Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 05, 2023

By Catherine Robinson and Coralie Laurencin

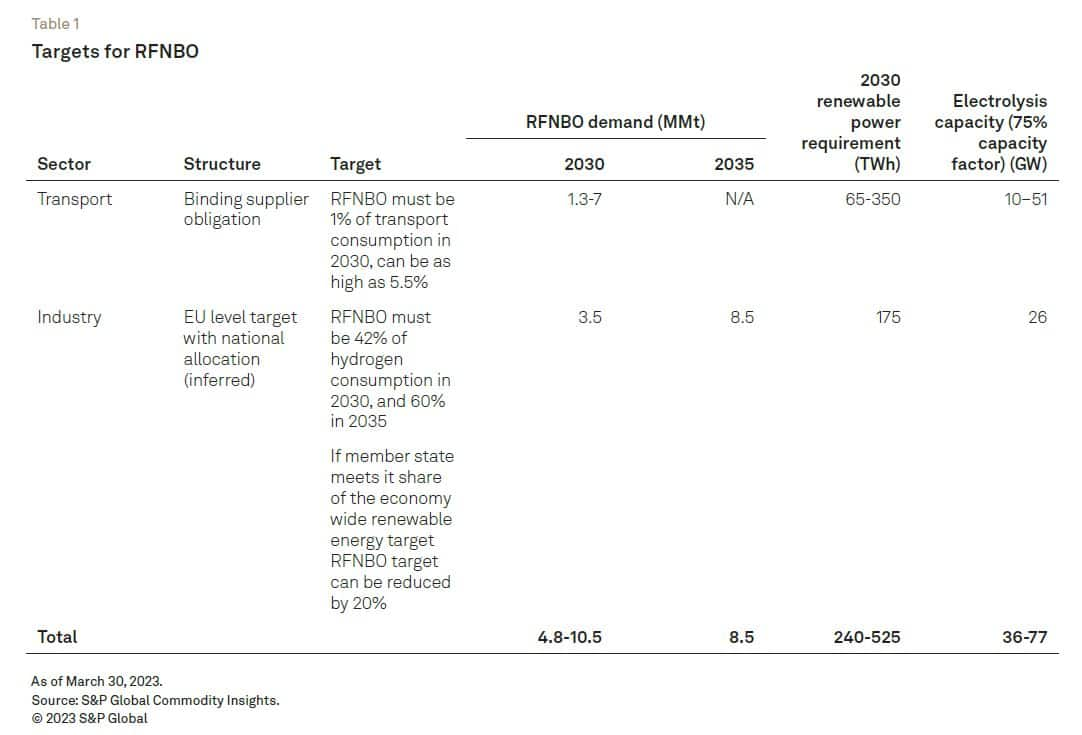

A provisional agreement has been reached by the European Council and European Parliament on the renewable energy directive (RED)*. At a high level, the European Union has committed to increasing the share of renewable energy in overall consumption to 42.5% in 2030. Underneath this high-level target are several subsector targets with two specifically related to hydrogen. Targets have been set for the use of renewable fuels of nonbiological origin (RFNBO) in transport in 2030 and industry in 2030 and 2035 (see Table 1). RFNBOs should account for:

The council's press release provides an overview of the agreed targets, but several important elements will only be fully clarified when the final text is released, which could be some time. The final text of the Emission Trading System (ETS) directive that was agreed in December has not yet been issued.

A binding 5.5% target obligation on suppliers for advanced biofuels and RFNBOs has been agreed, building on the targets in the 2018 RED II. Within this blended target, 1% of fuel supply must be RFNBO. We anticipate that the 2030 energy consumption in the transport sector in the European Union will be 369 million metric tons of oil equivalent (MMtoe). The targets therefore imply RFNBO demand of 3.7-20 MMtoe, equivalent to 1.3-7.1 MMt of renewable hydrogen, but how much is likely to be developed?

One way of estimating this is to consider the current use of hydrogen in refineries. Replacing this largely natural gas-based hydrogen with RFNBOs would be the lowest cost and simplest way of meeting the RFNBO target. The 1% target is equivalent to 53% of refinery hydrogen consumption. As such, the transport target can be met without requiring investment in hydrogen refueling infrastructure or onward conversion of RFNBO hydrogen to synthetic liquid fuels. However, challenges with accessing advanced biofuels mean that it is likely that the RFNBO share will be higher than 1%.

For the first time, the agreement creates a target for the use of RFNBOs in industry. There is very little detail in the press release on the implementation mechanism for the industrial target—this will come with the final draft. However, from reading previous versions, we assume that the agreement creates a target at the EU level, which is then allocated to the member states in a similar manner to the overall renewable consumption target. It is then the responsibility of the member state to design the implementation mechanism for their market.

