Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global — 8 Apr, 2020

By S&P Global

After 11 weeks of lockdown, Chinese authorities lifted restrictions on the city of Wuhan’s 11 million people today. Austria, the Czech Republic, Denmark, and Norway plan to loosen crisis-related guidelines on their populations in coming weeks. These countries were some of the first to implement anti-coronavirus measures on movement—while many sovereigns, including Thailand and Russia, instituted nationwide stay-at-home orders last week. Today, the European Commission recommended its 30 countries keep their external borders (except for essential traffic) closed until May 15.

“Now is not the time to relax measures,” the World Health Organization’s director for Europe, Hans Kluge, said today. “It is the time to once again double and triple our collective efforts to drive toward suppression with the whole support of society.”

“When we have the curve under control, we will shift toward a new normality and toward the reconstruction of our economy,” Spanish Prime Minister Pedro Sanchez said.

“It’s like walking a tightrope,” Danish Prime Minister Mette Frederiksen said. “If we stand still, we may fall. If we go too fast, it may soon go wrong. We don’t know when we’ll be on firm ground again.”

U.S. President Donald Trump asserted on Twitter that the United States will reduce restrictions “sooner rather than later.”

"If 'back to normal' means acting like there never was a coronavirus problem, I don't think that's going to happen until we do have a situation where you can completely protect the population," said Dr. Anthony Fauci, the U.S.’s top coronavirus expert and director of the National Institute of Allergy and Infectious Diseases. “But when we say getting back to normal, we mean something very different from what we're going through right now. Because right now, we're in a very intense mitigation."

“Please don’t politicize this virus,” W.H.O. Director-General Tedros Adhanom Ghebreyesus said, addressing President Trump’s criticisms on the premier health organization’s handling of the crisis. “If you want to be exploited and you want to have many more body bags, then you do it. If you don’t want many more body bags, then you refrain from politicizing it."

In a report sent to the Trump Administration, the National Academy of Sciences warned that the coronavirus may not diminish in summertime with warmer weather, confounding hopes for this crisis to wane at the turn of the season. “There is some evidence to suggest that SARS-CoV-2 may transmit less efficiently in environments with high ambient temperature and humidity; however, given the lack of host immunity global, this reduction in transmission efficiency may not lead to a significant reduction in disease spread without the concomitant adoption of major public health interventions … The other coronaviruses causing potentially serious human illnesses, including both SARS-CoV and MERS-CoV, have not demonstrated any evidence of seasonality following their emergence,” the report said. “Given that countries currently in ‘summer’ climates, such as Australia and Iran, are experiencing rapid virus spread, a decrease in cases with increases in humidity and temperature elsewhere should not be assumed.”

As countries take further measures to protect their populations and economies, the effects on businesses and markets remain negative. The global surge in COVID-19 cases, pressures of the global recession, and overall weaker capital market conditions are weighing on corporate credit quality. The pandemic's erosion of global GDP growth has hit emerging markets especially hard.

The economic shock could increase credits costs for Chinese banks by nearly $224 billion in 2020, according to S&P Global Ratings.

S&P Global Ratings also expects credit conditions in Latin America to worsen as the pandemic advances in the region. Because of the correlation of most infrastructure assets with the economy, their regulated nature, and the measures imposed so far by several governments to contain the pandemic that have hampered cash flow generation, S&P Global Ratings expects this sector to remain highly vulnerable in the short- to medium-term. Downside risks are still significant.

Japan is estimated to lose out on about $5 billion of inbound and domestic consumption this year as a result of the postponement of the Olympic Games. The nation, which for months had low infection rates, is now under a state of emergency due to a recent spike in cases.

As the U.S. Federal Reserve began taking extensive action to limit the economic implications of the coronavirus in the U.S., all central bankers “viewed the near-term U.S. economic outlook as having deteriorated sharply in recent weeks and as having become profoundly uncertain. Many participants had repeatedly downgraded their outlook of late in response to the rapidly evolving situation. All saw U.S. economic activity as likely to decline in the coming quarter and viewed downside risks to the economic outlook as having increased significantly,” according to minutes of the policy-making Federal Open Market Committee’s March 15 meeting.

