Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 11 Jun, 2020

By Berlinda Liu

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In the first quarter of 2020, the global economy experienced not a slowdown, but a shutdown. As COVID-19 swept the world, outsized market movements became the new norm. The S&P 500® finished its worst quarter (-19.6%) since 2008’s global financial crisis. International equities fared even worse as the S&P International 700 lost 22.4%. While investors were catching their breath after the February-March sell-off, the S&P 500 rebounded in April and posted its largest monthly gain (12.8%) since 1987.

Active managers sometimes seek to soften the conclusions of our regular SPIVA® reports by arguing that, while index funds may have the advantage in rising markets, it’s in volatile downturns that active management can prove its worth. Historical data argue otherwise,[1] and most active managers continued to underperform in 2020.

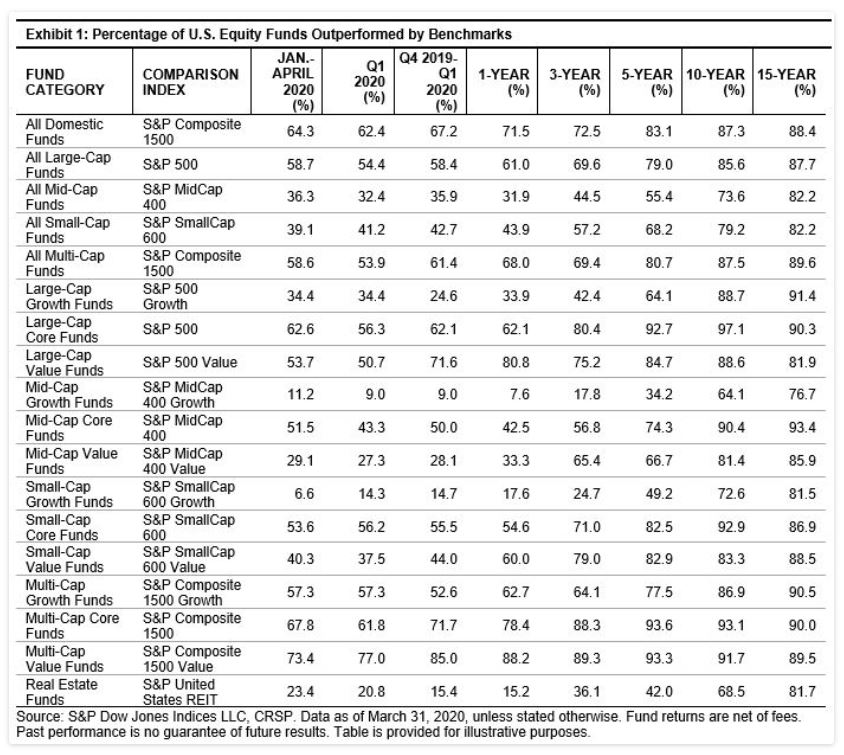

Of domestic equity funds, 64% underperformed the S&P Composite 1500® in the first four months of 2020, and 67% underperformed in the past two quarters. During the one-year period ending March 2020, 72% of domestic equity funds underperformed, slightly worse than the year-end 2019 result (70%).

Most large-cap funds underperformed the S&P 500 across all time horizons. The consistency of their underperformance in the first quarter market decline and the April rebound was especially noteworthy. During Q1 2020, 54% of all large-cap funds underperformed; in April, the YTD underperformance percentage increased to 59%. We also observed this pattern in other categories, highlighting the difficulty in market timing.

Short-Term Success versus Long-Term Underperformance

Unsurprisingly, SPIVA results are noisier for shorter time horizons. Although we see pockets of relative success for active managers up to three years, over the long term, they still generally lagged their benchmarks.

In the large-cap space, the only bright spot was large-cap growth, where 75% outperformed in the past two quarters. However, short-term success didn’t compensate for previous underperformance. For the past 15 years, 91% lagged the S&P 500 Growth. Mid-cap and small-cap funds were similar: 64% of all mid-cap and 57% of all small-cap funds beat their benchmarks in the past two quarters, aided by the superior performance of larger names. Their short-term success had little impact on their long-term scores though: 82% underperformed over the past 15 years in both categories.

