Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jan 05, 2023

By Charles Ross

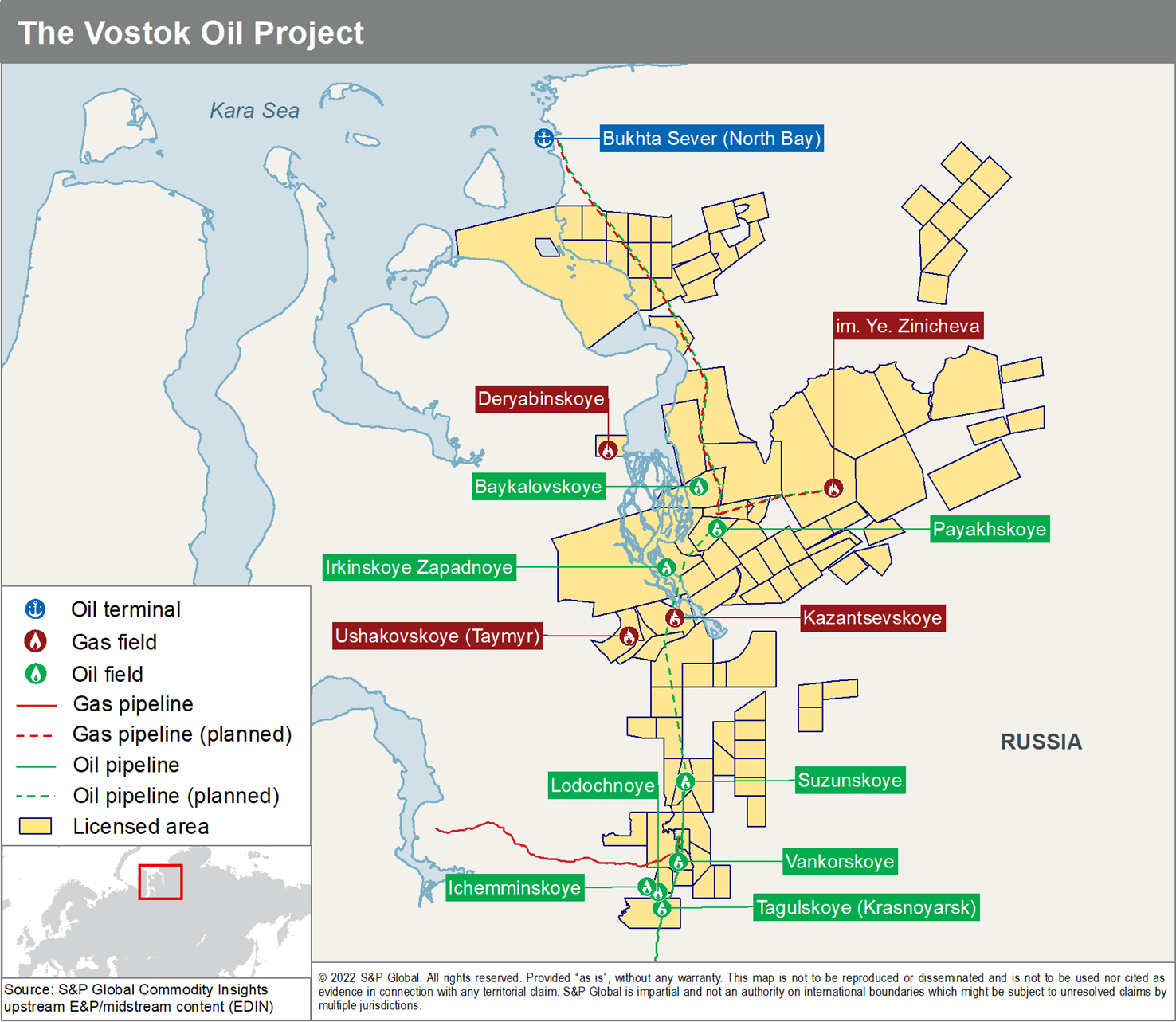

The Vostok Oil development is a vast project located in the Arctic portion of Krasnoyarsk, around the Yenisei Bay that extends to Russia's Taymyr peninsula (Figure 1). The project is stated to export around 30 million tonnes per year by 2024 and gradually increase to around 100 million tonnes (~730 million barrels per year (MMbbl/y)) by 2030. However, analysis of the current resource, political uncertainty and market demand may prove this difficult to achieve.

Figure 1: Location of the Vostok Oil Project and the Vankor Cluster. The Licensed area's represent licenses that could use the Bukhta Sever port infrastructure for export.

On June 6th 2022, the European Union announced an embargo on Russian crude imports from December 5th 2022 and petroleum products from February 5th 2023. As a result, forecasts from the Energy Information Agency (EIA) in June 2022 expect a fall in Russian crude production by 2 million barrels of oil per day (MMbbls/d), or around 18% in the first quarter of 2023. In addition, a price cap on Russian seaborne crude was announced by the G7, the EU and Australia at the beginning of December at 60 USD/bbl. This is an attempt to curb Moscow's revenue streams and ultimately its funding of the conflict in Ukraine. All seaborne Russian crude will be affected by the price cap, with western countries not providing shipping insurance to cargoes priced over the 60 USD/bbl threshold. This is likely to affect a significant number of projects in Russia, especially in the west of the country.

Vostok Oil being Russia's new mega oil project is currently in the appraisal / development stage with all crude destined for export markets via tankers. China and India, who are Russia's largest crude export markets, are not likely sign up to the price cap in risk of compromising their energy security and damaging political relations with Moscow. The price cap could mean that additional volumes of crude could reach these markets at a further discounted rate, squeezing out more expensive Middle Eastern and North American imports. Nevertheless, the quality of Vankor oil coupled with the threat of additional cuts by Russia, the announcement from OPEC+ to cut production by 2 MMbbl/d and implementation of the 60 USD/bbl cap could help prop up Russia's export prices to its far eastern markets.

