Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Drought Hits Agriculture, Trade, Energy and Credit Markets

Droughts in the Western U.S. and Europe have negatively impacted crop yields, lowered river levels, shrunk reservoirs and put energy supplies at risk. But the impact of droughts on markets can extend beyond just a yearly or seasonal impact; credit markets must also account for longer-term climate trends and physical asset risk.

According to S&P Global Commodity Insights, heat waves across Europe have led to droughts that are reducing water levels in the Danube Delta. Water levels have fallen to the point where larger vessels are unable to reach river ports. With access to Ukraine’s deepwater ports still unpredictable due to Russian blockades, the Danube has been the critical outlet for grain and vegetable oil shipments.

The European drought and heat waves have also led to a decline in rice and corn output from the EU. According to the U.S. Agriculture Department, the bloc’s 2022 milled rice output will dip by 21% year over year, with the effects of the drought being particularly acute in Italy, which is responsible for 50% of EU rice production. Corn production is also expected to be down for the year in the EU due to prolonged drought. Ukraine has been the largest exporter of corn to the EU for the last two years, and the invasion of the country is creating additional food scarcity across the region.

"Water and heat stress are driving crop yields down from a previously already negative outlook for cereals and other crops. France, Romania, Spain, Portugal and Italy will need to deal with this reduced crop yield," the European Commission's Joint Research Centre said in a recent report, according to S&P Global Commodity Insights.

Dry conditions in Southern Europe are also impacting the hydropower industry. With energy supplies tight and prices high due to the unpredictable flow of Russian gas, the loss of additional energy capacity could have negative consequences for industry and consumers. The generation capacity of hydropower has always fluctuated, and some observers have attributed the increasing frequency of fluctuations to climate change.

Last month, the National Oceanic and Atmospheric Administration predicted that the unusually warm temperatures observed across most of the U.S. will persist through October. Severe drought conditions will continue across the Western U.S. and water curtailments have become the norm. While S&P Global Ratings believes that most of its rated water and sewer utilities in U.S. public finance are positioned to weather the situation, drought risk and climate change can influence credit ratings and an issuer's creditworthiness.

In a recent analysis by S&P Global Ratings, the key factors related to drought that can influence creditworthiness were identified. These included the cost of water, storage capacity, political obstacles and water rights uncertainty. Water rights are a particularly contentious issue in the Western U.S., partly because the Colorado River’s allocations to the seven basin states were set several decades ago during an unusually wet period. Therefore, allocations are set higher than the river can support nowadays.

Today is Friday, August 19, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

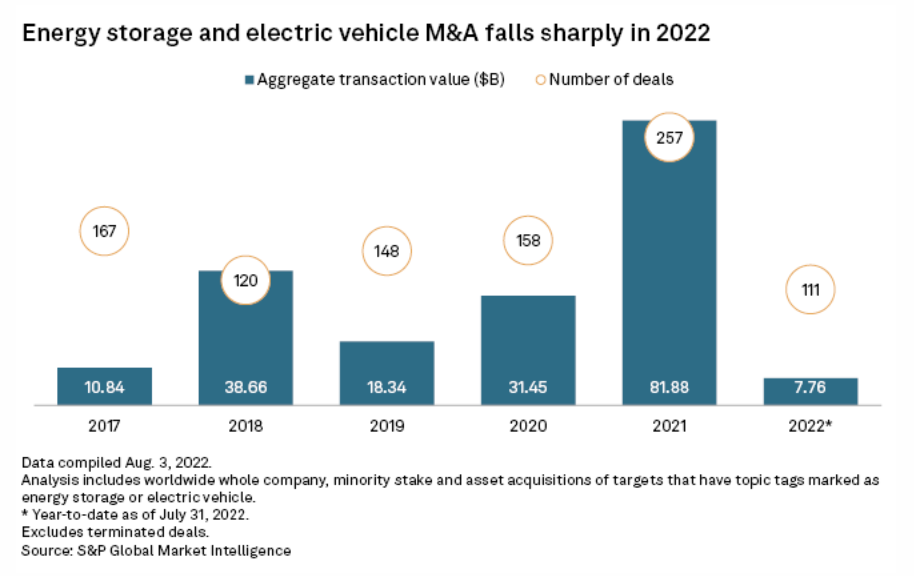

Global EV, Energy Storage M&A Collapses As Investors Moderate Tempo

A year after funneling money into companies creating electric vehicles, charging infrastructure, energy storage devices and related technologies, investors have slowed amid economic and geopolitical turbulence. Global M&A activity in 2022 involving companies developing such tools to decarbonize the power and transportation sectors collapsed to just $7.76 billion through July, marking a significant deceleration from $81.88 billion in all of 2021 and $31.45 billion in 2020, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

