Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Nov 15, 2023

By Zayd Wahab

Following multiple years of relentless escalation, upstream costs seem to have begun to moderate. Any slowdown is deceptive however as it obscures the considerable momentum driving the various markets implicated in industry expenditure. Sector fundamentals - such as rig counts, oil prices, and spending budgets to name a few - all remain supportive of growth, and activity is not expected to decline in the near-term. Looking at the difference between upstream capital and operating cost changes reveals how the recent plateauing of the former is driven by weakness from non-industry sectors. It also supports the expectation for this lull to be short-lived: upstream markets are already strained by the current levels of industry demand and a strong outlook will only lead to higher prices.

The root causes for the softening of overall costs this quarter have been two-fold: lower materials prices and the depreciation of various currencies dragging down regional indices. As these weaknesses stem from international economic underperformance, it is difficult to foretell how long they will continue to have an impact on markets. What's clear is that only the persistence of such forces can restrain the otherwise buoyant energy markets: upstream markets are still struggling to deal with the surge of demand after years of low spending and underinvestment. Suppliers reduced their capacity significantly in the aftermath of the downturn of 2015. The overall workforce supporting the industry is estimated to have decreased by over 25%, with specialized markets such as subsea equipment having fallen even further. Constrained supply and rising demand are a recipe for higher costs and Energy expects all three of its industry indices to return to their positive trajectories and to maintain them for the entire duration of the forecast timeline.

The Energy Upstream Capital Costs Index (UCCI) decreased by 0.5% between the start of July and the end of September, marking is first decline since the fourth quarter of 2020. This is not a signal that project costs are falling: the drop came from three markets, two of which - construction labor and bulk materials - were disproportionately impacted by exchange rates due to the local nature of their supply and pricing. Wages are still moving upward in the local currency index as economic growth remains positive and market conditions are supportive of increased oil and gas activity. The global bulk materials US dollar index decreased by 1.7% in US dollar terms and increased by 0.8% in local currency terms in second quarter 2023. Most bulk material prices increased in the local currency index in the third quarter, but price growth is much more muted compared to the first half of 2023. Raw material input prices are easing for most bulk materials which is helping reduce pressure on prices. Finally, the steel market is currently experiencing mean reversion; prices are receding from their record peaks, but they remain far above pre-pandemic levels.

Construction labor, bulk materials, and steel are all massive markets which get most of their demand from outside the industry. With economic deflation in the world's largest exporter - mainland China - this quarter and the ongoing turmoil in its construction sector, there are several factors exerting downwards pressure on costs in these markets. Focusing on the upstream space gives the opposite impression however: costs in industry-specific markets like offshore rigs and vessels both increased by over 3.5% in the third quarter. The offshore rig market has recovered from COVID-19 shutdowns owing to higher commodity prices and increased demand on crude oil since economies reopened. Day rates are trending positive but still nowhere near the 2014 highs, a level that is not expected to be reached anytime soon, if ever. The offshore installation vessel market day rates continued to rise due to higher upstream demand along with a preference for well-equipped, high-spec vessels. Costs increased the most in the Middle East as the region's NOC's press ahead with their ambitious offshore plans. Day rates in the North Sea also increased as expected for the busy summer season. Offshore vessel contracting grew more expensive in all other regions as well this quarter. The subsea index trended upward over the third quarter. The improvement in activity has been the main driver of the price escalations witnessed over the past three months. The impact of reduced supplier capacity has outweighed lower material costs, leading to cost escalation in standardized equipment and longer lead times for customized solutions.

Offshore fabrication yard costs continue to rise, up another 0.6% over the third quarter. Capacity remains tight in Singapore as well as in most hull yards in mainland China, while the South Korean yards continued to be very cautious when bidding for new offshore projects. All these are happening in an up market despite signs pointing toward lower costs for the yards, such as easing labor supply and lower material prices. Yards service prices remain persistently high as yards price in higher premiums corresponding to the risk level of their projects.

The land rigs and engineering and project management (EPM) markets both increased about 2% in the third quarter of 2023. Drilling contractors are reporting high revenues and strong margins, allowing them to focus on maintaining fleet quality, a key differentiating factor for rig suppliers. EPM rates increased due to a strong pipeline of projects either recently awarded or awaiting imminent award. Equipment costs moved up slightly by 0.3% in third quarter 2023 mainly driven by high demand levels and elevated costs inputs, such as labor and some bulk materials. Some raw material costs are in retreat, but suppliers have no incentive to pass any savings on when demand and lead time are high. Equipment suppliers are opting instead to improve their balance sheets and profitability.

Despite significant currency depreciation in certain key economies like Russia, Angola, and Nigeria, the global Upstream Operating Costs Index (UOCI) increased fractionally this quarter. In local currency terms - once the impact of currency fluctuation is stripped away - every regional index increased, averaging 2% growth overall.

The operations index decreased by 1% in third quarter 2023, increasing by 0.8% in local currency terms. Local currency depreciation constrained growth in the labor and diesel indexes in third quarter, masking underlying trends. In local currency terms the labor index grew by 0.8% while the diesel index increased by 3%. High pricing in the first half of 2023 led to demand destruction for specialty chemicals markets resulting in a 0.5% decline in the production chemicals index.

The maintenance index increased by 0.8%, 3% in local currency terms. The subsea vessel index drove growth with 7% quarter on quarter uplift while the FIM index fell by 1%. Subsea vessel index growth was particularly high in the Middle east and Latin America, each rising by over 15%.

The logistics index fell by 0.9%, increasing by 1% in local currency terms. The aircraft index remained relatively stable, down just 0.3% while the supply services indexes fell by 3% owing to the influence of currency depreciation in West Africa and Russia weighing on the index at the global level and counteracting increases in local currency terms across all regions. The support vessel index grew by a modest 2% as although offshore activity remains high, support vessels remain in good supply.

The wells index increased by 2% in third quarter 2023, 4% in local currency terms. Specialty vessels increased by 7%, with European day rates rising the furthest at 14%. The well services index grew by 1% while materials index growth slowed to just 0.3%.

Year over year the index has increased by 4%. The UOCI forecast for 2023 has been revised down to 3% on account of ground lost in third quarter owing to local currency depreciation, and a slightly lower Brent price forecast. For context the UOCI currently sits at 197, just 3% shy of its peak value, which was attained in Q2 2014. In real 2014 terms, the index is 10% lower and thus still has room to grow.

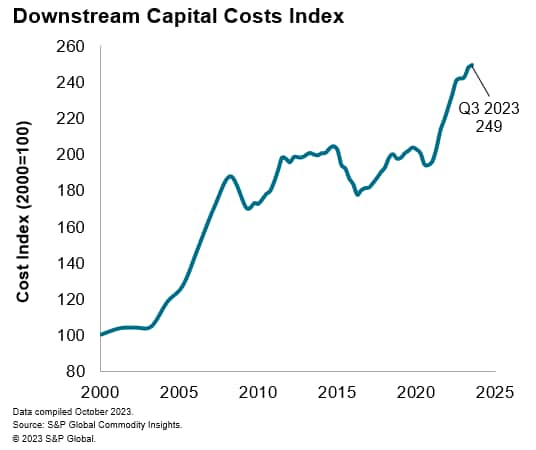

The S&P Global Energy Downstream Capital Costs Index (DCCI) increased by a little over half a percent overall: the refining index increased by 1.3% while the petrochemical index decreased by 0.7% during third quarter 2023. The DCCI experienced a small increase in the third quarter of 2023 as price declines in the steel market offset increases in all the others. Even with monetary tightening policies sector activity remains strong enough to push up labor, equipment, and material costs. However, prices seem to be easing from earlier in 2023 and price growth is likely to slow further in the first half of 2024.

Steel costs were at historical highs and had nowhere to go but down. Prices are retreating for most steel subcategories owing to lower surcharges and slowing demand. Prices for steel are likely to recover somewhat in the first half of 2024; however, the price floor for steel will stay above pre-pandemic levels. Prices in Asia-Pacific and Europe have fallen faster than North America, but the pace of retreating prices is expected to quicken in North America in the last couple months of this year.

The energy transition is keeping prices elevated for electrical instrumentation and construction materials. Countries are implementing carbon border taxes which drive up costs for heavy-polluting industries such as cement and steel. The demand for electrification will keep electrical material prices from softening even as some raw material prices decline.

Construction labor and engineering and project management (EPM) rates remain elevated as demand for labor is still high in most regions. Global refined product demand has proven resilient so far in 2023, which has kept employment numbers high in the downstream sector. Economic growth has also been stronger than expected in 2023, which is putting upward pressure on wages. The rate of wage growth is likely to ease slightly in the first half of 2024 but will remain positive for the rest of the year.

This blog is an extract from the Upstream Capital Cost Index, Upstream Operating Cost Index and Downstream Capital Cost Index market reports that are available to subscribers on our Connect platform. A summary of the Cost and Supply Chain Indexes can be found on the Costs and Supply Chain capability pages on the S&P Global website. For more information contact James Blanchard.

***

Posted 15 November 2023 by Zayd Wahab, Associate Director, Upstream Costs and Technology, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.