Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Semiconductor Shortages and Gluts

It is sometimes said generals are always preparing to fight the previous war. Businesses, too, have a knack for creating policies and procedures that would have served them well in a past crisis. In the semiconductor industry, governments and suppliers have been hard at work building the capacity, inventory and manufacturing capability that would have benefited them during the shortages created by pandemic lockdowns and their associated supply chain disruptions.

“For professionals in the semiconductor industry, shortages are not new; they are cyclical in nature,” Tammy Max, technical director for Part Solutions at S&P Global Engineering Solutions, wrote in a recent article. “Historically, these periods of electronic component allocation have been short-lived (six months to a year), but the current chip shortage is an unprecedented deviation to that trend.”

There have been many causes of the semiconductor shortage, including a series of fires, lockdowns, an ice storm, a ship blocking the Suez Canal and bottlenecks outsides of U.S. ports. But part of this unprecedented deviation was a product of just-in-time inventory strategies. With manufacturers only ordering the number of semiconductors they believed that they would need in the short term, they lacked the inventory to ride out sustained disruptions. When the pandemic began, car manufacturers slashed their orders for semiconductors. Their suppliers, the semiconductor foundries, switched over to manufacturing the more advanced chips used in consumer electronics, an industry that was booming due to lockdowns. When car manufacturers realized they were facing a shortage, suppliers began the laborious process of switching back to the simpler semiconductors used in cars. It takes up to 26 weeks to manufacture a complete semiconductor.

Globally, the solution to the semiconductor shortage has been the construction of new foundries, with 29 currently under development. Most of that development is happening in China and Taiwan, followed by the U.S., Japan and Korea. But this capacity development will not help ease current shortages. It takes one to two years to build a foundry, and another year to install equipment.

On Aug. 9, U.S. President Joe Biden signed the CHIPS and Science Act to ease the semiconductor shortage in key industries. The act provides $52 billion in federal funding to domestic semiconductor manufacturing. Critics charge that the new law’s focus on domestic manufacturing will limit innovation and distort supply chains without fixing the semiconductor shortage, assuming it persists.

“We now appear to be entering a downturn in demand, as the buying frenzy of consumer technology during the lockdown ebbs,” Principal Research Analyst John Abbott of 451 Research, a part of S&P Global Market Intelligence, wrote in an Aug. 22 blog post. “In a year or two, we are likely to see a glut of capacity, at least temporarily, which will test the resolve of those companies that have committed to expensive build-outs.”

According to S&P Global Ratings, weakness in demand for consumer electronics may lead to an oversupply in semiconductors. The capacity being added in the form of new factories and a new willingness to hold “just in case” inventories could amplify a downturn in the market for semiconductors. At the same time, it’s hard to fault governments, suppliers or manufacturers for trying to address the problems that led to the semiconductor shortage. Sometimes prudence demands we fight the previous war.

