Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Aug, 2020

By S&P Global

After experiencing its shortest bear market in history, on Aug. 18 the S&P 500 benchmark index closed up 0.11% from its previous peak six months ago—rallying more than 50% to erase the pandemic-prompted losses and marking a new historic high. Under the current conditions, the latest market record comes as a surprise when juxtaposed with the widespread loss of life and unemployment spurred by the pandemic.

“Closing at 3389.78 [on Tuesday], the index narrowly eclipsed its previous Feb. 19 record at the close,” Chris Bennett, Director of Index Investment Strategy at S&P Dow Jones Indices, said in a letter to clients. “While the S&P 500 stands 0.11% above where it closed on Feb. 19, performances among its underlying sectors have been anything but flat: the Consumer Discretionary sector is up a whopping 16% over that same time period, while the Tech sector has also helped fuel the return to glory, gaining 12% since mid-February. On the other hand, Energy and Financials have lagged, sliding 32% and 21%, respectively, since the benchmark last set an all-time high.”

Of the more than 20 bear markets that occurred between 1929 and this year, the median bear market lasted 302 days, according to the sell-side consultancy Yardeni Research. This year’s bear market, measured from the peak on Feb. 19 to trough on March 23, was only 33 days.

Apple Inc., one of the companies with the greatest weight within the S&P 500, became the first publicly-traded U.S. company to reach a $2 trillion market capitalization on Aug. 19, one day after the index peaked. This year, prior to and during the pandemic, Alphabet, Amazon, Apple, Facebook, and Microsoft have gained roughly 40% in value so far this year.

That same day, equities markets dropped lower following the release of the U.S. Federal Reserve’s minutes from its July meeting, which reiterated that the central bank’s staff expected growth to recover at a rate “somewhat less robust than in the previous forecast” in the second half. The S&P 500 slid 0.4%, to 3,374.85, while the Dow Jones Industrial Average slid 0.3% to close at 27,692.88.

"The S&P 500 has been impressive and has created a lot of wealth, but I am not sure that reflects the overall health of the economy," Patrick Leary, chief market strategist at the retail banking firm Incapital, told Reuters on Aug. 18 after the index rebounded.

The rise may continue over the long-term, as the S&P 500 has historically climbed during U.S. presidential election years, according to S&P Dow Jones Indices.

“The benchmark posted a positive price return in 17 of the last 23 election years, giving it a hit rate of roughly 74% and an average return of 7.05%. But there was substantial cross-sectional variation in election returns: there was a return spread of over 75% between the S&P 500’s best election year (1928) with its worst (2008),” Hamish Preston, an associate director of U.S. Equity Indices at S&P Dow Jones Indices, said in an Aug. 18 commentary, acknowledging that “it is important to recognize that the performance of the S&P 500 during election years has typically been similar to its performance during other years … [as] the average and median calendar year S&P 500 price return, volatility, and risk-adjusted returns have been similar across election and non-election years.”

Today is Thursday, August 20, 2020, and here is today’s essential intelligence.

Listen: Fixed Income in 15 – Episode 10

On this edition of Fixed Income in 15, Joe Cass is joined by Anthony Scaramucci, Founder at Skybridge and S&P Global Ratings’ Global Chief Economist Paul Gruenwald. The three discussed credit markets, economic recovery and the global financial outlook. As always, there was some off-topic debate too – here Anthony describes how the ‘Wall Street’ movie impacted him as a young professional and his cameo role in the sequel.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

Default, Transition, and Recovery: The Still-High Weakest Links Tally Contracts As Defaults Rise

Although decreasing from their all-time highs in June, the number of weakest links globally and in Europe remains elevated with 589 and 99 entities, respectively. Weakest links are the weakest of the borrowers, namely those rated 'B-' or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch with negative implications, and they typically default at a rate 8x that of speculative-grade companies. This comes at a time when the number of year-to-date defaults is also breaking records. In Europe, the 2020 tally has hit a year-to-date historic high of 20, surpassing its year-to-date 2009 tally of 15. As weakest links are a particularly important indicator of future defaults, S&P Global Ratings will likely see the Europe default tally surpass its 2009 year-end record tally of 22.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: Credit And Economic Deterioration Signals A Rising European Speculative-Grade Default Rate Despite Market Optimism

