Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 31, 2023

Companies around the world are actively developing strategies to decarbonize their business by setting promising net zero targets, reducing their carbon footprint by switching production to green technologies, purchasing renewable electricity, and minimizing carbon emissions along the whole supply chain.

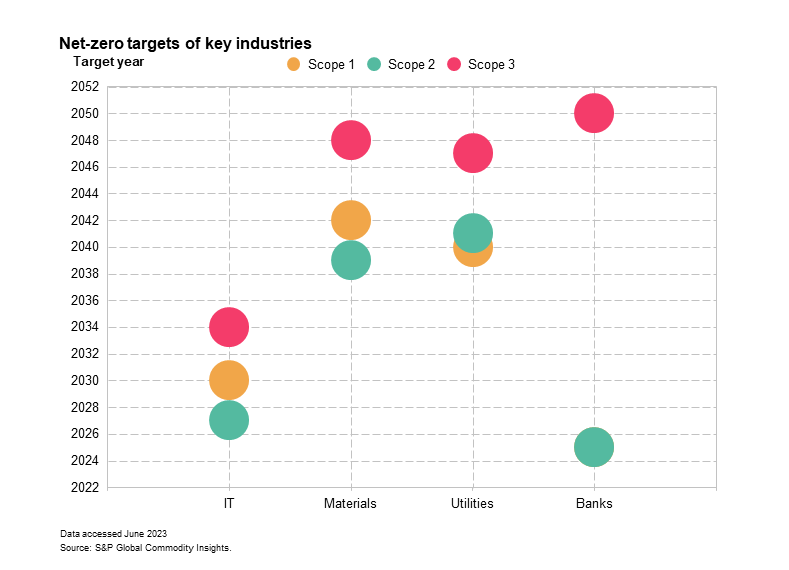

According to The Science Based Targets initiative group, as of May 2023, about 2,200 companies, accounting for more than 20% of the global stock market, have set net-zero targets. Another key group, the RE-100 Initiative numbers now over 450 companies globally, increasing by one fifth over the past year, mainly due to growing manufactures of consumer goods from the Asia-Pacific region, which have recently started developing a market for corporate procurement of renewable electricity. As is known, Scope 1 captures emissions created directly by the firm, Scope 2 concerns "purchased emissions", such as electricity to run production facilities, while Scope 3 identifies indirect emissions, usually generated by "upstream" and "downstream" business in the supply chain.

The technology sector remains the most active, setting ambitious targets for Scope 2 reduction, with 2027 as the most common target year for emissions cuts and among the first sector to set Scope 3 targets. This is bold, especially as S&P Global estimates that 70% of data centers will occur in China and India, markets whose power grid have high carbon intensity. On the other end of the spectrum, manufacturers and mining companies appear to be lagging, with the average year of net zero targets set around 2039. This delay appears to be related to the much larger electricity consumption, but also technical requirements of electricity-intensive processes. For the financial sector, achieving the goals on Scope 1 and 2 doesn't present great difficulties, however, the main challenge is to get Scope 3 and decarbonize its high-emissions portfolios. Most U.S. banks have signed onto the Net-Zero Banking Alliance and committed to achieving net-zero emissions across their lending and investment activities by 2050.

However, beyond the fanfare around the growing number of corporates setting decarbonization targets, the way these targets are being reached is becoming more central in the discussion. The recent report Corporate renewable electricity sourcing strategy highlights observed trends based on companies sustainability reports and RE-100 disclosures.

Corporate renewables sourcing strategies: EACs still dominate. If we focus on Scope 2 targets, when it comes to purchasing renewable electricity, there are a few options that corporates face. Companies can buy electricity at a green tariff from suppliers, or simply purchase energy attribute certificates (EAC) confirming the origin of renewable electricity. They also can enter into Power Purchase Agreements or even commission their own renewables facility.

