Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Oct 27, 2023

By Ankita Chauhan

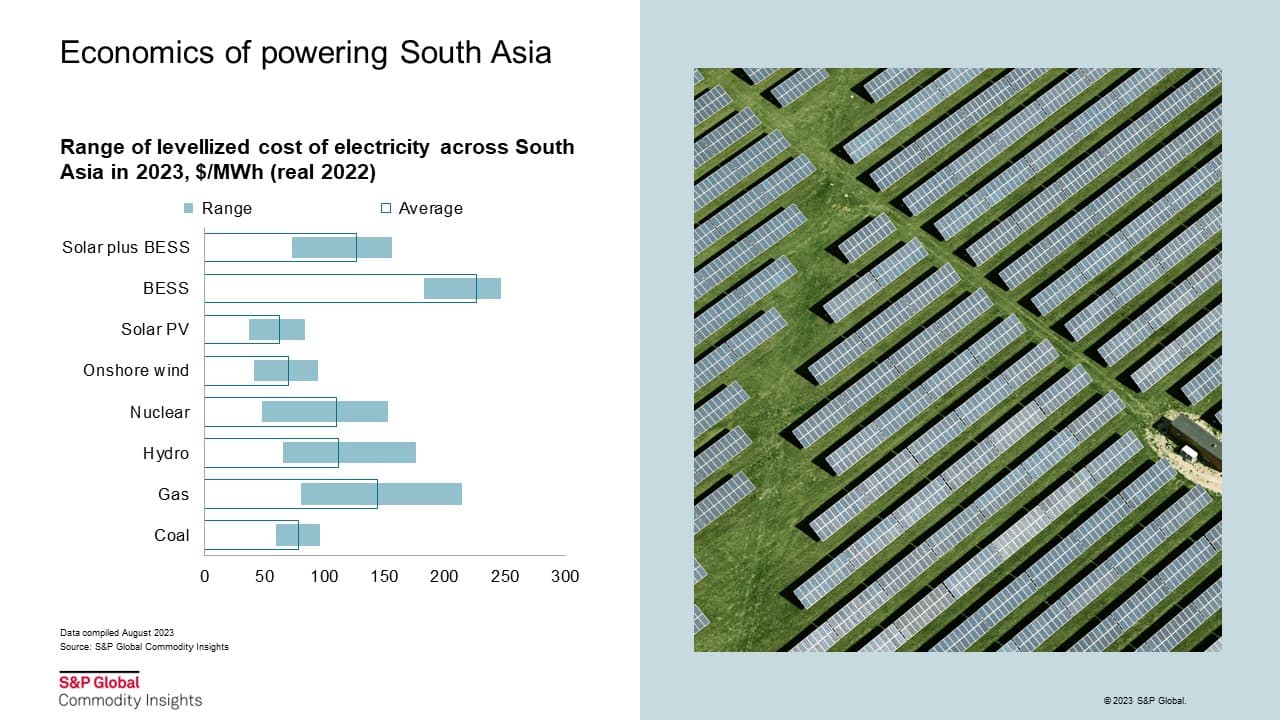

Capex, financing costs and fuel costs are major drivers of levelized cost of electricity (LCOE) and vary based on market fundamentals and resource availability in South Asia. Fuel costs and capex make up more than 90% of the levelized costs of conventional technologies including coal and gas. The increase in LCOE is driven primarily by the increase in capital costs owing to an expected increase in the input cost and installation of emission control technologies.

In India, the LCOE of (load center) coal-fired plant in 2023 is expected to be about $60/MWh and falls within the range of approved cost-plus tariff, while the LCOE for gas and nuclear varies between $50 to $125/MWh in 2023 and is highly sensitive to capital costs, fuel prices and utilization rates.

Utility-scale solar PV and onshore wind are cost-competitive versus the newly constructed base load plants. Solar photovoltaic (PV) and onshore wind are currently the cheapest sources of electricity generation in utility-scale applications. The impact of post-pandemic supply chain pressures has been alleviated in India, with wind costs rebounding in 2023 to the lowest levels of 2020, while solar costs are expected to decline beyond 2020 levels next year. Solar PV projects also face import duties on solar cells and modules, however a rapid decline in global polysilicon prices in 2023 has moderated the impact of duties.

In rest of south Asia, the solar LCOE are about 30-50% higher than in India mainly due to differences in adoption of technology in utility-scale applications, competitive landscape, and development and construction costs. Renewable costs are expected to converge in the region in the long term with maturing markets, increasing scale, and globally linked supply chains.

Hybrid projects with battery storage to supply firm and dispatchable renewable power are at about 1.5 times the cost of standalone solar projects and are expected to be adopted across South Asia. While other new technologies including offshore wind, stand-alone battery storage and green hydrogen are still not cost competitive in the short term. However, government support for these technologies, for example in India, may help their build-out, leading to long-term cost reduction driven by lower capex due to technology improvement, economies of scale and maturing supply chains.

Learn more about our Asia-Pacific energy research.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.