S&P Global Ratings Research expects the European trailing-12-month speculative-grade corporate default rate to increase to 8.5% by June 2021 from 3.4% as of June 2020. S&P Global economists have once again lowered their expectations for European economic performance in 2020 and 2021 because of the COVID-19 pandemic. S&P Global Ratings has also been witnessing an uptick in the default rate to a several years' high, alongside arguably the most pronounced deterioration in credit quality ever. That said, the pace of declines on the economic and credit fronts have been slowing recently, while the European Central Bank (ECB) recently expanded the Pandemic Emergency Purchase Program (PEPP) and the EU unveiled a new, massive fiscal debt stimulus, which includes pooled debt issuance across sovereigns and a large amount of forgivable loans.

—Read the full report from S&P Global Ratings

Not-For-Profit Higher Education Mid-Year Sector View: Fall 2020 Enrollments Will Drive Credit

S&P Global Ratings' view on the U.S. not-for-profit higher education sector has been negative for three years, and the COVID-19 pandemic and related economic impacts exacerbate financial pressures colleges and universities were already facing. Measures to contain the pandemic caused most colleges and universities to substantially reduce on-campus activities and send students home in the spring, resulting in a loss of auxiliary revenues and a move to online learning. As a result, on April 30, S&P Global Ratings revised the outlooks to negative from stable and affirmed its ratings on 117 U.S. not-for-profit colleges and universities, and revised the outlooks to stable from positive and affirmed the ratings on 10 other U.S. not-for-profit higher education institutions.

—Read the full report from S&P Global Ratings

COVID-19- And Oil Price-Related Public Rating Actions On Corporations, Sovereigns, And Project Finance To Date

In response to investors' growing interest in the coronavirus pandemic and its credit effects on companies, S&P Global Ratings is publishing a regularly updated list of rating actions taken globally on corporations and sovereigns, as well as summary table and supporting charts. Also included is a summary of project finance rating actions. These are public ratings where S&P Global Ratings cites the coronavirus pandemic, oil prices, or both as a factor. This information is as of Aug. 17, 2020, unless stated otherwise.

—Read the full report from S&P Global Ratings

U.S. Bank Margins Crushed In Q2, Falling To Record Lows

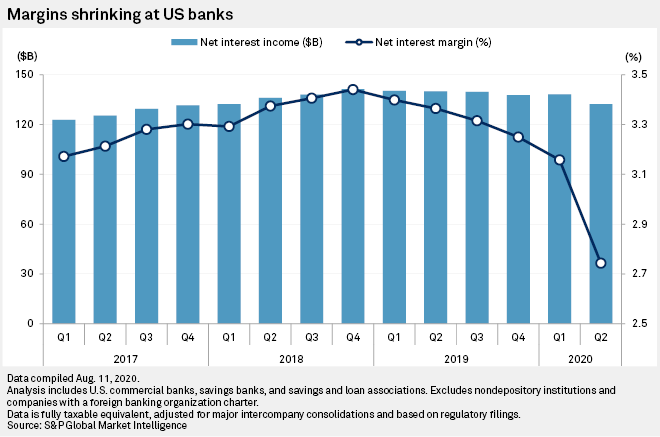

U.S. bank margins plummeted in the second quarter of 2020 as institutions found few opportunities to put excess liquidity to work outside of the low-yielding credits associated with the government's small-business rescue program. Bank margins took a nose dive in the period, dropping 41 basis points in the second quarter, with the industry's taxable equivalent net interest margin falling to 2.74% from 3.16% in the prior quarter.

—Read the full article from S&P Global Market Intelligence

Banks Battle PPP Agent Fees In Court

A legal battle has broken out over when lenders must pay accounting firms and other "agents" fees for preparing borrowers' loan applications under the Paycheck Protection Program. Banks across the country are facing lawsuits from agents, such as accountants, attorneys and loan brokers, who are seeking payment for services rendered, sometimes in cases in which a lender did not even know that an agent was providing PPP loan application services. The controversy stems from early PPP guidance from the Treasury Department and the Small Business Administration, which states that lenders would pay fees to agents out of their own fees for processing the loans.

