Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Dec 05, 2023

By Etienne Gabel

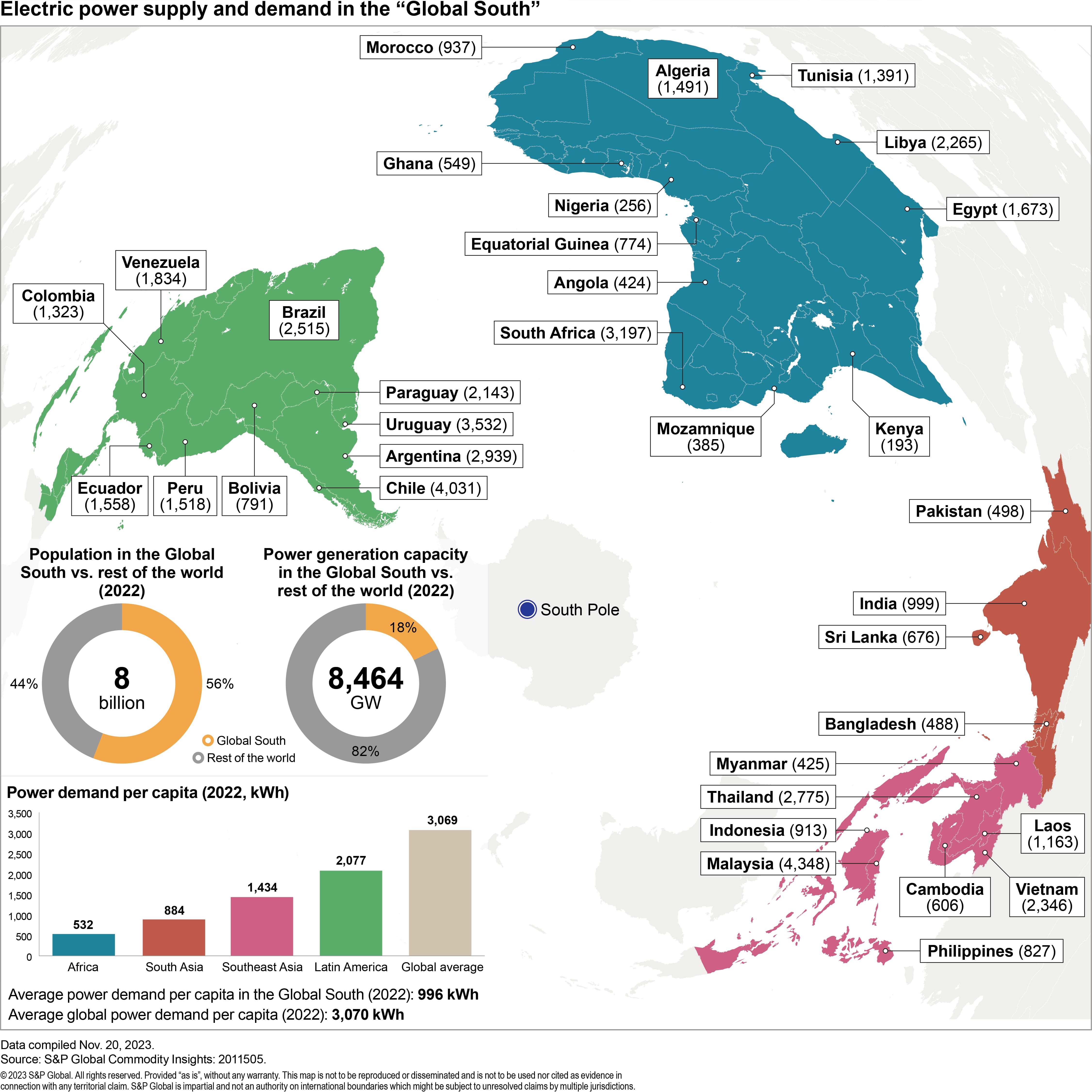

The "Global South"—a term often used for the developing countries of South Asia and Southeast Asia, Latin America, and Africa—houses 56% of the world's population but holds only 18% of its power generation capacity (see figure below). Power demand per capita, at about 1000 kWh/year (about the same as a clothes dryer), is less than a third of the world average.

