Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 31 Mar, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

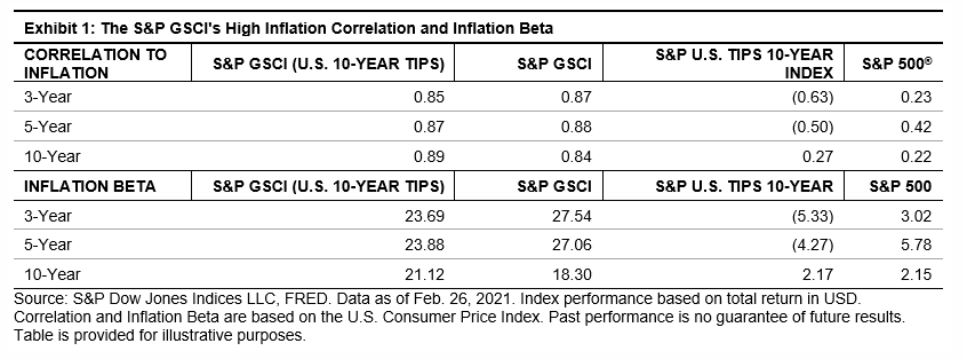

The newly launched S&P GSCI (U.S. 10-Year TIPS) TR was designed with inflation protection in mind. This index takes the renowned broad commodity market benchmark, the S&P GSCI, and aims to add boosted return potential from an exposure to on-the-run U.S. 10-Year Treasury Inflation-Protected Securities (TIPS). Normally, the S&P GSCI TR includes the collateral yield from the U.S. 3-Month T-Bill rate. The S&P GSCI (U.S. 10-Year TIPS) TR exchanges that T-Bill rate for the U.S. 10-Year TIPS, represented by the S&P U.S. TIPS 10-Year Index. If we are entering a period of high inflation, collateralizing commodity exposure with TIPS may be attractive to some market participants. Historically, real assets, including commodities, real estate, infrastructure, and inflation-linked bonds have exhibited a positive correlation to inflation. A strategy that combines commodities and inflation-linked bonds may help hedge inflation risk and maintain the purchasing power of the investment.

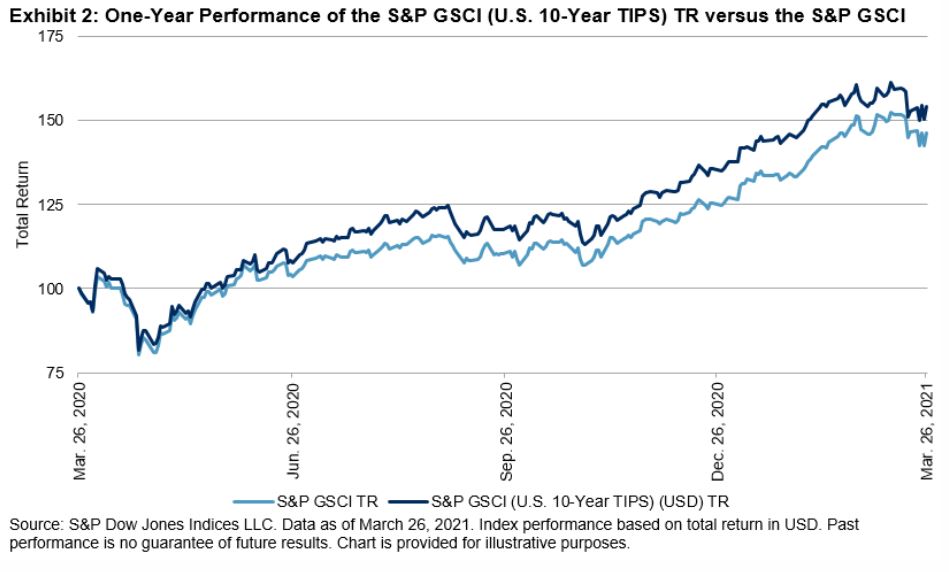

Most of the return from this new index comes from the S&P GSCI, which is the most widely recognized broad commodity market benchmark available. Commodities tend to perform well in high inflation environments as opposed to low inflation environments, like those seen during the 2010s. With a combination of highly accommodative central banks since the Global Financial Crisis, globalization, productivity improvements advanced by technology, and a global push to lower costs everywhere, commodities lagged other asset classes. Many commodities that flirted with record low prices in the wake of the initial COVID-19 lockdowns have recovered strongly over the past 12 months, benefiting from a rebound in demand, expansive fiscal spending programs, and ongoing supply disruptions. Prior periods of commodity price strength have tended to coincide with high and rising (usually unexpected) inflation.

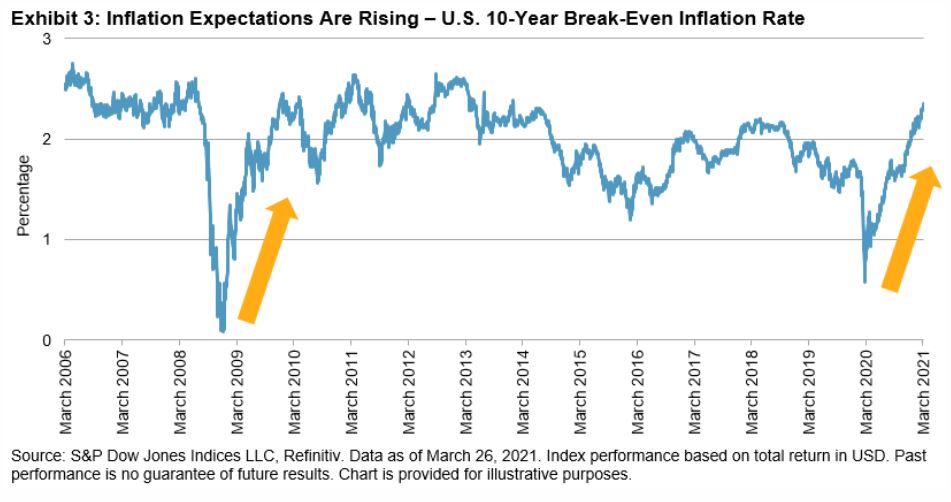

The S&P GSCI (U.S. 10-Year TIPS) TR may offer market participants the opportunity to hedge against the risks of inflation. Historically, commodities outperformed during inflationary times. During prior periods of extreme volatility, like the COVID-19 lockdown drop and Global Financial Crisis, market participants expected the worst and reset their inflation expectations lower. Exhibit 3 shows what happened to inflation expectations during shocks to the markets and how quickly they recovered.

Check out https://www.spglobal.com/spdji/ for more information and be sure to tune in to our new content coming in April as we celebrate the 30th anniversary of the S&P GSCI.

The posts on this blog are opinions, not advice. Please read our Disclaimers.