Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Political Crisis and Organic Food in Sri Lanka

On July 12, Sri Lankan President Gotabaya Rajapaksa fled the country and resigned from office after the South Asian nation’s economy virtually shut down and protesters amassed in the capital of Colombo. The explanations for the political crisis in Sri Lanka are simple: The country was defaulting on its international debt and was unable to pay for basic commodities. The powerful Rajapaksa family has been mired in accusations of corruption for years, and economic hardship provided the spark for a “middle-class revolution.”

So, where does organic food come in? Over the past decade, Sri Lanka has built significant tourism and garment manufacturing industries, but the population is still dependent on agriculture for domestic consumption. In May 2021, former President Rajapaksa and his allies decided to ban chemical fertilizers as a way of tackling some of the nation’s problems. Since chemical fertilizers were mostly imported, banning them could cut Sri Lanka’s balance of payments deficit. The Rajapaksa government also pointed out the health and reputational benefits of moving to a fully organic model.

Unfortunately, the chemical fertilizer ban was implemented with little planning and no transition program. In contrast, a similar program to encourage the adoption of organic farming practices in the U.K. has a phased four-year timeline. Many observers warned that Sri Lanka’s hasty transition would lead to problems.

According to a U.S. Department of Agriculture report issued at the time, "Sri Lanka's leading agricultural economists indicate that the immediate, non-phased-in replacement of chemical fertilizers with organic ones will result in significant drops in crop yields. Rice productivity drops are being calculated to potentially lead to losses of 33%. A similar 35% productivity drop in the tea crop can result in income losses of 84 billion [Sri Lankan rupees]."

The ban on chemical fertilizer didn’t last long. By November 2021, it was rescinded in response to widespread protest. But the damage had been done. Overall food production in Sri Lanka fell by 40% to 50% during the period, according to the United Nation's Food and Agriculture Organization. In the agriculture-dependent country, this decline in food production has caused serious shortages.

The Rajapaksa government tried to blame the falling crop yields on the biofertilizer companies it contracted to replace chemical fertilizers, insisting it would no longer pay for the biofertilizers that were contracted or delivered. The restive Sri Lankan populace was not persuaded.

The new government, formed under current President Ranil Wickremesinghe, is left with nothing but difficult choices to resolve the food crisis. The International Monetary Fund and other multilateral lenders may be willing to extend credit to the cash-strapped nation, but with the usual strictures such loans require. In the meantime, Sri Lanka will need to import grain to meet its domestic needs but will struggle to pay.

Today is Tuesday, August 16, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