Population growth, urbanization and economic development will lead to very rapid electricity demand growth in the Global South—300 TWh of additional consumption every year for the coming 25 years, according to S&P Global reference outlooks.

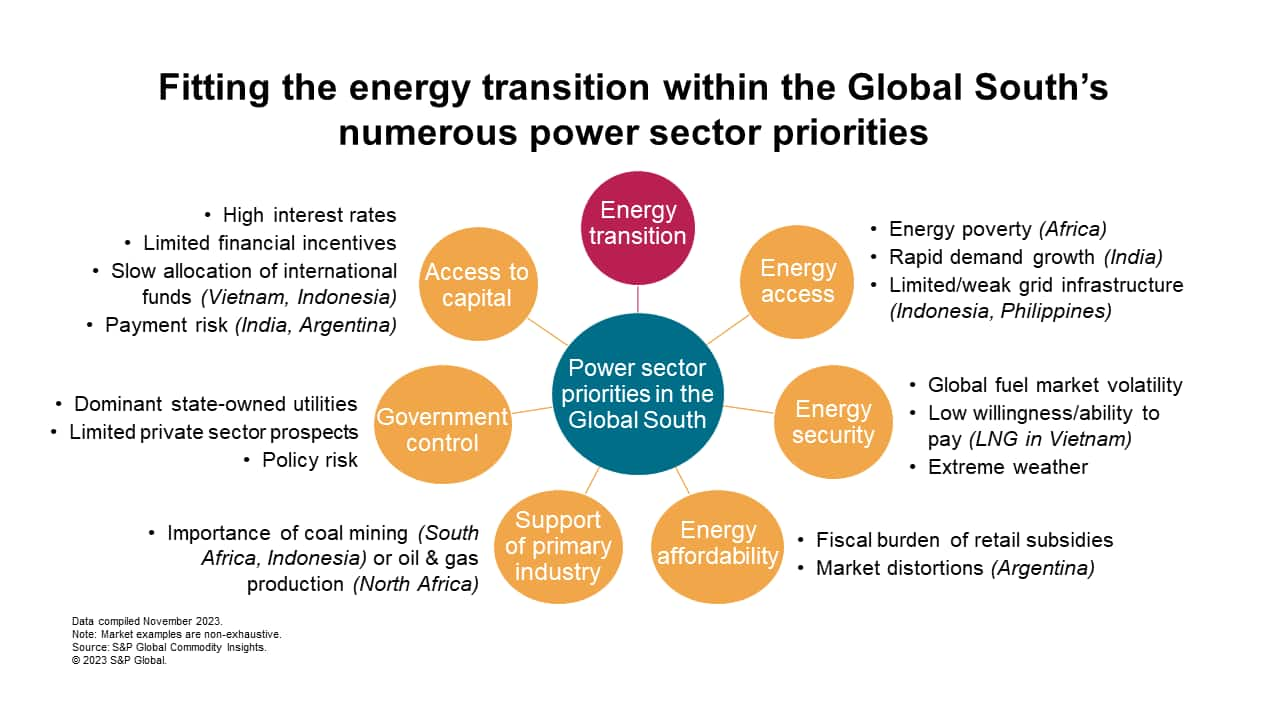

How to decarbonize the power mix under these circumstances, in markets where public funds and foreign capital can be scarce, and where fossil fuels still produce 60% of electricity, creates a unique set of challenges and opportunities for private sector investments in clean energies.

Ahead of COP28, S&P Global Energy held a webinar discussing the power sector landscape and what companies may need to consider when evaluating opportunities in the region. Below we share a portion of the discussion topics. The full webinar is available here.

The Global South's long road towards decarbonization must fit within a set of policy and market priorities that has governed the power sector's development to date (see figure below). These priorities in turn affect the business models suitable for private sector investments in the region's renewable resources.

Learn more about our global power and renewables research.

Etienne Gabel, a senior director at S&P Global Energy with the Global Power and Renewables team, specializes in the analysis of market and regulatory developments in power sectors worldwide.

Posted 5 December 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.