Now, the Fed is fielding calls from Congress and energy regulators to give electric, gas, and water utilities easier access to short-term loans amid commitments to suspend customer disconnects due to the pandemic, according to S&P Global Market Intelligence.

The 23-country OPEC+ alliance is aiming for a global oil-output cut of 10 million-15 million barrels a day, including producers outside the group, when ministers meet Thursday for a critical summit to shore up the coronavirus-stricken market, Kuwaiti oil minister Khaled al-Fadhel told S&P Global Platts. Many details remain in flux, but all OPEC+ members are committed to clinching a deal, Mr. Fadhel said.

Saudi Arabia's attempt to negotiate a global pact with Russia to rescue oil prices from the coronavirus crisis will climax tomorrow, when ministers from OPEC and other key countries meet virtually to settle the geopolitical conflict and determine production cuts.

Today is Wednesday, April 8, 2020 and here is essential insight on COVID-19 and the markets.

Amid record leveraged loan downgrades, B– debt swells, CCC loans test CLO limits

In the wake of a whopping 114 loan downgrades by S&P Global Ratings in March, the share of outstandings in the $1.2 trillion U.S. leveraged loan market rated B– and below now stands at an all-time high, according to the S&P/LSTA Leveraged Loan Index. And the three-month rolling count of downgrades to loans in the Index has increased to 171, likewise a record. While this activity is raising eyebrows across the credit markets, to say the least, it is of particular interest to CLO managers, who are growing increasingly concerned about the impact of downgrades on returns of their various CLO vintages, should portfolio tests start to fail as a result.

These recent downgrades were predominantly at the lower end of the ratings spectrum, and came at break-neck speed, even though the full scope of the global economic slowdown is yet to be understood (to be sure, the markets do not like uncertainty). Even with the full effects of COVID-19, and its harm to the global economy, unknown, the latest three-month rolling downgrade count surpassed that of the Great Financial Crisis of 2007-08, when loan downgrades topped out at 169.

—Read the full article from S&P Global Market Intelligence

Pandemic fears drag utility market caps in Q1'20

The coronavirus pandemic and related economic worries drove a steep drop in market capitalization during the first quarter of 2020 among the top 20 U.S. utilities covered by S&P Global Market Intelligence. These companies recorded a total market capitalization of $682.87 billion as of March 31, compared with $783.97 billion as of Dec. 31, 2019.

Allentown, Pa.-headquartered PPL Corp. posted the largest drop at 31.2% but remained at the 15th spot with a market cap of $18.95 billion. During the quarter, the company saw the U.K. exit the European Union, which executives hope will stabilize the market for its utility business there. "We still have the risk of Brexit that is keeping the markets a bit jittery," PPL Chairman William Spence said in a Feb. 14 earnings call. "I think that as we look forward, particularly as we get through 2020, it's very likely that we'll know a lot more about where Brexit ultimately lands and what the currency landscape looks like for sure."

—Read the full article from S&P Global Market Intelligence

Advertising market reassesses path forward amid coronavirus pandemic

The coronavirus pandemic is slowing down businesses and forcing companies to reassess their positions across many sectors, including advertising. The world's largest agency holding groups, including WPP PLC, Omnicom Group Inc. and Interpublic Group of Cos. Inc., have warned of significant uncertainty about the future. Meanwhile, Wall Street suggests an ad-sector recession is at hand.

WPP, in a March 31 financial update, noted that while media spending at that point had largely remained committed, the company was seeing an increasing number of cancellations and other signs of volatility from clients. As such, it withdrew its financial guidance for the year. Interpublic's ad research arm Magna Global now expects a 2.8% decline in U.S. ad sales this year, versus its prior projection of 6.6% growth. As the economy stabilizes, Magna sees a second-half rebound and 2.5% growth next year, up from its prior projection of 1.4%. The amelioration reflects delayed consumer consumption, the shift of the Summer Olympics to next year and low comparisons versus 2020. Interpublic withdrew its 2020 financial guidance on March 26.

