Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 4 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Global IT Spending To Accelerate in 2024

Global IT spending will continue to increase — and at a considerably faster pace — in 2024 as businesses loosen their purse strings amid expectations of a soft landing.

S&P Global Ratings expects IT spending to increase nearly 8% in 2024, significantly above 2023’s 4% rise and the rating agency's nominal global GDP growth forecast of 6%. AI, cloud and PC upgrades are anticipated to be the top funding recipients as businesses continue their transition to the cloud and build up investment in nascent generative AI projects to boost sales, increase operational efficiency and improve competitiveness.

Over the next 12 to 24 months, investment in copilots, assistants and other AI capabilities is anticipated to climb. These will be essential in delivering more value to customers and helping providers capture more revenue. Edge AI products are anticipated to emerge over roughly the same period, as device manufacturers will want to drive a replacement cycle with higher average selling prices.

Cloud capital spending is expected to accelerate to nearly 30% this year, supported by the resumption of new workload migration and strong interest in AI offerings.

PC shipments are projected to increase 4% in 2024 as many businesses will need to refresh the installed base: PCs purchased during the early parts of the COVID-19 pandemic in 2020 will be about four years old or older this year, and support for Windows 10 will end in 2025. AI PCs may also be on the market by the second half of 2024, which would attract interest from early adopters.

Given these priorities, the semiconductor segment is expected to experience the greatest rebound in revenue among technology products — growing 14% in 2024, compared with a decline of 10% in 2023. External storage systems revenue is forecast to climb about 5% in 2024, following a decline of roughly 2% in 2023, according to an S&P Global Ratings analysis.

Meanwhile, the software segment and IT services should see revenue continue to grow. For the former, the increase is expected to exceed 10%, outpacing the overall IT industry, given that software is a key enabler of business automation and plays an important role in ensuring cybersecurity. IT services revenue is forecast to increase nearly 7%, partly due to growing public cloud infrastructure spending.

As businesses become more cognizant of their environmental responsibilities, the degree to which IT operations contribute to their overall environmental impact is a crucial consideration.

In S&P Global Market Intelligence 451 Research's “Voice of the Enterprise: Digital Pulse, Sustainability 2023” survey, a "significant portion" of the surveyed businesses said they considered IT operations a major contributor to their environmental footprint, according to an S&P Global Market Intelligence report. Consequently, businesses' sustainability objectives factor into the expectations and criteria they bring to their relationship with technology vendors and suppliers.

However, sustainability does not seem to be a big factor in technology decision-making. In one of the contributing third-quarter survey components of the S&P Global Market Intelligence Tech Demand Indicator, respondents rated external economic conditions, equipment costs, the pace of technology innovation and customer demand as the factors with greater than usual influence on technology spending. Environmental considerations were last on the list.

Sustainability is expected to significantly influence technology decision-making in the coming years, particularly as macroeconomic pressures ease. In S&P Global Market Intelligence 451 Research's survey, more than 75% of surveyed businesses indicated that they expect to make moderate or major investments over the next several years to reach sustainability targets.

Today is Thursday, April 4, 2024, and here is today’s essential intelligence.

Written by Jasmine Castroverde.