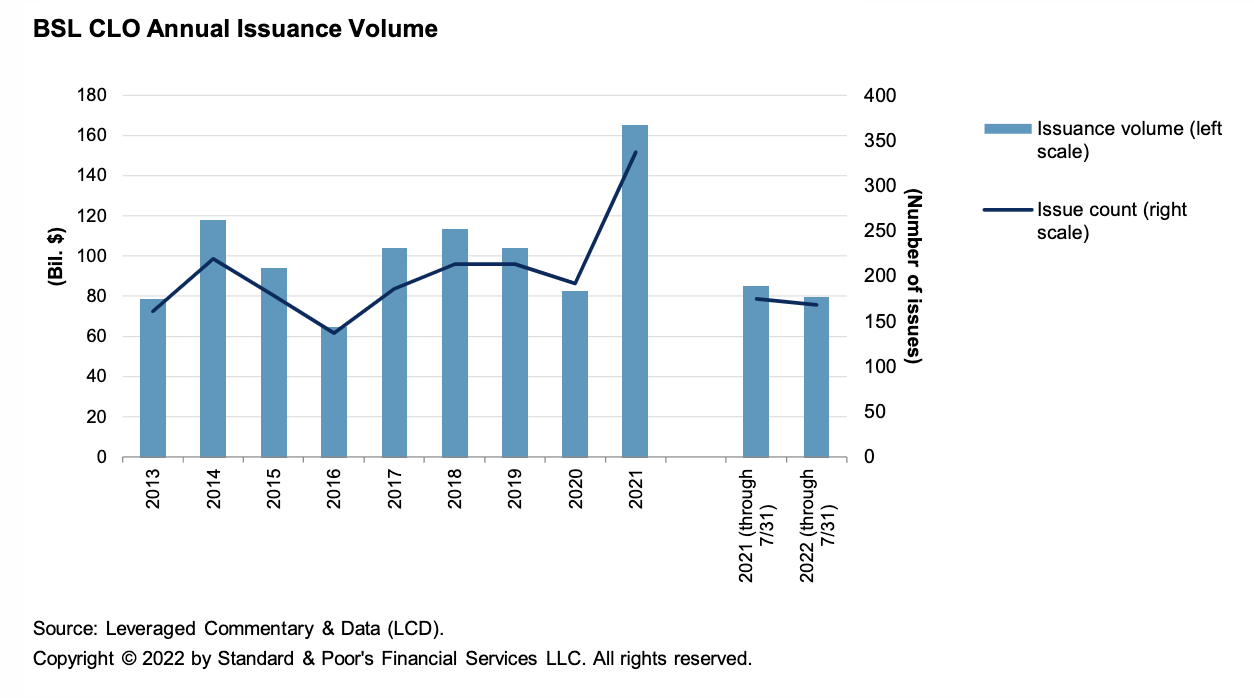

Middle Market CLOs Face Unexpected Headwinds Amid Rising Private Debt Demand

With volatility and uncertainty hampering capital markets, direct lending from private debt providers is increasingly competing with broadly syndicated loans and the high-yield market as an alternative source of funding. In response to volatile market conditions, several broadly syndicated loan borrowers have seen their prices flex wider this year, and deals are taking longer to finalize. By contrast, private debt borrowers typically have more certainty around pricing and timing by working with direct lenders.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

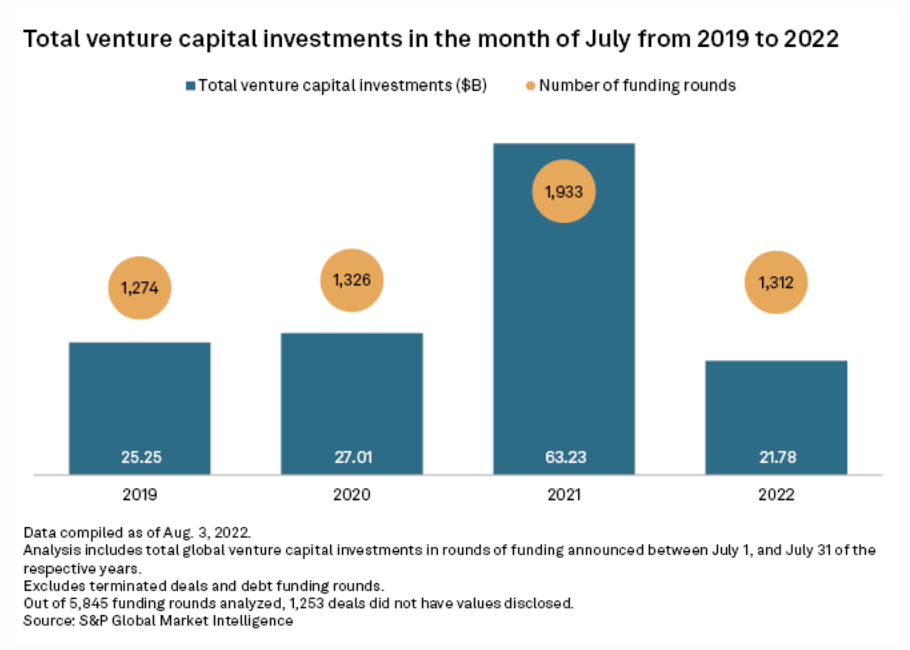

Global Venture Capital Funding Rounds Continue Decline In July

The value of global venture capital-backed funding rounds fell 65.6% year over year in July to $21.78 billion, while the number of rounds was down 32.1%, according to S&P Global Market Intelligence data. The amount raised in July is the lowest since April 2020, when $19.69 billion was pulled in, the data shows.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

