Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 April, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Global Credit Conditions Remain Resilient Despite Risks

In its quarterly global credit conditions report, S&P Global Ratings sounded a note of cautious positivity. Better-than-expected growth in many economies around the world has offset higher interest rates, revealing surprising resilience for global credit markets. However, defaults will continue to climb due to higher rates, likely peaking in the third quarter. Risks remain elevated, particularly geopolitical and climate risks. But a strong global economy and expected rate cuts in the latter half of the year have diminished expectations of a recession.

In 2024, global GDP is expected to grow at a healthy 3.2%. Growth in emerging markets and China will lead the way, while growth in the US is forecast to stand at 2.5%, and the eurozone will trail at 0.7%. Resilient labor markets have helped to power global growth as companies have hoarded employees and service sector demand has remained steady. Should China’s growth slow, global exports could weaken, and global growth could take a hit. Other anticipated risks include geopolitical tensions affecting supply chains, higher interest rates hitting the weakest borrowers, global real estate markets, climate and cyberattacks.

There is a broad consensus that central banks will begin cutting rates in the summer, which should provide some relief to the lowest-rated borrowers. Long-term yields on most bonds remain elevated, although they have fallen off slightly from the end of 2023. The slow decline of inflation in most developed markets has led to anticipated rate cuts. However, those cuts are now projected to be smaller and slower than borrowers may once have hoped.

Demand for corporate debt has remained high among investors, but further downgrades and defaults are possible. S&P Global Ratings anticipates that defaults may increase, particularly among the lowest-rated issuers. Meanwhile, investment-grade credit is solid. Consumer products companies led among sectors for downgrades, while the media and entertainment sector led for upgrades. The credit cycle indicator suggests upward momentum for a recovery in credit markets in 2025.

Credit conditions continue to vary by region. In the United States, credit conditions could brighten somewhat if the Federal Reserve begins to ease monetary policy as anticipated later in the year. In the eurozone, tepid growth is offset by a stable macroeconomic outlook, tight labor markets and disinflation. In Asia-Pacific, the rating outlook bias is uneven across sectors, with weaker growth and rising indebtedness in China causing concern. In emerging markets, an expected soft landing in developed economies supports credit conditions based on an anticipated increase in exports and trade.

Today is Monday, April 8, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

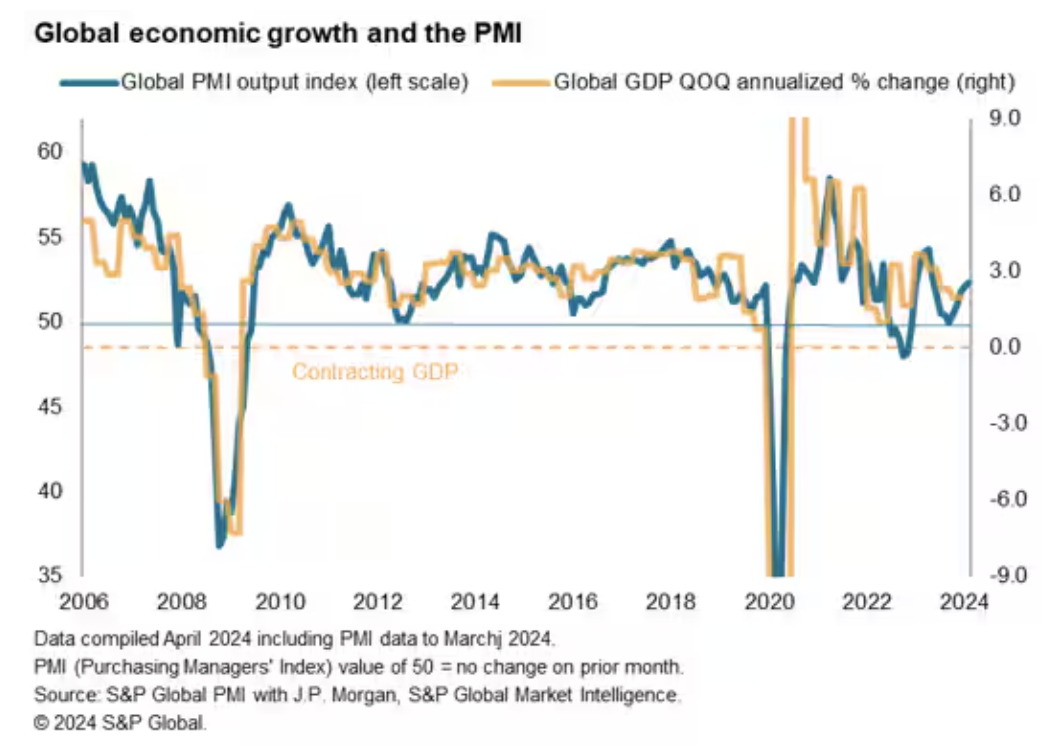

Global Economic Expansion Gains Momentum In March As PMI Climbs To Nine-Month High

