Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jun 26, 2024

The civil unrest in Kazakhstan in January 2022, triggered by increased liquefied petroleum gas (LPG) prices, highlighted the importance of energy security and affordable energy for the country's population. The Kazakhstan government, in its "Comprehensive plan for the development of the gas industry of the Republic of Kazakhstan for 2022-2026" [1], projected a gas deficit by 2025 due to the growth in domestic gas consumption. This article evaluates opportunities for a sustainable way of meeting domestic demand through the utilization of natural gas that is being flared during oil and gas operations.

Understanding Kazakhstan's gas deficit: demand and supply dynamics

Demand side

Kazakhstan faces the challenge of satisfying the country's energy needs with a growing population and stricter greenhouse gas (GHG) emissions reduction requirements from the countries that import Kazakhstan's oil and gas. In 2022, Kazakhstan was among the top five oil exporting countries to the EU [2], making adherence to EU GHG emissions standards crucial for maintaining market access and share.

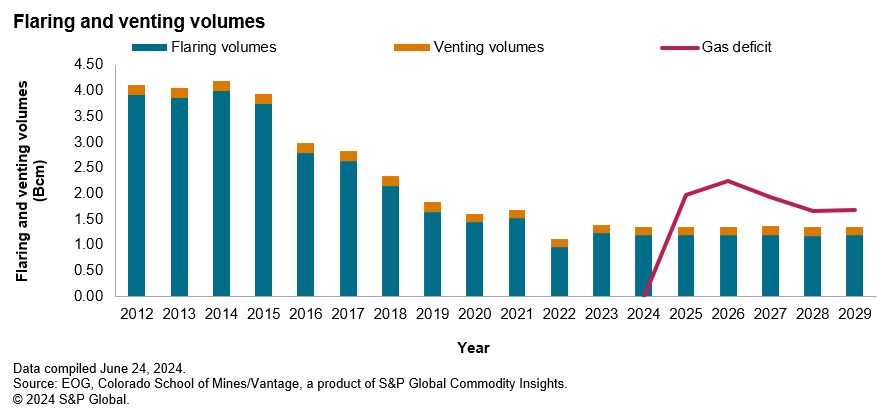

Domestic gas demand in Kazakhstan more than doubled from 2010 to 2022 with growth from 9.0 Bcm to 19.3 Bcm [3] and according to the government's estimates, it is expected to rise to 32.4 Bcm by 2030, resulting in an annual gas deficit of around 2 Bcm throughout 2025-29.

The growth in gas consumption can be partly attributed to population growth. Since Kazakhstan's independence in 1991, the population has risen from 16 million to 20 million, leading to higher overall gas consumption and an increase in per capita energy use.

However, the largest portion of the projected increase in gas consumption is due to initiatives in power generation, aiming to reduce coal's share from 70% to 40%, and to the expansion of petrochemical projects.

Supply side

In 2023, Kazakhstan produced 58.8 Bcm of gas, both natural and associated petroleum gas (APG). Despite having more gas reserves than Norway, Kazakhstan's sales volumes were just 25% of Norway's [4]. This is because 60% of the produced gas was attributed to APG, which is dependent on oil production levels. Additionally, one-third of the gas is reinjected to support oil output, and the high sulfur content complicates processing and transport.

In 2023, three major fields — Tengiz, Karachaganak and Kashagan, also known as the Big-3 and operated by foreign entities — produced 85% of Kazakhstan's gas. Due to low domestic market prices, these operators prioritized oil over gas commercialization, making oil production the key driver for gas infrastructure expansion.

Transforming flared and vented gas into opportunities

Enhancing energy security and achieving sustainability goals in Kazakhstan can also be realized by increasing the gas utilization rate through reducing flaring and venting.

In 2022, flaring [5] and venting contributed to 32% of Kazakhstan's GHG emissions in the upstream oil and gas sector according to our estimates. The 1.1 Bcm of gas lost this way amounted to 2% of the country's total gas production and 6% of its domestic gas consumption. Redirecting this gas to the domestic market could potentially have generated up to $61 million in revenue [6] and provided energy for 460,000 households [7]. Moreover, effectively capturing and using these flared and vented gases might cut the country's gas deficit by as much as 70% between 2025-2029 on average (flaring and venting volumes were analyzed and modelled in S&P Global Energy Vantage).

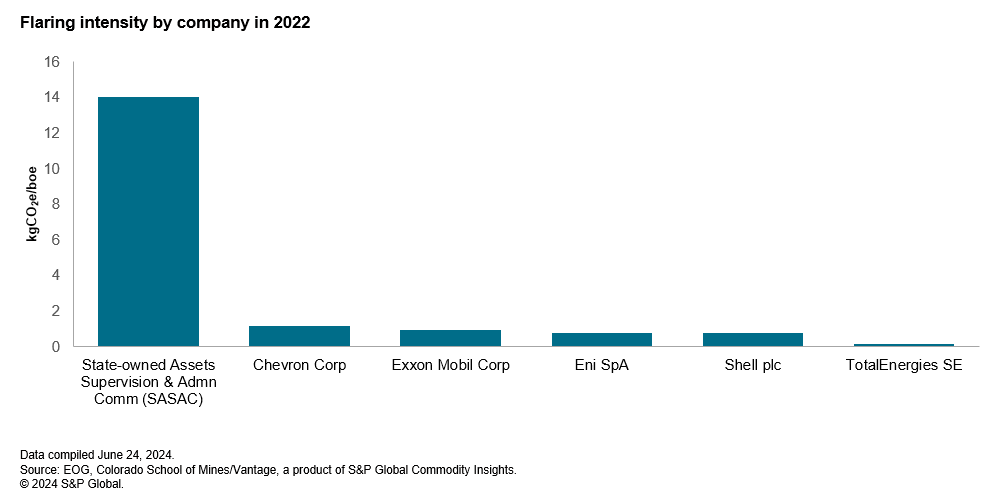

Over the past decade, Kazakhstan has significantly reduced flaring volumes, but there is still potential to improve gas utilization. In 2022, the flaring intensity in Kazakhstan was 3.1 kgCO2e/boe — 2.4 times higher than the intensity of its neighbor, Azerbaijan, and 6.7 times more than Norway, a leader in flaring efficiency.