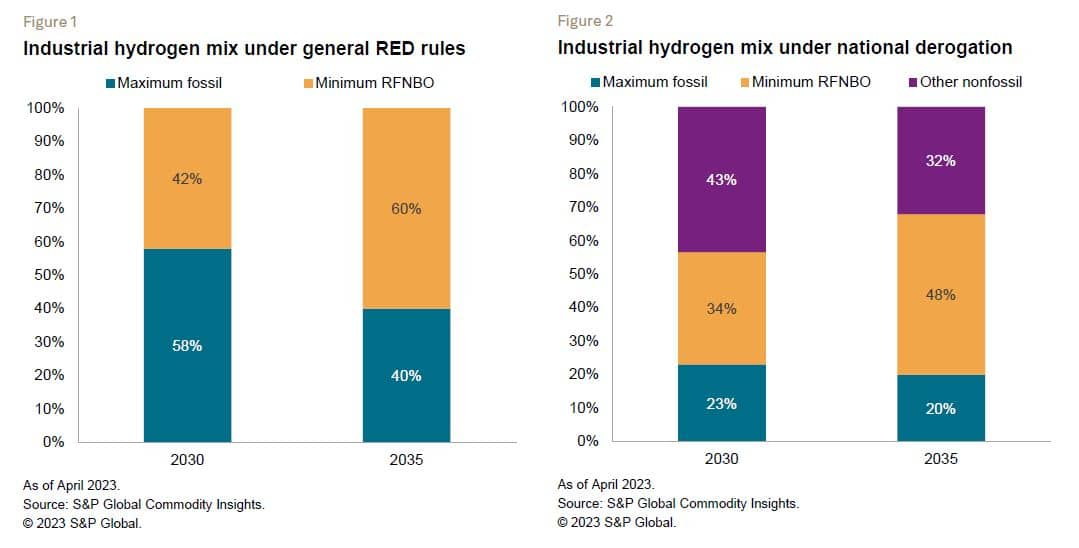

The headline targets that have been agreed are 42% in 2030 and 60% in 2035 (see Figure 1). This is in the middle of the range under discussion through the trialogue process. The European Parliament and the commission had proposed a 50% target, while the council sought a target of 35%. Based on the S&P Global Energy 2022 European Planning Case, this would imply RFNBO demand of 3.5 MMt in 2030 and 8.4 MMt in 2035.

Member states have the option to reduce their RFNBO target by 20% if two conditions are met:

If these conditions are met, then the RFNBO target reduces to 34% and 48% for 2030 and 2035, respectively (see Figure 2). Other non fossil forms of hydrogen therefore account for up to 43% of hydrogen consumption in 2030 and 32% in 2035.

This derogation creates the possibility of a role for hydrogen produced from nuclear power to replace some, but not all, of the hydrogen produced from renewables meeting the RFNBO criteria, which was a key objective for France. If France were to take advantage of the reduced 2030 RFNBO target, then 10 TWh (3%) of nuclear

electricity would be used for hydrogen production. However, France may struggle to take advantage of the derogation. France did not meet the 2020 renewable target (renewable share was 19% compared with a national obligation of 23%) and meeting the 2030 target will be similarly challenging. Rather than France, the country that may be able to take advantage of this derogation may be Finland.

The RFNBO demand implied by the RED II targets fall far short of the REPowerEU goals of 20 MMt of hydrogen by 2030, with 10 MMt produced domestically and 10 MMt imported. The European Hydrogen Bank Communication released on March 16 repeatedly referenced the 20 MMt figure as Europe's hydrogen target**. This discrepancy perhaps points to a tension between the commission and the council / parliament around the realism of the 20 MMt target.

Between 240-525 TWh of power generation and 36-77 GW of electrolysis would be required to supply the RFNBO demand implied from the new RED. This is equivalent to 20%-46% of current renewable production and 11%-24% of expected 2030 renewable production.

In our 2022 planning case, we assume domestic RFNBO production of 2 MMt. It should be noted that this outlook was developed prior to the publication of the Delegated Act and the agreement of the RED, and therefore it has higher shares of fossil-based hydrogen than would now be expected.

The question for domestic and international hydrogen developers as well as the European power market is the source of the renewable power required to meet the RFNBO target. With the publication of the Delegated Act in February 2023, the rules for electricity procurement for RFNBOs have been clarified***.3 For hydrogen production projects that commission prior to January 2028, there are no additionality requirements until January 2038 for the renewable power used, and for all projects temporal matching via a power purchase agreement (PPA) is monthly until January 2030. The document is awaiting approval from the council and the European Parliament, and although there has been some opposition, it is expected to be approved.

As a result, we now assume that most of the electricity used to produce RFNBOs will come from renewables that are already operational or under development and that electrolysis will operate at high levels of utilization. This mode of operation is characterized by S&P Global Energy as a "baseload" business model with the key element being the fact that the electrolysis operates at a higher capacity factor than the underlying renewables. In the "baseload" business model, we assume a 75% capacity factor.

The agreement between the council and the European Parliament is a very important milestone for the development of the European hydrogen market and may once again move Europe into a position of hydrogen leadership that it had lost following the adoption of the IRA.

Alone among major consuming markets, the European Union now has the outline of a legal framework to build demand. Combined with the European Hydrogen Bank, there is much more clarity on production support and minimum market size. Linking both ends of the chain should allow large-scale European projects to move forward.

The real spur, however, will come through the remainder of the year as more policy clarity is provided through:

* "Council and Parliament reach provisional deal on renewable energy directive." Council of the European Union. Retrieved April 2023 from https://www.consilium.europa.eu/en/press/press-releases/2023/03/30/council-and-parliament-reach-provisional-deal-on-renewable-energy-directive/.

** "Communication on the European Hydrogen Bank," Directorate-General for Energy. Retrieved April 2023 from https://energy.ec.europa.eu/publications/communication-european-hydrogen-bank_en.

*** See European hydrogen policy: Breaking the logjam? for detailed description of the requirements of the Delegated Act.

For more information on our hydrogen coverage, part of Clean Energy Technology service, please find the service page here, with supporting infromation on its research, deliverables, the value it delivers clients and how to request a demo to see it for yourself.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.