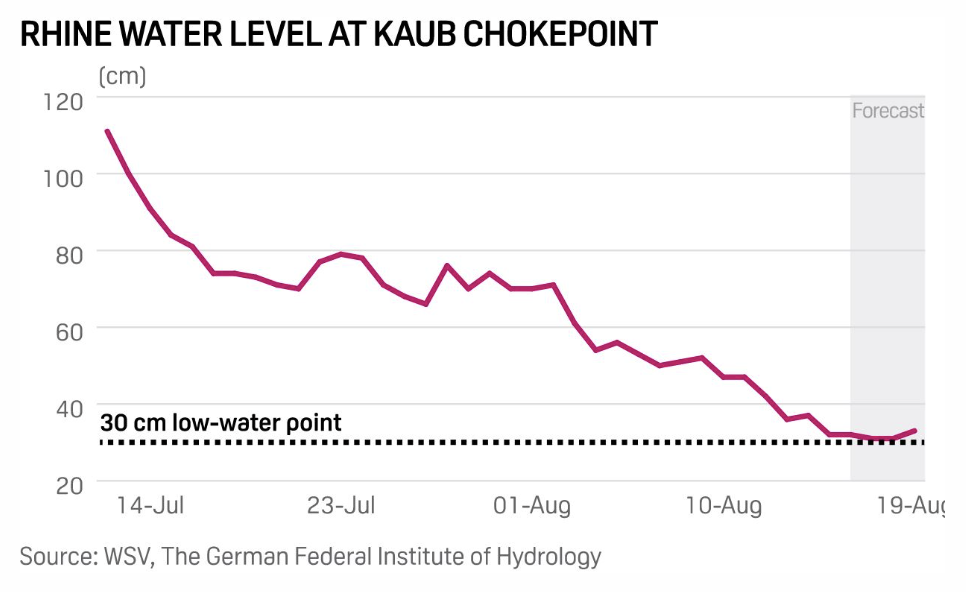

Oil Barge Trade To Be Hit Further As Rhine Water Levels Plunge: Traders

Disruptions to supplies of oil products and petrochemical feedstocks through the Rhine River are expected to worsen as water levels have fallen to extreme lows, traders told S&P Global Commodity Insights Aug. 15. Water levels at Kaub, a key chokepoint located between the Lower and Upper Rhine, fell to 30 cm on Aug. 15, the lowest in years, according to data from Federal Waterways and Shipping Administration.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Central Banks Help Combat Climate Change: An Interview With NGFS Chair Ravi Menon

In this episode of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon speak with NGFS Chair Ravi Menon, who is also managing director of the Monetary Authority of Singapore, the central bank of Singapore. He talks about the work of the NGFS, the challenges of addressing physical risk and transition risk, and the role of central banks in combating climate change.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