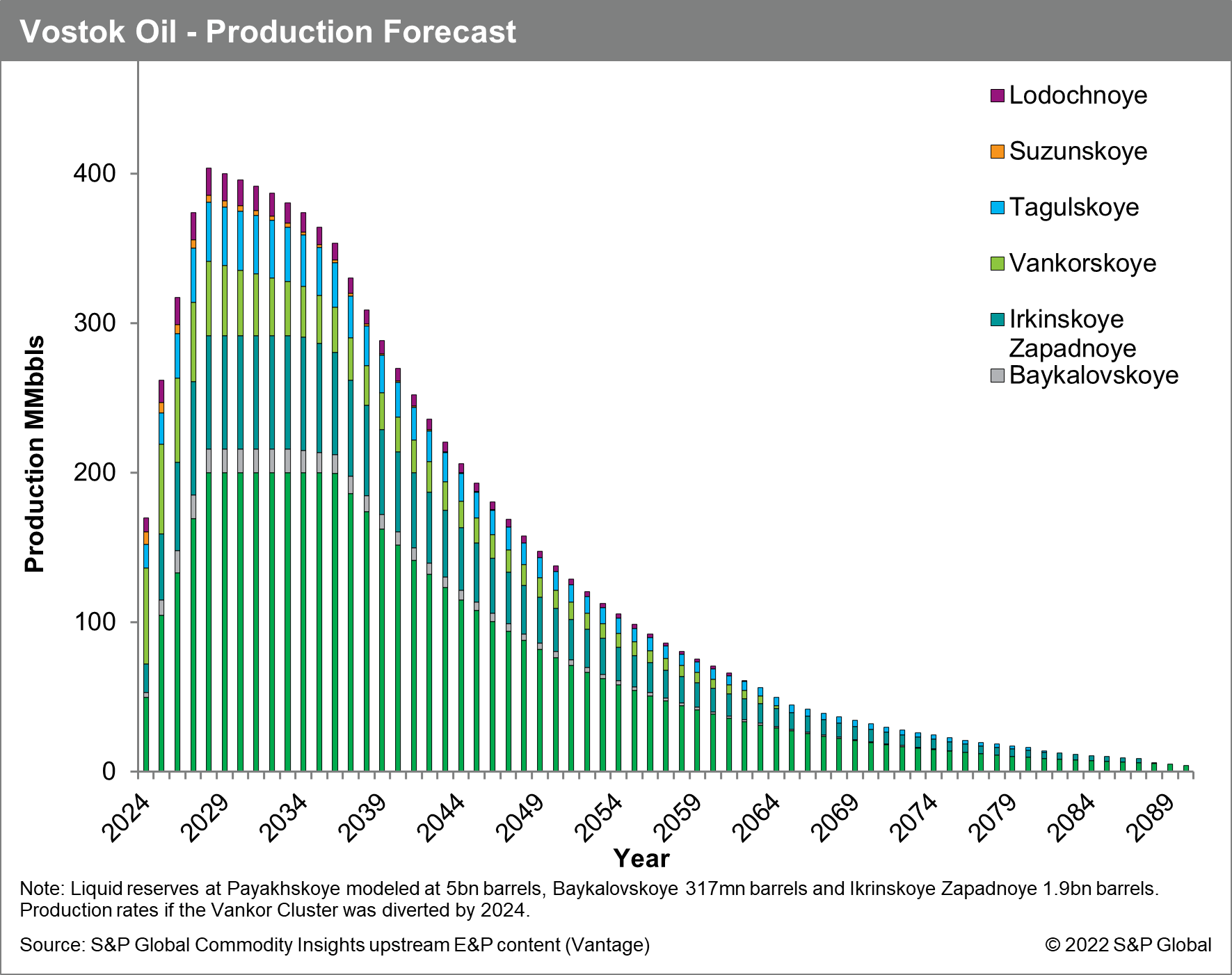

The Northern Area relating to Vostok Oil contains the Payakhskoye, Irkinskoye Zapadnoye and Baykalovskoye fields. They will be the backbone of future supply to the Vostok Oil terminal (Figure 2), but it appears the fields will struggle to underpin production rates to meet the desired 30 million (220 MMbbls/y) and 100 million (730 MMbbls/y) tonnes per annum goals. Resources at the fields remain under appraised and will likely be appraised through development drilling adding additional risk to overall

Figure 2: Forecast production figures for the major fields that could contribute to the Vostok Oil project. Note that Vankorskoye, Lodochnoye, Suzunskoye, and Tagulskoye will have to be diverted to the north rather than utilizing the exciting pipeline.

recoverable volumes and achieving these output targets. However, positive appraisal drilling could increase the resource base at the fields, potentially increasing production capacities and lowering the breakeven price. Even the total diversion of large producing fields such as Vankorskoye, Lodochnoye, Tagulskoye and Suzunskoye will only take production to a maximum of 400 MMbbl/, around 55% of the target capacity. Production at these some of these fields has already begun to decline with Vankorskoye reaching peak production in 2015. To offset this, Vostok Oil LLC will have to push an aggressive exploration strategy in the next few years to drastically increase the resource base coupled with a fast-track development system to attain the production volumes targeted for the project. Gazprom Neft has significant acreage around the planned export terminal which currently would be the only viable export route, though the acreage is unlikely to add any production to the 2024 or 2030 target.