The worldwide PMI surveys recorded a further modest acceleration of global economic growth in March, taking the pace of expansion to the fastest since last June. The upturn is also becoming more broad-based, both by sector and geographically. Forward-looking indicators have meanwhile likewise improved, boding well for the upturn to gain further pace in the second quarter, encouraging firms to take on staff at an increased pace in March. The overall rate of job creation remains only modest, however, reflecting a mixed hiring trends among the major economies.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Navigating Private Credit: Sector Selection And Debt Impact Analysis

Private credit has seen substantial growth over the past decade, reaching a total of almost $1 trillion in North America and $500 billion in Europe (as of Q1 2023), between disbursed credit and “dry-powder,” and attracting both investors and borrowers. The former are drawn in due to the prospect of higher yields, diversification of their investment portfolios beyond publicly traded securities and reduced exposure to market volatility typically seen for publicly traded bonds and equities. The latter see an opportunity to access capital on more flexible terms, easier and faster than via the traditional banking system, avoid equity dilution and maintain resilience during economic downturns, when public markets usually become volatile.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

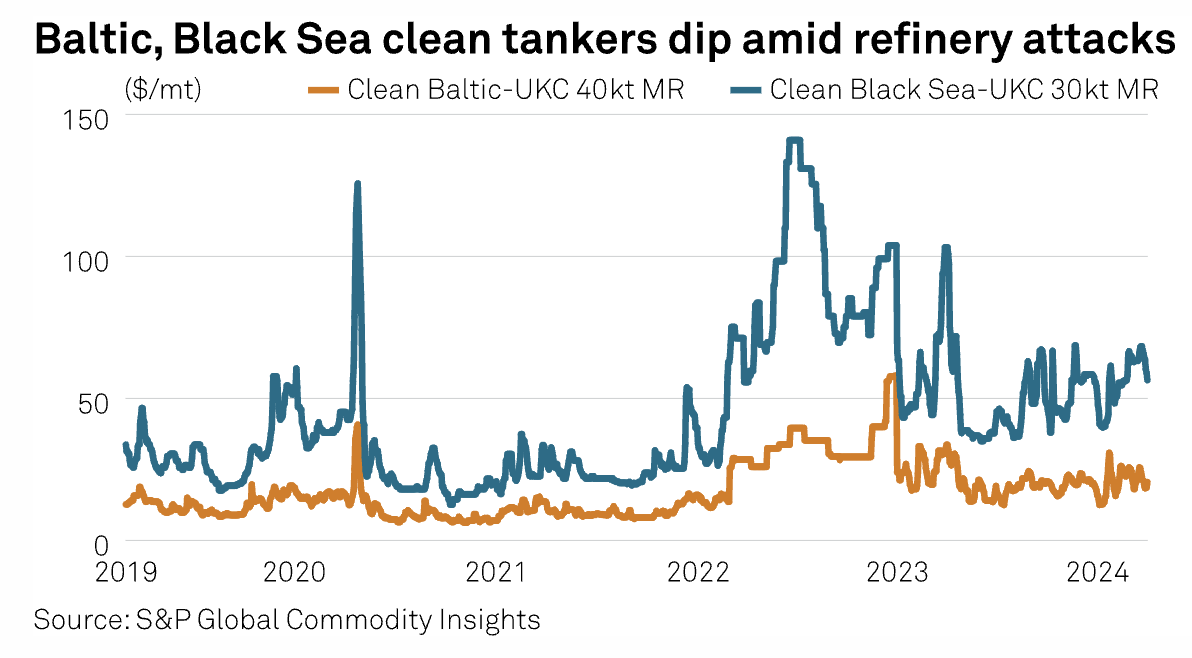

Volatility For Clean Tankers Increases In Wake Of Russian Refinery Attacks

Ukrainian drone attacks on Russian refining capacity point to disruption of refined product exports and lower loaded volumes are already weighing on tanker freight rates from the region. S&P Global estimates that refineries with a combined nameplate capacity of over 1.6 million b/d nationwide have now been affected to some degree by Ukrainian strikes, although the exact amount of capacity currently offline is not clear.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability Quarterly: First-Quarter 2024 Edition: Disclosure And Decarbonization

In this edition of the S&P Global Sustainability Quarterly, we take stock of two entwined trends shaping the sustainability conversation in 2024: investor demand for more consistent, comparable and reliable climate-related information and the challenges of decarbonization in hard-to-abate industries.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