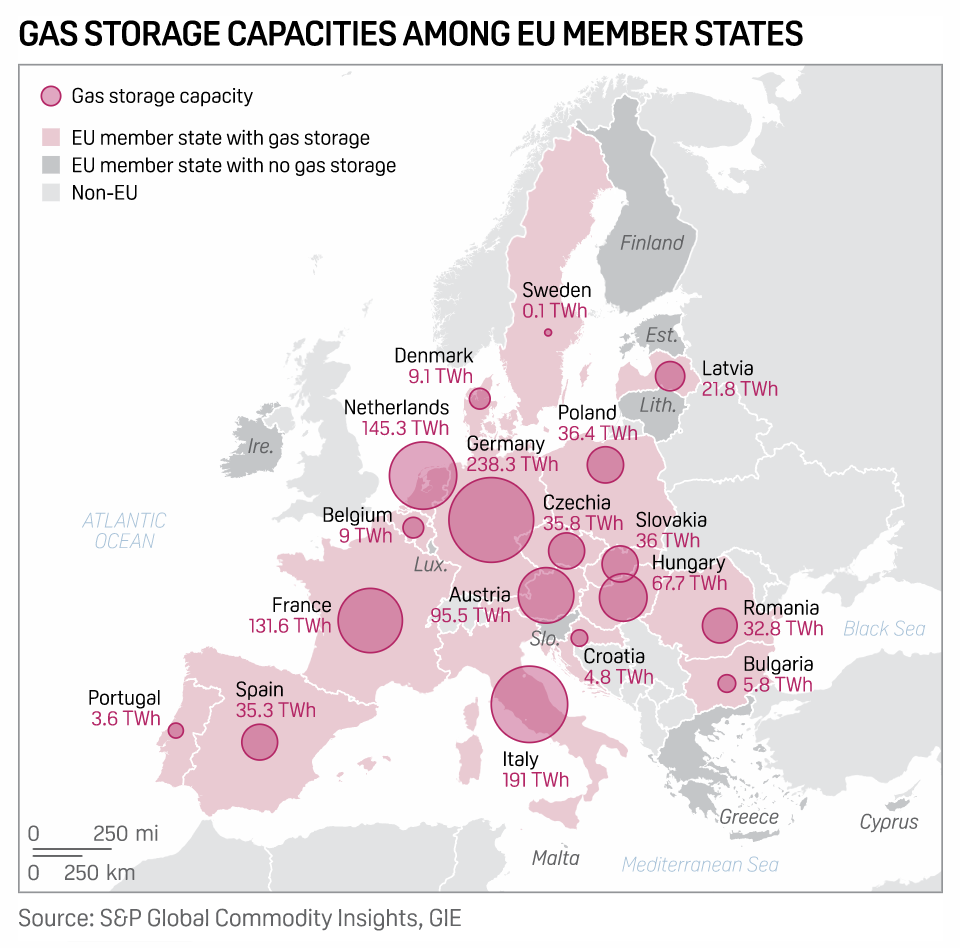

Russia Begins Extra Gas Flows To Hungary On Top Of Contracted Volume: Official

Hungary has begun receiving additional gas supplies from Russia on top of its contracted volume, Tamas Menczer—an MP in the ruling Fidesz party—said on Facebook, as Budapest looks to ensure winter gas supply security. Russia began delivering an additional 2.6 million cu m/d to Hungary via the TurkStream pipeline and associated onshore infrastructure on Aug. 12, Menczer said.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

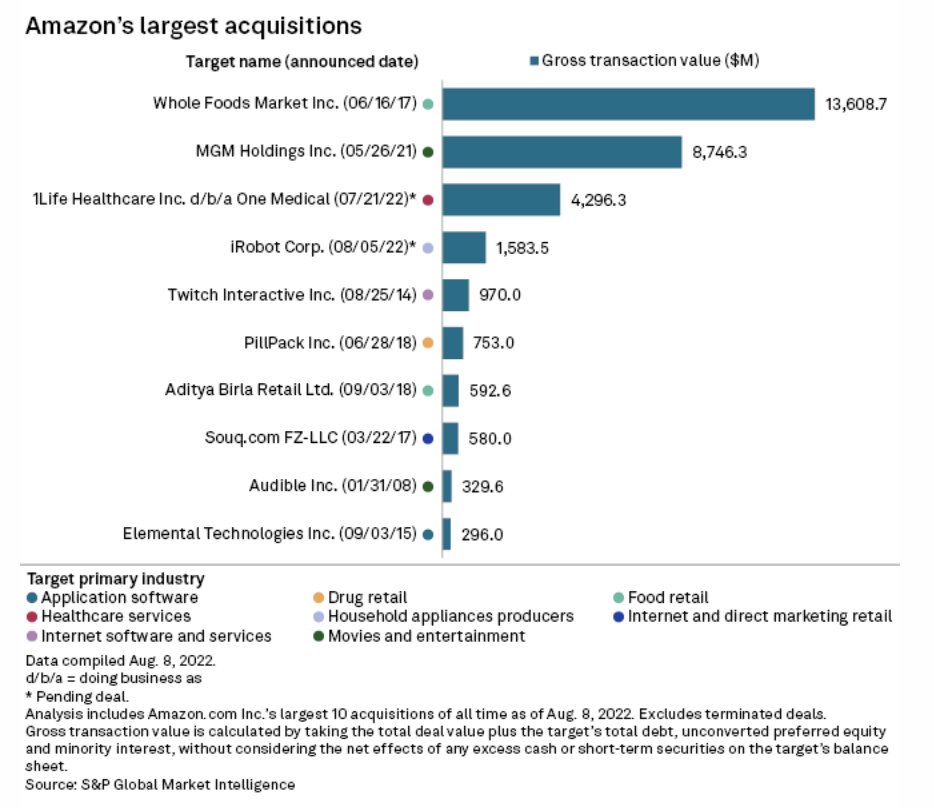

Amazon Treads Carefully With M&A Strategy Amid Growth, Regulatory Pressures

Amazon.com Inc.'s recent acquisitive streak aims to close big deals by targeting new sectors as executives look for future growth, analysts said. The company's M&A strategy appears tailored to withstand the scrutiny faced by Amazon's Big Tech peers, some of which are pulling back on dealmaking amid heightened regulatory headwinds. A key question is whether concerns about how Amazon will handle sensitive data like medical records could lead to roadblocks for the company's recently announced acquisitions.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >