Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 22 Jan, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

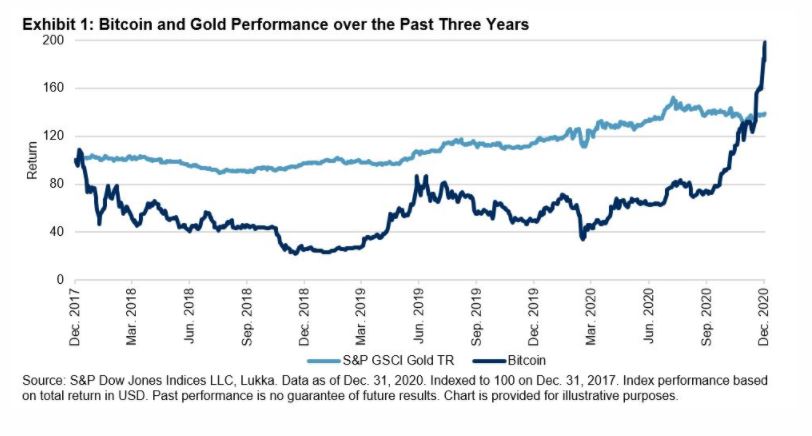

The recent enthusiasm for Bitcoin is reminiscent of the Gold Rush in the western U.S. from 1848-1860. With fits and starts, U.S. enthusiasm for gold exploded over this time period. Gold was the most popular safe haven and store of value in the 19th century. Viewed as one of the least volatile commodities, gold prices during that time were surprisingly tepid in comparison to the current, highly volatile moves from Bitcoin. Less liquid than other established stores of value, Bitcoin’s recent move has been parabolic in nature, as seen in Exhibit 1.

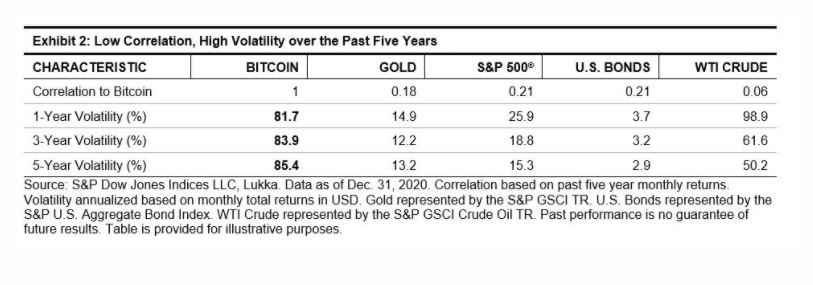

Recently, the parallels between the two assets have grown. Both Bitcoin and gold are viewed as scarce, have the potential to be held outside of conventional financial markets, and have values that cannot be inflated away by relentless money creation and currency debasement. Market participants, including mainstream asset managers, appear to be looking to both as attractive inflation hedges. Gold and Bitcoin are also uncorrelated to other popular asset classes in portfolios, which provides evidence of their diversification benefits. Despite the low correlation, one glaring difference can be seen in the volatility of Bitcoin over the past five years. It is multiple times higher than other asset classes as seen in Exhibit 2, which shows the monthly annualized volatility over one-, three-, and five-year horizons.

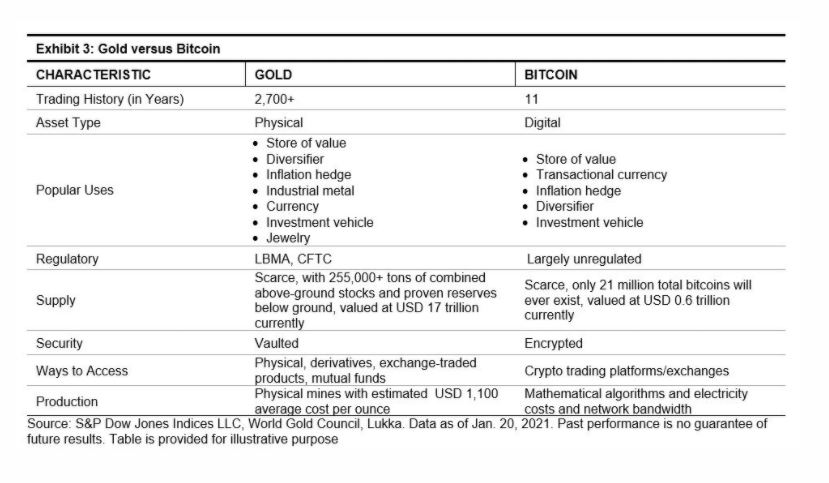

In addition to performance, the fundamentals of Bitcoin and gold differentiate in owning one versus the other. Gold is a physical asset, while Bitcoin is a digital one. While both are scarce, gold does not yet have a ceiling to supply, while there ultimately can only be 21 million Bitcoins mined. Also, according to Chainalysis, 20% of current Bitcoin supply is considered not recoverable due to hard drives being lost in garbage dumps or passwords lost in early investors’ heads. On the demand side, there are a lot of similarities between the two assets, as can be seen in Exhibit 3. Gold is viewed as a more secure investment with a long history of use and is widely accepted by all types of market participants. On the other hand, concerns of Bitcoin theft were rampant a few years ago; though as Bitcoin becomes more mainstream, these worries are fading, although lingering technology and exchange counterparty risks remain. The different ways to access return streams of gold are conventional and easily accessed by different types of market participants. Bitcoin, however, is in its infancy, but it is slowly becoming more easily accessible to mainstream investors.

S&P DJI intends to launch global cryptocurrency asset indices based on data sourced from Lukka, our cryptocurrency pricing provider known for its institutional-grade pricing. Soon, reliable and user-friendly crypto benchmarks will be available to promote more transparency in this area. Lukka is a New York City-based crypto asset software and data company. S&P Global participated in Lukka’s USD 15 million Series C in December 2020.

Market participants cite many reasons why they allocate a slice of their portfolio to Bitcoin. For many of those reasons, gold is already the ideal, established candidate for adoption. The S&P GSCI Gold tracks the most actively traded gold futures on the CME. Whether looking for an inflation hedge, store of value, way to diversify, or directional play in commodity markets, gold is the asset with the longest track record of price appreciation in human history.

The posts on this blog are opinions, not advice. Please read our Disclaimers.