—Read the full article from S&P Global Market Intelligence

Olympics delay brings consumer companies respite amid COVID-19 disruption

The decision to postpone the 2020 Olympics in Tokyo by a year will be met with relief by many of the consumer companies that sponsor the games, which can now focus on tackling the impact of the COVID-19 pandemic and planning for the 2021 event, industry observers said. Domestic and international sponsors were expected to account for 64%, or $3.8 billion, of the projected $5.9 billion of total revenue generated by the games, according to data from the organizing committee for the Olympic Games. Top-tier consumer-facing sponsors include The Coca-Cola Co., Alibaba Group Holding Ltd., The Procter & Gamble Co. and The Swatch Group AG-owned Omega brand.

Japan is estimated to lose out on about $5 billion of inbound and domestic consumption in 2020 as a result of the postponement. Many companies will be forced to write off their marketing investments, but the early decision on the deferral means that much of it could be recouped in 2021. Additionally, the move to retain the Tokyo Olympics 2020 name, despite the event now beginning July 23, 2021, will allow companies to save some of their marketing merchandise.

—Read the full article from S&P Global Market Intelligence

Analysis: Freight jumps on floating storage rush, uncertainty reigns amid coronavirus-related demand slump

Oil tankers have found a second life as floating storage engines to stock cheap crude until markets pick up, after March saw near record low oil prices and sinking demand. As ships were chartered out for storage, spot lists shortened and freight spiked in March. The contango has since narrowed after OPEC+ members announced a meeting for April 9, hence encroaching on the profitability of the floating storage trade.

VLCC and Suezmax freight rates jumped in the first quarter of 2020, largely due to the oil price war and crude prices tumbling to levels not seen in 20 years. On April 1, Dated Brent was assessed at $15.135/b. It was last assessed lower on April 9, 1999. As of Tuesday, oil prices had rallied ahead of Thursday's OPEC+ meeting and whether members will agree a production cut deal.

—Read the full article from S&P Global Platts

OPEC+ oil cut talks head down to the wire, with Saudis, Russians still not on same page

Saudi Arabia's attempt to negotiate a global pact with Russia to rescue oil prices from the coronavirus crisis will come to a head Thursday, when ministers from OPEC and other key countries log on to a high stakes online summit to settle geopolitical scores and parcel out production cuts. The meeting will not include the world's largest oil producer, the US, though Energy Secretary Dan Brioullete is expected to take part in an emergency Saudi-chaired G20 ministerial webinar Friday that could endorse and widen any OPEC+ accord to narrow the widening gap between surplus oil supply and sickly demand.

With Trump administration officials exerting strong back-channel pressure on the countries to close a deal to stave off further industry bleeding, Saudi Arabia and Russia will likely be motivated to avoid a repeat of their last meeting a month ago, which ended in recriminations and launched a bitter price war. Russia would be willing to cut 1.6 million b/d from its Q1 production level, Tass news service reported Wednesday, while Saudi Arabia has not disclosed how much output it would be willing to rein in, as the two countries remain split over the baseline production figures from which to determine new quotas.

—Read the full article from S&P Global Platts

Interview: OPEC+ seeks outside help to hit 10 million to 15 million b/d cut deal: Kuwait minister

The 23-country OPEC+ alliance is aiming for a global output cut pact totalling 10 million to 15 million b/d, including producers outside the group, when ministers meet Thursday for a critical summit to shore up the coronavirus-stricken market, Kuwaiti oil minister Khaled al-Fadhel told S&P Global Platts. Many details still remain in flux, but all OPEC+ members are committed to clinching a deal, Fadhel said in an interview Wednesday.

