Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 05, 2024

By Doug Giuffre and Mark Griffith

While US power generation expansion is largely focused on clean energy technologies like solar, wind and batteries, S&P Global Energy research has identified a growing trend in the United States to define a reliability-centered role for new natural gas-fired power generation. Energy review of recent utility integrated resource planning (IRP) filings reveals a consistent pattern:

This new natural gas generation is typically a small proportion of the total new build and is justified in the context of enabling the associated clean energy development and the retirement of coal plants, thereby making the new gas generation an essential part of a utility's decarbonization strategy. These plans remain contentious, with environmental advocates and others often raising objections about the necessity of any new gas generation. These plans are, however, consistent with Energy observation that the need for such dispatchable long-duration resources is becoming a global trend. Our see the tactic of including a relatively small amount of new gas-fired generation as part of a broader clean energy and coal retirement strategy which has been developing for several years, for example with the Tennessee Valley Authority's 2019 IRP and Duke Energy Indiana LLC's 2021 IRP. This trend is accelerating as evidenced in a review of 2023 IRPs from Georgia Power, Salt River Project, Dominion Energy South Carolina, Tucson Electric and Unisource Energy Services.

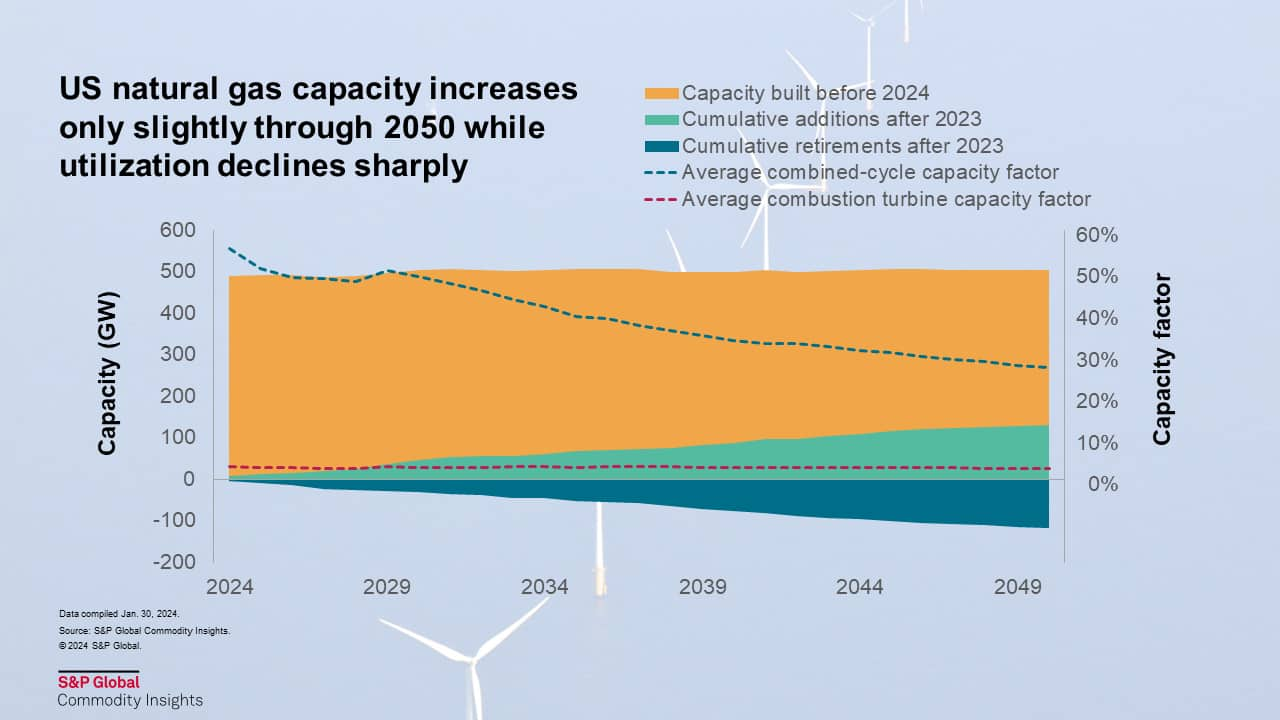

Natural gas power plant development is at a 25-year low according to a recent US Energy Information Agency report. The above utility strategies represent a potential reversal in this trend, and are consistent with Energy long-term US power market view, which anticipates a sustained but evolving role for natural gas. Our most recent outlook calls for the size of the US gas power fleet to remain relatively stable through 2050, growing slightly from about 487 GW today to 503 GW in 2050 (see accompanying Figure). Notably, the 2050 US power fleet will consist largely of assets already in operation, with new construction through 2050 slightly exceeding expected retirements.

Natural gas fleet operations are expected to significantly change as the role of natural gas-fired generation realizes a diminished emphasis on providing energy and more focus is put on grid reliability. The operational change is focused primarily on combined-cycle technology, declining from a fleet annual average capacity factor of 56% in 2024 to about 27% in 2050. The average capacity factor for combustion turbines remains relatively constant at about 3% through 2050.

Trends to watch for. The evolving role for gas capacity as envisioned in Energy Planning Case is not without risk, and we recommend that power market participants monitor two major signposts:

To find out more information and learn the value of our global gas markets coverage, please click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.