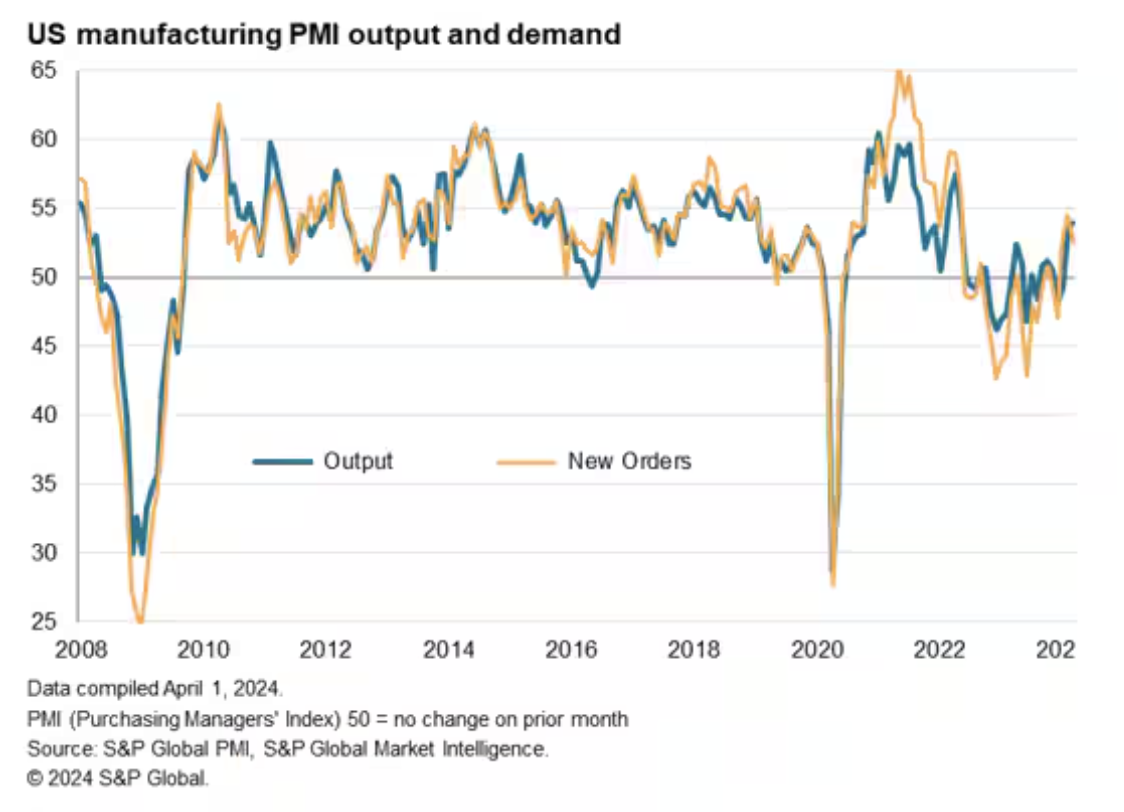

Final PMI Signals Fastest Factory Production Growth In The US Since May 2022, But Also Steeper Price Rise

The final PMI data for US manufacturing showed the production cycle moving up a gear at the end of the first quarter, but also indicated that pricing power has likewise revived, especially in relation to consumer goods. Coming as the Federal Reserve seeks to pivot to looser policy, these two developments underscore the likely bumpy path in bringing inflation down to the Fed's 2% target.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Australian Banks Risk Alienating Regional Communities Amid Branch Network Cuts

Australia's four largest banks have accelerated branch closures as more customers choose digital channels, but such closures risk alienating rural communities that rely on physical branches. The big four banks — Commonwealth Bank of Australia, ANZ Group Holdings Ltd., Westpac Banking Corp. and National Australia Bank Ltd. — closed 375 branches in 2023, up 56% from 239 in 2022 and 337 in 2021. The four banks have closed 1,446 branches since 2018, according to data compiled by S&P Global Market Intelligence.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

