Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 12, 2024

By Qingyang Liu

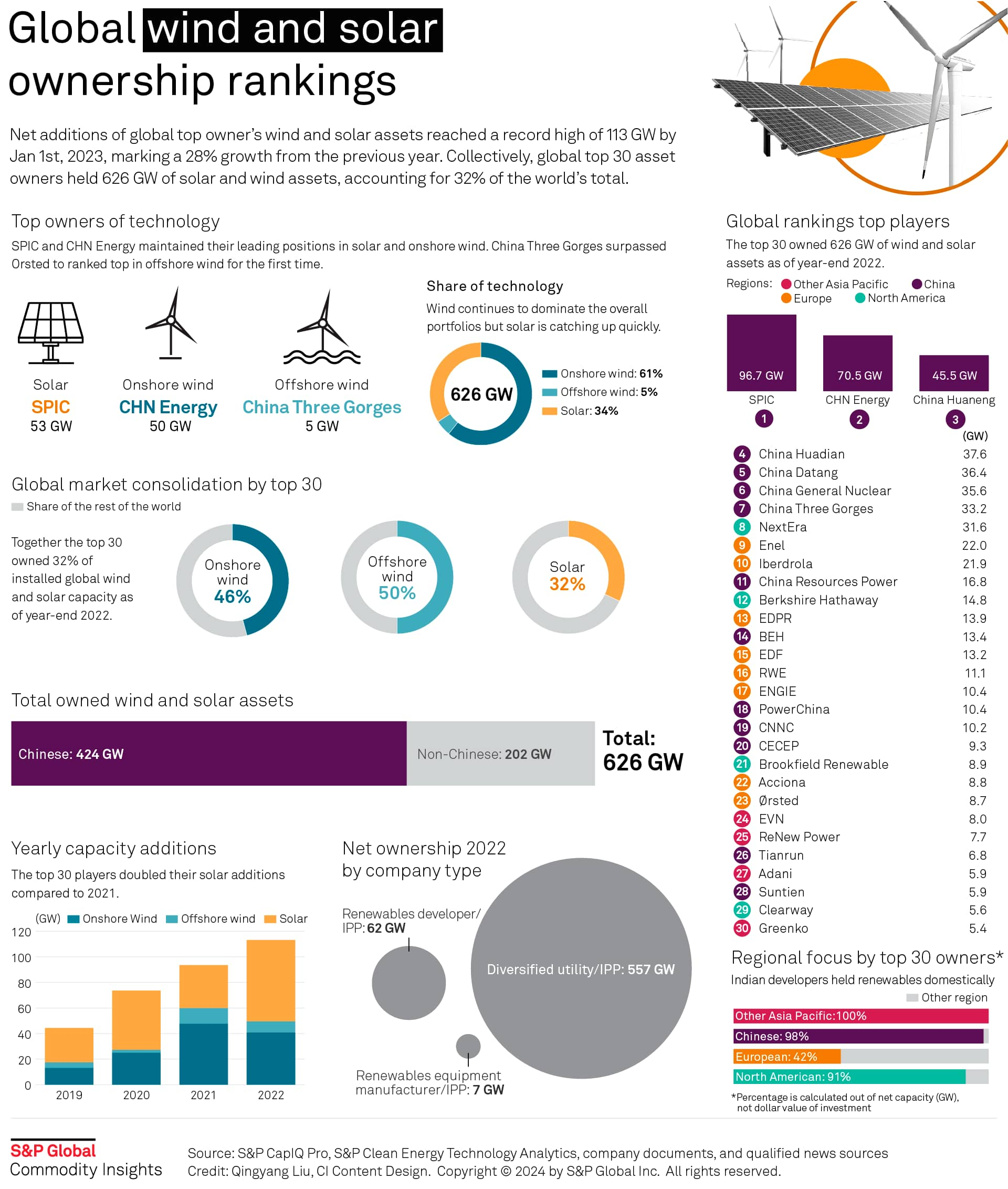

Net additions of global top owners' wind and solar assets reached a record high of 113 GW by Jan. 1, 2023, marking a 28% growth from the previous year. Collectively, global top 30 asset owners held 626 GW of solar and wind assets, accounting for 32% of the world's total. This marks a noticeable increase in market consolidation, up from a 31% share the year prior.

Asia-Pacific retained the top spot in portfolio additions during 2022. The leading 30 global players added 64% of the new capacity in Asia in 2022. The strong growth in Asia is largely driven by China's favorable government policy amid ambitious climate pledges and ongoing energy transition. While not generally accessible to the international market, the Chinese renewables market is dominated by few state-owned enterprises with significant project capacities in their pipelines.

Meanwhile, in North America and Europe, owners of renewable assets are streamlining their operations by divesting noncore segments. North American utilities have been moving away from competitive renewable generation portfolios for years, focusing instead on more stable, regulated business lines — a trend that has recently started to take hold in Europe as well.

The rise in interest rates and the inflation of input and labor costs that began in 2022 have compromised the feasibility of many projects, leading to delays and cancellations, particularly in the US offshore wind sector. Facing weakened financial standings and operational hurdles, companies are now seeking innovative financing methods to sustain their investment plans. Portfolio divestitures, asset rotation programs and sales of minority stakes are among the alternatives being employed.

Chinese firms have started to broaden their renewable energy portfolios internationally, whereas many North American and European companies are concentrating more on their primary markets, pulling back into well-established geographies. In Asia, there's a growing trend toward diversifying the range of technologies in renewable energy projects. Conversely, Western companies that adopt portfolio specialization strategies are placing greater focus on their foundational technologies.

To learn more about our Global Power and Renewables Service and the reports featured in this post, click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.