Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Apr, 2023

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Oil Shortage Looms as U.S. Tightens Sanctions on Iran

The collapse of talks to revive the Iran nuclear deal, officially known as the Joint Comprehensive Plan of Action (JCPOA), has left the output of a major petroleum producer still banned, at least officially, from world markets.

Optimism was high in 2022 for a renewal of the JCPOA, abandoned by the Trump administration in 2018, but the Iranian government rejected an agreement brokered by the EU, and talks have since stalled. Iran’s production capacity is nearly 4 million barrels a day, according to the U.S. Energy Information Administration, but that total has been pushed down by sanctions from the U.S. and the EU. Production reached about 2.5 million b/d in 2022, the EIA estimates.

Under President Joe Biden, the U.S. has been relatively lax in enforcing sanctions on Iran’s oil shipments in the hope of luring the hard-line government of President Ebrahim Raisi back to the negotiating table, said Brian O’Toole, a nonresident senior fellow with the Atlantic Council, on a recent S&P Global Commodity Insights podcast. Like Russia, Iran has taken advantage of a “shadow fleet” of tankers to ship oil to markets in Asia, particularly China.

That policy has changed in recent months as the administration tightens sanctions enforcement in response to the suppression of citizen protests in Iranian cities and Iran’s support for Russia’s invasion of Ukraine.

“Now that it’s clear that there’s no deal in sight, the U.S. is enforcing the sanctions, going after the companies and paths that are obviating or bypassing sanctions, trying to shut down that line of revenue for the hard-liners in Iran,” O’Toole said.

With the price cap on Russian oil, the reopening of China’s economy and heightened geopolitical tensions, however, a global oil shortage looms, said Phil Flynn, senior energy analyst at the PRICE Futures Group, on another S&P Global Commodity Insights podcast.

A surge in demand coupled with spiking prices in 2023 is likely to lead to “a scramble in global energy markets,” Flynn said.

That combination — failed diplomacy and tightening oil markets — raises the specter of military confrontation.

“The JCPOA's collapse, especially if through a deliberate Iranian decision to withdraw, would raise the likelihood of a strike initiated by Israel/the US targeting Iran's nuclear facilities,” wrote Kevjn Lim, principal research analyst for the Middle East and North Africa with the Global Intelligence and Analytics division at S&P Global Market Intelligence, on March 10.

The situation has been further complicated by the renewal of diplomatic relations between Iran and Saudi Arabia, which for years shunned the Islamic Republic of Iran due to its support of extremist terrorism across the region. Marking the escalating tensions, a U.S.-led alliance recently launched a fleet of seagoing drones to monitor and secure seaborne trade, including vital oil shipments, in the Persian Gulf and the Arabian Sea. Experts believe that Iran is responsible for many attacks on ships and energy infrastructure, including by the Yemeni Houthi rebels the country allegedly arms.

"We don't have the enormous number of planes, ships, troops and air-defense systems we had in the region just five years ago," said General Michael Kurilla, head of the U.S. Central Command, in a press briefing. "Instead, we've got to cultivate deep, abiding partnerships that can serve as a hedge against threats in the region while deterring Iran from its worst, most destructive behavior."

Today is Tuesday, April 4, 2023, and here is today’s essential intelligence.

Written by Richard Martin.

The Global Economy: Recessions Averted Or Delayed?

The global economic expansion is moving forward at a subdued pace in 2023, as tightening monetary policies and pandemic scars are creating challenging business conditions. Tight labor market conditions could delay progress in reducing inflation, prompting more aggressive monetary policy responses that threaten growth.