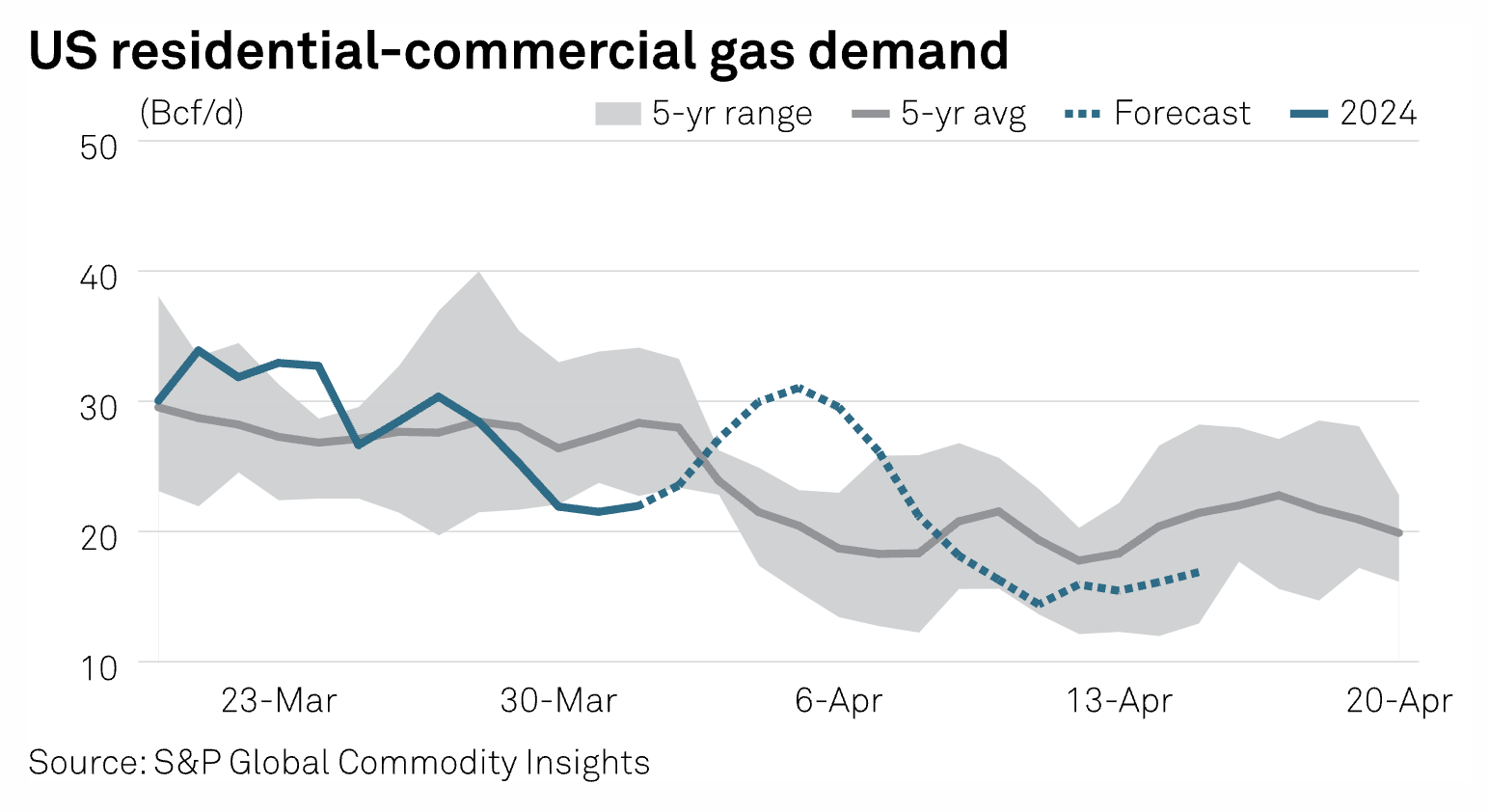

US Upper Midwest, New England Gas Markets Tighten Ahead Of Wintry Blast

Wintry weather forecast for the Northern Great Lakes and New England in the first week of April could offer the region's gas markets much-needed support in the form of stronger heating and storage demand. Beginning April 2, unseasonably cold air from southern Canada will begin making its way into parts of Wisconsin, Illinois, Indiana and Michigan bringing along isolated snowfall that's expected to develop into more widespread snowstorms overnight from April 2-3. Beyond midweek, colder air and snow will move eastward into Upstate New York and New England with snowfall totals expected to total anywhere from 3 inches to as much as 2-3 feet in isolated and mountainous areas, according to a forecast published by AccuWeather.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: CERAWeek: How Cleantech Companies Are Innovating To Facilitate The Energy Transition