Overall, 62% of the total 2022 flaring volumes were generated by just three assets: Zhanazhol, Tengiz and Karachaganak, which are operated by international companies. While total flaring volumes indicate the scale of gas being flared, flaring intensity — a relative measure that compares the volume of gas flared to the production volume — provides a ratio that reflects the efficiency of the flaring process. The Big-3 fields were among the most efficient in terms of flaring practices, with flaring intensities ranging from 0.2 kgCO2e/boe to 1.1 kgCO2e/boe.

Assets with higher flaring volumes and higher emissions intensity have greater potential for flaring reduction. Zhanazhol and Truva North, both operated by CNPC-Aktobemunaygaz, had a combined share of 50% (or 0.48 Bcm) in total flaring volumes in 2022. Their flaring intensities were significantly higher than the country's average, at 36 and 26 kgCO2e/boe respectively. Zhanazhol, with spare gas processing capacity of around 3.3 Bcm (total capacity of 8.4 Bcm and utilization rate of around 60%), along with Truva North, which utilizes Zhanazhol's gas processing infrastructure, could be the primary focus for implementing best practices in flaring reduction.

Overall, flaring intensity analysis shows a tangible difference in flaring practices across assets operated by international majors (Chevron, ExxonMobil, Eni and Shell) and Chinese companies. Among Kazakh-operated assets, the Prorvinskaya group, part of KazMunayGas, contributed 3% to the country's total flaring emissions.

One prominent example of improved flaring intensity practices is the Tengiz field, where flaring volumes decreased by 95% from 2000 to 2022 despite increased production according to data reported by Tengizchevroil. Most of the reduction was due to the commencing gas infrastructure, but other measures also contributed, such as capture and recompression of routinely flared gas, improved well completion techniques, early leak detection and repair, operational optimization, and improved flaring practices.

KazMunayGas also achieved a notable reduction of 2.6 MtCO2e in absolute flaring volumes by implementing projects to expand gas infrastructure at the Alibekmola, Kozhasai, Prorvinskaya group, Vostochny Makat, and Balginbayev S. fields between 2012 and 2022.

These examples illustrate that Kazakhstan's efforts to reduce flaring have shown significant progress. However, despite this progress, opportunities for further enhancements remain. Focusing on assets with high flaring volumes and intensities, such as Zhanazhol and Truva North, and adopting best practices from fields like Tengiz could enhance flaring efficiency. The redirection of flared and vented gas to the domestic market could yield substantial economic and environmental benefits, including a potential revenue increase and a considerable reduction in the gas deficit.

Conclusion

In light of the challenges and opportunities outlined, Kazakhstan stands at a pivotal moment in its energy strategy. The nation's commitment to energy security and sustainability is being tested by the increasing domestic demand and the need to reduce GHG emissions. The strategic utilization of gas through the reduction of flaring and venting not only offers a practical solution to the anticipated gas deficit but also supports environmental objectives. By capitalizing on this resource, Kazakhstan can generate additional revenue, cater to the needs of its growing population, and set an example of responsible energy management in the CIS region. The path ahead requires creating harmonized actions to optimize gas production, regulatory framework that incentivizes the capture and utilization of flared and vented gas volumes, and the development of infrastructure that sustains a balanced energy future.

This insight is part of a continuing series of analyses from Energy upstream GHG emissions dataset.

[1] Resolution of the Government of the Republic of Kazakhstan dated July 18, 2022, No. 488 "On the Approval of the Comprehensive Development Plan for the Gas Industry of the Republic of Kazakhstan for 2022-2026". Source: Об утверждении Комплексного плана развития газовой отрасли Республики Казахстан на 2022 - 2026 годы - ИПС "Әділет" (zan.kz)

[2] Eurostat. Oil and petroleum products - a statistical overview. Source: Oil and petroleum products - a statistical overview - Statistics Explained (europa.eu)

[3] Ministry of Energy of the Republic of Kazakhstan. Gas Industry. Source: Gas industry (www.gov.kz)

[4] Norway's Total sales of gas amounted to 117.3 Bcm. Source: Production forecasts - Norwegianpetroleum.no (norskpetroleum.no)

[5] This article was written utilizing VIIRS Nightfire (VNF) data produced by the Earth Observation Group, Payne Institute for Public Policy, Colorado School of Mines. Credit: C. D. Elvidge, M. Zhizhin, F.C. Hsu, and K. Baugh, "VIIRS nightfire: Satellite pyrometry at night." Remote Sensing, vol. 5, no. 9, pp. 4423-4449, 2013.

[6] Vantage fiscal model Kazakhstan domestic gas price is $1.6/Mcf.

[7] Average annual gas consumption per household (Kazakhstan's government statistical data for Kazakhstan for 2022) - 2 437 cubic meters per household.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.