—Read the full article from S&P Global Market Intelligence

Pandemic To Prolong German Banks' Struggle With Low Profitability

German banks are expected to remain among Europe's least profitable over the next two to three years, and if this continues over the long term, they may be less able to attract new business, according to industry observers. The fragmentation of the German banking system has created a vicious circle of low profits and high costs. In recent years, these issues have been compounded by negative interest rates in Europe, to which German banks are particularly exposed because of their high reliance on net interest income.

—Read the full article from S&P Global Market Intelligence

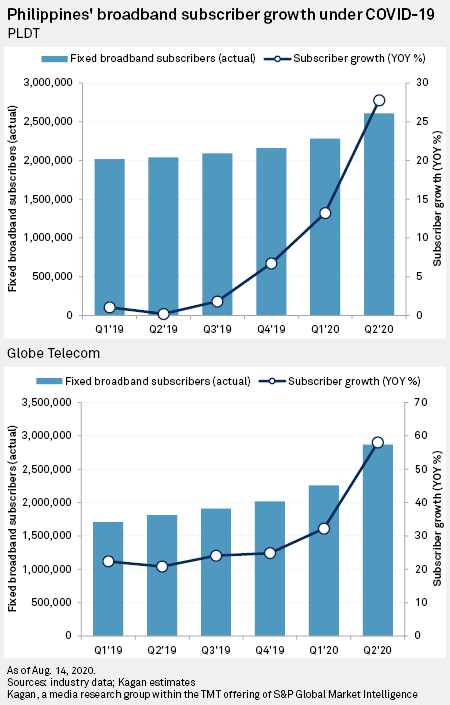

Philippine Carriers See Surge In Broadband Subs, Revenues Amid COVID-19

The top two internet service providers in the Philippines experienced a surge in fixed broadband subscriptions and revenues amid the coronavirus pandemic, data collected by S&P Global Market Intelligence shows. In the three months to June 30, PLDT Inc. saw a 14.30% quarter over quarter increase in total broadband subscribers. PLDT is owned by Hong Kong-based investment management and holding firm First Pacific Co. Ltd., and trades on the NYSE under the ticker PHI.

—Read the full article from S&P Global Market Intelligence

Latest Tiktok Order Could Be 'Backup Plan' To Ensure U.S. Ownership Change

Within the span of two weeks, President Donald Trump issued two orders targeting TikTok Inc., creating fresh confusion over how soon the video-sharing app must be sold. But foreign investment experts said the two orders are not at odds. On Aug. 4, Trump told reporters that TikTok and its Chinese parent Beijing Byte Dance Telecommunications Co. Ltd. had until Sept. 15 to find a "secure" and "very American" buyer for TikTok, or risk having the app shut down in the U.S. Two days later, the president issued an executive order that would ban "any transaction" related to ByteDance by any person or entity subject to U.S. jurisdiction beginning 45 days after the order's release — or on Sept. 20.

—Read the full article from S&P Global Market Intelligence

Intel's New Roadmap Draws Skepticism From Analysts Who Say New Strategy Needed

Intel Corp. is redrawing its product roadmap to fill in gaps left by delays in the development of its next-generation processors, but analysts are still unclear on how it plans to catch up to rivals Advanced Micro Devices Inc. and NVIDIA Corporation. Intel's recent three-hour Architecture Day briefing focused on plans to increase the performance of chips it is currently able to produce by enhancing the software, security, data interconnections, memory and architecture of its chips. The briefing day followed the company's July announcement that manufacturing problems would keep it from upgrading in its usual way, by shrinking its best designs from a 10-nanometer fabrication process to one at 7-nanometers.

—Read the full article from S&P Global Market Intelligence

Studio-Theater Consolidation Now Possible But Still Improbable, Analysts Say

A recent move from federal regulators means that movie studios can now own theater chains. But given the rise of streaming platforms, the rule change may be too little, too late. In a long-anticipated decision, the U.S. Department of Justice lifted the Paramount Consent Decrees, a 71-year-old set of antitrust rules regulating theater ownership among movie studios. But considering how much the video market has evolved in the last couple of years, analysts say studios are not likely to be eager buyers.

—Read the full article from S&P Global Market Intelligence

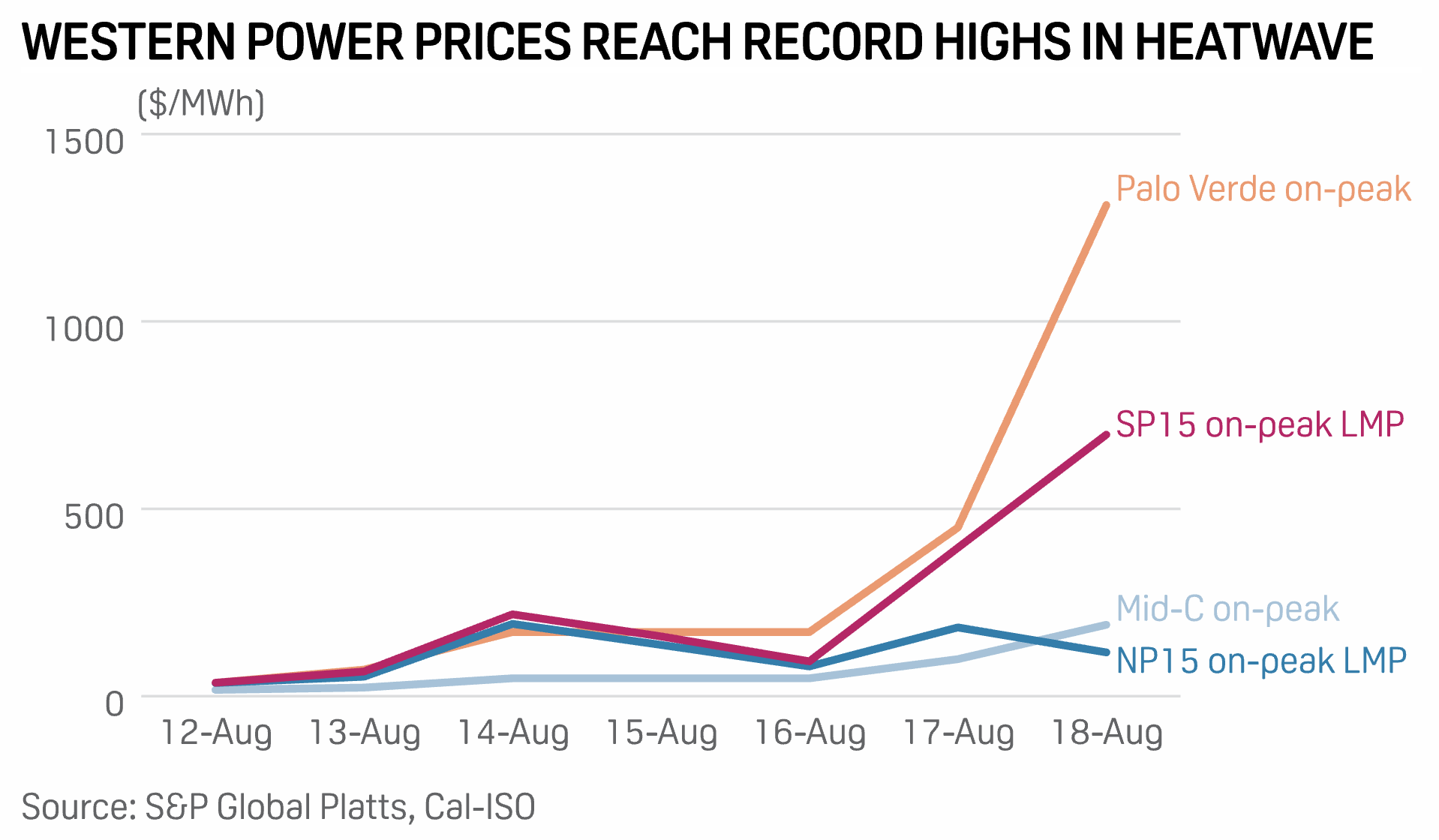

US West Power Hubs Find Record Highs As Heat Wave Boosts Power Demand

US Western power prices could set back-to-back record highs on continued record-breaking temperatures driving up power demand and leading to threats of power outages, as the California Independent System Operator footprint remains under a flex alert and restricted maintenance operations. Cal-ISO is on restricted maintenance operations through Aug. 21 and a flex alert for 3-10 pm PT each day through Aug. 19. A flex alert urges consumers to voluntarily conserve energy when power demand could outstrip supply, while restricted maintenance operations require generators and transmission operators to postpone any planned outages for routine equipment maintenance, ensuring all grid assets are available for use.

