Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 04, 2022

By Amy Groeschel, Francesco d'Avack, and Jeff Nitto

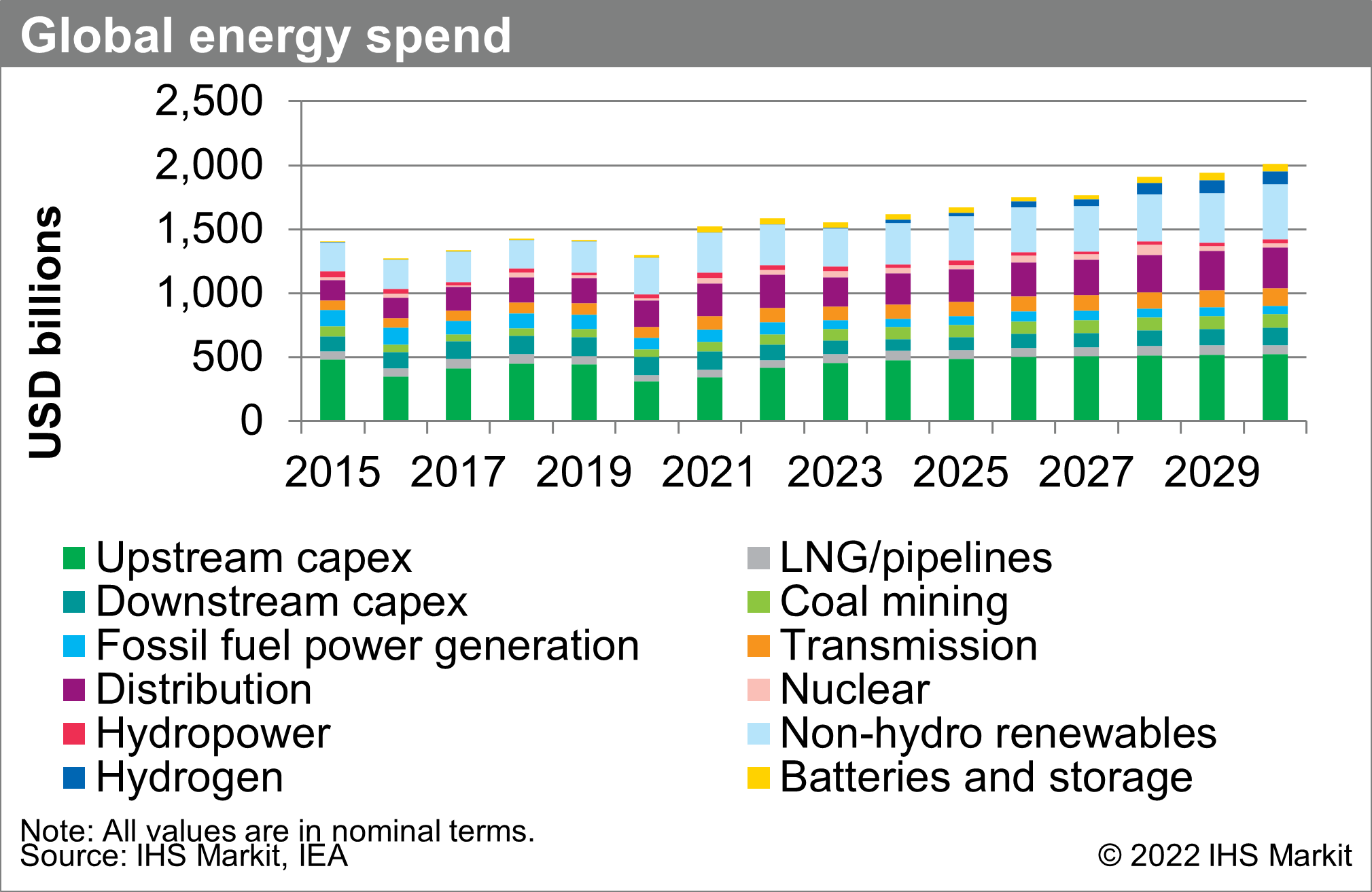

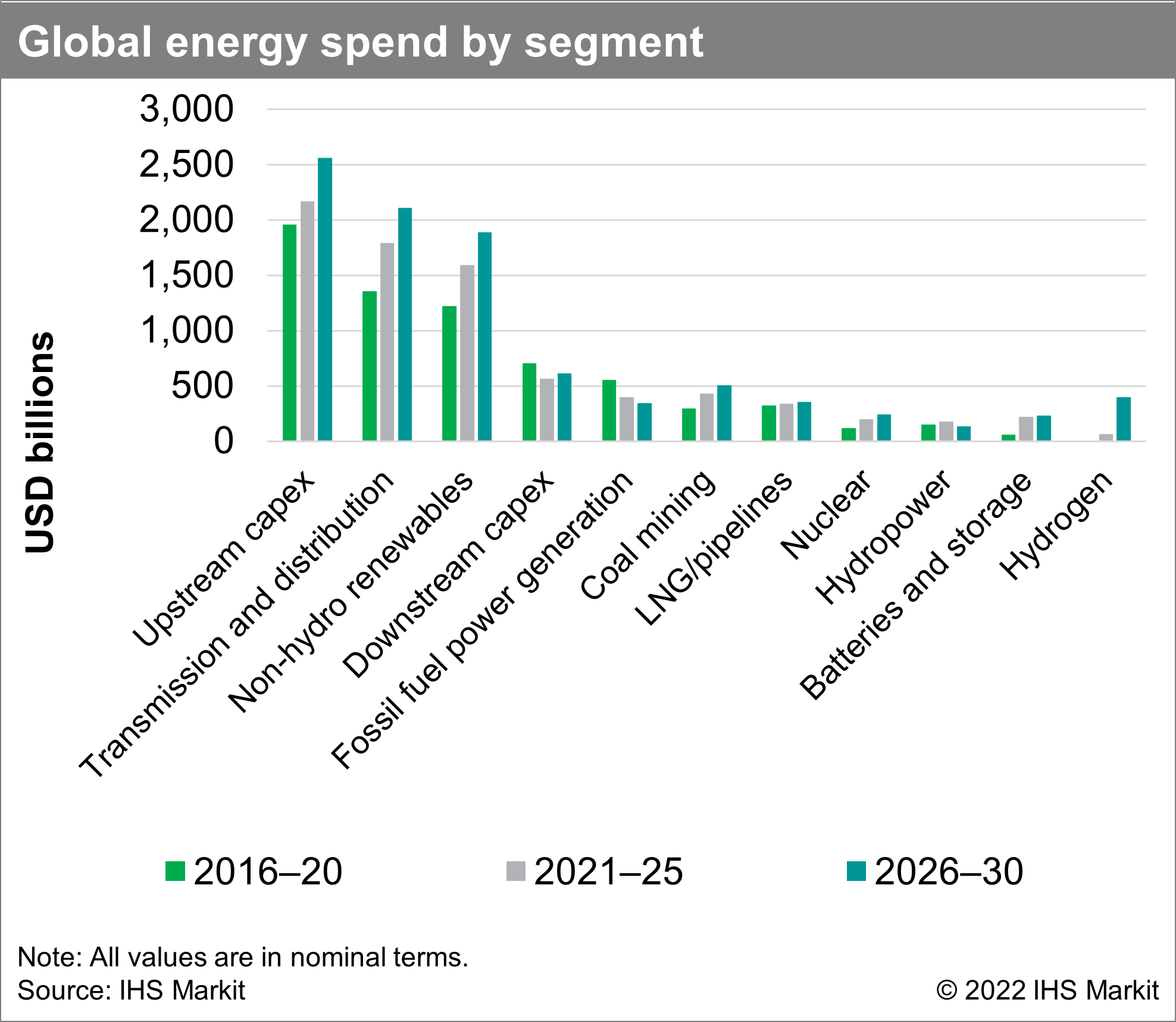

Global energy sector capex was over $1.5 trillion in 2021 as economic activity increased following the global downturn in 2020. Energy spend was directed mostly toward transmission and distribution at $363 billion, upstream oil and gas at $341 billion, and renewable energy at $315 billion. Over the five-year period from 2021-2025, cumulative global energy sector capex is projected to increase by 18% compared to the 2016-2020 period. In 2021-2025, transmission and distribution spending is projected to increase by $433 billion, followed by renewables at $367 billion and oil and gas spending at $209 billion.

The global economic downturn in 2020 led to a fall in global capex spending, but capex rebounded in 2021 as investment flowed back to the energy sector. Fossil fuel capex took the largest hit in 2020 and upstream capex is unlikely to reach 2019 levels until 2023. Renewable energy spending rose by $40 billion in 2020 and another $29 billion in 2021. Growth in wind power was particularly strong as companies took advantage of expiring subsidy schemes. Renewable energy spending is likely to remain relatively even in 2022 compared to 2021, hovering around $315 billion. Supply chain issues could lead to rising costs and higher spending levels in 2022.

Global energy sector spend is forecast for 18% growth in 2021-2025 compared to the previous five-year period. Fossil fuel capex is projected to garner the most spend totaling $2.2 trillion in 2021-2025. Total upstream spending is expected to be 21% higher than transmission and distribution and outpace renewable spending by 36% in 2021-2025. Clean energy is the likely beneficiary of the global energy transition with almost every category of non-fossil energy experiencing growth in capex spending over the next five years. Spending will be needed to connect disparate forms of electricity to the grid, leading to a rise in transmission and distribution capex. Spending on transmission and distribution will also help mitigate weather-related risks, as well as meet growing demand for electric vehicles.

This is an extract from a new Energy Sector Capex Spending report that covers energy sector investments, specifically capital expenditures focused on energy supply of all types, including power transmission and distribution.

The Energy Sector Capex Spending report is available to our Connect subscribers

Learn more about our oil and gas supply chain coverage

Posted 04 March 2022 by Amy Groeschel, Principal Research Analyst, Costs and Technology, S&P Global Energy and

Francesco d'Avack, Principal Analyst, Global Power and Renewables, Climate & Sustainability, S&P Global Energy and

Jeff Nitto, Senior Research Analyst, Upstream Costs and Technology, S&P Global

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.