—Listen and subscribe to Economics & Country Risk, a podcast from S&P Global Market Intelligence

Access more insights on the global economy >

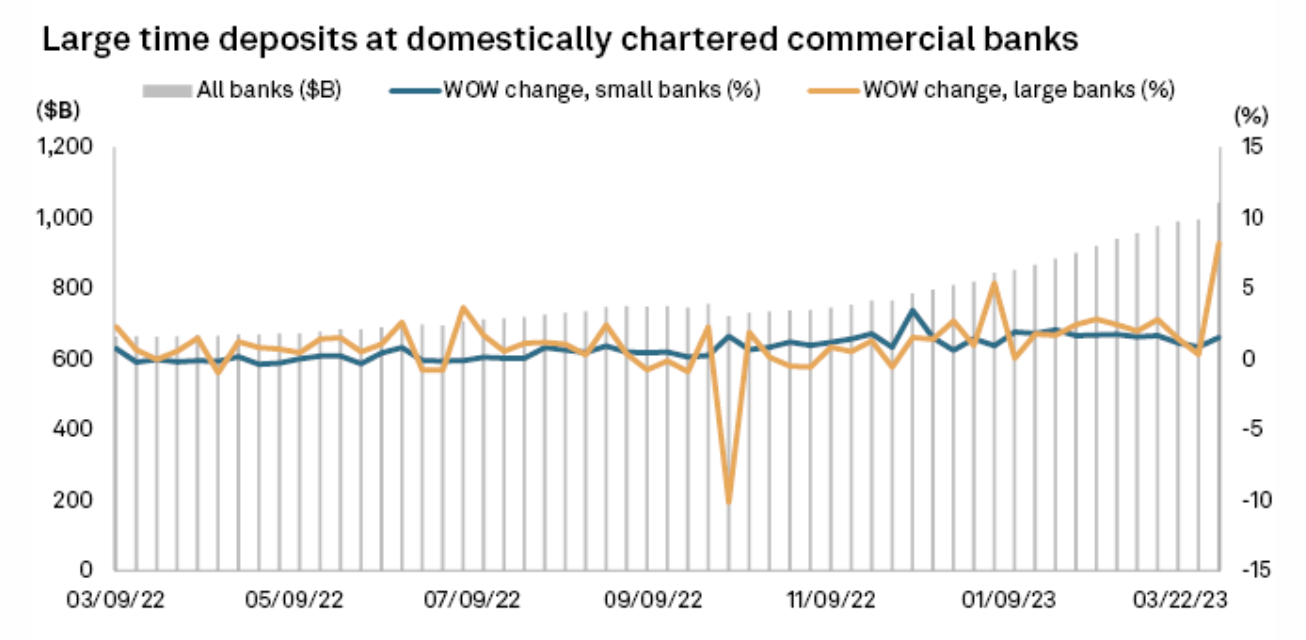

Small Banks Notch Deposit Gains In Latest Weekly Data

Small banks managed modest gains in deposits during the second week of the recent liquidity crunch, while industrywide deposit outflows moderated, according to new data from the Federal Reserve. The data on bank balance sheets, published late March 31, covers the week through March 22. Seasonally adjusted deposits at domestically chartered, U.S. commercial banks fell by $83.97 billion, or 0.5%, to $16.037 trillion. At small banks, or banks excluding the 25 largest by domestic assets, deposits increased by $5.81 billion, or 0.1%, to $5.386 trillion.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

