Upstream service sector in the new sub-$40/bbl Brent environment

This crash could add the finishing touches to the grand reshuffling of the upstream service sector that started in 2014

The last month has been a nightmare for the upstream service sector. Brent plunged to around $20 in March. And the signs of an impending upstream service sector recovery in 2020 was quickly vaporized. Demand destruction as a result of COVID-19, and the oil market price war are the key factors derailing the recovery. Both are unforeseen and their future development are highly uncertain. The upstream supply chain must brace itself for an uncertain and volatile future.

Out of fear, buyers have deferred a significant portion of pre-FID projects in 2020, despite the much lower costs today compared to 2014

At first sight, this crash seems a repeat of 2014, but much have changed since 2014. Costs levels are different. Costs levels in 2020 is still way below that in 2014. This means that although Brent price has slumped to the $20/bbl range, project economics have not deteriorated as much as back in 2014, when oil price had also slumped to $20/bbl.

In addition, after 5 years of pressure to reduce costs, operators are much more open-minded with their procurement and development strategies than in 2014, which further reduce cost. One such area is the wider use of supplier's specifications and repeated designs rather than insisting on operators' unique in-house standards and designing everything from scratch. For complex facilities like FPS, this could reduce EPC cost by a third.

Furthermore, standardisation, which began at the component level before 2014, has intensified after 2014. Standardisation not only reduces item unit costs, but also inventory and logistic costs. Since then, standardisation has spread to entire facilities at a rate not seen before 2014. Concepts such as SBM fast4wards and Modec 350 FPSO are gaining popularity.

Lastly, supported by rising competencies, new contracting models have reduced the risk to buyers for using lower costs, but new contractors. This has opened many opportunities promising buyers lower cost in the previously expected inflationary environment of 2020-25.

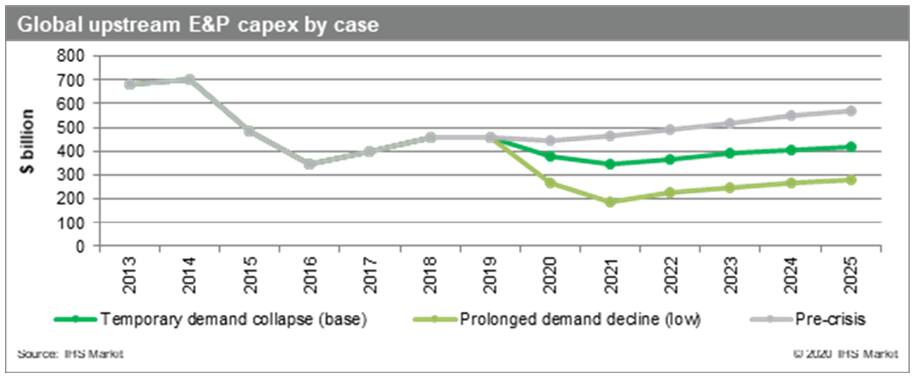

Project fundamentals aside, fear of a prolonged low oil price has overwhelmed the market. Demand destruction is real as most operators are bracing themselves up for a prolonged period of very low oil price. We have already seen major oil and gas companies cutting capex budget for 2020 by 20-30%. Almost all yet to FID projects of the IOCs for 2020 have been shelved for now. We are bracing ourselves for two more years of winter.

Figure 1: Global upstream

E&P capex by case

Figure 1: Global upstream

E&P capex by case

All the bad news and pragmatism aside, many are hoping for a $55 oil. We must stress that $55 is not in any of our scenarios for the next 2-3 years. But if oil price were to rebound to $55, we will see a sharp recovery in tendering activities. This is because many of the projects that have been delayed in 2020 like Barossa, Scarborough, Cambo and Tano are all in very advanced stages of tendering. Their progress is only derailed by the sudden drop in oil price.

