Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 May, 2020

By S&P Global

After 2.1 million Americans filed first-time jobless claims in the week ended May 23, the total number of workers who have sought unemployment insurance since the pandemic took hold of the country in mid-March topped 40 million, according to U.S. Department of Labor data released Thursday.

The seasonally adjusted figure marks a decline from the prior week, when 2.4 million Americans filed for initial unemployment benefits, and is the eighth consecutive week of declining claims. The numbers could reflect that states are processing back-logged applications—but the initial claims total doesn’t include laid-off workers who haven’t applied for benefits, individuals who have entirely left the labor force, and undocumented workers who can’t apply.

Continuing claims, or people who have collected benefits for at least two weeks, dropped by nearly 4 million from the previous week, to 21.1 million, signaling that states’ lifted lockdowns have allowed more people to return to work.

“Will customers, confident that the virus has been contained, flock to stores, with revenues soon picking up once the doors open wide? Even if prospective shoppers risk the streets, it's unclear if these customers (many of whom were laid off) will have money to spend after the pandemic hurt their financial health (and possibly devastated their physical health),” S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino said in a May 27 report. “Consumers may want to continue to hold back on discretionary purchases until they get the call back from their boss. These factors will determine the pace of economic recovery once the virus is contained, which is almost as tricky thing to project as the path of COVID-19.”

S&P Global Economics found that 59% of the U.S. federal government’s first round of Paycheck Protection Program loans—designed to support small businesses and encourage companies to keep employees on payrolls—were given to industries with jobs less affected by social distancing and were concentrated in states with relatively less job destruction. According to Ms. Bovino’s analysis, the first round saw 1.66 million PPP loans, averaging $206,000, approved—of which 28% went to goods-producing industries and 19% to leisure, hospitality, and retail industries. In April, 30.9% of the jobs lost were in accommodations and food services, but those industries only received 8.9% of the first round of funding. Eight of the 10 states that received the smallest dollar amount of PPP loans had the 10 highest unemployment rates in the country.

The program’s second round assessed appears to have expanded the depth and breadth of benefits. Although widespread data on PPP 2 is sparse thus far, the program has approved measurably more smaller loans than in the first round, which are reaching more businesses in states that have higher levels of unemployment, according to the S&P Global Economics report. Still, the majority of funding across both phases of the program has benefitted states with fewer joblessness claims.

“While governors open their states hoping for a strong rebound, a state's recovery ultimately depends on whether Americans believe that COVID-19 is really contained and they feel comfortable enough to leave their homes and spend,” Ms. Bovino said. “Assuming businesses survive the lockdown, their decision to rehire workers will likely depend on Americans' willingness to spend. Businesses may test the waters on consumer demand before they decide to rehire workers, and, if they do, how many workers they could afford to bring back on the books. Businesses may ultimately decide that the loan forgiveness ‘carrot’ may not be enough to cover the costs required to rehire their workers.”

According to a May 26 Conference Board report, the amount of U.S. consumers who anticipate jobs to increase in the coming months declined to 39.3% in May, from 41.2%—alongside those who expect fewer in the same period, which decreased to 20.2%, from 21.2.

Consumer confidence in the U.S. stabilized in May after plummeting in April, according to the Conference Board Consumer Confidence Index, which edged up slightly, to 86.6, from the previous month’s 85.7.

“Following two months of rapid decline, the free-fall in confidence stopped in May,” Lynn Franco, senior director of economic indicators at the Conference Board, said in a statement. “The severe and widespread impact of COVID-19 has been mostly reflected in the Present Situation Index [that measures consumer sentiment on business and labor market conditions], which has plummeted nearly 100 points since the onset of the pandemic. Short-term expectations moderately increased as the gradual re-opening of the economy helped improve consumers’ spirits.”

“However, consumers remain concerned about their financial prospects. In addition, inflation expectations continue to climb, which could lead to a sense of diminished purchasing power and curtail spending. While the decline in confidence appears to have stopped for the moment, the uneven path to recovery and potential second wave are likely to keep a cloud of uncertainty hanging over consumers’ heads,” Ms. Franco said.

Comparatively, S&P Global Ratings reported that Europe’s short-time work programs have prevented the massive layoffs seen in the U.S., as the eurozone’s largest economies implemented programs during the pandemic for almost 30% of the workforce to maintain job security, productivity, income, and household liquidity. While “the cost of short-time work schemes in terms of public finances appears to be very high—€100 billion or more for the five largest European economies—but the cost would likely have been even higher if workers had been unemployed instead,” S&P Global Ratings’ Senior European Economist Marion Amiot said.

Today is Friday, May 29, 2020, and here is today’s essential intelligence.

Economic Research: The Paycheck Protection Program Impact On Jobs: (More) Help Wanted

The U.S. government moved quickly to address liquidity needs of small businesses. However, the first round of the Paycheck Protection Program (PPP) funds may have missed the mark, in terms of geography, industries served, and size to meet significant small business demand. S&P Global Ratings found that 59% of first-round PPP loan approvals (average size $206,000) went to industries with jobs less affected by social distancing, such as good-producing industries. Loans approved were concentrated in states with relatively less job destruction. On second-round PPP data (through May 8), it already appears that a higher number of smaller loans have been approved (average size $73,000), reaching a greater range of businesses across the U.S., instead of being concentrated in a few states. Still, at this point in time the bulk of the programs seem to lean toward benefitting states with fewer jobless claims. And based on small business surveys, it's apparent that more help is wanted (and needed).

—Read the full report from S&P Global Ratings

Financial industry now tops default probability risk in Argentina

Argentina's financial sector is the most at risk of defaulting as the global economic fallout from the coronavirus pandemic collides with the country's prolonged recession and yet another sovereign debt crisis, S&P Global Market Intelligence data shows. The median probability of default for public Argentine companies that operate mainly in the financial sector has skyrocketed in recent months to about 45% as of May 21 from 19% at the start of the year and about 8% a year ago.

—Read the full article from S&P Global Market Intelligence

'A potential war chest': COVID-19 pandemic may spur M&A among US hospitals

As the coronavirus pandemic continues to devastate the finances of U.S. hospitals and health systems, experts predict a short-term rise in strategic M&A dealmaking and interest from private equity to scoop up flagging physicians offices. The pandemic "provides a potential war chest if you're thinking about going out and acquiring struggling providers," Christopher Whaley, a researcher at policy think tank the RAND Corp., said in an interview. Hospitals and providers have deferred elective or nonessential care in an effort to stop the spread of the virus and conserve much-needed resources, cutting off a lucrative line of business that is expected to cost the industry over $161 billion by June. Some of the country's largest for-profit hospital companies — HCA Healthcare Inc., Universal Health Services Inc. and Tenet Healthcare Corp. — have reported substantial patient and procedure volume declines in the first quarter of 2020 with the trend expected to continue. Larger hospitals and health systems may be well-positioned to weather the downturn and use strategic M&A to boost revenues, Whaley said. Smaller systems, on the other hand, may be forced to sell or close their doors.

—Read the full article from S&P Global Market Intelligence

Amazon's 1-day shipping program could see more coronavirus-induced delays

Amazon.com Inc. is working to resume its one-day shipping program to pre-pandemic levels while navigating longstanding challenges and new issues from the coronavirus outbreak that could hinder the company's ability to offer speedier delivery times, experts say. Even before the pandemic, Amazon was facing logistics obstacles with the program due to its reliance on an unpredictable system of third-party carriers and infrastructure set up for two-day deliveries. Those challenges were exacerbated by the unanticipated surge in volume as quarantined consumers moved online, causing weeks of shipping delays for the company and its delivery partners like the U.S. Postal Service and independent contractors.

—Read the full article from S&P Global Market Intelligence

US renewable generation overtakes coal in Q1'20

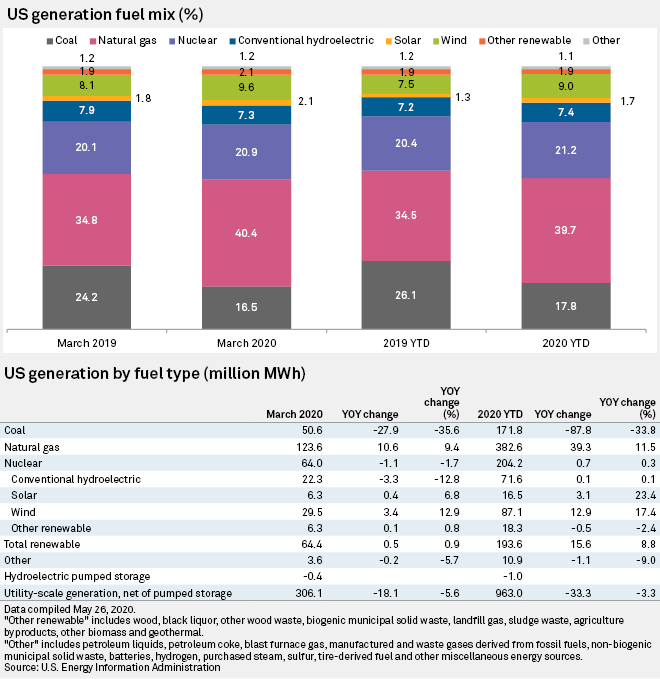

The share of natural gas and renewable sources in U.S. electricity generation widened in the first quarter compared to the prior year, primarily at the expense of coal generation. According to the U.S. Energy Information Administration's latest "Electric Power Monthly" released May 26, utility-scale generation net of hydroelectric pumped storage declined 3.3% year over year to 963.0 million MWh in the period of January through March. Coal supplied 17.8% of the nation's power in the first quarter, from 26.1% in the year ago. The share of natural gas grew from 34.5% to 39.7% year over year, as the share of renewables widened from 17.9% to 20.1%. Wind led renewable sources, accounting for 9.0% of total U.S. electricity generation in the first quarter. Over the same period, coal-fired generation declined 33.8% year over year to 171.8 million MWh, while gas-fired generation climbed 11.5% to 382.6 million MWh. Renewable generation rose 8.8% to 193.6 million MWh.

—Read the full article from S&P Global Market Intelligence

EC seeks views on huge EU clean hydrogen output, use growth plans

The European Commission wants to see a massive scale-up in EU clean hydrogen production and demand to help meet its 2030 and 2050 climate goals, and is asking stakeholders how best to achieve this. The EC now considers clean hydrogen so important that it will present a dedicated EU hydrogen strategy alongside its EU energy sector integration strategy expected on June 24.

—Read the full article from S&P Global Platts

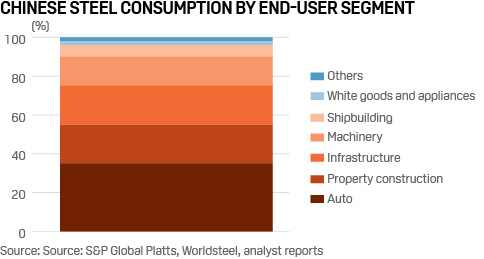

COVID-19 speeds up global manufacturing, steel production shift

Global manufacturing was in the doldrums for much of last year, pulled down by weak demand in key consumer-driven segments amid ongoing trade tensions and slower economic growth. Countries such as Japan, South Korea and Germany that rely on exports found it tougher to sell to overseas customers, while the downturn in auto sales in the United States exemplified what was happening to the sector internationally. When the coronavirus outbreak hit in early 2020, it was akin to kicking manufacturing when it was already down. While the full weight of COVID-19 hit the manufacturing sector in April, with many countries around the world in lockdown, China was already starting to get back on its feet.

—Read the full article from S&P Global Platts

Analysis: South Korea's road traffic increase signals gasoline demand recovery in Q2

South Korean roads and highways have registered an increase in passenger and commercial vehicle traffic volumes in recent weeks as economic activity gathers pace, paving the way for a rebound in the country's gasoline consumption in the second quarter. South Korea consumed 17.86 million barrels of gasoline in Q1, down 13% from a year earlier and 15% lower than Q4 last year, as transportation activities came to a halt at the height of the coronavirus outbreak in the country over February-March.

—Read the full article from S&P Global Platts

German driving returns to pre-COVID levels but qualms remain over recovery

Driving activity in Germany, Europe's biggest economy, has rebounded to pre-COVID levels as lockdowns ease but remains below year-ago levels and questions still hang over the pace of oil demand recovery. German direction routing activity, a proxy for road fuel demand, stood 2% above January 13, 2020 levels on May 26, according to the latest Apple mobility data. Europe's biggest fuel market began easing lockdown restrictions in mid-April and traffic activity first surpassed pre-pandemic levels on May 20 after hitting a lockdown low of 38% on March 21, the data shows.