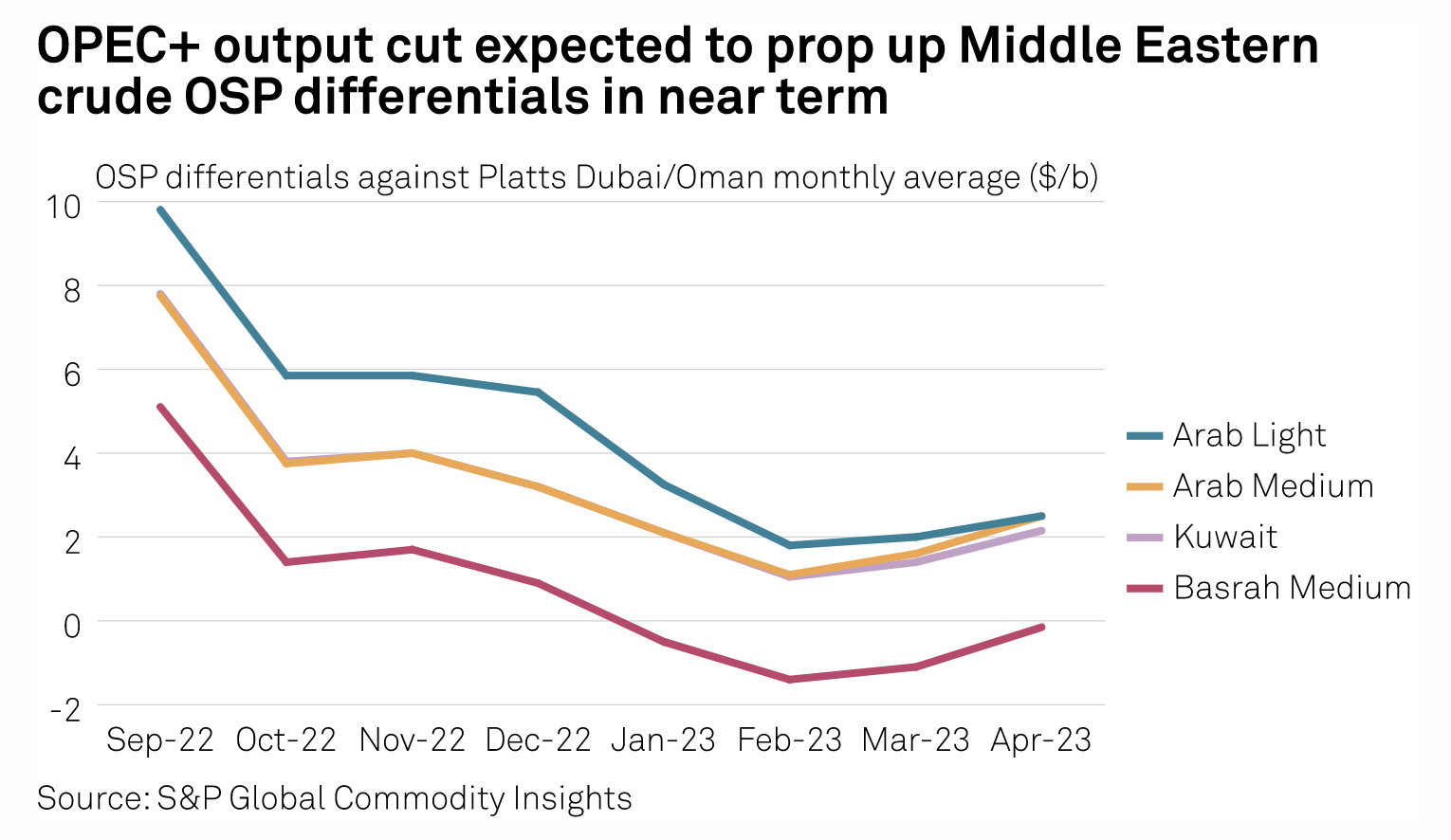

Unforeseen OPEC+ Cuts Prompt Asia To Recalibrate Buying Strategy

The abrupt production cuts by OPEC and its allies may prompt Asia to recalibrate its buying strategy at a time when the region is witnessing demand recovery after years of pandemic-hit growth and spur increasing competition for crude from outside the supply bloc. Although leading Asian buyers such as India and China may see a relatively smaller supply impact due to the relentless flows of Russian crude over the past year, what is more worrying for Asia overall is the anticipated surge in oil prices that could stoke inflation at a time the region is witnessing fragile economic recovery.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