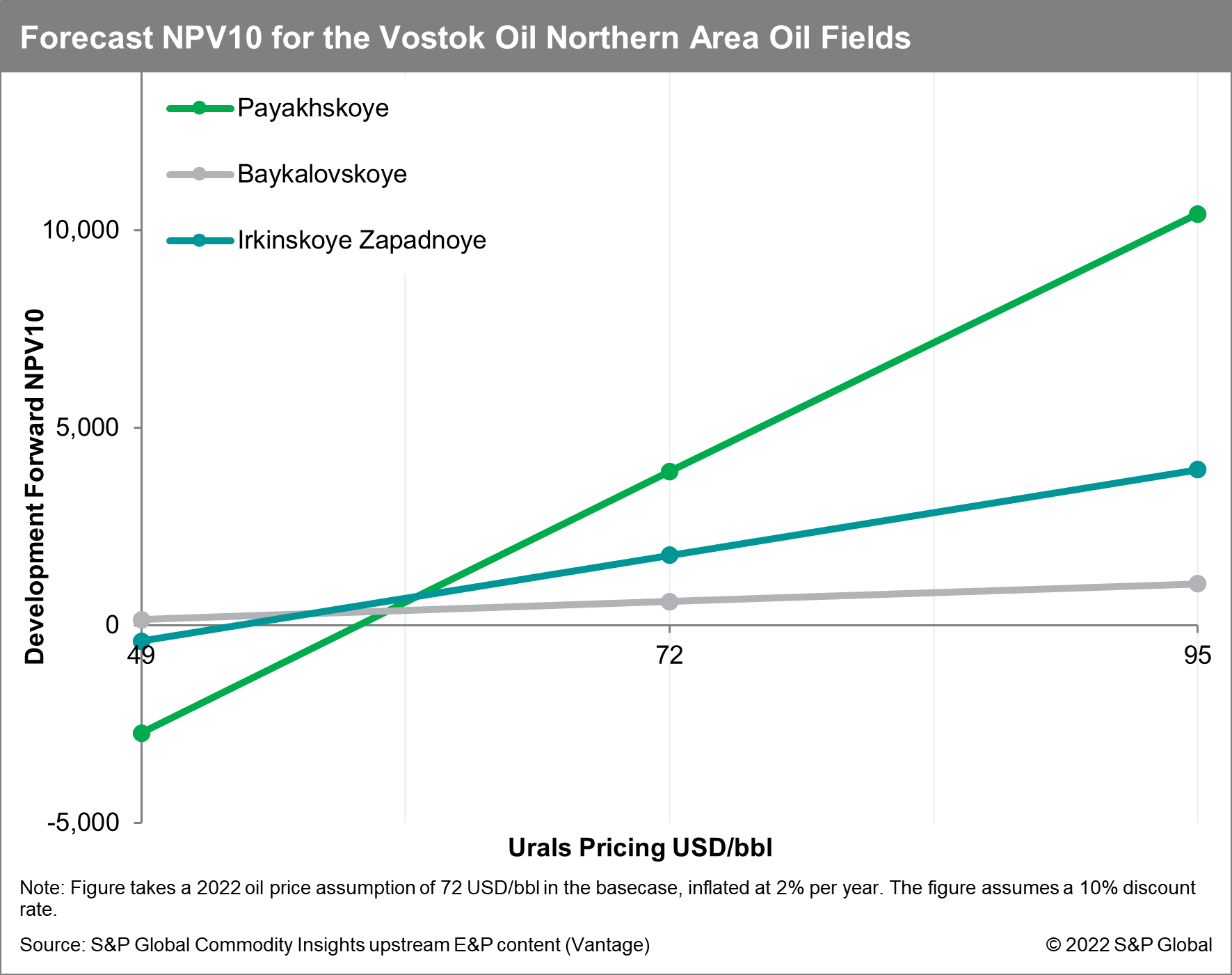

The economics of the three major fields prior to sanctions and global market volatility seen over the last year presented viable development opportunities with all breakeven prices being below 60 USD/bbl. Strong viable economics are present in the base case of 72 USD/bbl and 95 USD/bbl in the high case. However, in the low case of 49 USD/bbl the projects quickly present negative NPV10 values (Figure 3). At the current price cap at 60 USD/bbl, the fields economics become marginal with small positive NPV10. Depending on the operator's price outlook and additional incentives from the state, the project is likely to still go ahead as planned.

Figure 3: NPV10 vs oil pricing for the three main fields that will supply the Vostok Oil Project in S&P Global Vantage. Breakeven prices for the fields are in the region of 50-60 USD/bbl, higher than the regional average but expected with significant new infrastructure required.

The new 60 USD/bbl price cap could provide short term problems for the project, especially with Rosneft stating that exports could start as early as 2024. All oil cargoes will be seaborne and could still be subject to a price cap, however the duration and the likelihood of the cap changing is dependent on future global economics and politics. If Vostok Oil LLC can discover additional liquids in the next 12 to 18 months, the project will benefit greatly, however additional volumes coupled with the current resource base and production from the Vankor Cluster is unlikely to attain the desired production rates in 2024 and 2030.

***

Want to access upstream-related expert content? Try the Upstream Demo Hub free membership to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.