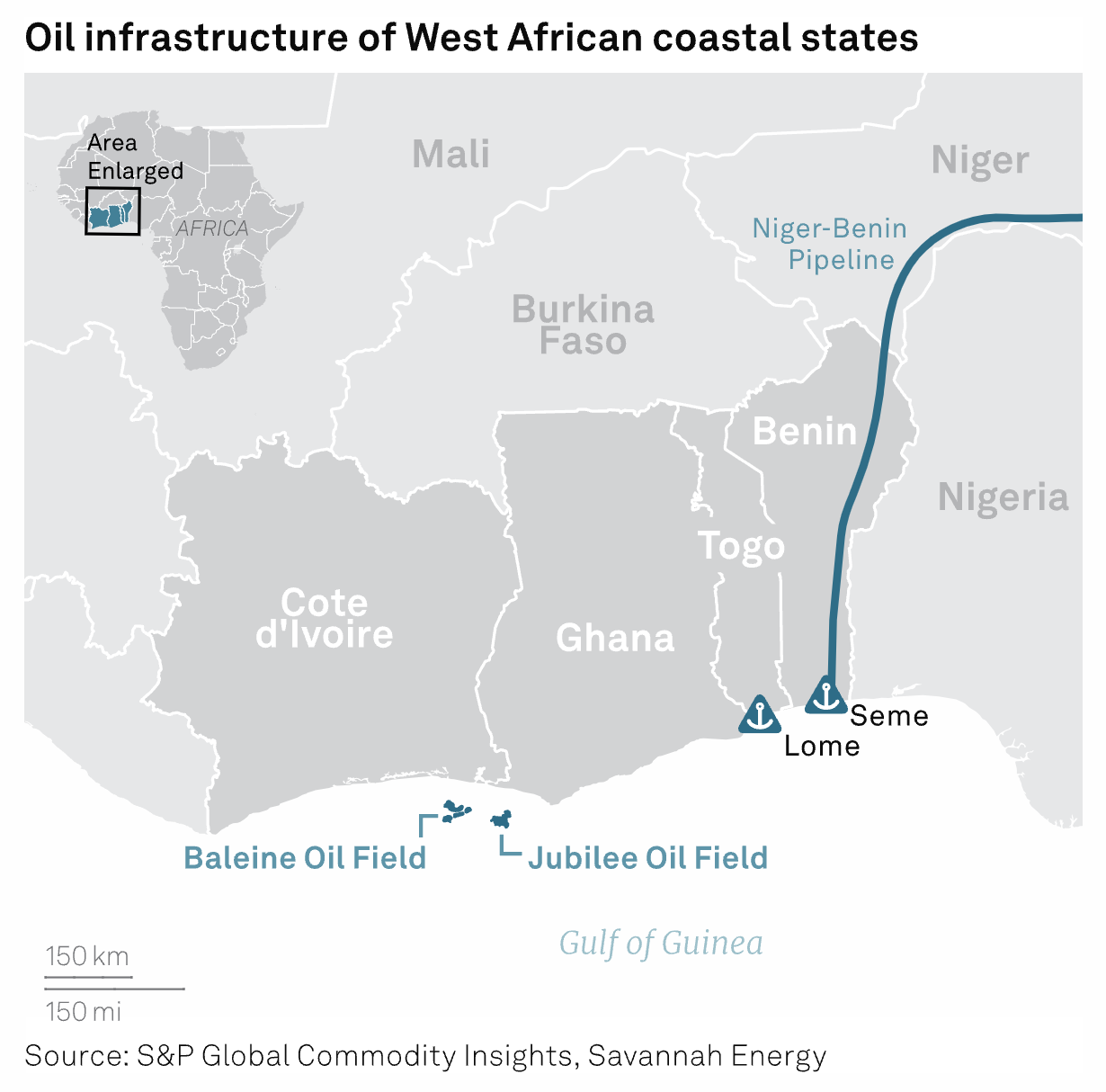

Instability, Extremism Threaten Coastal West African Oil Belt

Insecurity and extremism in the coup-plagued Sahel risk destabilizing West African coastal states, which will soon be responsible for almost 500,000 b/d of oil and refined product flows, according to S&P Global Commodity Insights data. Benin, Cote d'Ivoire, Ghana and Togo are peaceful and relatively prosperous but have seen a recent uptick in violence on their northern borders from Islamist insurgents active in junta-led Burkina Faso, Mali and Niger.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: MediaTalk | Season 2 Ep.7: How The Business Of Gaming Is Changing

In this episode, MediaTalk host Mike Reynolds talks with S&P Global Market Intelligence Kagan analyst Neil Barbour, who leads video game coverage for the consumer technology team. Neil shares his thoughts on the gaming industry's performance in 2023 while providing an early read on what we might expect in 2024 and beyond. He also assesses where some of the key players stand and explains why the newest consoles from Microsoft and Sony both exited their growth phase sooner than expected.

—Listen and subscribe to MediaTalk, a podcast from S&P Global Market Intelligence