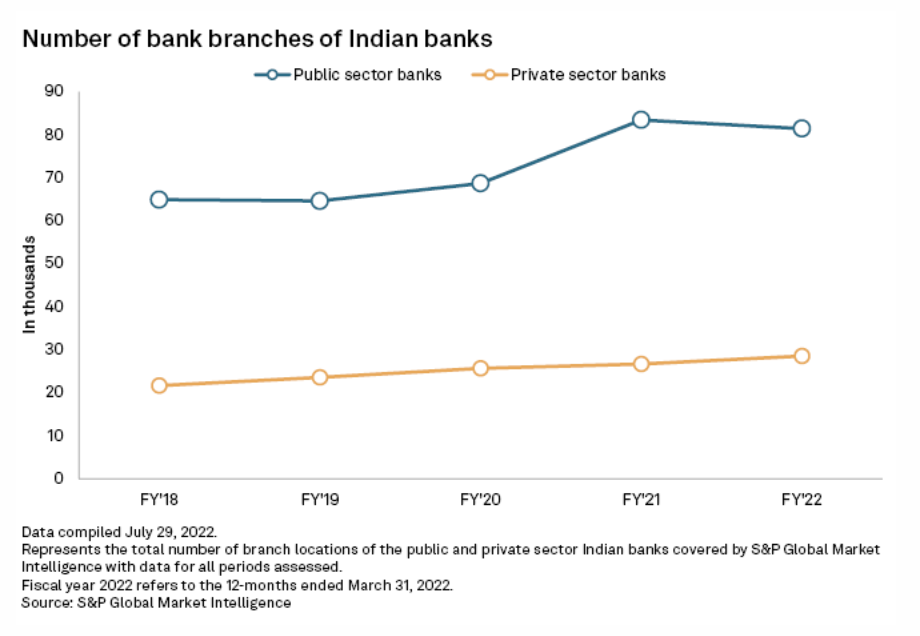

India's Private Sector Banks Grow Branches Along With Digital To Tap Clients

Several Indian private sector banks including HDFC Bank Ltd. and Axis Bank Ltd. are expanding their local branch networks, contrary to expectations that digitalization would obviate the need for physical branches. The number of branches operated by private sector banks grew to 16,189 in the year ended March 31, from 14,893 a year ago, according to data from S&P Global Market Intelligence. HDFC Bank and Axis Bank accounted for the bulk of that growth, with HDFC Bank's branches expanding to 6,342 from 5,608, and Axis Bank's branches increasing to 4,758 from 4,594.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

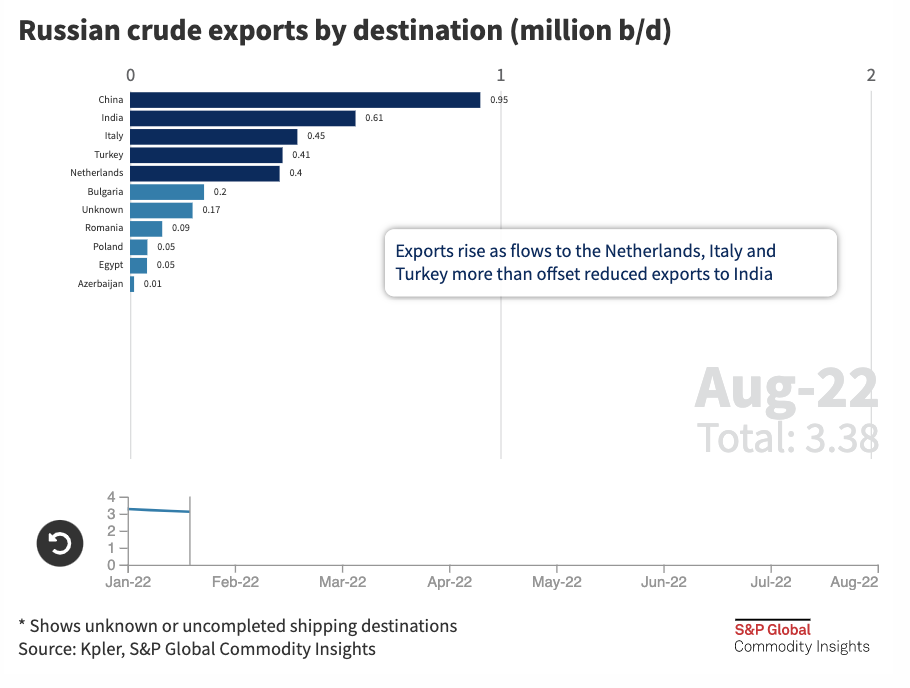

Russia's Seaborne Oil Exports Rise In August As Sanctions Impact Remains Muted

Russia's seaborne exports of crude and oil products continued to elude the thrust of Western sanctions during the first half of August exceeding 6 million b/d for the first time since hitting a post-pandemic high in April, according to tanker tracking data. Russia's crude exports rose by 140,000 b/d on the month to average 3.36 million b/d from Aug 1-16 to remain above pre-war levels for the fifth month in a row, preliminary data from vessel analytics provider Kpler shows.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

