Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 29, 2024

By Cecillia Zheng and Choon Gek Khoo

S&P Global published the Southeast Asia (SEA) power and renewable market briefing for the second quarter of 2024 (Q2 2024). The report discussed the power demand, supply, pricing, and major market events in this quarter, as well as the latest proposed or enacted policies and regulations. The report is now accessible via Connect.

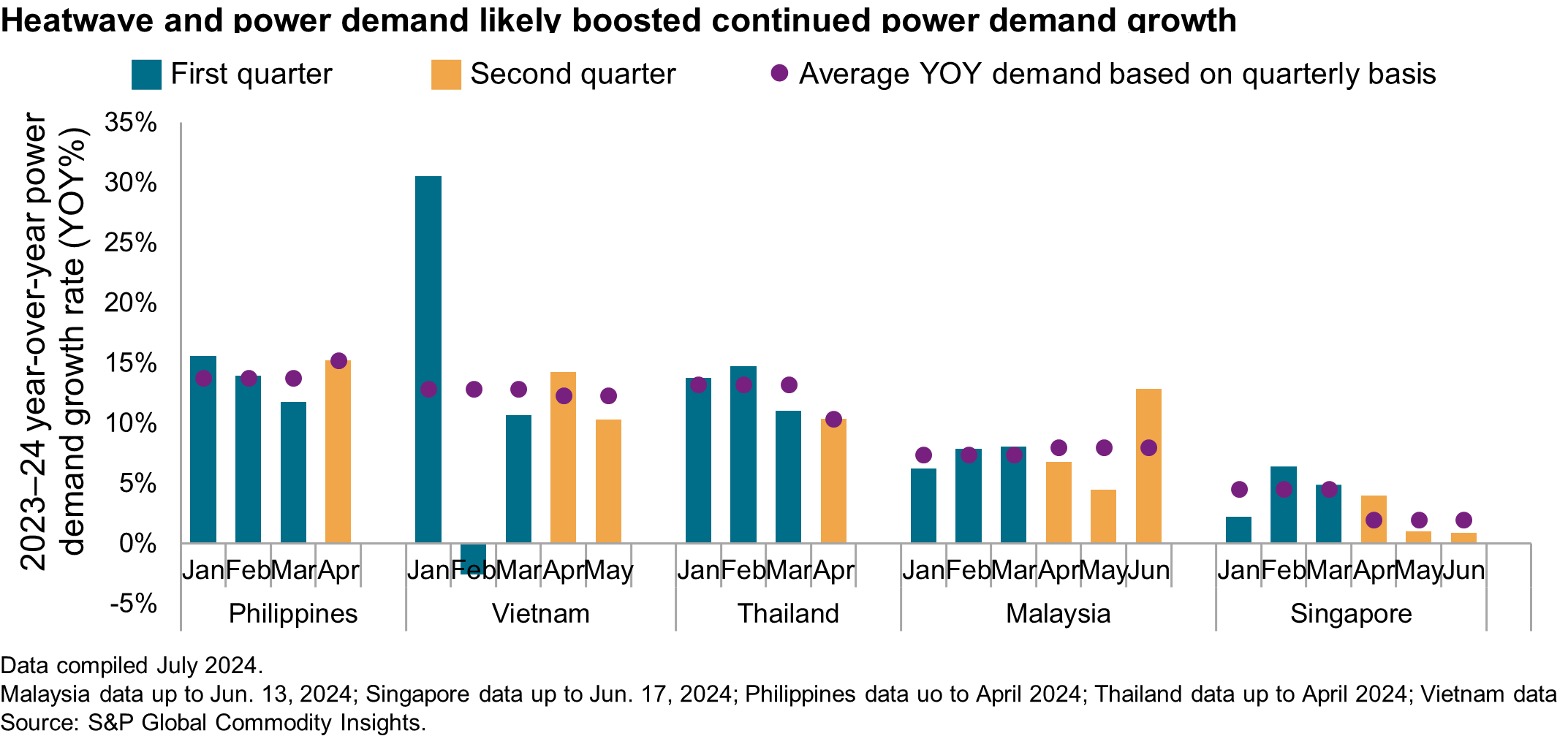

Data from the power market suggests a significant year-over-year (YOY) increase in power demand during the Q2 2024 for major Southeast Asian (SEA) countries, including Malaysia, Singapore, the Philippines, Thailand, and Vietnam (see figure below). The year-over-year growth falls within a range of 3.3% to 15% YOY. This upsurge reflects an elevated power demand, likely driven by the higher temperatures and growing exports demand.

The Philippines' April 2024 data witness a continuous impressive resilience growth, with 15.2% YOY growth. Several factors are likely driving the impressive surge in power demand—domestic demand rise, tourism rebound, and manufacturing expansion. Besides that, hot weather triggered a surge in domestic power consumption, pushing peak demand to unprecedented highs.

Vietnam's power demand continued to maintain a double-digit YOY increase in Q2, averaging 12.3%. The country booming export sector, particularly in smartphones, electronics, and garments, is fueling a robust economic expansion. This translates to increased energy consumption across industries. Additionally, record-breaking hot weather pushed power consumption to new highs in this quarter, further boosting national power demand.

Thailand's April 2024 power demand has seen a significant surge, showing a 10.4% YOY increased compared to the same period of 2023. This acceleration is likely driven by the government's successful efforts to boost tourism activities, which has fueled growth across several subsectors, including wholesale and retail trade, transportation, as well as business services. Additionally, scorching temperature further intensified domestic demand, putting additional strain on the national power grid.

Malaysia's power demand saw a significant increase in Q2, averaging 8.0% YOY. The resurgence of global production and international trade, particularly electrical and electronics trade with major trading partners such as China and the US, is fueling the industrial power demand. While higher temperatures throughout Q2 2024, coupled with the risk of transboundary haze from uncontrolled forest fires have exacerbated the situation by pushing power consumption higher.

Singapore's power demand growth has slowed significantly in Q2, averaging a mere 2.0% YOY―a significant slowdown from the previous quarter's 4.5% YOY growth. This sluggish pace marks the slowest growth rate among all analyzed SEA countries. The power demand contraction was attribute to the current wave of geopolitical tensions, which have disrupted global supply chains. These disruptions pose a potential threat to Singapore's economy, which heavily relies on pharmaceutical and precision engineering manufacturing products exports.

Major SEA countries see robust power demand growth, mostly exceeding double digits growth in Q2 2024. This is fueled by resurgent manufacturing and tourism activities, as well as hot weather boosting air conditioning usage. Overall, we expect power demand to remain high throughout 2024 owing to ongoing economic expansion and recovery in global manufacturing exports.

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.