Today is Friday, August 26, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

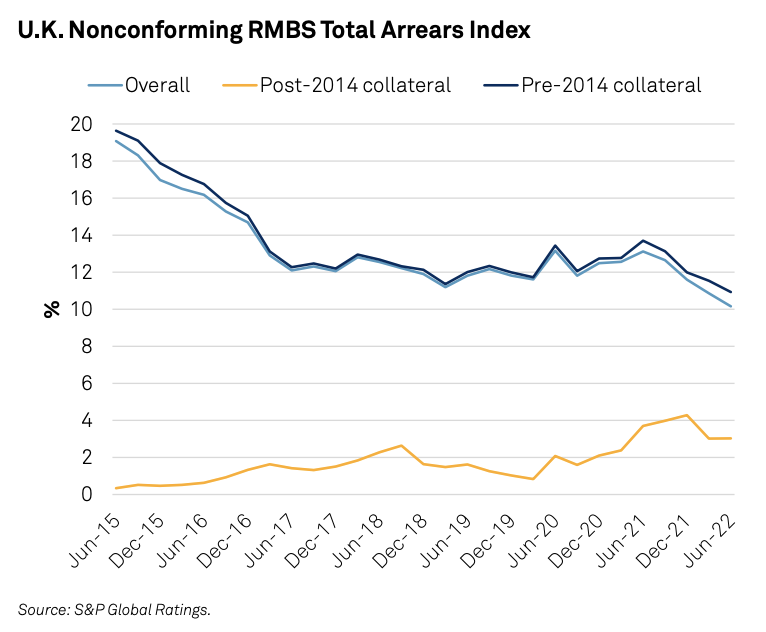

U.K. Nonconforming RMBS: Looking Beyond Headline Arrears

Total arrears in S&P Global Ratings' U.K. nonconforming RMBS index stood at 10.16% at the end of Q2 2022, the lowest level since it began producing the index. Current cost of living pressures could soon cause arrears to rise. Borrowers with variable-rate loans could see additional stress due to the accompanying rise in mortgage rates and higher mortgage payments.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Private Equity Wades Into Cybersecurity Subsector Consolidation

The fragmented identity and access management subsector of cybersecurity needs consolidation, and private equity firms are taking the opportunity to combine vendors and create players that can compete better in the marketplace. Deal activity in 2022 by Thoma Bravo LP is an example, according to Garrett Bekker, principal research analyst at 451 Research. The software-focused private equity firm completed its approximately $6.9 billion acquisition of SailPoint Technologies Holdings Inc. on Aug. 16 and is now in the process of acquiring Ping Identity Holding Corp. for $2.8 billion.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

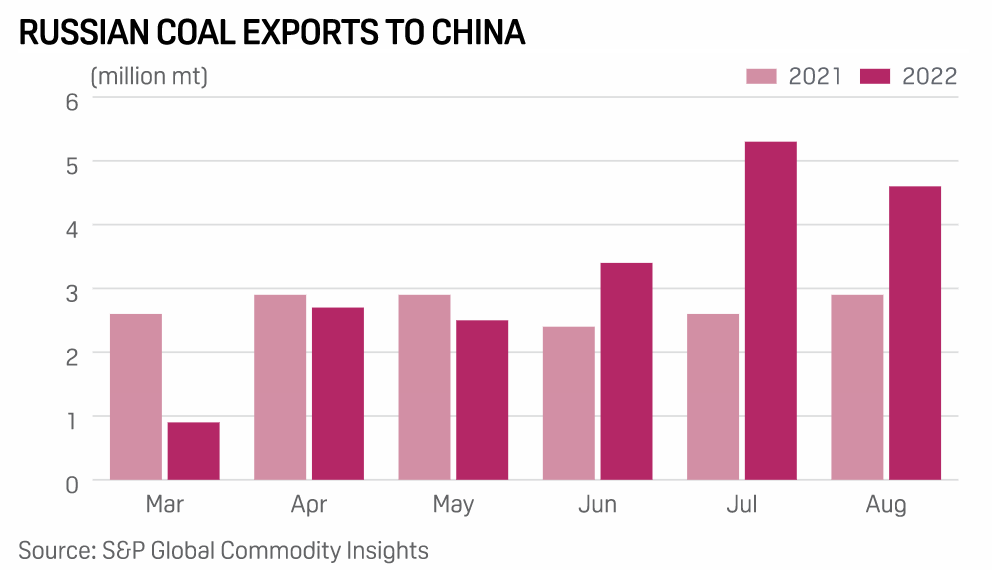

Europe's Loss On Russian Coal Translates Into Sizeable Gains For Asia, Turkey

With Europe's sanctions on Russian coal following its invasion into Ukraine, Asia and Turkey are emerging as direct beneficiaries, highlighting the change in trade flows in the global thermal coal markets six months after the war broke out. A half-yearly analysis of data from S&P Global Commodities at Sea shows that with Russian coal being offered at a discount compared to the Australian and the South African origin material in the absence of European buyers, countries like China and India have been leveraging it the most.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