—Read the full article from S&P Global Platts

Germany-Based Proton Gears Up For 15% Annual Growth In Fuel Cell Market

Proton Motor Power System's latest fuel cell stack module is ready for volume production in anticipation of 15% compound annual growth rate in global demand for hydrogen fuel cells, the UK-listed, Germany-based manufacturer said Aug. 18. An automated manufacturing line was installed at the company's headquarters in Puchheim near Munich in May last year, with the goal of increasing capacity up to 10,000 fuel cell units a year. This it said could be increased to 30,000-50,000 units with further investment in automation.

—Read the full article from S&P Global Platts

Listen: Full Throttle For New European Freight Benchmark Prospects To West Africa

Gasoline volumes from Northern Europe to West Africa are expected to continue to grow, and new hedging tools may be needed for medium range clean tankers in the West of Suez market. Platts Shipping Editors Sam Eckett, George Griffiths, and Chris To discuss emerging benchmark opportunities into West Africa, while probing the unprecedented state of trans-Pacific container rates.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Uncertainty Looms In Libya As PFG Allows Eastern Oil Ports To Reopen

The Petroleum Facilities Guard of Libya's eastern oil terminals said they will reopen the country's key oil ports to allow the exports of some barrels from storage, but the restart of a bulk of Libya's crude oil production remains uncertain as the state-owned National Oil Corp. has yet to agree to terms with the PFG, sources close to the matter said Aug.19. On Aug. 18, the head of the eastern-PFG, Naji al-Maghrabi, said the oil blockade which has been in place for seven months would be lifted to allow for the exports of stored fuel and gas to help alleviate power shortages gripping the country.

—Read the full article from S&P Global Platts

Analysis: Floating Storage At Two-Month Lows Despite Inflated Volumes Off China

The amount of crude and condensate hoarded on tankers has tumbled to more than two-month lows as the incentives for storage start to recede, although volumes offshore China remain high, putting pressure on the physical oil market, according to analysts. The easing of OPEC+ production cuts together with a gradual demand recovery have assisted the rebalancing of the global oil market. But congestion outside the ports of the world's largest crude importer, China, along with a slower than expected demand recovery, has meant floating storage levels haven't tailed off sharply.

—Read the full article from S&P Global Platts

Gas Ban Monitor: Calif. Vote Freeze Thaws; Bay Area Tackles Existing Buildings

California's Bay Area saw an uptick in votes to require all-electric systems in new buildings in recent weeks, following a pause in adoption as the nation grappled with the COVID-19 pandemic, economic downturn and protests over racism. The debates on the measures telegraphed potential challenges ahead as the gas ban movement progresses beyond a period of early adoption and as local lawmakers seek to address gas use not just in new construction but existing buildings.

—Read the full article from S&P Global Market Intelligence

FEATURE: Moldova Set For Gas Diversity As Romania Link's Launch Imminent

The former Soviet state beholden to Russia for its gas supply for decades -- is on the verge of a new chapter in its gas history with an expanded connection linking to Romania just days from being launched. The 120-km (74-mile) pipeline from the Ungheni entry point on the border with Romania to the Moldovan capital Chisinau will enable up to 1.5 Bcm/year of gas to flow from Romania into Moldova, bringing much needed supply diversity.

—Read the full article from S&P Global Platts

China's Steel Mills Mull Altering Sinter Feed Blend As Iron Ore Hits 6-Year High

Chinese steelmakers are considering adjusting their sinter feed blending ratios as the price of popular medium grades hit multi-year highs, increasing the value-in-use advantage of high grade ores, although practical limitations make widespread changes unlikely, market sources said Aug. 19. A surge in iron ore prices over the past month on the back of tight supply for medium grade fines has narrowed the spread to high grade iron ore cargoes.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language