"How much, when, what share -- these remain topics of discussion for the meeting," the minister said. "According to the discussions and phone calls and optimistic comments I hear from my colleagues, it seems that the platform is ready to take decisions that are beneficial to both producers and consumers."

—Read the full article from S&P Global Platts

Credit Costs For China's Banks Could Rise By US$224 Billion In 2020

Loan forbearance such as payment holidays, reduced interest charges, and lengthened maturities are an important type of financial support to alleviate the economic fallout wrought by COVID-19. In China, S&P Global Ratings estimates that the additional credit costs due to forborne loans will be nearly Chinese renminbi (RMB) 1.6 trillion (US$224 billion) over 2020. This is equivalent to more than half our pre-outbreak estimate of sector net profits in 2020. The impact to the sector's net profit in 2020 could be less if banks opted to lower their provision buffer.

S&P Global Ratings expects the sector's nonperforming assets would increase about 2 percentage points to 7.25% after taking the potential impact of forborne loans into consideration. S&P Global Ratings' forward-looking assessments reflect the impact on bank earnings of the economic damage from COVID-19, including our view of a strong rebound in 2021. However, if virus-related disruptions extend beyond our estimated timeline, then the chances of recouping delayed payments will diminish. Chinese banks would face more pressure to recognize additional credit costs.

—Read the full report from S&P Global Ratings

China Developers' 2019 Results Expose Strains Before COVID-19 Crisis Hit

The release of most Chinese developers' 2019 results show many firms were facing margin compression well before the COVID-19 outbreak hit. The event simply amplified strains underway before this crisis. Tepid sales and tighter margins should drive the ratings on China developers in 2020, particularly as U.S. dollar funding dries up. S&P Global Ratings maintains its baseline view for the sector. We assume a 5%-10% drop in national contracted sales for 2020.

Chinese developers have grown steadily in recent years, with almost all lifted by the rising tide of surging property sales. Most rated entities seemingly built meaningful buffers through this flush period. However, the business disruptions triggered by the COVID-19 pandemic have exposed vulnerabilities in weaker firms that didn't use the good years to bolster their financial strength.

—Read the full report from S&P Global Ratings

Credit FAQ: How Will COVID-19 Affect Japanese Structured Finance?

The COVID-19 pandemic and virus containment measures has led to stress that could reach Japan's structured finance market. The crisis put an additional stress on the Japanese economy, which was already shrinking after a sales tax hike implemented last year. S&P Global Ratings has in light of the pandemic revised down its 2020 real GDP growth forecast for Japan to -1.2%. In this report, S&P Global Ratings addresses frequently asked questions about the influence of the ongoing crisis on Japanese securitization transactions it rates.

In order to avoid the further spread of COVID-19, the Japanese government declared a month-long state of emergency for Tokyo, Osaka, and five other prefectures on April 7. At the same time, the government announced a package of economic measures to mitigate the negative impact of the pandemic. This report is based on S&P Global Ratings' most recent macroeconomic forecasts. However, S&P Global Ratings will revise its assessment of the pandemic's impact on Japanese structured finance transactions in line with changes in forecasts and other matters.

—Read the full report from S&P Global Ratings

Research Update: Australia Outlook Revised To Negative As COVID-19 Outbreak Weakens Fiscal Outcomes; 'AAA/A-1+' Ratings Affirmed

The government has announced several large stimulus packages to support the economy in response to the COVID-19 shock. S&P Global Ratings expects the government debt burden to weaken materially as a result. S&P Global Ratings has revised its outlook on Australia to negative from stable to reflect a substantial deterioration of its fiscal headroom at the 'AAA' rating level. At the same time, S&P Global Ratings is affirming our 'AAA/A-1+' long- and short-term local and foreign currency ratings. S&P Global Ratings' ratings on Australia benefit from the country's strong institutional settings, its wealthy economy, and monetary policy flexibility. The country's high external and household indebtedness as well as its vulnerability to weak commodity export demand moderate these strengths.

—Read the full report from S&P Global Ratings

Factbox: Indian petrochemical plants shut after lockdown, prices fall

Several petrochemical plants in India have been forced to shut down after the country imposed a nationwide lockdown from March 24 until April 14 to fight the fast spreading coronavirus outbreak. Sign Up Uncertainty still lingers around whether the lockdown will be lifted next week, and how fast the plants can get back into production considering it may take some time for workers to return and for logistics and transportation to resume normal operations.

—Read the full article from S&P Global Platts

COVID-19: Coronavirus-Related Public Rating Actions On Nonfinancial Corporations And Affected European CLOs

In response to investors' growing interest in the COVID-19 coronavirus and its credit effects on companies and European collateralized loan obligations (CLOs), S&P Global Ratings is publishing a regularly updated list of rating actions taken globally on nonfinancial corporations, which have had an effect on European CLOs, and a summary table. These are public ratings where S&P Global Ratings mentions the COVID-19 coronavirus as one factor or in combination with others.

—Read the full report from S&P Global Ratings

Coronavirus-ravaged European hotel sector faces long road to recovery

Of all the industries devastated by the battle against the new coronavirus, it is hard to think of one more damaged than hospitality. When countries close their borders, the global airline industry grinds to a halt, and billions of people are told to stay home, it spells big trouble for the hotel sector. With demand disappearing almost overnight, hoteliers around the world have had to let millions of staff go. In the U.S. alone, 4 million hospitality workers are expected to lose their jobs as a result of the crisis, according to the American Hotel and Lodging Association.

In Europe, the region worst hit by the virus to date, hotel occupancy had fallen to 12% by March 28, according to data from select countries presented by travel intelligence specialist STR during an April 2 webinar. Most European markets face zero demand in April and May, added STR, which expects the region's hotel sector to be negatively impacted for eight months, four of which will see it severely impacted.

—Read the full article from S&P Global Market Intelligence

The Spread Of The Coronavirus To Erode Credit Quality Of Latin American Infrastructure Assets

S&P Global Ratings expects credit conditions in Latin America to worsen as the COVID-19 pandemic advances in the region. As the virus spreads, governments are already taking measures to contain it that range from mandatory country quarantines to travel bans and mobility restrictions. In this new context, and considering the global threats, S&P Global Ratings updated its forecasts for the region. S&P Global Ratings now expects Latin America to fall into a recession in 2020, recording its weakest growth since the Global Financial Crisis. More precisely, S&P Global Ratings forecasts the regional GDP to contract 1.3% in 2020, and then to converge to growth again by 2021.

So far, S&P Global Ratings has taken negative rating actions on more than 60 Latin American infrastructure entities in our portfolio. These were attributable to recent sovereign rating actions and to expected weaker financial performance, particularly in the transportation sector given the mobility restrictions. In S&P Global Ratings' view, downside risks are still significant. A prolonged outbreak or a further dip in oil prices will put additional pressure on local economies and indirectly on sovereign ratings, which in turn could further challenge infrastructure assets.

—Read the full report from S&P Global Ratings

In coronavirus crisis, Latin America looks to QE. The move 'has its dangers'

The coronavirus pandemic's erosion of global economic growth has hit emerging markets especially hard, including those in Latin America, where a limited and depleting fiscal armory has left central banks scrambling to find new tools. In late March, Colombia's central bank, Banco de la República, launched an asset purchase program widely considered to be Latin America's first ever first quantitative easing, or QE, initiative. The 12 trillion peso (US$2.98 billion) package, which hopes to "inject permanent liquidity" in the economy, covers private and public debt, including treasury bonds. Chile, meanwhile, has launched a form of QE with a $4 billion asset purchase program, though it only covers bank bonds held by financial institutions at the moment.

The programs add to a list of emerging markets across the globe that are now turning to QE-like measures as part of their response to the pandemic.