—Read the full article from S&P Global Platts

US-EU energy relations must strengthen to face security concerns: report

The United States and the EU should "reinvigorate" the US-EU Energy Council to address a range of energy security concerns, notably the ability of Russia to use natural gas as a political lever, The Atlantic Council said Thursday. In a new report, titled European Energy Security and the Critical Role of Transatlantic Energy Cooperation, the council says European regions with limited natural gas infrastructure will need public and private transatlantic investment to diversify their supply.

—Read the full article from S&P Global Platts

Souring US/China relations could have big impacts on energy, agriculture trade

The US move to no longer recognize Hong Kong's independence from mainland China could lead to new tariffs and a potential collapse of the Phase 1 trade deal that promised $50 billion in US energy purchases through 2021. While relations were already fraying between the two world powers as a result of the coronavirus outbreak, China's vote this week to end Hong Kong's autonomy may serve as a key turning point in US/China relations. In response to China's action, Secretary of State Mike Pompeo said Wednesday that Hong Kong no longer warrants special trading status with the US.

—Read the full article from S&P Global Platts

Consolidation coming: Oil companies set to party like it's 1999

The oil industry tailspin created by a combination of glutted markets, weak demand and lingering apprehension over coronavirus shutdowns will lead to a wave of consolidation, energy experts agreed. And if history is a guide, megadeals may be on the horizon. The biggest oil deals follow oil price crashes, according to an S&P Global Market Intelligence analysis of the past 25 years of M&A action in oil and gas. Since 1995, more than 50 deals have been completed in the sector valued over $10 billion. The priciest deals, excluding pipeline partnership reorganizations, all came after the market collapse in the late 1990s or the price fall that began in the second half of 2014. Conditions are somewhat similar to the waning years of the 20th century that led to the demise of iconic companies such as Amoco, Mobil, Texaco, Phillips Petroleum and Atlantic Richfield as stand-alone entities, oil industry insiders and observers said. Although the fear of peak oil has receded, which creates less urgency for M&A, the industry is fragmented, profitability prospects are diminished, and the strongest companies have cash ready to spend.

—Read the full article from S&P Global Market Intelligence

Large investors flee US oil refining sector in Q1

Large institutional investors fled U.S. refining equities during the first quarter as the COVID-19 pandemic took hold during March. But as some reduced their exposure to the sector, others sought to take advantage of a potential rebound in petroleum markets. State Street Global Advisors Inc. was among the top buyer of four refining stocks as it bought a net 900,000 shares of HollyFrontier Corp., 700,000 shares of Delek US Holdings Inc., 1.8 million shares of Valero Energy Corp. and 1.7 million shares of Phillips 66. BlackRock Inc. increased its holdings in Valero and Phillips 66 by 1.6 million shares and 1.2 million shares, respectively.

—Read the full article from S&P Global Market Intelligence

US oil, gas rig count slips 24 week on week to 333 as cycle bottom seen nearing

The US oil and natural gas rig count slipped 24 this week to 333, rig data provider Enverus said Thursday, with the slowing rate of decline suggesting a bottom is near. Oil rigs, as usual, made up most of the total drop this week, falling 23 to 223. Just one gas rig left fields, leaving 110 operational. The US rig count has plummeted from 835 in early March, shedding more than 500 rigs in 11 weeks, or 60% of the total. A week earlier, the rig count fell by 12, and experts believed that indicated a bottom was near. This week's 24-rig decline is larger, but far less than in previous weeks, Matt Andre, an analyst with S&P Global Platts Analytics, noted.

—Read the full article from S&P Global Platts

Listen: Coronavirus lockdowns put the spotlight on crude oil storage

US crude storage quickly became a major issue at the crux of the coronavirus pandemic lockdowns, as global markets struggled to find enough places to stash oil amid the oversupply and decreased demand. That created a huge incentive for traders and producers to store their barrels instead of selling them on a prompt, physical basis, which overwhelmed storage availability. Ernie Barsamian, CEO of the Tank Tiger, talks with Laura Huchzermeyer, managing editor of the Americas crude team at S&P Global Platts, about the changes and challenges of the storage market.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language