Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 03, 2022

By Edurne zoco and Paola Perez Pena

Costs for every component of the carbon capture, usage, and storage (CCUS) value chain vary greatly across industries and regions based on the purity of the carbon dioxide (CO2) stream, capture technology, plant size, process design, plant utilization, location, type of transportation, type of storage, and cost of capital. As a result, a large range of cost is associated with CCUS, and the cost outlooks vary greatly depending on the final industry application.

Levelized cost of CO2 avoided (LCCA) assesses the CO2 capture system as a carbon mitigation option, it considers investments, operating costs of the system, and the additional CO2 emissions as a result of operating the capture system. It also facilitates comparison between different decarbonization technologies (i.e. renewables, hydrogen) and industries (power, industrials), which is critical to optimize the selection of the best decarbonization solutions for each project and industry and support the achievement of Net-Zero commitments by 2050.

A new report from the Global Clean Energy Technology team at S&P Global Energy provides a detailed analysis of the LCCA for carbon capture, utilization, and storage projects in key industries between 2020-50. It provides detailed data on the LCCA trends by industry and region and the key cost drivers based on S&P Global Energy CCUS activity forecast. This blog includes a summary of the main conclusions and implications of this recently released report- Levelized cost of CO2 avoided for carbon capture, utilization, and storage—Long-term outlooks report.

Overview of CCUS project developments

CCUS projects in natural gas processing facilities have been the main driver for capture capacity growth in the past 10 years. The commercial need to remove CO2 from the produced gas to meet pipeline specifications coupled with the opportunity to monetize CO2 for enhance oil recovery (EOR) operations, and the low cost of capture made these projects attractive. Currently over 90% of the operating projects are associated to industries with low cost of capture. Capture cost rise rapidly as proportion of CO2 in the flue gas decreases, natural gas processing and ethanol production have one of the lowest costs of capturing due to the high concentration of CO2.

Recent climate pledges and improved government support have incentivized new industries to consider CCUS projects. The current pipeline shows a significant increase in projects in the power generation sector and heavy industries with traditionally higher capture costs compared to natural gas processing. In fact, close to 40% of the projects in the pipeline are associated to projects with high capture costs, which will bring new challenges to the industry, increased risk, but also cost reduction opportunities. A clear example of this trend are the Hydrogen-related projects, since low-carbon hydrogen is at the core of many of the proposed CCUS clusters.

Carbon Capture, Utilization, and Storage: Cost drivers

The cost drivers for CCUS projects will vary significantly by final industrial application, thus understanding the cost drivers for each sector will be relevant to develop the right strategies for cost reduction in the next decade, although CCUS hubs and improvements on capture technologies will overall contribute to cost reductions each of them will have a different effect in each sector.

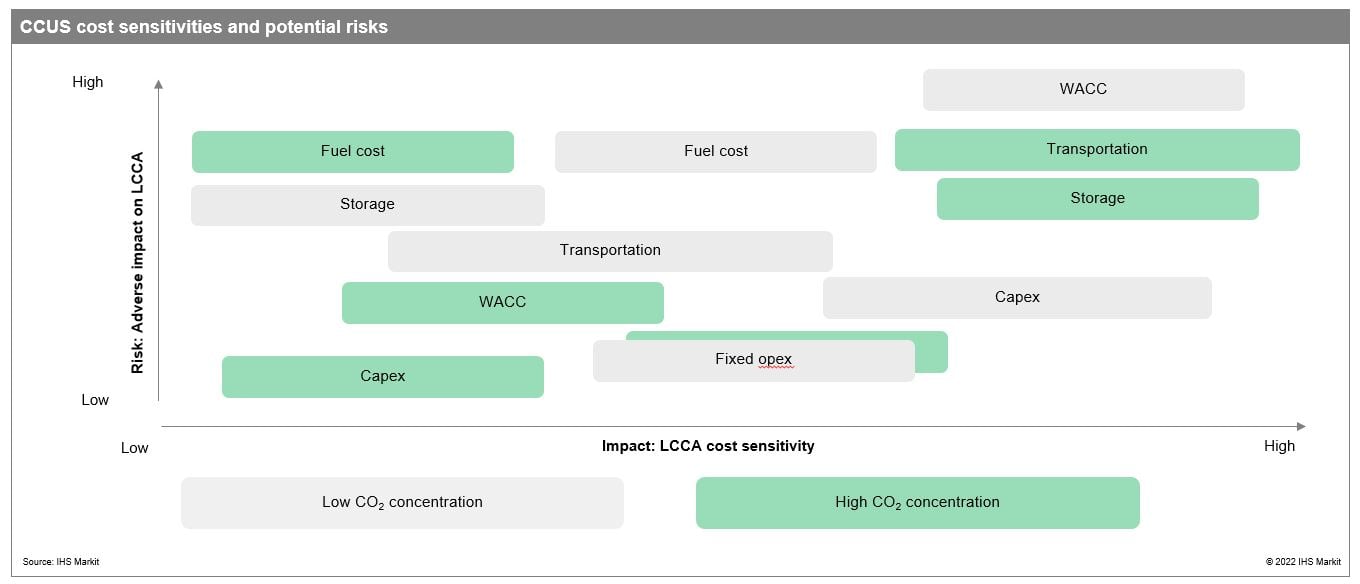

On average, CCUS projects for high CO2 concentration streams are less expensive than projects for low CO2 concentration streams, since the former avoids the capture cost and only needs compression, dehydration, transport, and storage. As a result, any cost reduction associated to capture technologies will not affect this type of projects, instead economies of scale from CCUS hubs will have a more significant impact.

Projects with low CO2 concentration are typically more expensive since these projects will require to have a capture system (purification unit) that could take up to 65% of the capex investment. Projects with low and high CO2 concentration have different key cost drivers. While high CO2 concentration projects are more impacted by transport and storage cost, low CO2 concentration projects are primarily impacted by the increase in capex and opex from the capture system.

The impact and risk each cost component has in a CCUS project could play a significant role to identify key cost reduction opportunities by industry:

Levelized cost of CO2 avoidance - Long-term outlook

In the next decade, CCUS costs are expected to decrease at different rates by sector, while cost reductions from projects in ethanol production and natural gas processing are not expected, unless they are developed in a CCUS Hub, other projects such as power generation could see very small cost reductions. Rising fuel prices, mature capture technology being used, small scale of deployment, and multiple first-of-a-kind CCUS projects will hinder cost efficiencies. In fact, projects in some industries may even face an increase a short-term increase in cost (e.g cement).

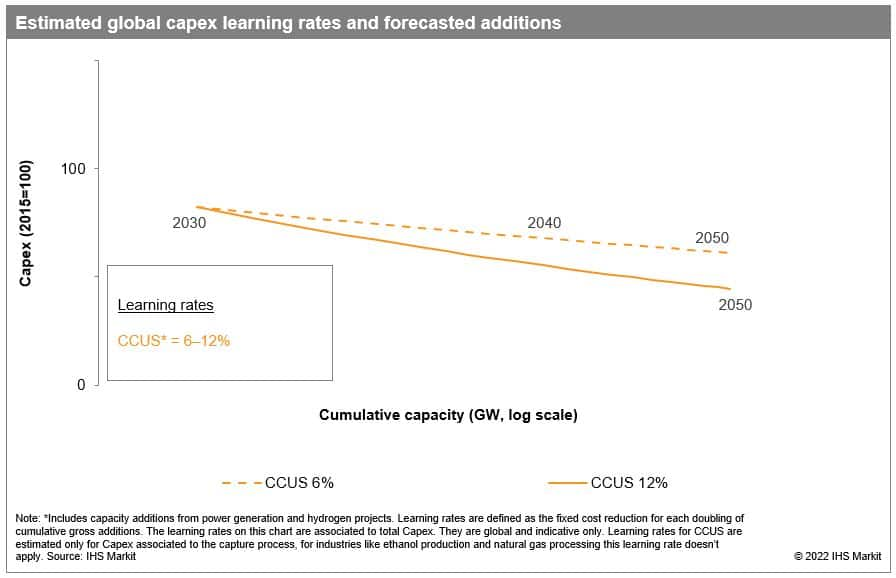

Beyond 2030, CCUS costs are expected to have a much significant decrease mainly driven by increased efficiencies in capture capacity and increase in operational CCUS Hubs. S&P Global Energy inflections scenario implies five doublings of capture capacity between 2030 and 2050, representing opportunities of cost reduction through "learning by doing" and economies of scale improved by CCUS hubs. Transportation and storage segments could benefit significantly from large volumes of CO2, which could decrease the levelized cost of CO2 avoidance up to 30% depending on the industry, capture technology breakthroughs could increase the cost reduction even further but there is still a lot of uncertainty around performance of new technologies at large-scale.

CCUS learning rates will be driven by technology progress and integration; the scale of deployment expected creates uncertainty around cost reduction:

Although the levelized cost of CO2 avoidance (LCCA) for CCUS projects have a wide range of values, natural gas processing and ethanol production will continue to have the lowest cost per metric ton of CO2 (MtCO2) avoided in the next decades. These high CO2 concentration processes are most sensitive to transportation and storage cost, and as a result CCUS hubs will significantly drive the CO2 avoidance cost down for projects in these industries.

Low CO2 concentration processes in industries like hydrogen production, heavy industries and power generation have different cost drivers mainly associated to capital and operating cost of the capture system, which means that innovation from capture technologies and efficiency improvements will make the most significant difference for cost reduction. However, the cost analysis shows that current incentives are not enough for sustainable business models in these industries. Higher ETS prices and improvements in 45Q or other form of incentives and tax credits would be required to open opportunities for these industries and allow to reach large scale of deployment and steep learning rates for CCUS technologies from 2030.

To learn more on this topic, sign up for the upcoming webinar our Clean Energy Technology team are hosting: Is CCUS the Best Solution to Decarbonize the Steel and Cement Industries?

Posted 03 May 2022 by Edurne zoco, Executive Director, Clean Technology & Renewables, S&P Global Energy and

Paola Perez Pena, Principal Research Analyst, Gas Power and Climate Solutions, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.