Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jan 09, 2024

By Chengyao Peng

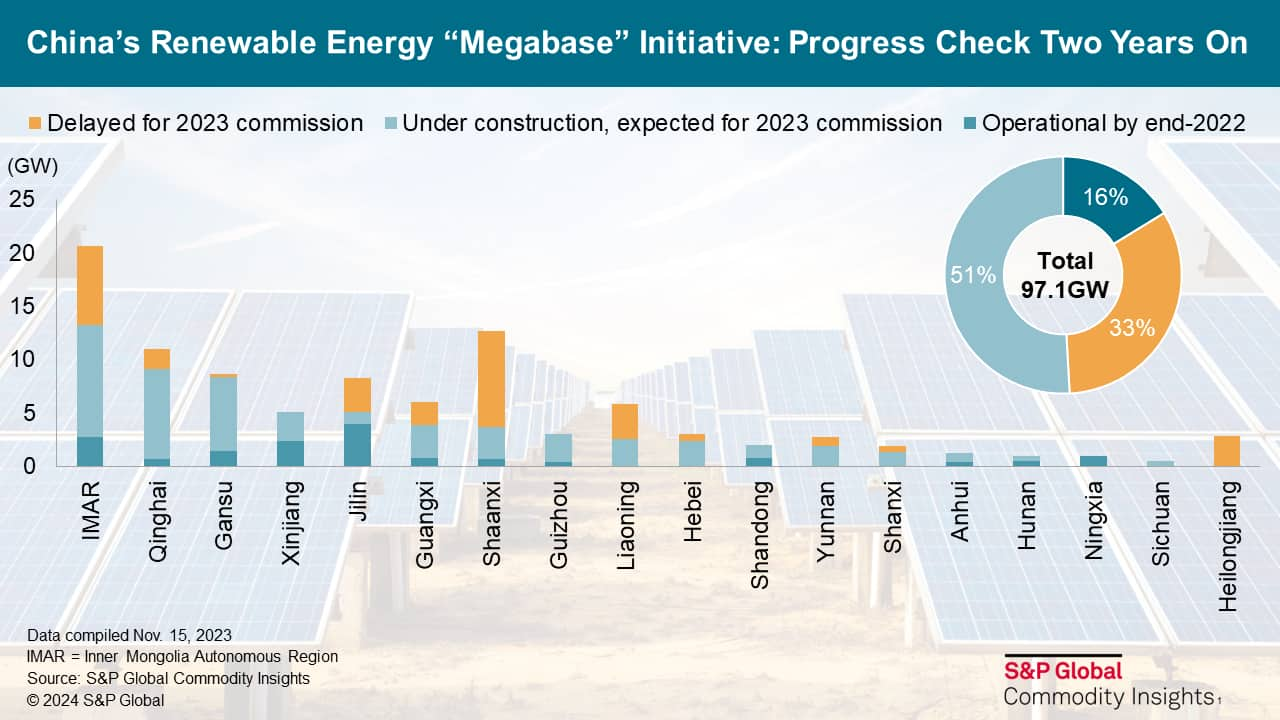

It has been two years since President Xi Jinping announced the development of about 100 GW of wind and solar to kick-start the national renewable megabase initiative. How are the projects in this first batch progressing so far? Are these projects facing similar or repetitive challenges that will impede future development? Can China rely on the megabase initiative to deliver cost-competitive clean power to decarbonize its power mix?

The development of the first batch of megabase wind and solar projects was announced in November 2021 totaling 97.1 GW, with grid commissioning targets set at the end of 2023. From Commodity Insight's project tracking, close to two-thirds, or 65.3 GW, of the first batch of renewable megabase projects can be expected to commission on time and contribute 148 TWh of zero-carbon energy from 2024 onward, or 1.5% of China's power mix equivalent. Inner Mongolia, Qinghai and Gansu together contributed 47% of these additions.

The top-down planning mechanism certainly favored such a development pace. Being included in the first batch of the national renewable megabase project list was somewhat like getting a fast pass in the permitting and administrative approval queue. The National Energy Administration (NEA) hosted monthly key stakeholder meetings, aiming to coordinate among agencies and iron out any outstanding issues that impeded the project development. Similar forums were also organized at provincial-level energy bureaus to expedite the administrative approval required from peer departments.

Despite all the coordinative efforts, roadblocks have delayed the remaining 32 GW of projects from the originally planned schedule. According to S&P Global Energy analyst tracking, transmission capacity and land-use issues remain the key challenges that delayed over 18 GW of projects. Land-use disputes and related administrative approvals will rely on better top-down coordination as new batches of projects flux in. Transmission capacity issues, however, are expected to persist throughout the 14th Five-Year Plan period when new-build renewables far outpace transmission network development. There are 5.53 GW of projects that have obtained the necessary approvals but are too late to catch the end-2023 commission timeline; these are expected online in 2024. There are also 8.28 GW of planned projects in the first batch that have no publicly available information on their progress.

According to the announced project investment, per-kilowatt capital investment in renewable mega-base projects is spread across quite a wide bandwidth without much cost advantages over ordinary utility-scale projects. The weighted-average capital expenditure of solar PV and onshore wind projects in the first batch of megabases was 5,159 yuan/kW and 6,144 yuan/kW, respectively; both landed on the higher end of per-kilowatt capital investment during the past two years. Solar PV projects in megabases cost up to 5,683 yuan/kW, while onshore wind projects are as expensive as 8,646 yuan/kW. The higher up-front cost of megabase projects can be attributed to multiple factors and is expected to be better managed for subsequent development as developers gain experience in geologically harsh regions and with growing project size to the gigawatt level.

Nevertheless, megabase new-build wind and solar can deliver more cost-competitive clean energy despite higher capital investments. In receiving-load regions such as Shandong, Henan, Hubei and Zhejiang, landing costs of solar or wind from megabases can be on average 16% or 10% cheaper, respectively, than local renewables new build. Clean energy from far away can also expedite the decarbonization of the load center's power mix with convincing economics. Across the four provinces mentioned above, importing renewables from megabases will be 22% cheaper on average than local operating coal.

To learn more about our Asia-Pacific gas, power and renewables coverage, more information is available here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.