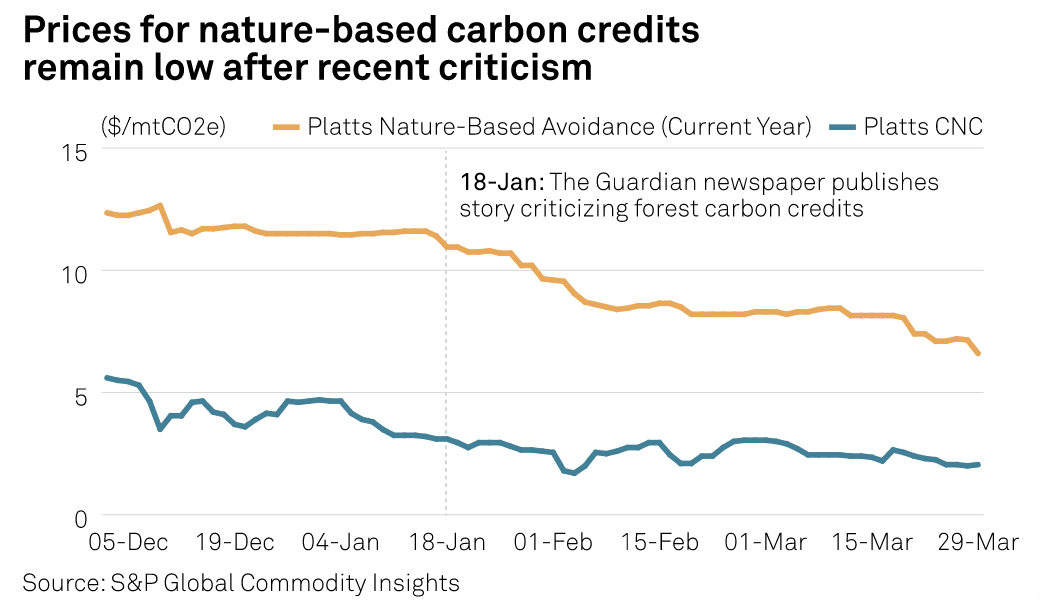

Soil Carbon Controversy: Unfounded Concerns Or Healthy Skepticism?

Soil carbon credits have been gaining popularity in the U.S. voluntary carbon market and Australia's compliance-based market, but there are numerous critics of this type of carbon credit. Soil carbon credits are generated through projects that enhance soil carbon sequestration, or the process of plants removing CO2 from the atmosphere and storing it below ground through various biological and chemical processes.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

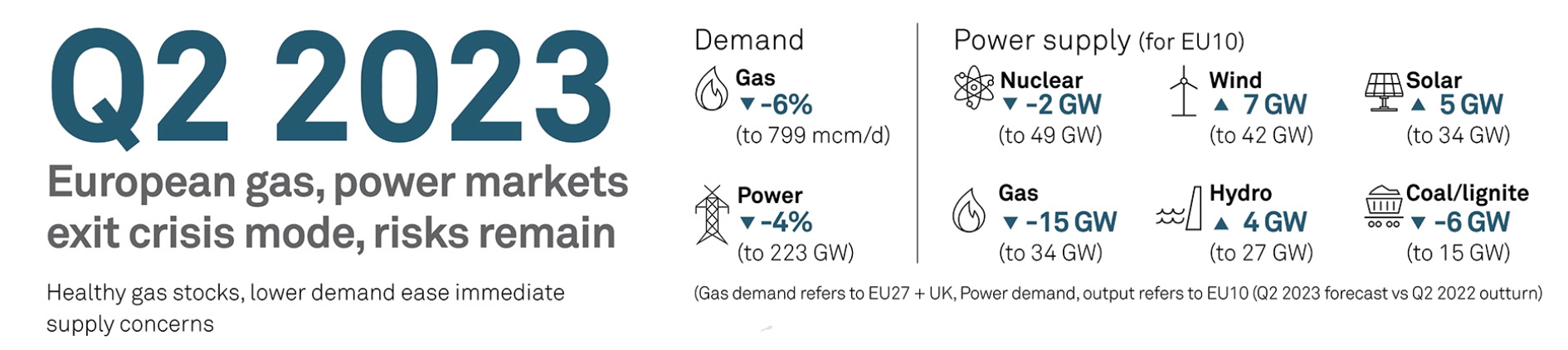

Infographic: European Gas, Power Markets Exit Crisis Mode, Risks Remain

Europe's energy supply concerns are easing with the Continent starting Q2 2023 in much better shape than many had expected. Strong LNG deliveries and lower demand helped push gas and power prices close to pre-crisis levels. Stronger renewables are shrinking the thermal gap, and carbon market auctions are in focus.