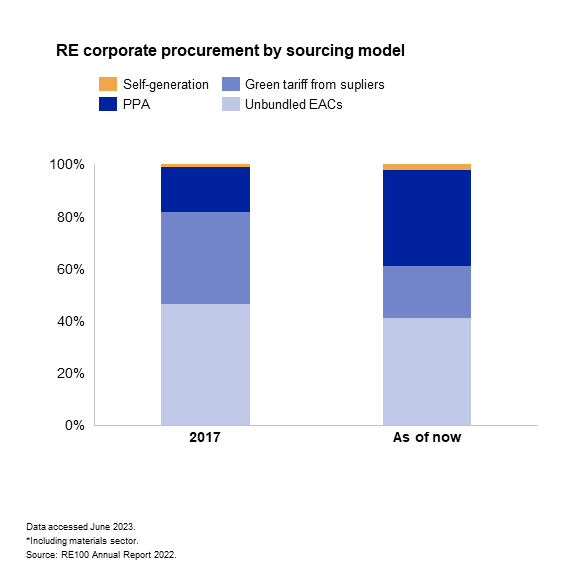

Based on the RE-100 initiative data, the most important renewables procurement strategies of surveyed companies remains unbundled energy attribute certificates (39% in 2022). An EAC is a contractual instrument that represents information about the origin of the renewable energy generated, such as EU Guarantees of Origins in Europe or I-RECS internationally. If we take a look at specific sectors, EACs account for about 70% in financial sector, 40% of corporate sourcing in the tech sector and 2% in heavy industry. Among financial sector, it makes sense to mention Bank of America with overall RE consumption -- 1.8 TWh per year using the EACs by 100% and Citibank purchasing 1.1 TWh of green electricity, 80% of which goes from EACs. Within the tech sector, Microsoft and Intel were among the largest buyers of EAC in 2022,with 15 and 9 TWh of volumes purchased, correspondingly.

With corporates looking to show additionality, the role of power purchase agreements has been increasing over the past years, but still accounts for 35% of the total procured renewable power among the surveyed companies. Procurement through utilities or electricity suppliers accounts for only 19%, with the remainder coming through self-generation and other forms (6%).

