Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 25, 2022

IHS Markit Climate and Sustainability is pleased to bring you the OECD Asia Power and Renewables Market Briefing covering the first quarter 2022 for Australia, Japan and South Korea. This is the first publication, and will be followed by a series of regular quarterly market briefings covering the latest insights for these OECD (Organisation for Economic Co-ooperation and Development) countries.

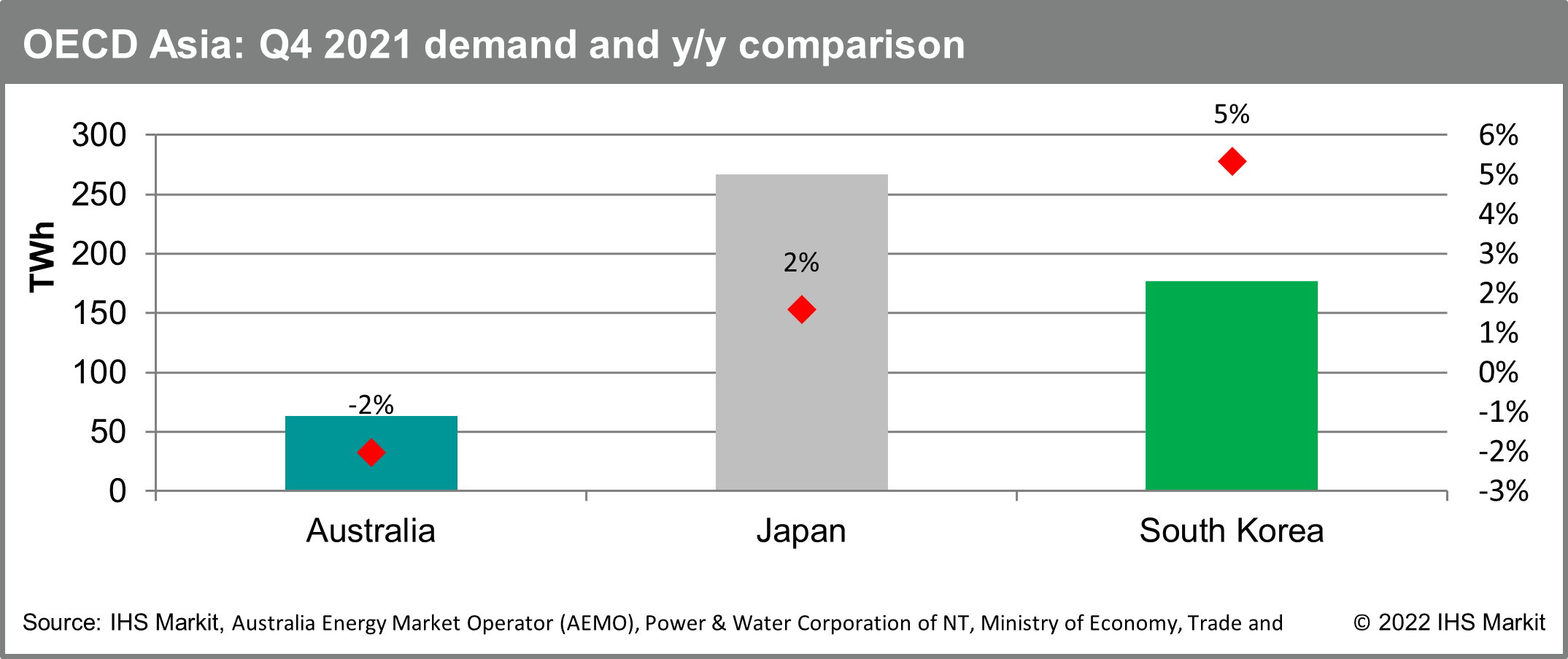

A recovery in electricity demand was seen in Japan and South Korea during Q4 2021, thanks in part to an easing of COVID-19 related restriction in Japan, as well as the onset of a cold winter pushing up electricity demand for heating. In contrast, on-grid demand declined in Australia during the same period, as strong growth in behind the meter generation along with cooler east-coast weather dampening cooling power demand.

At the same time, wholesale power price in Japan and South Koreas are on the rise—high crude oil prices have fed into the weighted average cost of Korea Gas Company (KOGAS), resulting in a surge in wholesale gas prices. KOGAS has begun to charge the full cost of spot LNG purchases to power generators as the price hike soar to four times the previous year's level. Japan's residential electricity price have risen to a five year high, as crude oil and LNG price hikes last summer begin to transpire within the electric power companies' lagged fuel adjustment formula. As oil and LNG prices continue on its high streak, end-user prices will likely stay at its high level applying down-ward pressure to an economy just recovering.

As the new fiscal year transpires, several new announcements have been observed on the policy side;

Learn more about our coverage of the Asia Pacific energy research through our Asia-Pacific Regional Integrated Service.

Logan Reese, based in Brisbane, Australia, is an associate director within the Gas, Power, and Climate Solutions team, covering the gas, power, and renewables markets in Australia, focusing on market fundamentals, power and renewable developments, and policy developments.

Kaori Tachibana, based in Tokyo, Japan, is an associate director within Gas, Power, and Climate Solutions team, covering the power, gas, and renewable markets in Japan, looking at supply/demand balances, infrastructure developments, policy developments, and pricing outlooks.

Vince Heo (Yoonjae Heo), based in Seoul, South Kora, is an associate director within the Gas, Power, and Climate Solutions team, focusing on power and renewable market development and LNG demand analysis.

Posted on 25 April 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.