Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Dec 21, 2023

By Etienne Gabel

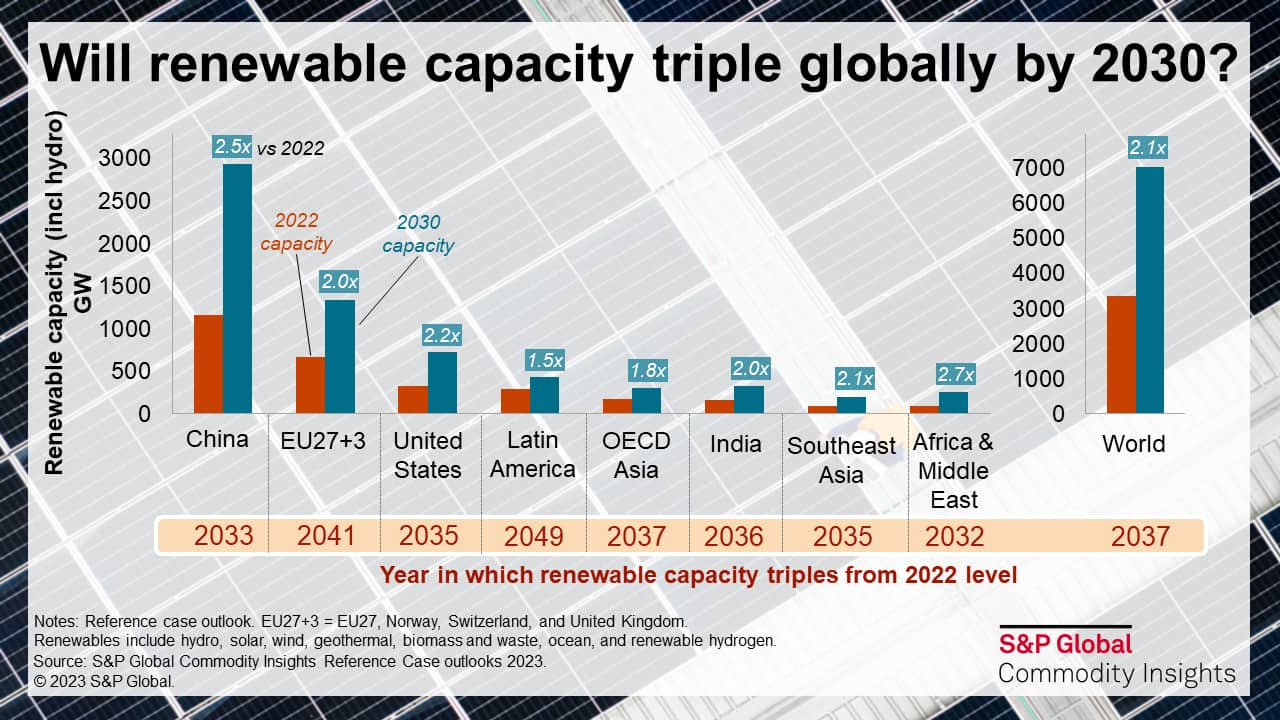

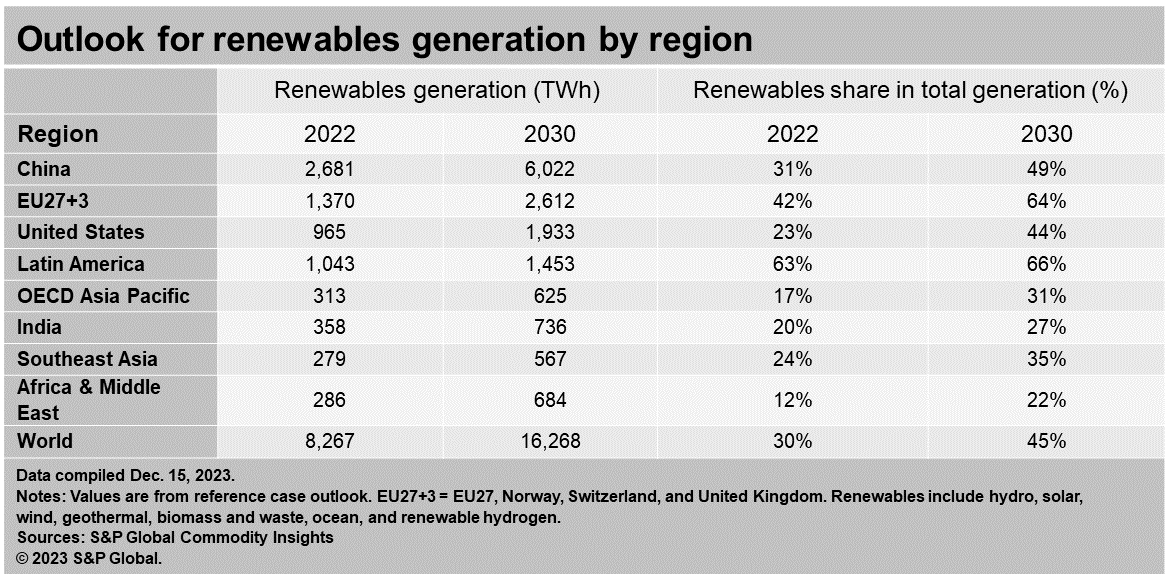

COP28 ended on December 13th with parties pledging to triple renewable energy capacity by 2030. How difficult is this goal for different governments? And which markets will likely find it easier or harder to achieve it than others? S&P Global Energy reviewed renewable project pipelines around the world, analyzed existing policies and market dynamics, and compared our latest 2030 outlooks by market. We conclude that although the tripling objective is not established by country—it is global, or "collective"—reaching it will require accelerating renewable deployment in markets that have substantially different advantages and challenges.

Several factors impact how much more renewables capacity different markets are likely to see.

Lastly, of note, the Global Renewables and Energy Efficiency Pledge includes hydropower in the 2030 target—but the COP28 Global Stocktake agreement does not mention it. This has major impact on the room for growth for power markets with significant hydro capacity. Markets in Latin America and Scandinavia have large-scale hydropower fleets that have very limited scope for growth. Even in less hydro-dependent regions, including the resource in the pledge complicates its achievement. For example, under the reference outlook of S&P Global Energy, India will triple its solar and wind capacity by 2033 but triple its renewables capacity (including hydro) by 2036.

Policymakers and other stakeholders will need to consider these geographic realities when elaborating new strategies that support the landmark pledge. These realities also demonstrate the benefits for governments and companies worldwide to collaborate to reach the objective in an economically and technically practical way.

Learn more about our Global Power and Renewables research.

Etienne Gabel, senior director at S&P Global with the Global Power and Renewables team, specializes in the analysis of market and regulatory developments in power sectors worldwide.

Posted on 21 December 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.