Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Dec, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Carbon Capture Overpromises and Underdelivers

Carbon capture and sequestration is a lovely idea. Rather than change the energy mix and phase out fossil fuels such as oil and natural gas, the CO2 emissions from combustion are simply whisked out of the atmosphere.

Oil and gas companies and countries that depend on oil and gas revenues are proponents of carbon capture and sequestration (CCS) because it appears to guarantee that they can continue conducting business as they always have, rather than confront a cascade of stranded assets. At this year’s UN Climate Change Conference in Dubai, United Arab Emirates, some attendees from OPEC countries strenuously argued that resolutions should focus on emissions rather than fossil fuels. While that may sound like a distinction without a difference, this is an argument in favor of continued fossil fuel use combined with carbon capture. The only problem is that CCS won’t allow the world to meet its climate goals. It’s a nice technology, but it’s far from a panacea.

“There are people here who want to just continue business as usual. And the great facade is: ‘Oh no, we'll be able to capture everything,’” said US climate envoy John Kerry at an event on the sidelines of the conference. “No scientist tells me we can capture it all. Can't do it. Can we capture some? Yes, and by the way, I'm for it.”

CCS is often confused with a similar technology called direct air capture. Direct air capture removes CO2 that already exists in the atmosphere through an engineered solution. Carbon capture removes CO2 from power plants and industrial facilities the moment it is created. Direct air capture is like a robot vacuum that cleans an entire room, while carbon capture is more like following a particularly messy toddler around with a handheld vacuum, focusing cleaning efforts on the area of greatest need. Direct air capture has the benefit of being particularly effective on hard-to-abate industrial processes such as cement- and steelmaking. Unfortunately, it is quite expensive at $400-$700 per metric ton of CO2. Carbon capture is only effective for certain facilities such as power plants, but it has the benefit of being cheaper than direct air capture at $50-$250/tCO2.

Government incentives to adopt carbon capture technology have supercharged the growth of CCS around the world. Despite this growth, even optimistic estimates of CCS’ ability to limit carbon emissions are not particularly promising. S&P Global Commodity Insights’ outlook indicates that by 2050, CCS will only be responsible for about 4% of CO2 reductions necessary under the International Panel on Climate Change’s 1.5 degrees C scenario. The 4% makeup isn’t nothing, but CCS is a long way from being a solution to climate change.

CCS critics have been quick to deride the technology as a scam or as a greenwashing effort by the fossil fuel industry. But CCS advocates point out that meeting climate goals is going to be a collective effort involving many different approaches. Creating an economic incentive to decarbonize, potentially using a carbon tax or similar mechanism, could help CCS gain wider adoption and increase its impact on emissions.

On June 8, S&P Global published a detailed analysis of carbon capture, removal and credits, assessing the effectiveness of carbon mitigation efforts. The analysis focused specifically on the top 25 companies in the oil and gas industry, not all of whom have committed to carbon emissions reduction efforts. The study concluded that CCS investment is both prudent and affordable for large oil and gas companies, but not transformational. While CCS can be effective in reducing the emissions in the sourcing and processing of fossil fuels, 93% of total emissions come from the burning of fossil fuels by end users. CCS doesn’t address this challenge.

Today is Monday, December 11, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week of 11 December 2023

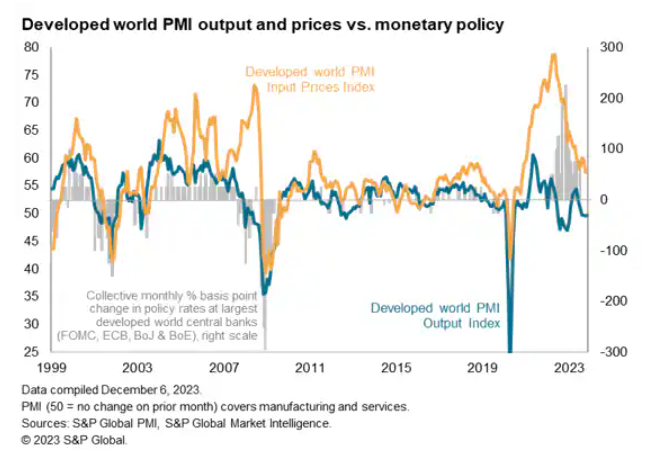

Into mid-December, a flurry of central bank meetings is anticipated including in the US, UK and Eurozone. December flash PMI releases will also be due for the earliest look into economic conditions across major developed economies in the final month of the year. Additional key economic data releases due in the week include US CPI, UK GDP and labour market data, eurozone industrial production, Japan's Tankan survey and monthly production and retail sales data from both the US and mainland China.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

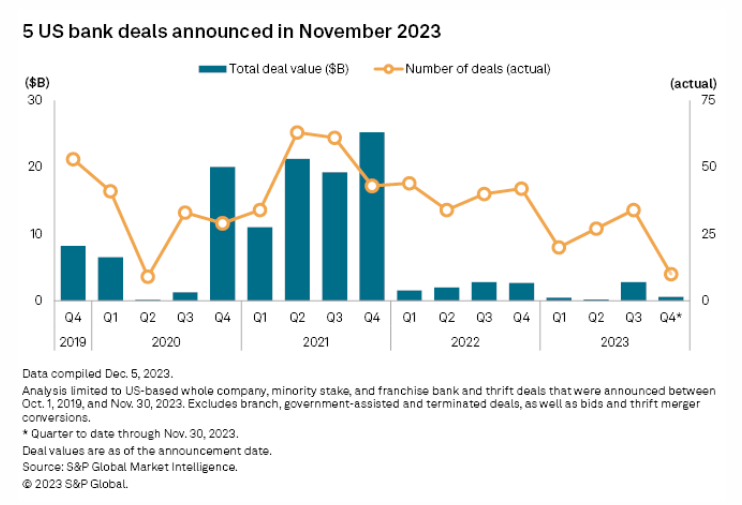

Bank M&A 2023 Deal Tracker: 5 deals announced in November

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration in global trade in November, extending the sequence of decline to 21 months. There was some good news, however, in that the seasonally adjusted PMI New Export Orders Index rose from 48.0 in October to 48.5, which corresponded to only a moderate decline in trade conditions and the slowest pace of contraction since May.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

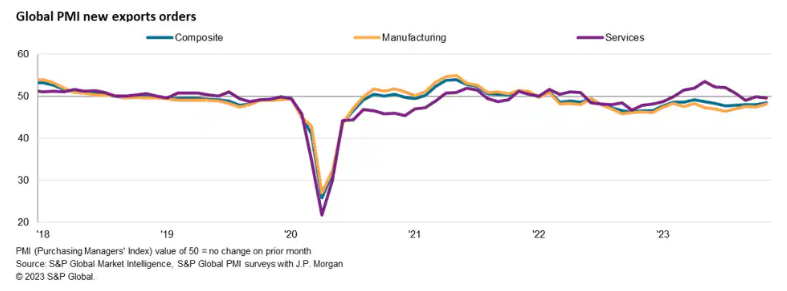

Deterioration Of Global Trade Conditions Ease In November

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration in global trade in November, extending the sequence of decline to 21 months. There was some good news, however, in that the seasonally adjusted PMI New Export Orders Index rose from 48.0 in October to 48.5, which corresponded to only a moderate decline in trade conditions and the slowest pace of contraction since May.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: COP28 Highlights Need For Innovative Climate Finance Solutions

In this episode of ESG Insider, the podcast is on the ground at the UN’s COP28 climate conference in Dubai covering the role the financial sector plays in addressing climate change. Finance is a cross-cutting theme on the COP28 agenda, and the week kicked off with a day dedicated to the topic. In today’s episode, hear Dame Susan Rice talk about what needs to happen to close the climate finance gap.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

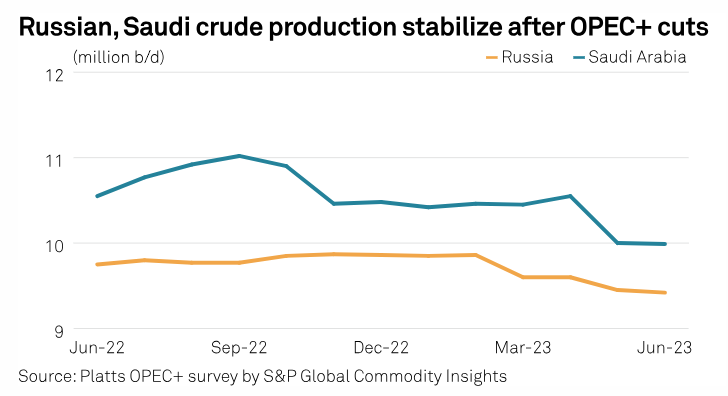

OPEC+ Alliance Tightens Crude Output By 110,000 B/D In Nov, Led By Iraq Drop: Platts Survey

OPEC+ crude production fell 110,000 b/d in November to 42.6 million b/d, as exports from several key producers fell month on month, the latest Platts survey by S&P Global Commodity Insights has found. Output from OPEC's 13 members contracted by 70,000 b/d to 27.82 million b/d, mainly due to a drop in Iraqi output, the survey found, while 10 non-OPEC allies, led by Russia, pumped 40,000 b/d less.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

American Honda Sees A Share Rebound

American Honda Motor suffered severe inventory droughts during the pandemic and semiconductor crisis, but it has emerged in 2023 with redesigned core products and an easing of production challenges — giving the automaker a boost heading into 2024. While supply chain disruptions hit every OEM, they rocked parent company Honda Motor particularly hard. The automaker built just 3.9 million vehicles worldwide last year, down from 4.1 million in 2021, 4.4 million in 2020, and 5.2 million in 2019, according to the automaker.

—Read the article from S&P Global Mobility