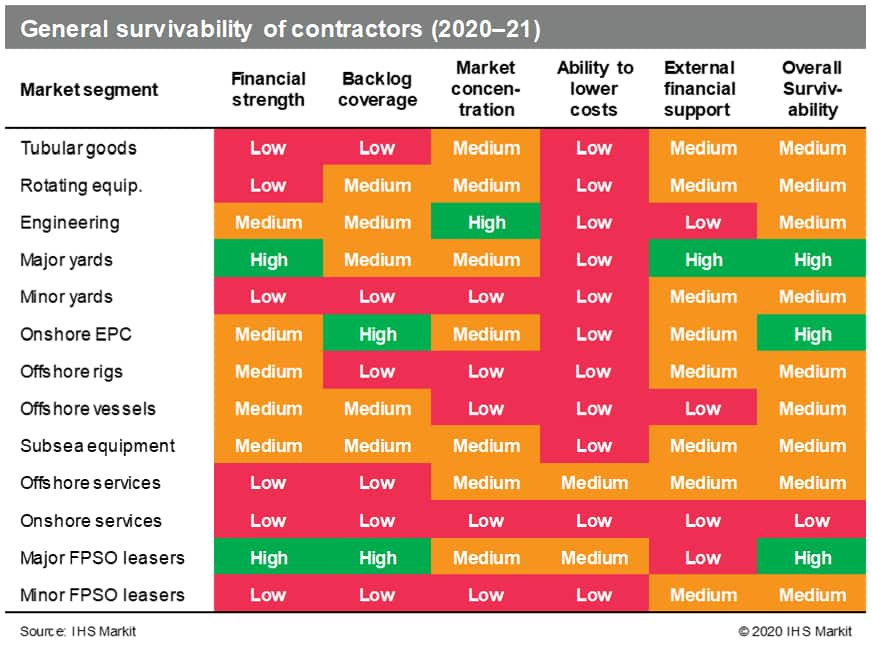

Only the strongest contractors will survive this time; the contractor market might achieve the sustainable balance 2014 did not managed to bring about

The fate of the contractors is bleaker than before. The survivability of contractors has generally deteriorated in the last five years.

Figure 2: General survivability of contractors

(2020-21)

Firstly, flushed with cheap money and historically high backlog, capacity destruction is insufficient to balance the oversupplied contractors' market five years after 2014. Today, the market is generally still oversupplied. E.g. the vessel market, there are about 10% more vessels today than five years ago. The much-hoped-for recovery in 2020 was supposed to breathe a second life into many of these contractors. This recovery is not coming, and many contractors will not survive this crash.

Secondly, excessive competition, which manifested itself in under bidding, went undeterred even when it was the cause of reduced margins before 2014 and losses after 2014. We saw EBITDA and shareholders' equity falling as suppliers burn more money as they work through projects. After five years of weak financials, contractors as less financially positioned to survive today.

Lastly, moreover, the wish of draining down a huge backlog is futile for many today as a weak recovery that started in late-2018 has not sufficiently beefed up many contractors to survive another two years of deep winter. Worse when arguably much of the existing backlog is toxic and priced on loss-ensuring bids.

Too big to fail might apply to some financially strong contractors like the major FPSO leasing companies and those deemed strategic to the state such as the major shipyards. Most upstream contractors are neither. This crash will bring about the balance that 2014 failed to bring about to enable the competitive contractors to build a more sustainable supply chain.

And what about the cheap money that kept them afloat after 2014? Upstream contractor is just one sector among the industries wreaked by COVID-19. Governments have injected multiple trillions of dollars worldwide, but there is likely not enough to go around. Only a rebound in oil prices could save many of the upstream contractors. Not many are going to survive these 2 years.

After this crash, unit cost inflation is needed, but whether it is a "sustainable future" or one haunted by "ghosts of the past" remains to be seen

Our future after this crash will depend on how the recovery looks and what procurement and development philosophy and strategy the operators will adopt. We see one certainty with two futures.

The one certainty is inflation. Do not let the inflationary decade between 2002-12 dash our hope for the future. History does not necessarily need to repeat itself, if we learn from it. And the two futures are one of higher unit costs but lower project costs and the other being one of even lower unit costs, but higher project costs accompanied by runaway cost overruns.

Today, there is only one way for the upstream supply chain to survive sustainably - that is to increase unit cost, but to decrease project cost. We are, may be to the disdain of many, advocating letting unit cost increase. But we stress the importance of keeping project costs down. And bear in mind from experience, cost overruns can easily eliminate any savings in unit cost.

The prices that many contractors are charging today are unsustainable given the risks they are taking for many projects. Many contractors have little room to cut costs further today. For many, even surviving on today's unit rate is akin of eventual bankruptcy and the loss of accumulated capabilities. This is not good for the operators too. We may have no more good contractors like a DSME or Keppel to build our FPSO. We may not have a McDermott to lay our pipes or a Transocean to drill our wells.

As such, the approach to cost reduction must change more. Structural cost is the key. We saw green shoots of tackling structural costs sprouting since 2014. Some of them were mentioned earlier. This got to continue. It is a start and we are confident this crash will and must hasten it.

Ding Li Ang is the Head of Research (APAC),Head of Engineering & Fabrication for the Upstream Costs and Technology team at IHS Markit.

Posted 07 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.