This episode of the ESG Insider podcast looks at the role that technological innovation will play in finding solutions for the low-carbon energy transition. This was a big topic at S&P Global’s annual CERAWeek conference in Houston, Texas, and our hosts sat down on the sidelines of the event with two CEOs running emerging technology companies that seek to facilitate the transition.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

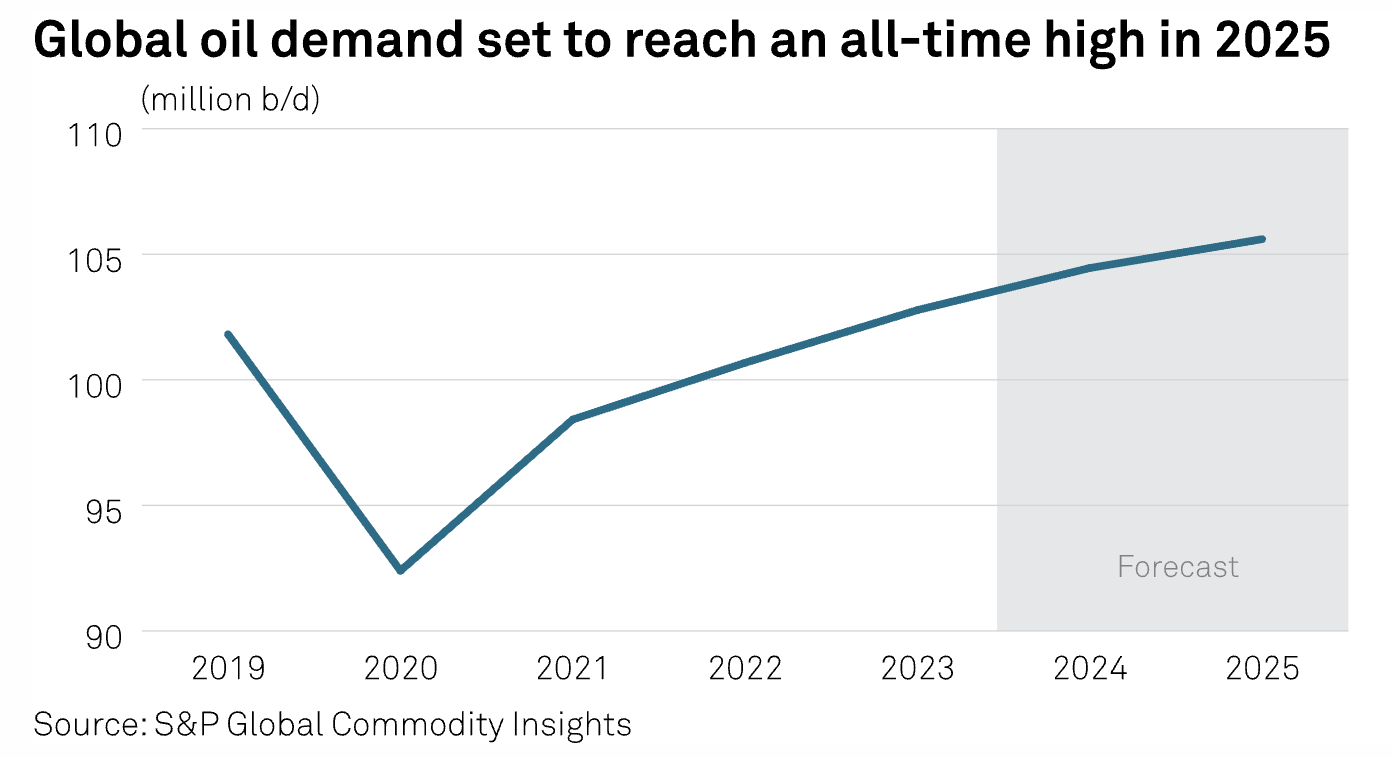

Oil, Other Commodities Have Reasons To Hold Up In Big Election Year — Jim Rogers

Commodity markets are witnessing many reasons for oil to remain a favorite among investors in the near term as declining reserves, the slow pace of energy transition and the anticipation of favorable policies following elections in India and the US are adding up to create opportunities, according to one of the world's leading commodity investors, Jim Rogers.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

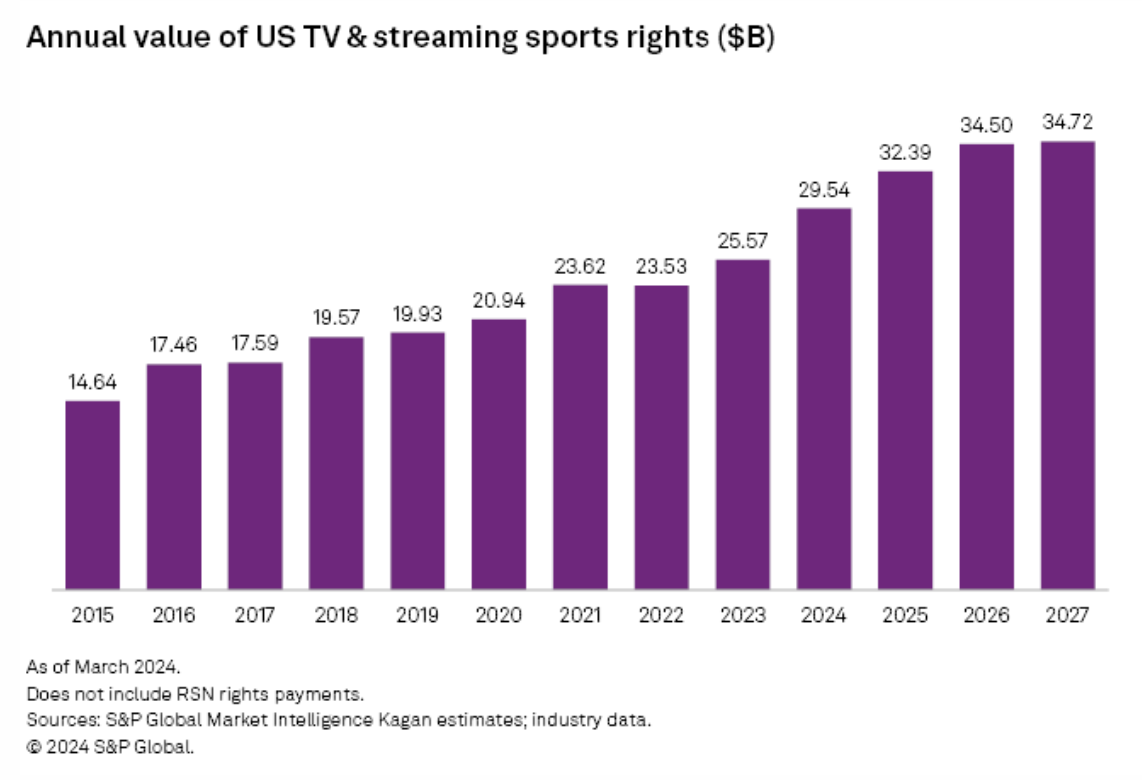

Sports Rights In The US Approach $30 Billion In 2024

Traditional pay TV subscriptions have been on the decline for a decade, resulting in dramatic declines to linear TV ratings. However, live sports content continues to keep audiences interested in what's on TV. Many new media rights deals were forged in recent years, bringing new players like Apple, Amazon and Alphabet into the circle of sports media rights holders, making the shift from traditional linear television to streaming platforms heavily reliant on the availability of live sports content.

—Read the article from S&P Global Market Intelligence