Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 05, 2024

By Ford Tanner and Pedro Martinez

Since taking office in December 2023, the libertarian administration of President Javier Milei has achieved progress in its effort to unwind the economic crisis inherited from the previous government. President Milei's corrective measures have bolstered Argentina's fiscal accounts, reduced the pace of inflation growth, increased international reserves, and lowered the parallel exchange rate. Milei's initial results have won praise from the International Monetary Fund, increasing the likelihood of critical financial assistance from the organization. On March 15, S&P Global Ratings raised its local currency sovereign credit ratings and its long-term foreign currency sovereign credit rating for Argentina.

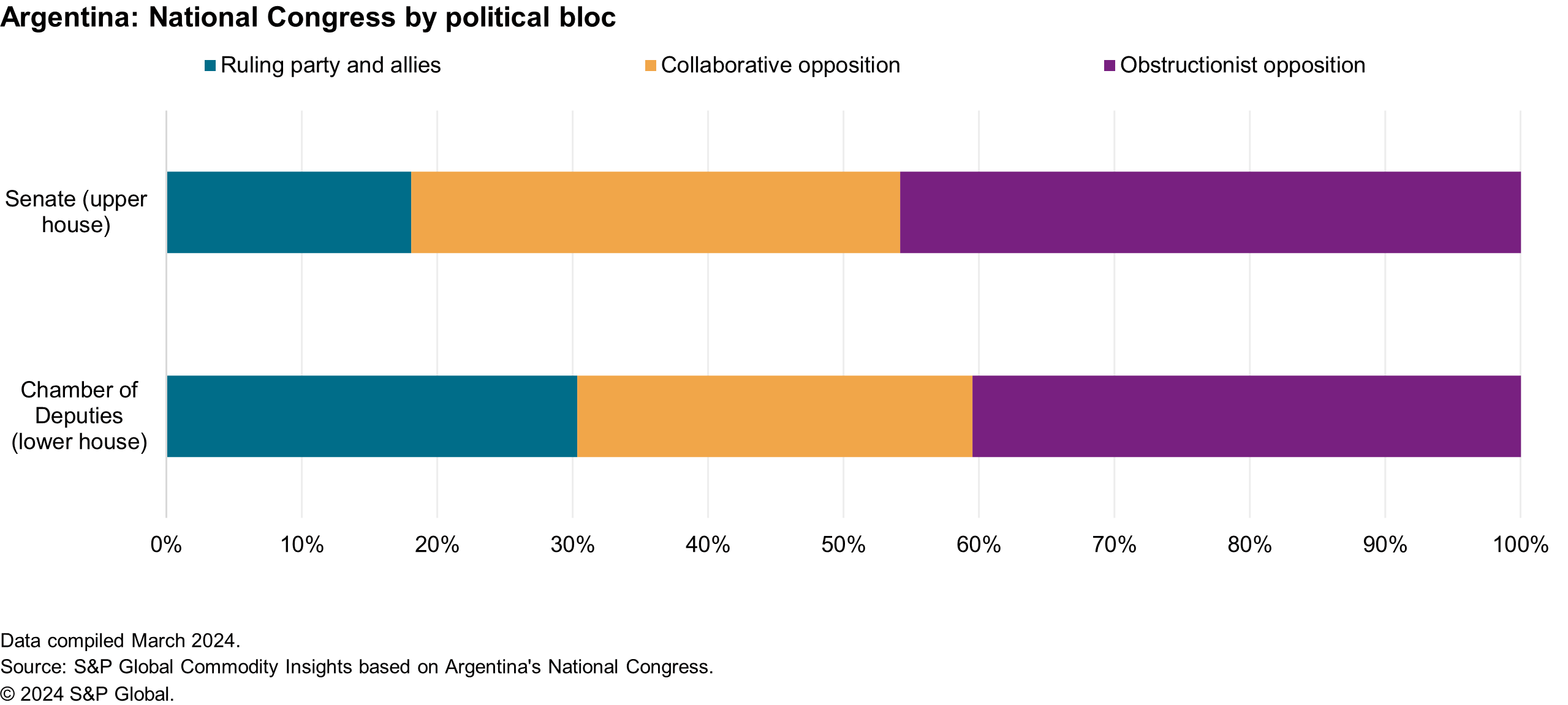

However, Milei's lack of a strong political base in Congress has curbed the scope and speed of additional reforms, forcing him to seek compromises to ensure governability (see chart below). The president's austerity programs have also raised Argentina's poverty rate and fueled protests among unionized workers. Although social unrest poses a major risk to the government's reform plan and political stability, recent public opinion surveys indicate that about half of respondents are willing to give the administration until mid-year to improve living standards.