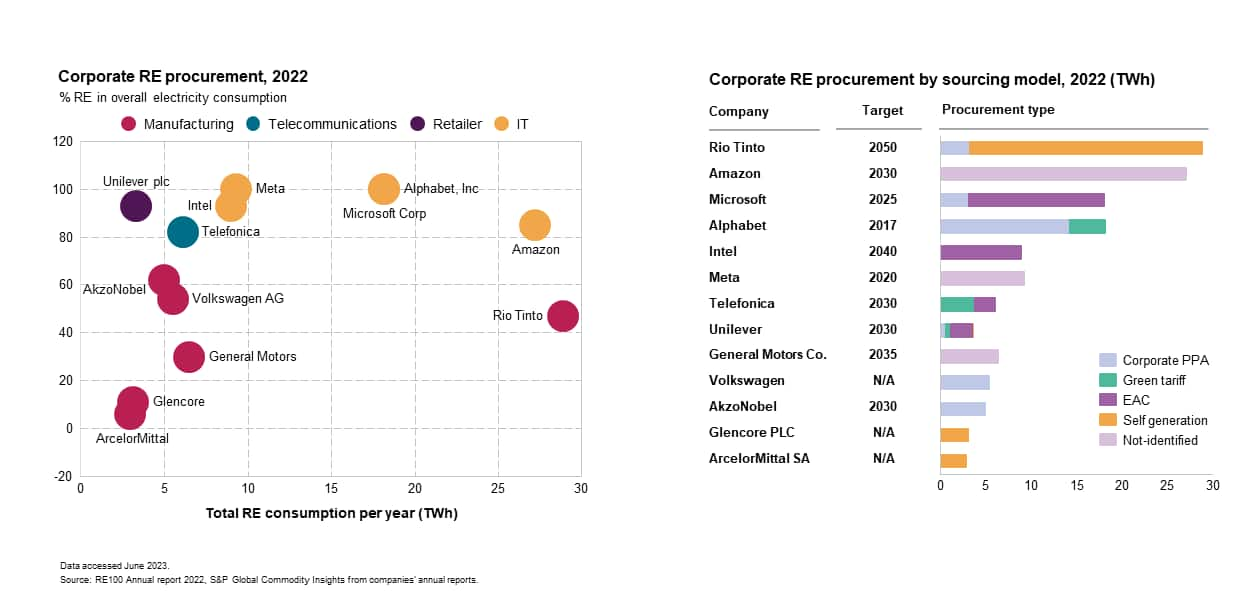

PPAs are driven by tech companies, while mining and manufacturing rely on self-generation. While most PPAs are contracted in Europe and North America, the tech sector remains the leader, with Amazon in particular the largest PPA off-taker globally, followed by Google/Alphabet and Meta. Tech companies are generally locked into virtual PPAs, where the renewable generator sells its electricity in the spot market and then settles the price (based on the difference between the variable market price and the strike price) while the buyer receives the associated EACs. In 2022, Google purchased 14 TWh of electrify directly from wind and solar farms. Amazon, which has a goal to power its operations with 100% renewable energy by 2030, announced 25 clean energy projects in 2022.

It's worth noting that Volkswagen and Siemens are among the largest corporate PPA offtakers, notably in Europe. The companies rely entirely on direct contracts with RE producers with total volume of purchases in 2022 amounted to 5.5 TWh and 1.3 TWh, correspondingly. Rio Tinto -- the largest metal and mining company in the world -- has also set its net zero goal, committing to decarbonize its portfolio by 2050. As of 2022, almost 40% of it electricity demand was sourced from renewables, which was secured by 90% from self-generation assets and the remainder with corporate PPAs. Norsk Hydro, one of the largest aluminum producers in Europe, operates 39 hydropower plants with a combined installed capacity of 2.7 GW, but through PPAs has been able to purchase more than 9 TWh of renewable power annually (2022). More generally, we do see that mining and materials companies tend to rely more on self-generation, as the share of direct procurement via self-generation is the largest among all surveyed companies across sectors.

The corporate RE sourcing strategy differs based on geography and industry. The sourcing models available to companies depend greatly on the policy frameworks under which they operate, and on the nature of each company's operations and its internal capacity to procure electricity. In the US, where the main tech giants are headquartered, PPAs account for half of renewables procurement in the region, while in the Asia Pacific region, renewables sourcing with unbundled EAC prevails, in particular among consumer goods manufacturers and amounts to 52%. Rio Tinto's recent announcement that they could miss their 2030 targets appears to be due to regulatory challenges in a number APAC countries. In Europe, contract with suppliers (green tariff) and EAC still remain key approaches for procurement and totals around 40% each, but PPAs are now also growing in popularity as the combination of volatile wholesale electricity prices and reliability concerns have pushed corporations as a cost competitive way to source electricity.

The variety of approaches is likely to persist. PPAs are not always an option suitable for all companies, either due to the complexity of signing these deals or credit worthiness, but also broader regulatory barriers. As a result, unbundled EACs have a role to play, as also shown by growing demand for I-RECS. I-RECS redemption has doubled so far this year, with top markets being Brazil, Chile, Turkey, along with China. EACs are widely available across the globe and have the advantage of offering flexibility and simplicity, which sometimes is more suitable for smaller size companies, or also companies in specific sectors, such retail, but also textile, food and beverages.

Learn more about our offering for clean energy procurement.

Would you like a demo of our Clean Energy Procurement service? Contact us directly.

Danylo Babkov, a low-carbon electricity market analyst at S&P Global Energy, has extensive expertise in commercial and regulatory policy in the energy sector and currently focuses on environmental product coverage in the Europe, Middle East, and Africa region (guarantees of origin, renewable energy guarantees of origin, and power purchase agreements).

Posted on 31 July 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.