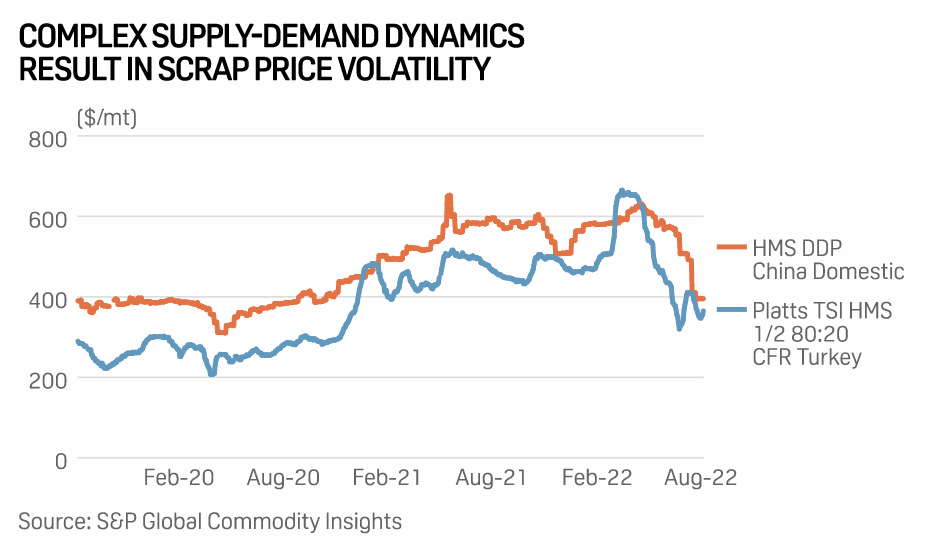

The 'S' Word: Recycling Scrap Metal's Image

Scrap metal is changing its status, its image, its price and even its name. "Rag and bone" men with carts no longer shout around the houses for "any old iron, any old iron?" — at least not in the U.K., and scrap merchants are no longer "scrappies" but increasingly up-market "recyclers."

—Read the article from S&P Global Commodity Insights

Listen: Oil Products Trickle Along The Rhine As Low Water Levels Bite

Record low water levels are hindering the transportation of naphtha, LPG, gasoline blending components and diesel, amongst other commodities, along the Rhine into regions of Germany, France and Switzerland leading to critically low inland stocks and the release of strategic reserves for products already affected by the war in Ukraine and a rebound in transportation demand. In this episode of the Oil Markets Podcast, S&P Global Platts Global editors Eklavya Gupte, Virginie Malicier and Vinicius Maffei discuss with Gary Clark the market implications of strained supply chains for clean oil products for Europe.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

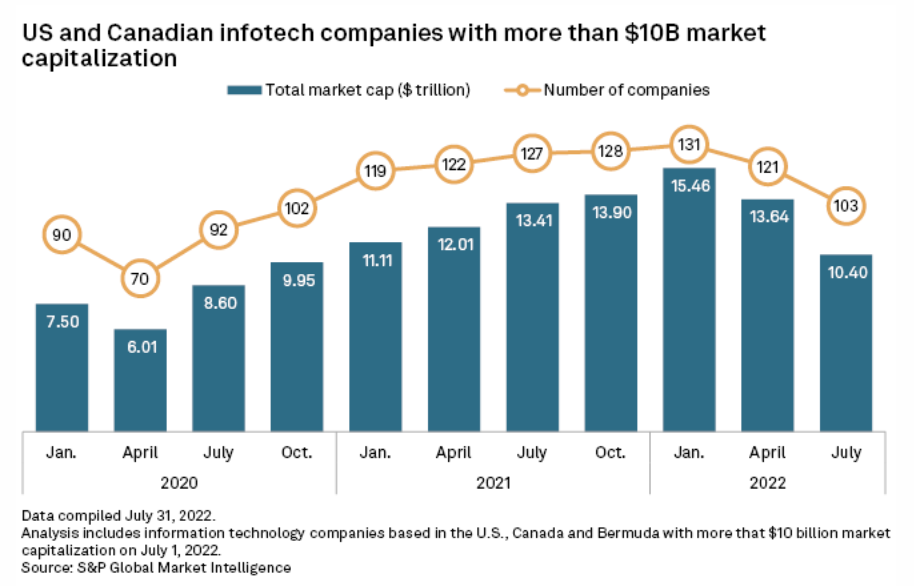

Bearish Investors Shrink Ranks Of Large-Cap Infotech Companies In H1'22

The first half of the year took a heavy toll on information technology stocks, with the tech-heavy Nasdaq down almost 30% as of the end of June. The drop in equities led to an equally steep fall in market capitalizations. Only 103 infotech companies in the U.S. and Canada still had a market cap of more than $10 billion as of July 1, down from 131 on Jan. 1, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >