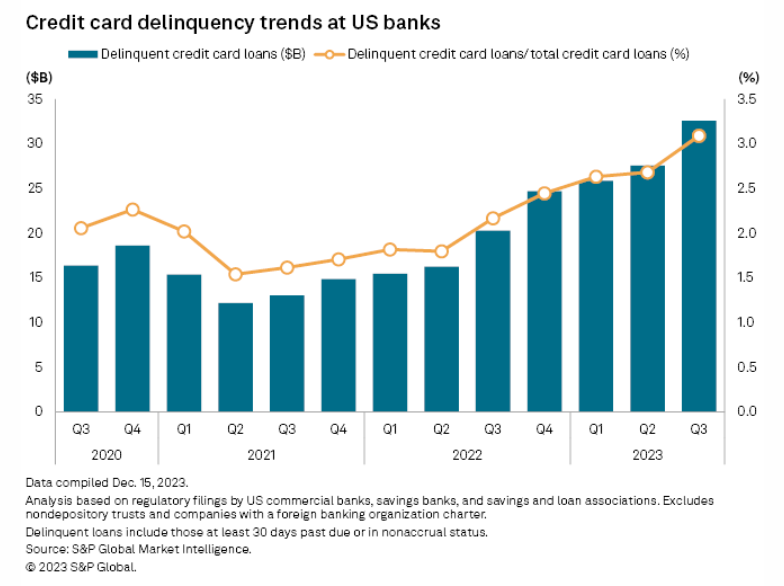

Peak credit card loan losses might be coming into view after a jump in delinquencies in the third quarter. Card delinquencies across US banks spiked 41 basis points quarter over quarter to 3.09%, according to S&P Global Market Intelligence data. That exceeds the most recent peak of 2.89% as of March 31, 2020.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Russian Shipping And Trade — Sanctions Risk Analysis

A spate of events and actions have hit the headlines in recent months regarding Russian trade sanctions and the enforcement of its various components, most notably the Group of 7 (G7) coalition's oil price cap. Five vessels have been sanctioned in October and November 2023 for violating the price cap. The first two added to the Office of Foreign Assets Control (OFAC) specially designated nationals (SDN) list in October were a United Arab Emirates (UAE)-based registered shipowner with clear association to a Russian group owner and a tanker owned by a Turkish entity.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: It's Blue-Sky Thinking For Sustainable Aviation Fuel Markets

There's just over a year to go until the EU introduces its sustainable aviation fuel mandate. S&P Global Commodity Insights' Seb Lewis, associate director for biofeedstocks and biofuels consulting, speaks with Stephen Li, associate director for biofuels research and analysis, and Simone Burgin, associate editor for biofuels pricing. The team discusses the current state of the SAF market and HEFA fuels, developments in advanced biofuels and PtL pathways, feedstocks and the current state and future paths of SAF pricing.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

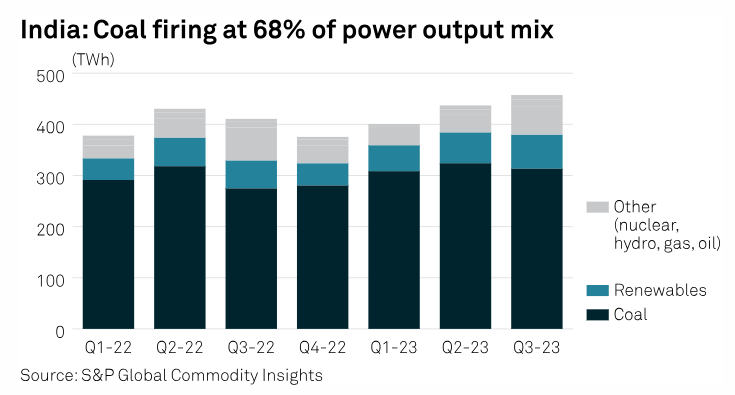

India Set To Ramp Up Renewables Capacity In 2024 But Thermal Dash Continues

India's power sector is expected to see significant renewables capacity expansion alongside new coal-based capacities in 2024 as it works to meet the surging demand. The country's power demand is growing at over 8% year on year at present, while its climate emissions are not forecast to peak until 2040-41.

"In 2024, India is expected to see the highest ever renewable energy capacity additions at 19 GW including about 16-17 GW solar and 2-3 GW wind," said Ankita Chauhan, Principal Research Analyst at S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Fuel For Thought: Connected Cars And The Automotive Revolution

The automotive industry is reaching an inflection point that will reshape its near-term future, precipitated by the connected car era — also known as software defined vehicles or "SDVs." This will affect every aspect of future mobility, from Generative AI implications in Level 2+ autonomy to the HMI of the cockpit domain software.

—Listen to the podcast and read the article from S&P Global Mobility