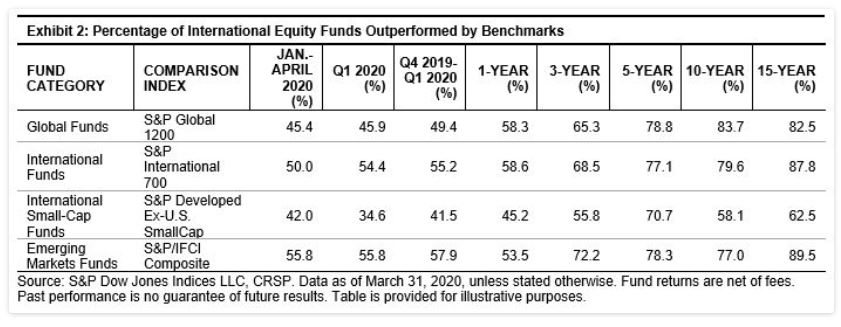

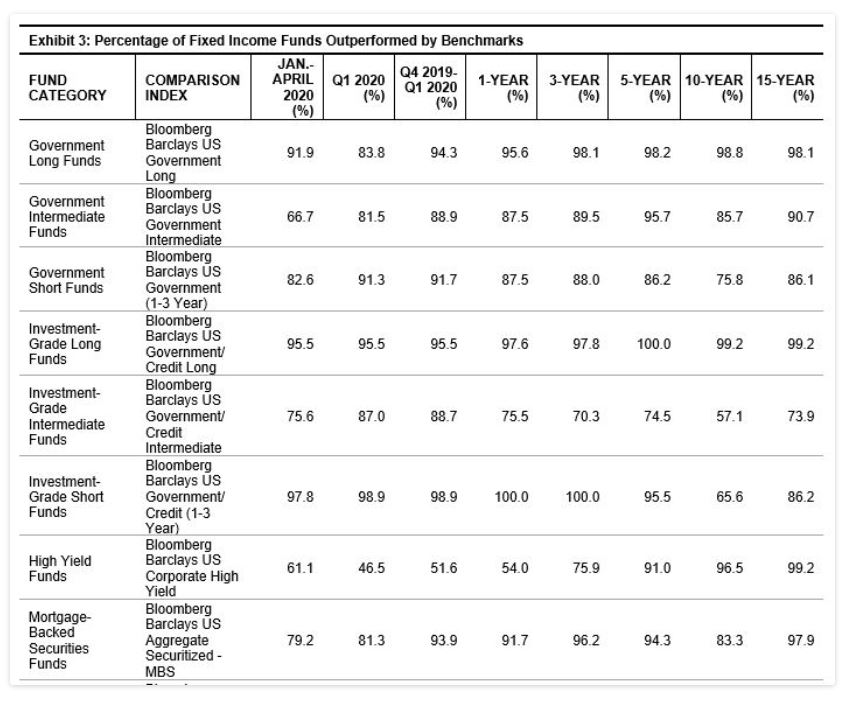

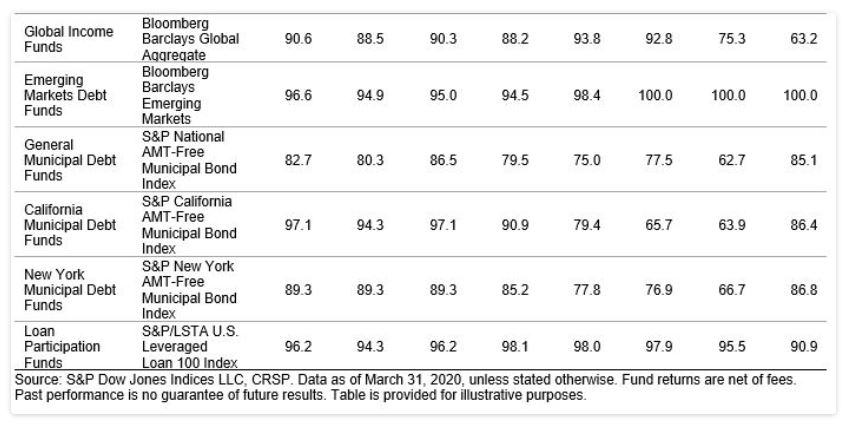

A similar story occurred in international equities and fixed income. Despite the short-term success of global funds and international small-cap funds, most managers lagged their indices across all categories for any periods three years or longer.

Conclusion

Early 2020 results rebut the view that active funds navigate market turmoil better than index-based funds. Even where results are relatively favorable, the data show the difficulty of market timing. Mixed results in the short term did not change active funds’ tendency to underperform indices over the long term.

[1] 65% of domestic equity funds underperformed the S&P Composite 1500 in 2008.

Content Type

Theme

Location

Language