—View the full infographic from S&P Global Commodity Insights

Access more insights on energy and commodities >

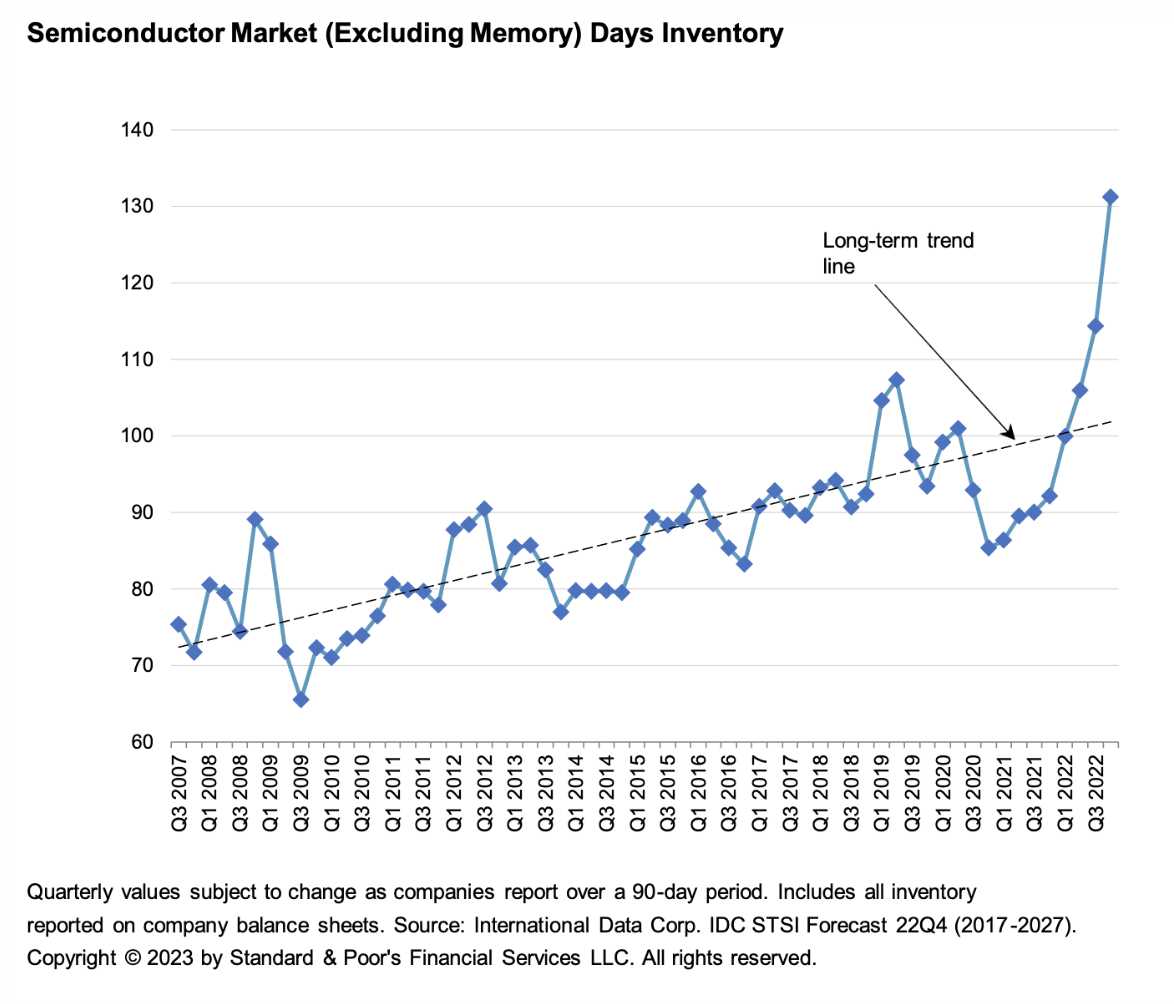

Excess Inventory Is The First Roadblock To Tech Recovery

Elevated inventory will hurt the technology supply chain sales, earnings and cash flow generation almost across all product end markets. Pace of demand recovery and safety stock will determine timing of a cyclical trough. Inventory should peak in the first quarter for most product end markets, and about a quarter later for component and semiconductor suppliers.

—Read the report from S&P Global Ratings