Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 20, 2022

By Bing Han

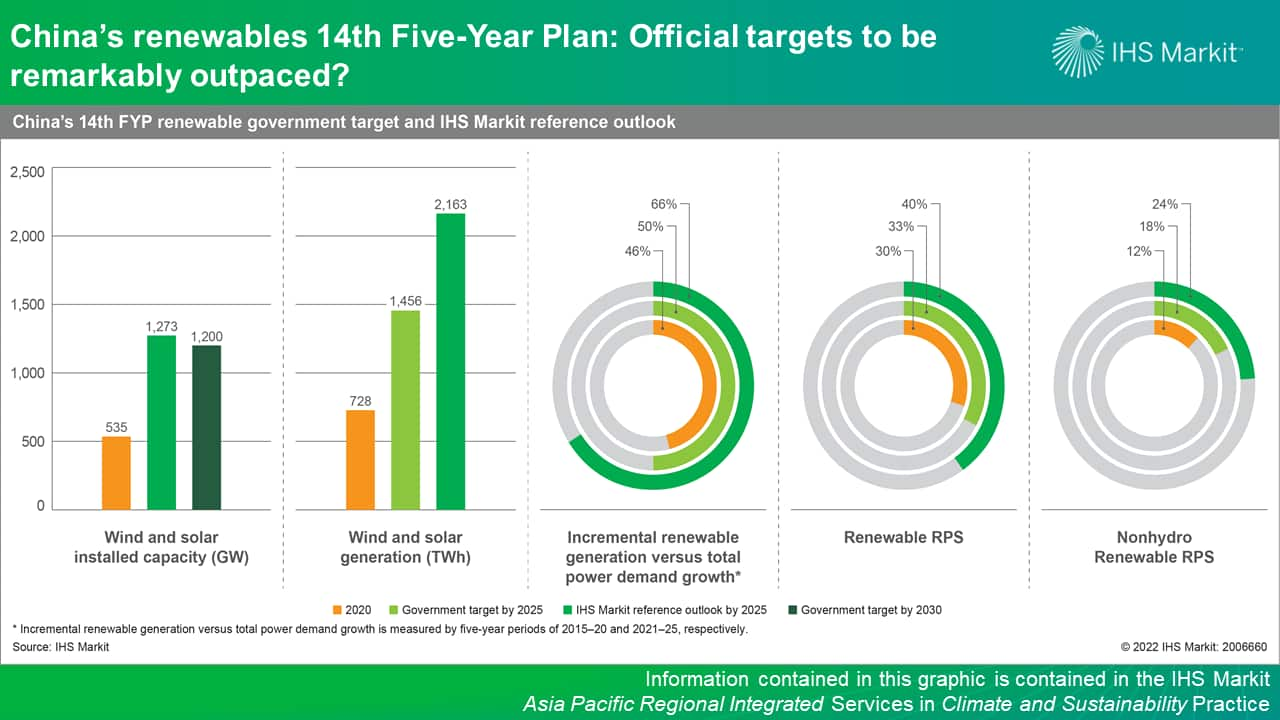

Following the release of China's 14th Five-Year Plan (FYP) on the overall energy sector covering 2021-25, the National Development Reform Committee (NDRC) announced China's 14th FYP on renewables in June 2022. The plan not only covers capacity targets, general guidelines, and regulatory framework, but includes plant-level details and measures to support renewables consumption that are critical for the plan implementation.

The national government target indicates a doubling of renewables generation by 2025 from the end-2020 level. However, provincial targets and project pipeline dynamics reflect a far more aggressive deployment pace. The provincial renewables targets for wind and solar power added to 1,263 GW by 2025, which, if all projects are commissioned on time, will bring China's 2030 nationally determined contribution (NDC) target achievement five years earlier.

In fact, developers have already taken actions ahead of the government plan announcements. It is estimated that wind turbine tenders soared to 45.2 GW during January-May 2022, more than double the orders in the same period last year. The solar photovoltaic (PV) industry showed similar signs of booming additions in 2022 and 2023.

China has planned 10 renewable energy mega bases to build utility-scale renewable projects, including Xinjiang, Hexi Corridor, Hebei North etc., which will contribute to nearly 70% of gross additions in the next four years. Intermittent renewables integrated with local firming power sources will be transmitted to demand centers in the central and coastal regions.

Capacity potentials of distributed renewables, especially distributed solar PV, will increase remarkably owing to policy incentives and approvals of more land available for renewables sites. Local government subsidy support, tax benefits and curtailment-free procurement will benefit project economics. Meanwhile, policymakers specified various approaches to explore the deployment potentials in new rooftops as well as hybrid with transportation and IT facilities.

In addition to emphasizing renewables additions, the government made a massive push for flexible power to increase the power system's readiness to accommodate more intermittent renewable energy. Retrofitted coal-fired, gas-fired power, pumped hydro, battery storage, concentrating solar power (CSP), and conventional hydro were listed as the major flexible power sources. Meanwhile, the inflated budgets from grid companies will mitigate the capacity congestions in the current transmission and distribution network.

The mismatch of project lead times and a late start for pumped hydro acceleration will leave China to either rely on flexible fossil-fueled sources or battery storage to increase power system flexibility in the short term. However, effective power pricing of flexible sources is not yet in place to incentivize adequate investments in coal-fired and gas-fired power. Meanwhile, battery deployment also faces fundamental economic challenges as developers have few options to recoup the investment.

Renewables growth in the short term could also be affected by the stringent administrative procedures in UHV lines buildout, challenges in distribution networks upgrades, as well as the change in revenue streams and material revenue decline when renewables shift from guaranteed procurement to market.

Learn more about our Asia Pacific energy research.

Bing Han, based in Beijing, is a senior research analyst of Gas, Power, and Climate Solutions team and primarily focuses on the China power and renewable market analysis.

Posted on 20 July 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.