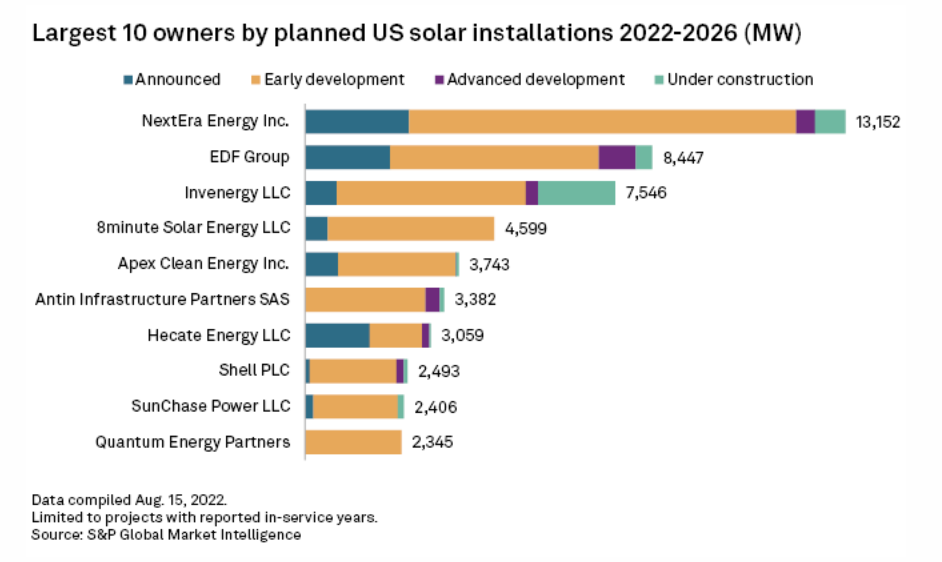

Top Developers Plan 92.1 GW Of Wind, Solar Projects In U.S. Through 2026

The top wind and solar developers plan to build a collective 92,105 MW of capacity in the U.S. through 2026. The figure — roughly the same from the first quarter of this year — is limited to projects with reported in-service years. Of the total, developers have 51,172 MW in planned solar projects and 40,933 MW in planned wind projects, according to S&P Global Market Intelligence data. At the end of 2021, the top developers had a project pipeline of 76.9 GW.

—Read the article from S&P Global Market Intelligence

Listen: China’s Private Refiners On Tenterhooks As Beijing Kicks Off Fresh Round Of Inspection

Beijing has been stepping up efforts to tighten supervision and standardize operations of its refining sector. It launched a series of investigations on refineries beginning April 2021. The latest round of inspections this month will focus mainly on tax issues, as small-scale private refiners often fail to fulfill their tax obligations in an attempt to stay competitive. In this episode, S&P Global Commodity Insights' Philip Vahn, Asia oil market managing editor, and Oceana Zhou and Daisy Xu, senior analysts covering China’s market, discuss Beijing's latest tax investigation and its impact on independent refineries' future operations.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

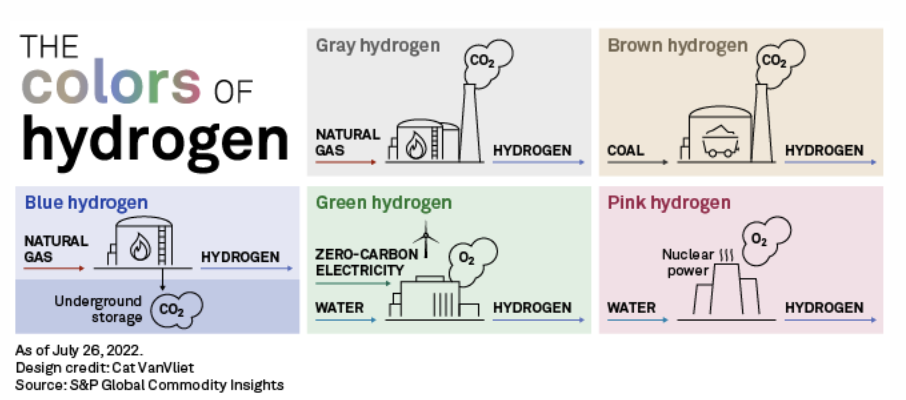

Amazon Signs Green Hydrogen Deal With Plug Power

Hydrogen fuel cell maker Plug Power Inc. will supply 10,950 tons per year of liquid green hydrogen to power Amazon.com Inc.'s transportation and building operations starting in 2025. Amazon officials said in a Aug. 25 news release that the green hydrogen supplied by Plug Power will replace diesel and other fossil fuels and supply enough annual power for 30,000 forklifts or 800 heavy-duty trucks used in long-haul transportation.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >