Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 05, 2023

By Anushil Anand Roy, Kallol Saha, and Manisha Mishra

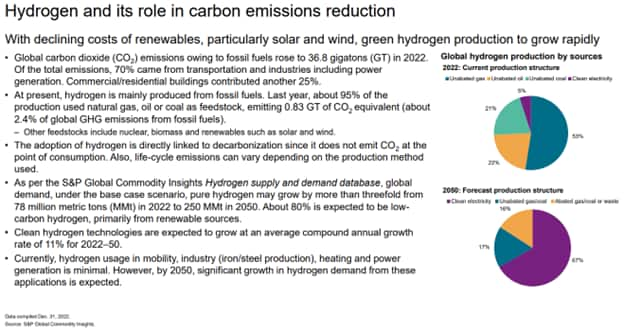

The increasing concerns over energy security and the pursuit of a lower-carbon future drive the growth of renewable technologies, surpassing all other alternatives. As a result, hydrogen is emerging as a critical component in achieving net-zero goals. Globally, approximately 78 million metric tons of hydrogen energy is produced annually, primarily from fossil fuels. As the low-carbon transition accelerates, hydrogen energy, especially clean hydrogen energy is expected to grow rapidly.

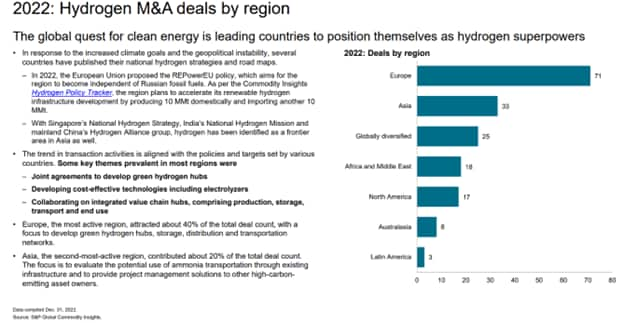

Despite geopolitical and economic challenges, 2022 saw a significant uptick in hydrogen deal making, with strategic alliances made up about 75% of the total deal count, highlighting the importance of partnerships in the hydrogen industry. Europe and Asia emerged as the leading regions for the M&A activity in the sector, with supportive government policies driving the momentum. Overall, the strong deal flow in 2022 underscores the growing interest in hydrogen as a key driver of the energy transition.

Among the companies investing in the hydrogen sector, Shell, one of the oil and gas majors, has been working towards navigating the energy transition and has set ambitious targets for the adoption of hydrogen. The company recognizes hydrogen as a critical fuel to decarbonize its operations and is heavily investing in the industry. Shell aims to gain a double-digit share of global clean hydrogen sales by 2035.

Shell is actively expanding its presence in the hydrogen market, both through partnerships and M&A activities. This is in line with Shell's broader strategy of transitioning to cleaner forms of energy and reducing its carbon footprint.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.