Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Oct 09, 2023

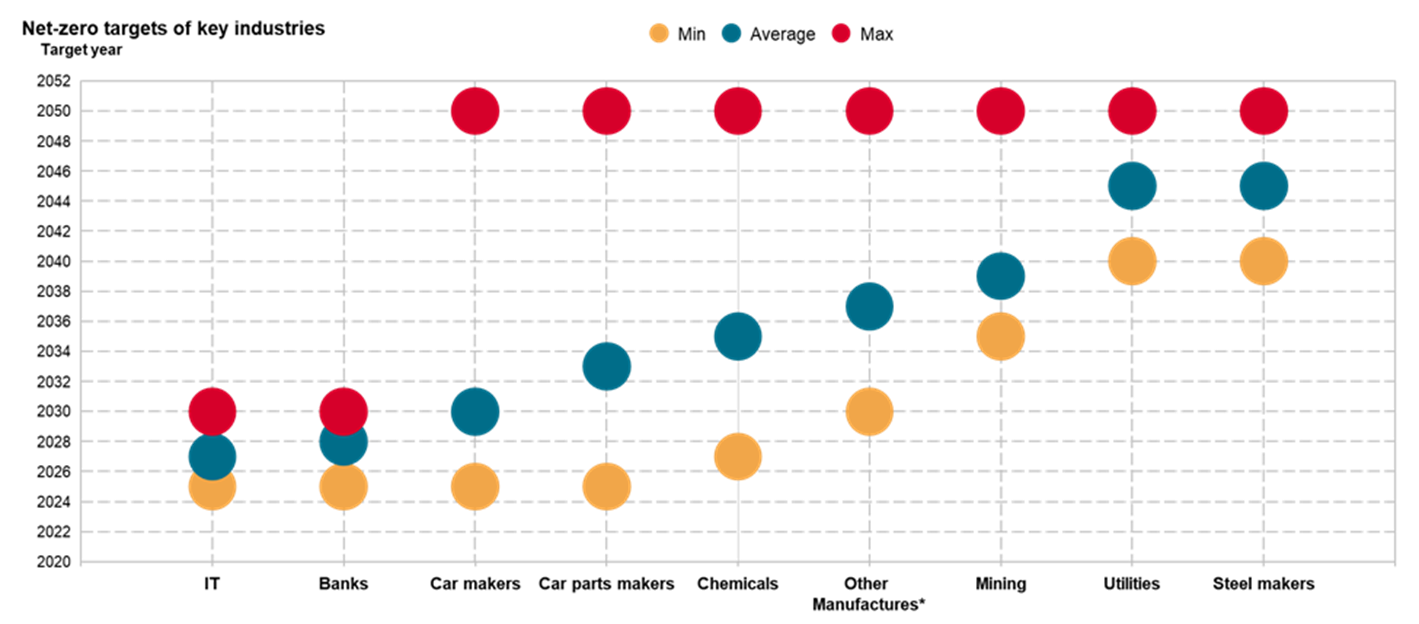

With the transport and mobility sector accounting for about 23% of global energy-related greenhouse gas emissions, behind the power generation industry with 42%, the entire sector is under heavy pressure to reduce its carbon footprint to comply with the Paris Climate Agreement. It is interesting that many car manufacturers have set ambitious targets for clean energy procurements, with commitments following the aggressive technology and financial sectors. A typical target year for 100% renewables and scope 2 targets have been set for 2030, compared with the mid- to late 2020s for the tech and banks. This should not come as a surprise, as automotive giants operate in the business-to-consumer segment, meaning they are under scrutiny from consumers, environmental organizations and local governments.

Data accessed September 2023

Source: RE100 Annual report 2022, Latest year refers to 2021; S&P Global Energy from companies' annual reports