—Read the full article from S&P Global Market Intelligence

US crude stocks see largest-ever weekly gain as refinery demand plunges

US crude inventories saw their largest-ever weekly build last week as refinery demand cratered amid a historic collapse in product demand, US Energy Information Administration data showed Wednesday. Commercial crude stocks surged 15.18 million barrels to 484.37 million barrels during the week ended April 3, EIA said, putting inventories more than 2% above the five-year average for this time of year.

The bulk of the build was at Cushing, Oklahoma, the delivery point of the NYMEX crude contract, where stocks climbed 6.42 million barrels to 49.24 million barrels. The build was the largest-ever on record at Cushing, and put tank levels there at an estimated 62% of working capacity, an S&P Global Platts analysis showed. US Gulf Coast crude inventories jumped 5.34 million barrels to 253.12 million barrels as exports fell to their weakest since November at 2.83 million b/d. While last week's build was the largest ever on record, it was in part tempered by a 600,000 b/d decline in US crude production. Total output averaged 12.4 million b/d last week, the weakest since September.

—Read the full article from S&P Global Platts

PODCAST OF THE DAY

Listen: North American LNG exporters face difficult test as price plunge sets new lows

S&P Gloal Platts senior natural gas writer Harry Weber and S&P Global Market Intelligence natural gas reporter Corey Paul discuss with Platts senior digital editor Jason Lindquist current trends in the North American and global LNG markets amid ongoing headwinds, including low prices, narrow margins, shifting trade flows and a significant dropoff in commercial activity that has been exacerbated by the coronavirus pandemic.The outlook has been clouded by extraordinary uncertainty about the near-term trajectory of supply and demand fundamentals.

—Share the Commodities Focus podcast from S&P Global Platts

Pandemic may have long-term effect on driving habits, says Allstate exec

Glenn Shapiro, president of Allstate Corp.'s personal property-liability business, said the company's telematics data shows a dramatic change in driving habits since the novel coronavirus outbreak was declared a pandemic in mid-March. Fewer drivers are on the road and driving distances have plummeted. Shapiro, who also oversees Allstate subsidiaries Esurance Insurance Co., Encompass Home & Auto Insurance Co. and Answer Financial Inc., talked with S&P Global Market Intelligence about what has changed in the last few weeks and what impact that may have down the line.

Allstate's telematics data has shown that driving has decreased by as much as 50% since mid-March, when President Donald Trump declared a national emergency in response to the COVID-19 pandemic. The company responded to that data with its "Shelter-In-Place Payback" program, which will return $600 million in premiums to its policyholders in April and May.

—Read the full interview from S&P Global Market Intelligence

Utilities call on Fed to expand access to short-term debt as nonpayments spike

The Federal Reserve is fielding calls from the U.S. Congress and energy regulators to give electric, gas and water utilities easier access to short-term loans amid commitments to suspend customer disconnects due to the coronavirus pandemic. Trade groups such as the Edison Electric Institute, or EEI, announced in late March that their member companies would suspend disconnects for nonpayment as the COVID-19 outbreak puts a record number of U.S. households out of work.

On March 24, the EEI was joined by the American Gas Association and National Association of Water Companies in urging the Fed to expand its Commercial Paper Funding Facility, or CPFF, to include what are known as Tier 2 companies. Launched a week earlier, the facility buys short-term debt from companies and is largely focused on helping investment-grade issuers. The commercial paper market is critical to the U.S. corporate finance system. Many large companies use it to issue short-term debt in exchange for cash, which they can then use to meet payroll and other short-term liabilities.

As currently structured, the central bank is only purchasing commercial paper from companies that were rated A-1/P-1/F1 as of March 17 as well as making one-time purchases from issuers that held that rating at the time but have been downgraded one tier below since then. Excluding other Tier 2 companies from the program will not address liquidity and cost issues in the A2/P2/F2 commercial paper market "where liquidity is rapidly declining," the EEI said in a letter addressed to Fed Chairman Jerome Powell.

