Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Aug 07, 2024

Should the Atum 1 well be successful, it would be only the second offshore discovery in Guinea-Bissau (excluding the two discoveries in the Joint Exploration Zone) and would potentially be a play opener for the deepwater area.

Apus Energy DMCC is about to start drilling the long-awaited Atum prospect in the MSGBC Basin offshore Guinea-Bissau. The drillship Ocean BlackRhino is scheduled to be deployed for this operation in the second half of 2024, with AGR providing well management consultancy. With recoverable resources estimated at 314 million barrels for the Albian targets and a water depth of between 200 meters and 900 meters, the upcoming well is set to be a game changer for the country should it yield positive results. Situated in Blocks 2 and 4A, and characterized by its shelf-edge play, similar to the Sangomar discovery in Senegal, this well is set to be the first-ever deepwater well drilled offshore Guinea-Bissau and the first offshore well drilled since 2007.

Given the stranded location and lack of infrastructure in the region, the most likely development concept would be with a floating production, storage, and offloading (FPSO) vessel. Gas injection has been assumed to enhance oil recovery and minimise emissions from gas flaring. However, this gas could potentially be commercialized for an additional revenue stream once the market and infrastructure are in place.

The 1999 Guinea Bissau Royalty Tax (RT) fiscal terms has a royalty of 5-10% for oil projects based on a sliding scale and 5% for all gas projects; an income tax of 45%; and an additional profit tax of 25-30% for projects with an IRR above 15%. It is worth noting that in January 2002, PetroGuin executed approval of new Deepwater Bidding Parameters designed to compensate for the larger cost of deepwater exploration and development operations. It is unclear whether these are applicable to Block 2 or if the Block 2 terms have been renegotiated at all at this stage for the deepwater prospects.

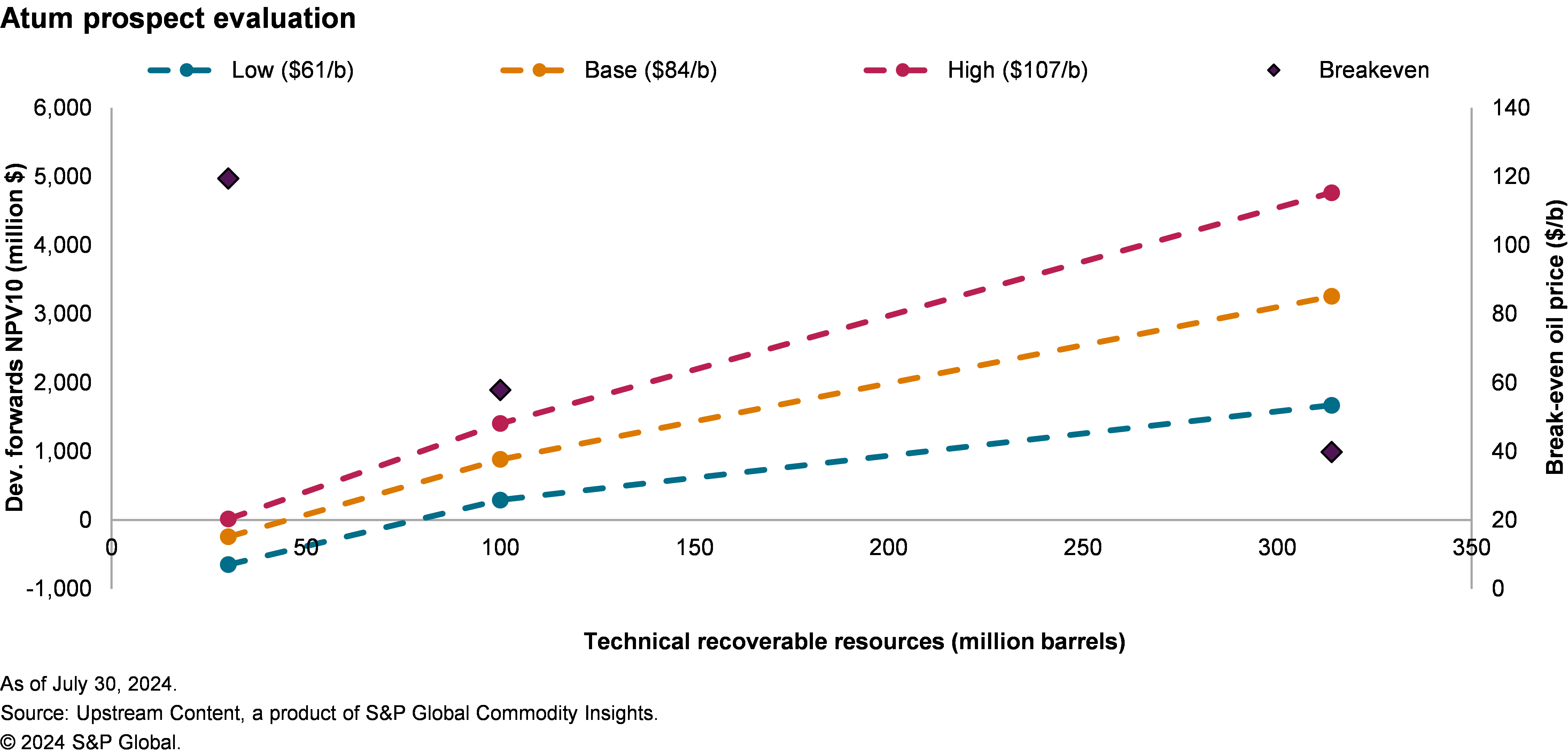

A prospect valuation has been conducted taking into account the above mentioned parameters. The analysis shows a minimum economic field size (MEFS) of around 45 million barrels recoverable at a Brent oil price scenario of $84/b, while a discovery of 314 million barrels recoverable is expected to have a NPV of around $3 billion. Above the MEFS, the prospect has an internal rate of return (IRR) of 15-50% depending on the recoverable volume and oil price and a government take of 50-60% which is well aligned with the average for Africa of approximately 60%. The break-even price for the announced recoverable volumes case is estimated to be approximately $40/b primarily driven by the increased costs due to the deepwater nature of the project and the requirement for gas injection. If the new, more favourable deepwater terms are applied, the economics of the development would be improved.

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.