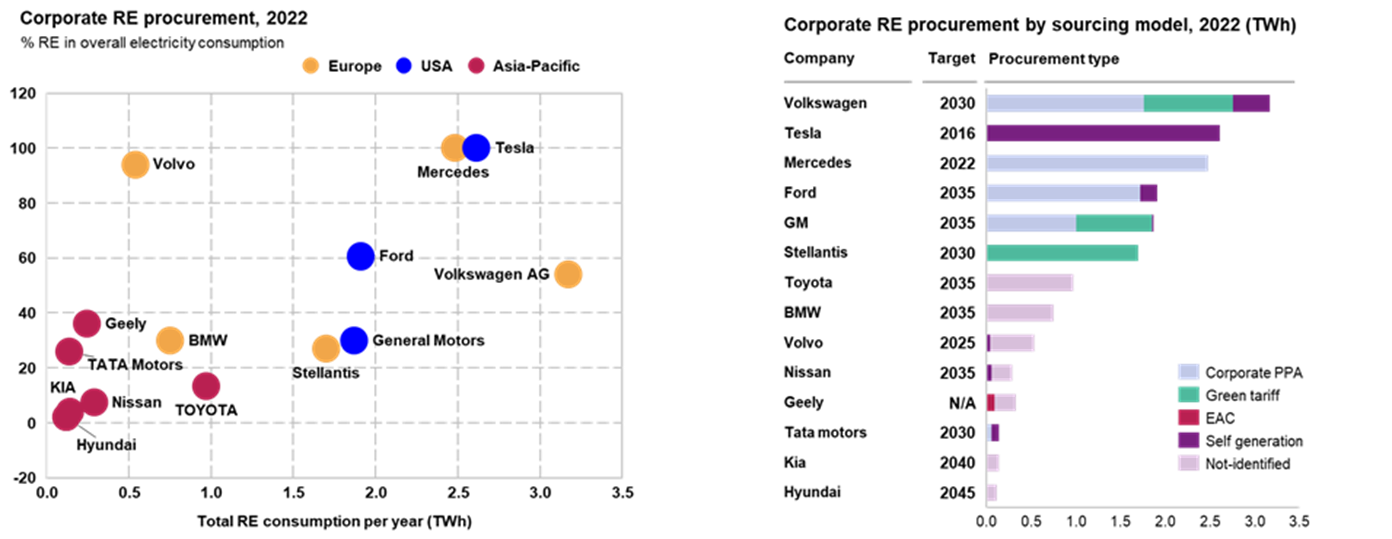

The rate of progress in green procurement across major car manufacturers appears to be closely dependent on the following factors: the renewable generation capacity in the region where manufacturing plants are present, the development of power purchase agreements and Energy Attribute Certificates markets in the region and the technological possibility of switching from hydrocarbons to electricity power in the production process. Automakers choose their strategic approach for energy transition taking these factors into account.

Data accessed September 2023

Source: S&P Global Energy from companies' annual reports

The analysis shown in the figure above on the left shows that US- and European-based companies have a significantly higher percentage of coverage for their electricity consumption by renewable energy compared with their counterparts in Asia-Pacific. That could be partially explained by the different electricity production mixes in the regions. For example, the share of renewable energy in the EU in 2022 amounted to 47%, while in Asia-Pacific it constitutes only 28%. Another factor is the relatively late start by Asian manufacturers to join net-zero initiatives. The companies in this region have just recently started developing a market for corporate procurement of renewable electricity.

Regarding the selection of tools for sourcing of green electricity, apart from Tesla Inc., which we will discuss in more detail later, the car manufacturers in the EU and US largely prefer PPAs, with green tariffs following. The automotive sector began to confidently gain momentum in the PPA market in North America and Europe. Its average annual growth in 2019-22 reached 50%, which makes it stand out compared with other manufacturing sectors.

Among the deals of note, in second quarter 2023, the Mercedes-Benz Group entered into a 10-year PPA contract with the Spanish utility Iberdrola SA, which entails the development of an offshore plant by 2026. In addition, this year, Mercedes in partnership with renewables developer UKA Umweltgerechte Kraftanlagen GmbH & Co. KG, built up 120 MW of wind power on site. Up to 2025, Mercedes has committed to making further investments to continue the expansion and installation of solar panels at more than 50 locations around the world. The installation of photovoltaic (PV) systems is already in progress at the German locations in Rastatt, Bremen, Hamburg, Kölleda and Sindelfingen.

Another very active player in the European PPA market is the French car manufacturer Renault SA. At the end of 2022, the company signed the largest direct contract in recent years with Voltaria Ltd. for the construction of 350 MW of solar generation in France.

The US market featured two major deals in 2022, both with the same supplier, DTE Energy Co., through DTE's MIGreenPower program in Michigan. Ford Motor Co. signed an agreement with DTE for the commissioning of 650 MW of new solar energy capacity in Michigan by 2025. The second big deal belongs to the European auto giant, Stellantis NV, who has approved a new project supply for renewable electricity in Michigan through the same DTE-MIGreenPower voluntary renewable energy program. The project supplies 400 MW of solar PV electricity guaranteed through a virtual PPA starting from 2026. Japan's Toyota Motor Corp. also entered into a virtual PPA with developer Savion LLC for 100 MW of solar generation in first quarter 2023 in the US.

As for Tesla, it is rather difficult to compare its renewable energy sourcing approach with counterparts, since from early days, the company`s development of electric vehicles production capacity went hand in hand with the expansion of its carbon-free renewable energy generation fleet. As of the end of 2021, Tesla had installed almost 4.0 GW of solar capacity and cumulatively generated more than 20.8 TWh of emissions-free electricity. This is eight times more energy generated than the total electricity Tesla has used to run all its factories.

There are a few factors why a company may prefer a PPA. For one, PPAs promote the development of the renewable industry by ensuring capacity "additionality". They can also hedge power price risks. In addition, it is interesting to note the choice of physical PPAs and on-site generation, a synergetic effect from cooperation with developers, since automakers do not have the appropriate expertise in construction works of generating capacity. With regards to selection of technologies, there does not seem to be a clear choice, as it falls on the specifics of the region where the capacity factor of solar or wind is higher, as well as power system balancing constraints.

Learn more about our clean energy procurement service.

Danylo Babkov is a low-carbon electricity market analyst at S&P Global Energy.

Posted 9 October 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.