—Read the full article from S&P Global Market Intelligence

Credit FAQ: Will U.S. Telcos Be Recession Proof This Time Around?

A surge in COVID-19 cases in the U.S., recessionary pressures, and weaker capital market conditions are weighing on corporate credit quality. That said, U.S. telecommunication companies (telcos) have historically been quite resistant to macroeconomic contractions. In wireless, the pandemic has caused the carriers to close stores, which will reduce gross postpaid subscriber additions and upgrade rates, but also lower churn. Supply chain impacts could also result in lower equipment revenue for the carriers, but bolster profitability.

S&P Global Ratings believes there is more risk in wireline, especially among companies with greater exposure to small and midsize businesses (SMBs) and, to a lesser extent, enterprise customers. Under normal conditions, we view wireline operators that derive a large portion of their revenue from business customers more favorably than providers that focus on the residential segment where competition is more intense. However, in a recession, we would expect many SMB customers to close locations and even go out of business. And, the spread of the COVID-19 pandemic could accelerate this process as many small businesses are facing a low- to zero-revenue environment for a period of time. An extended macroeconomic downturn could even prompt larger enterprise customers to reduce IT spending, bookings, and installations.

—Read the full report from S&P Global Ratings

Department stores lead consumer industries among probability of default rates

Department stores lead a group of consumer companies that have seen their odds of default spike over the past month, the latest indication that coronavirus-related challenges are mounting for an already struggling group of retailers.

S&P Global Market Intelligence's median one-year market signal probability of default, which represents the odds that a company will default on its debt within the next year based on fluctuations in the company's share price and other country and industry-related risks, rose to above 40% for some sectors in early April, up from below 10% at the end of February, according to an analysis of U.S. publicly traded consumer companies. Retailers dependent on foot traffic at malls as well as hotels and casinos that rely on leisure travelers were among the groups that saw their odds of default tick up the most.

—Read the full article from S&P Global Market Intelligence

CHART OF THE DAY

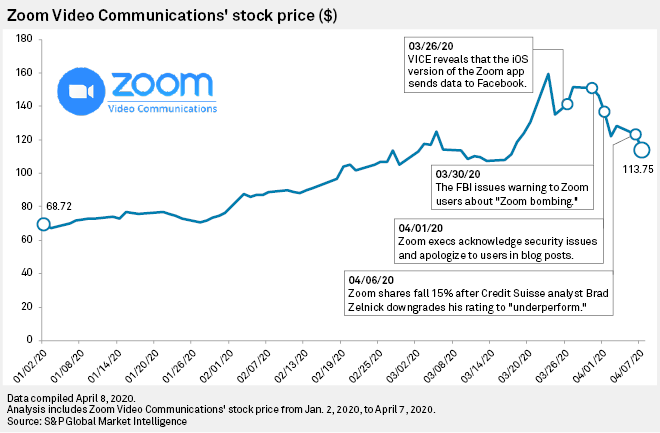

Zoom's popularity in jeopardy after privacy, security lapses

The rapid rise of Zoom Video Communications Inc.'s video conferencing app amid the coronavirus outbreak has led to a series of privacy and security headaches for the company, raising questions about the application's future. The company's daily userbase grew to 200 million in April from 10 million before the pandemic, and its share price surged to an all-time high close of $159.56 on March 23 up from $68.72 at the start of the year.

However, Zoom's sudden popularity has been marred by a string of privacy snafus that include sharing data with Facebook Inc. without consent and misrepresenting the level of encryption offered for its meetings. Now, the company is facing a host of lawsuits and government inquiries. Moreover, Credit Suisse analyst Brad Zelnick on April 6 cut his rating on Zoom shares to "underperform" from "neutral," arguing that even though the company's user base has grown twentyfold, the surge is likely to prove ephemeral as many of these new users will be difficult to monetize. The company's shares tumbled more than 15% in intraday trading on April 6 and were trading around $114.07 in late afternoon trading on April 8.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language