Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Feb 24, 2023

By Joo Yeow Lee

Southeast Asia as a region has experienced 5.7% annual power demand growth in the past decade, more than double the global average. This growth has been mainly powered by about 94 GW of new fossil fuel generation capacity, or 60% of the total capacity additions added over the past 10 years. Looking ahead, S&P Global Energy forecasts that power demand growth in the region is expected to remain at a robust 3.2% per year out to 2050, to support the continued development of the region's economies. This power demand growth, coupled with the decarbonization targets across the region, has already led to many governments instituting plans to switch from coal to gas, as the latter produces about half the carbon emissions of the former per unit of electricity generated.

However, the existing coal and gas generation fleet is still relatively young, with nearly 50% of current operating capacity being 10 years old or younger. These assets typically have a relatively long technical life of between 25 and 40 years, and there is more than 40 GW of new capacity that is currently under construction, which will likely come online in the next five years. As a result, fossil fuel generation will remain a sizable part of the region's generation mix, contributing to just less than 50% of total generation by 2050. Even with the coal-to-gas switch, the emissions remain substantial, owing to the growing power demand, giving rise to the need to adopt lower carbon fuel.

Many countries in the region intend to use hydrogen as a fuel for power generation. This will allow them to continue utilizing existing and currently under construction power plants, with some upgrades/retrofits required to allow for the blending of either hydrogen or ammonia, instead of requiring entirely new builds or the early retirement or a change of role for a substantial amount of capacity, which may give rise to supply security concerns.

There is a myriad of technologies to produce and transport hydrogen, some that have already been developed and others that are still being studied. The differing production technologies result in different "colors" of hydrogen; green hydrogen is the focus because many of the abovementioned plans and activities aim at utilizing it.

Across the globe, there is currently about 447 GW of power-to-X projects in the pipeline. About 80% of them are in the earliest stage, with only project announcements made but very little information on the partners and stakeholders, the capacity of production and expected completion date, 4 GW under construction, and close to 5 GW in advanced planning stage. Nearly half the pipeline capacity can be defined as megaprojects, which have more than 10 GW of electrolyzer capacity each.

Australia is one of the leading countries in terms of capacity in the pipeline, with 78 GW at various development stages. Owing to the proximity to Southeast Asia, it is the likely supply source for any imports of green hydrogen, especially given the high cost of transport. Currently, the estimated average cost of green hydrogen production in Australia is about $3.5/kg, with at least another $1.6/kg for it to be delivered to the region, which translates to nearly $40/MMBtu. This is equivalent to about four times the 2022 average delivered gas price in Southeast Asia. Even with cost declines, the delivered cost of liquid hydrogen is forecast to reach $3.5/kg ($27/MMBtu) by 2040.

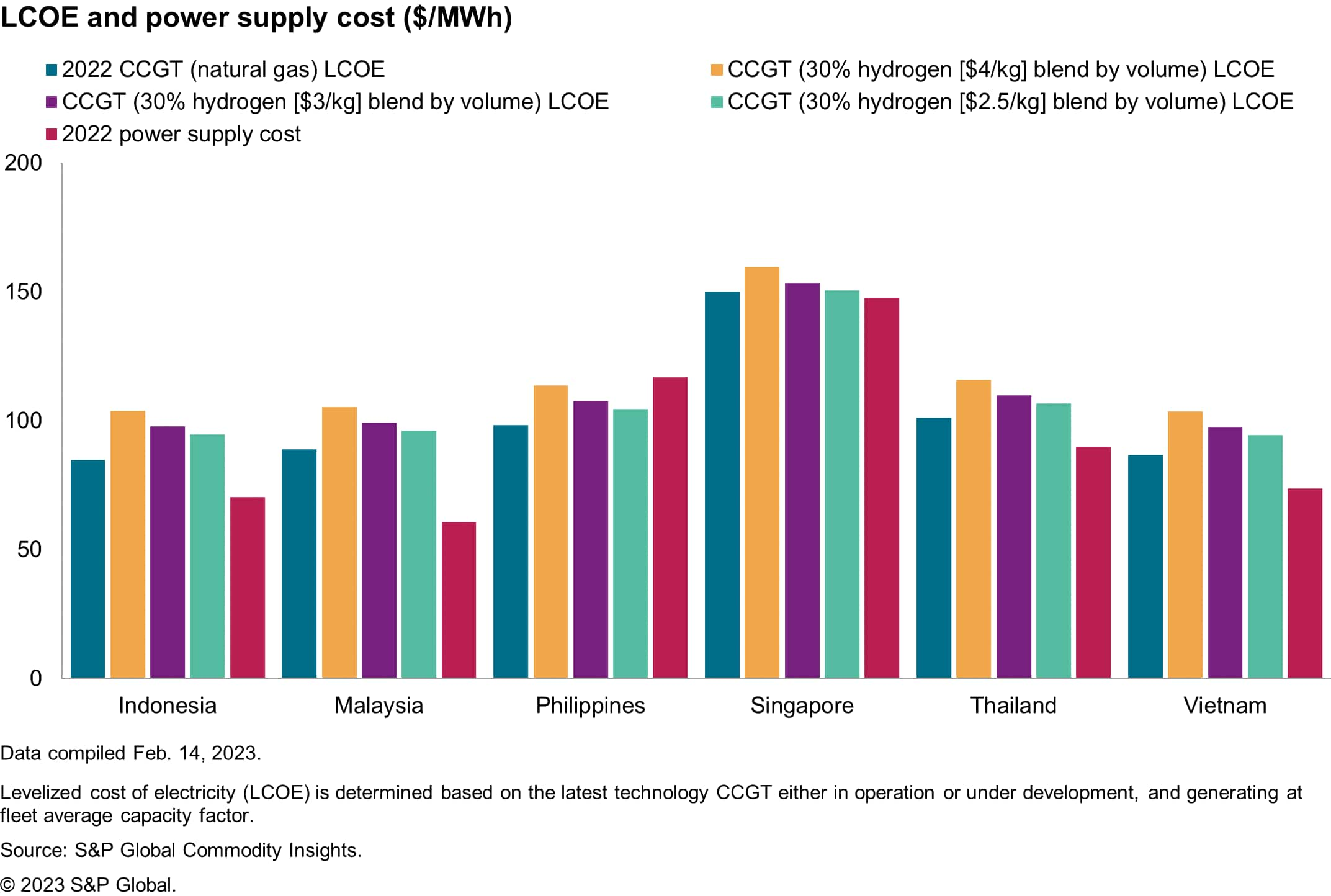

This high cost of imported green hydrogen will be detrimental to the adoption into the region's generation fuel mix. The adoption of hydrogen, even at a 30% blend by volume, appears untenable as it will raise the levelized cost by between 20% and 40%, drive up the power supply cost further, and raise affordability concerns. This is exacerbated further if the intention is to fully switch to hydrogen to decarbonize thermal generation, as this will raise the levelized cost of electricity anywhere from 2.5 to 4 times the current level.

Despite the higher cost of utilizing renewable hydrogen as a fuel source for power generation, adoption is still expected, through blending with natural gas, to mitigate the impact from a costly fuel, partly due to technology readiness for power generation equipment and other related infrastructure. The addition of renewable hydrogen into the generation mix is one of many tools that will be needed for decarbonizing the power sector. This is already acknowledged by companies in the region, as both national oil and gas companies and independent power producers have plans to develop renewable hydrogen production either domestically or abroad, to secure supply for their power generation needs.

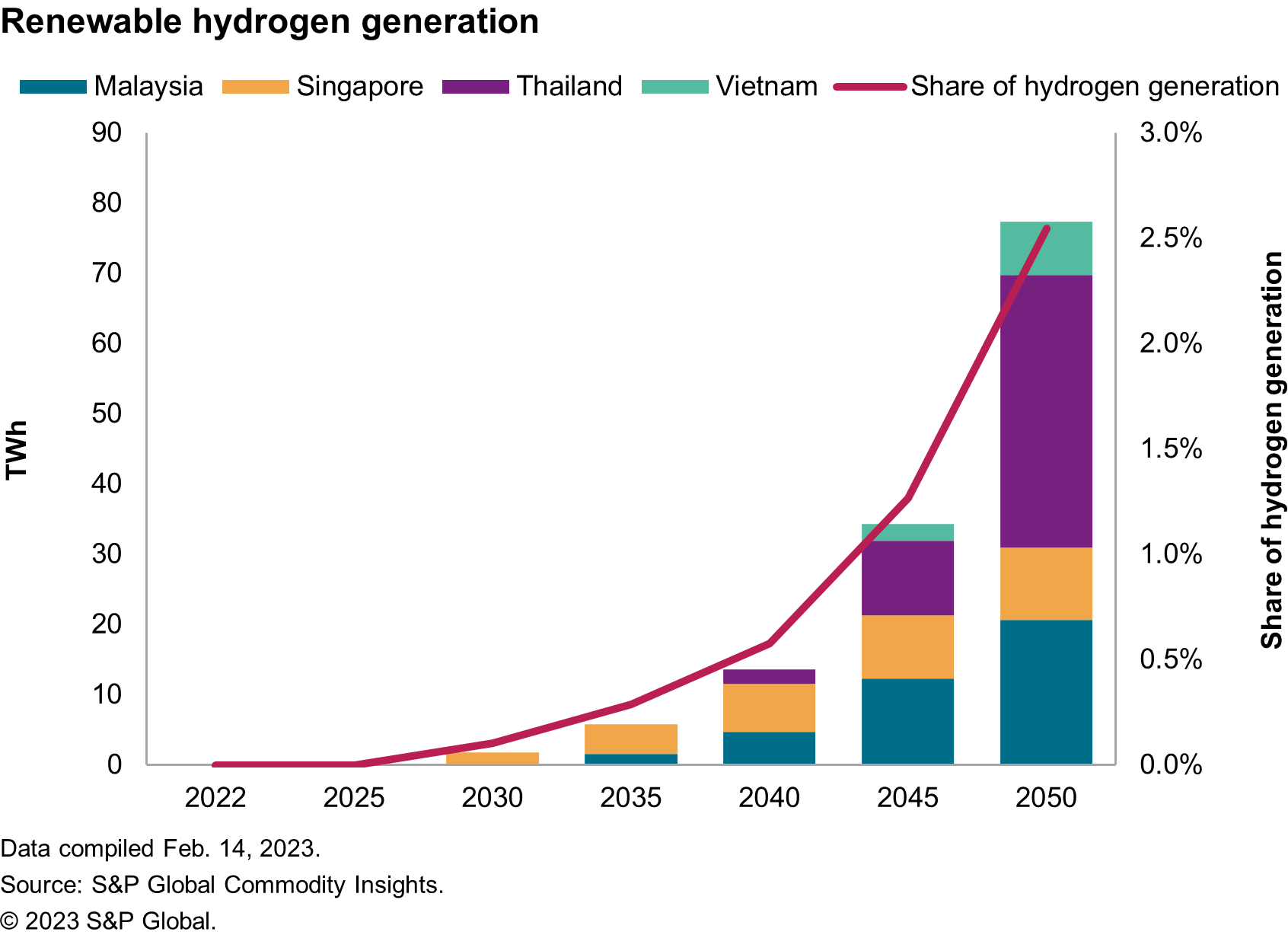

Across Southeast Asia, S&P Global Energy forecasts in its base case outlook that renewable hydrogen generation will reach 2.5% of the total generation by 2050, which translates to 77 TWh, with four countries adopting renewable hydrogen into the fuel mix. There is upside potential, which will be dependent on policy support and a potential decline in cost of renewable hydrogen, which may be contingent on cost reductions in transportation and production, as well as the possibility for domestic production. There will be more investment opportunities for hydrogen infrastructure and technology deployment in Southeast Asia as countries incorporate hydrogen in their power generation plans.

This post is an abstract of a featured topic from the S&P Global Energy series on energy transition in Southeast Asia, where we deep dive into various aspects of the region's power sector energy transition.

Joo Yeow Lee, an associate director with the Gas, Power, and Climate Solutions team at S&P Global Energy, covers the power and renewable markets in Southeast Asia.

Posted on 24 February 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.