Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 15, 2022

By Johan Utama and Zhi Xin Chong

In 2021, spot LNG trades led the global commodity price surge, and the tight conditions of the global energy market have been exacerbated by the Russia-Ukraine war.

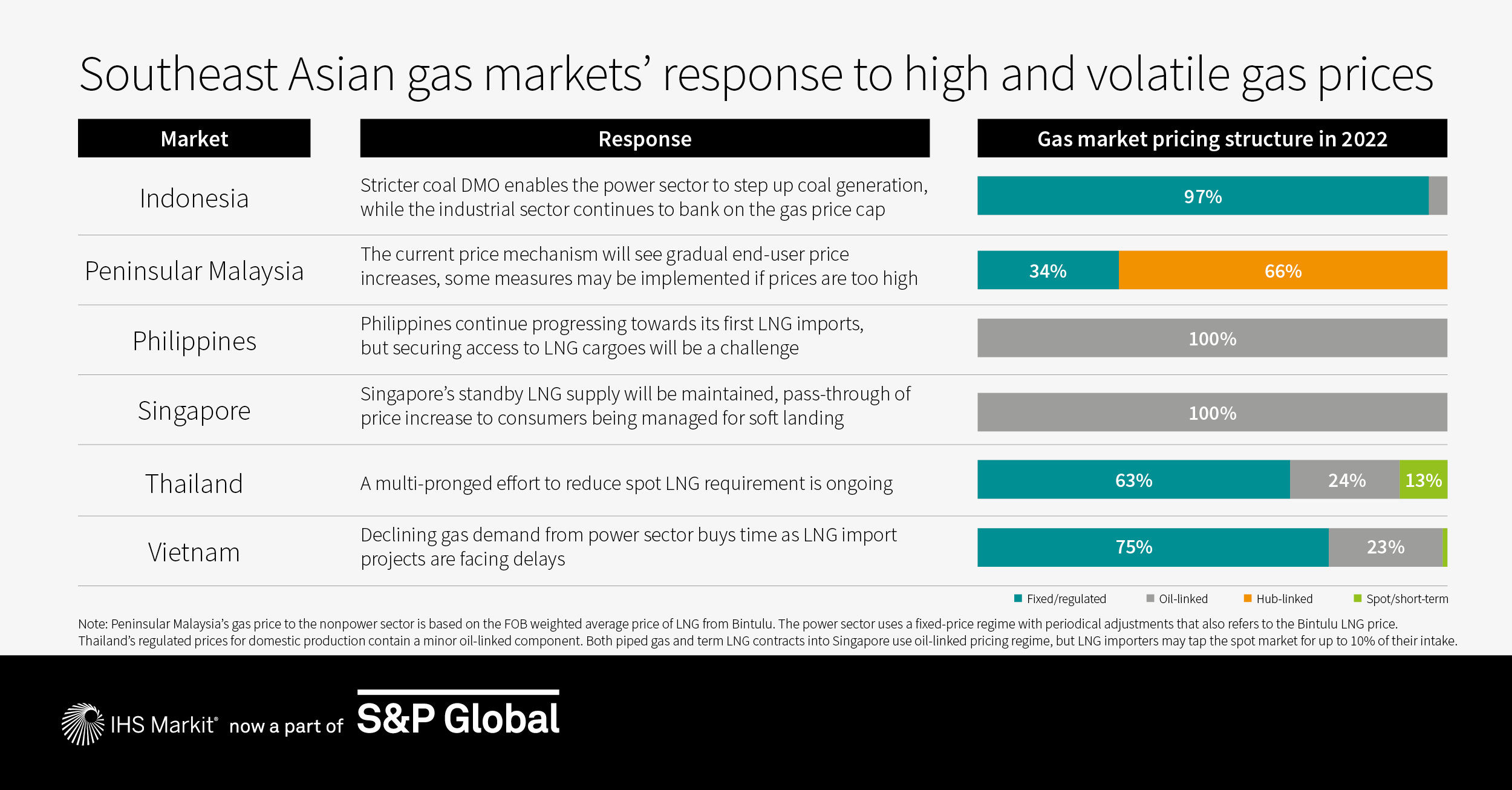

Spot LNG is currently a small proportion of Southeast Asian gas mix, but the crisis has grown. Oil prices, which were a laggard throughout most of 2021, have now caught up as risks around Russian oil exports propel prices well beyond $100/bbl. The surge in oil price is increasing the price of oil-indexed gas—the typical gas contract in Southeast Asia—and that hurts affordability even in markets with minimal exposure to spot LNG. Most markets in the region have distinct structure, and as a result each market has responded differently.

Many of the current measures in Southeast Asia were done in response to the energy market dynamics in the second half of 2021 and yet to incorporate the impact of the Russia-Ukraine war. In the near term, a persistent high energy price environment would test governments' ability to limit the impact on consumer prices to avoid derailing the economic recovery.

The long-term trend toward sustainability and liberalization is still on the agenda. However, should prices stay high over the next two years, governments may be forced to reassess the situation, moving back to cheaper power options, reverting to market consolidation and increasing government intervention.

Learn more about our Asia Pacific energy research.

Johan Utama is a Principal Analyst covering the Southeast Asia gas market at IHS Markit.

Zhi Xin Chong is a Director covering South and Southeast Asia gas market at IHS Markit.

Posted 15 April 2022 by Johan Utama, Principal analyst, Gas, Power and Climate Solutions, S&P Global Energy and

Zhi Xin Chong, Senior Director, Gas, Power and Climate Solutions, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.