Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jun 15, 2022

By Alessandro Piccoli, Cyril Ruchonnet, Etienne Kolly, and Philippe Mauron

As of mid-year 2022, Tullow Oil and Capricorn Energy were about forming a new Africa-focused energy company. They reached agreement to create a combined group on the terms of a recommended all-share combination of the two companies. The name of the new group is yet to be determined.

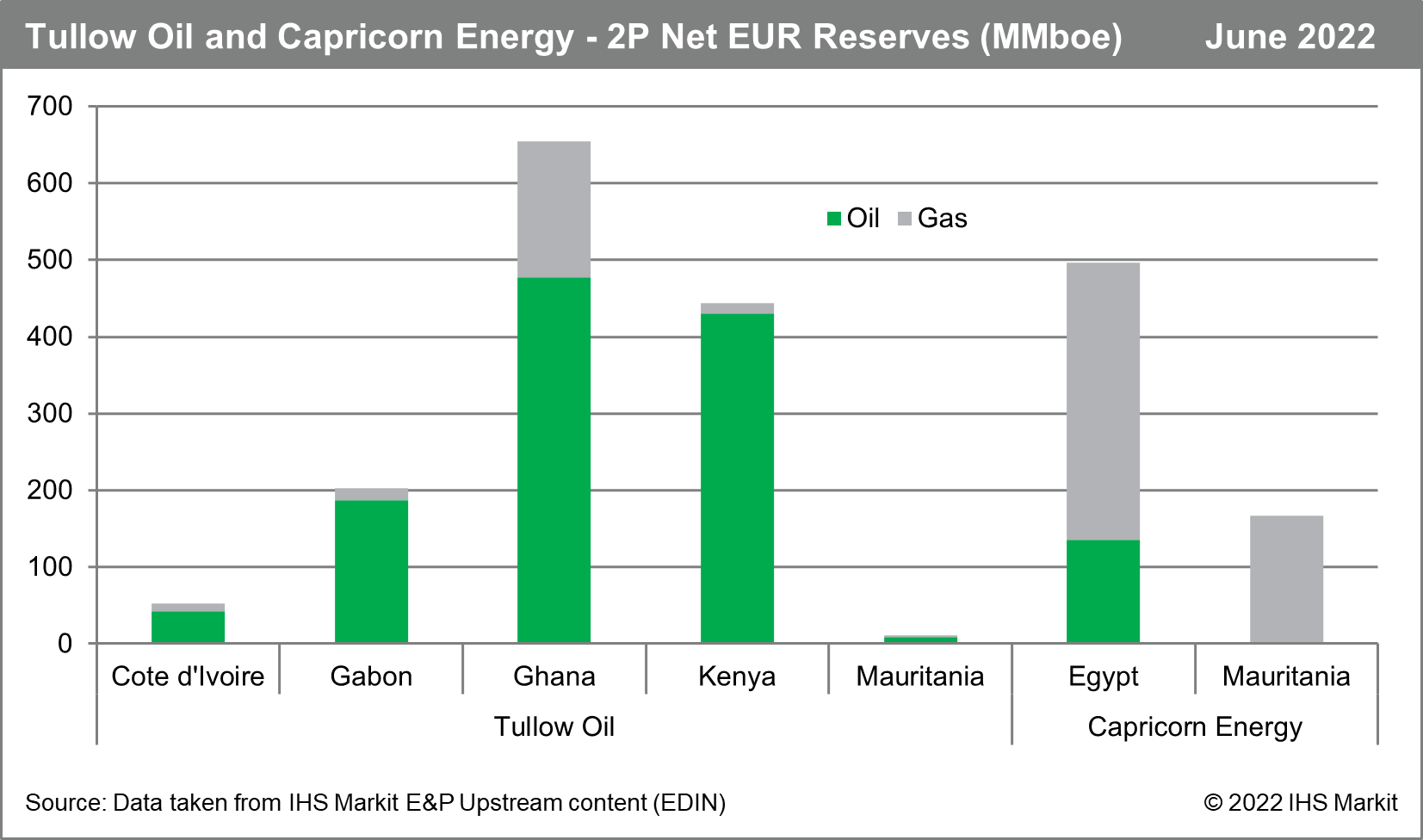

According to the management of the two companies, this combination has the potential to create a new energy company with a material and diversified asset base and a portfolio of investment opportunities. The aggregated pan-African upstream portfolio will be underpinned by low-cost producing assets having a high potential return on investment in Ghana, Egypt, Gabon and Côte d'Ivoire. On top that, and as shown in the charts below, Tullow also operates several onshore assets in Kenya and both companies are present offshore Mauritania.

On completion of the combination, Capricorn shareholders will hold approximately 47 % of the combined group and Tullow shareholders will hold approximately 53 % of the combined group. It is intended that the combination will be implemented by means of a court sanctioned scheme of arrangement under Part 26 of the Companies Act, where Tullow will acquire all of the issued and to be issued Capricorn shares under the terms of the combination, each Capricorn shareholder will be entitled to receive: for each Capricorn share: 3.8068 new Tullow shares.

Alongside of their announcements Tullow and Capricorn stated that the combination of the two companies will create robust cash generation, a resilient balance sheet of USD 1.8 billion of liquidity and cost synergies.

Interestingly, Tullow and Capricorn (formerly named Cairn Energy until December 2021) yet partnered in Cote d'Ivoire, where together they controlled the entire onshore fringe of Cote d'Ivoire Basin between 2017 and 2021. However, after a Full Tensor Gradiometry (FTG) survey in 2019 and an aborted 2D seismic campaign in 2020, both companies relinquished their valid contracts.

As of 31 December 2021, the production of the combined companies was of 96 kboe/d (76%) liquid) split between Ghana (44%), Egypt (38%) and others (18%) and their combined 2P remaining reserves amounted to 343 MMboe (75% liquid) divided between Ghana (62%), Egypt (26%) and others (12%). At the same time, their combined 2C resources (contingent resources) were estimated at 696 MMboe split between Ghana (45%), Kenya (33%), Egypt (10%) and others (12%).

The merger of Tullow and Capricorn will create a complementary portfolio for the new combined group.

The below chart indicates the estimated 2P Net EUR Reserves for both companies, as of June 2022, according to IHS Markit EDIN database (now part of S&P Global).

Posted 15 June 2022 by Alessandro Piccoli, Technical Research Principal and

Cyril Ruchonnet, Technical Research Associate Director, S&P Global Energy and

Etienne Kolly, Director, Upstream Intelligence and

Philippe Mauron, Technical Researcher, African Regional Team, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.