Argentina's economy is likely to be on firmer footing in the next couple of months because of the agricultural harvest and increased export earnings. A brightening economic outlook is expected to boost political support for Milei's reform agenda from members of the so-called collaborative opposition - i.e., politicians who are not affiliated with the president's coalition but are willing to cooperate with his administration. The Milei administration is likely to unwind capital controls, remove export restrictions, and unify the country's various exchange rates toward the end of the year as the inflation rate falls.

Meanwhile, the authorities are expanding upstream investment opportunities through provincial bid rounds and asset sales from national oil company (NOC) YPF. The NOC is seeking investment for more than 50 conventional onshore blocks, which represent 60% of conventional oil production and 40% of conventional gas production. For offshore E&P, which is under the purview of the federal government, a deepwater bid round would be expected in 2025 if drilling from the Argerich-1 new-field wildcat well in Argentina's CAN-100 block yields positive results this year. The consortium of Equinor, YPF and Shell is drilling Argerich-1 to see if it can replicate the exploration success achieved in areas with analogous geology offshore Namibia.

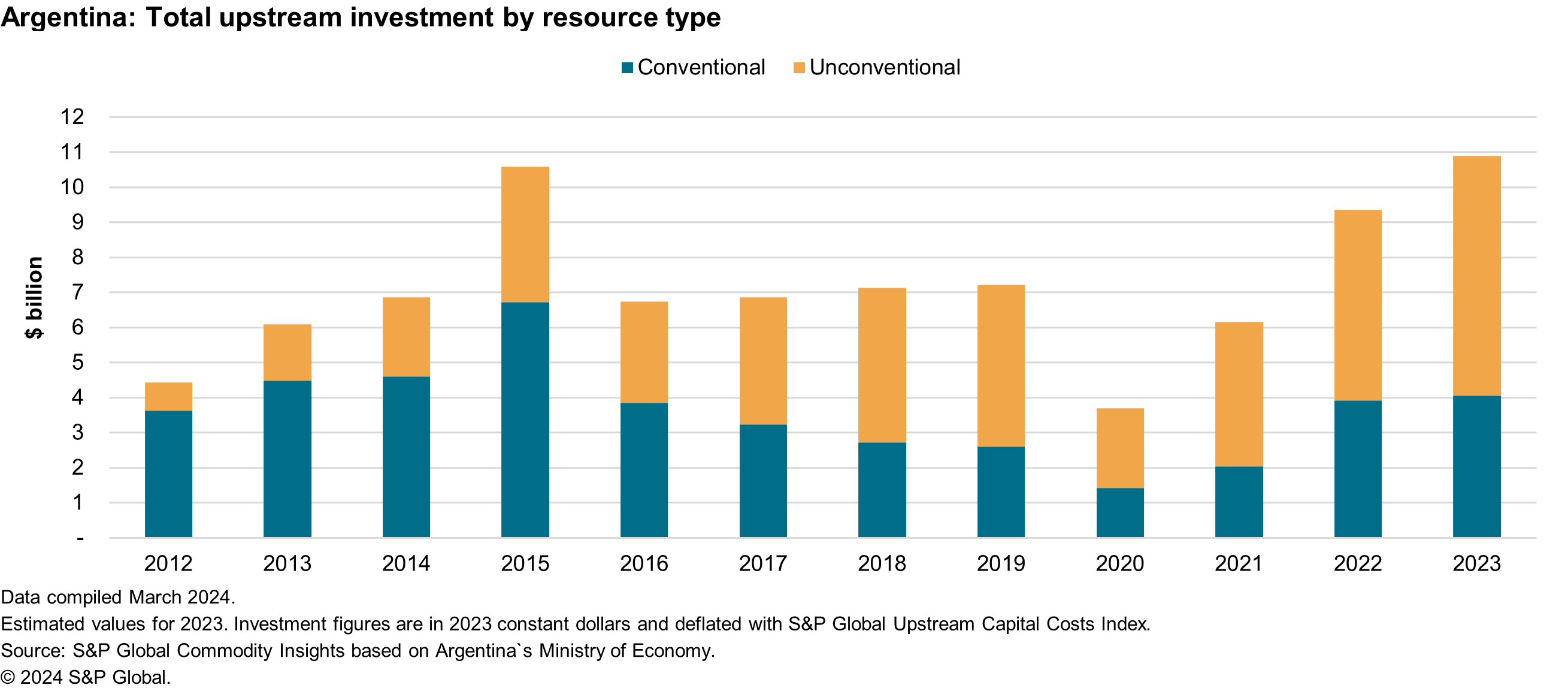

The removal of capital and trade restrictions and the expansion of oil and gas opportunities are likely to catalyze additional upstream capital inflows. In 2023, Argentina is estimated to have received record upstream investment of approximately $11 billion, reflecting the subsurface attractiveness of the country's unconventional hydrocarbon reservoirs and a series of piecemeal incentives enacted by successive governments to shield the E&P sector from economic volatility (see chart below).

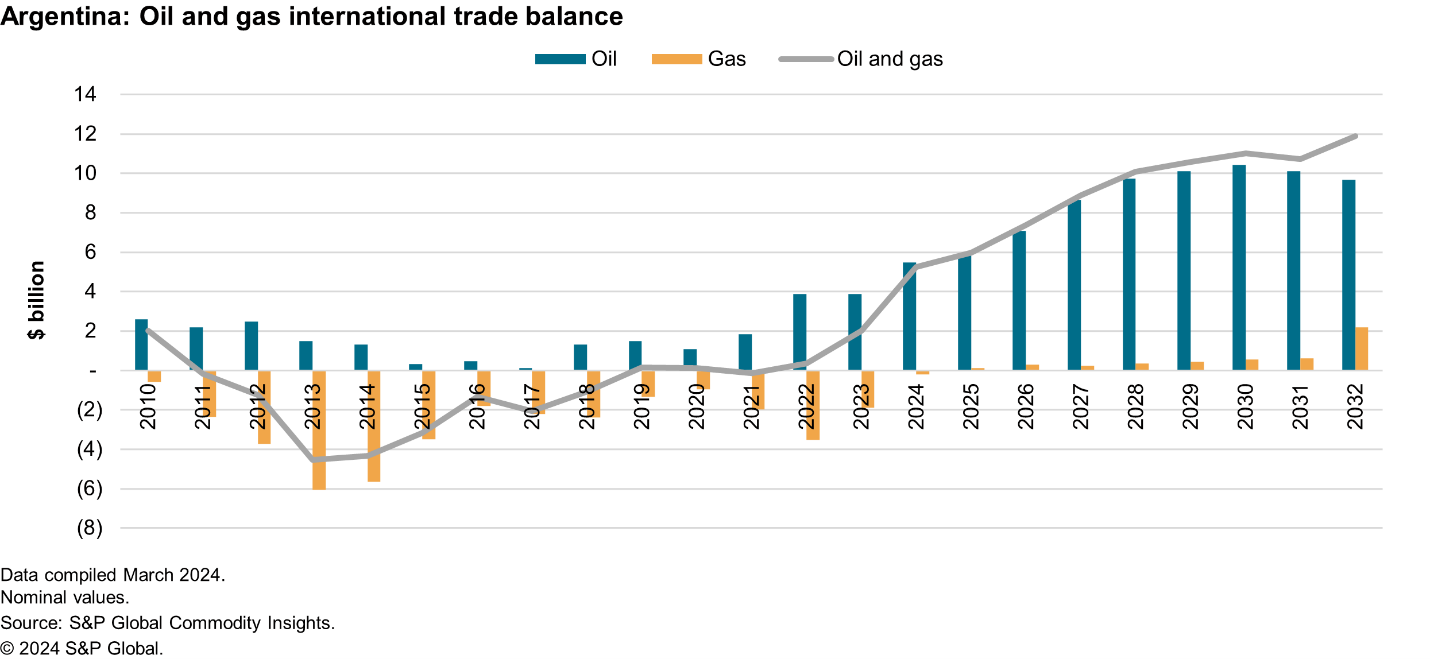

Robust upstream investment and the expansion of pipelines and other infrastructure will fuel continued growth in oil and gas production and exports, further strengthening the economy. S&P Global Energy expects that Argentina's oil and gas trade surplus will exceed $10 billion by the end of this decade, marking a major shift from the past decade during which gas imports resulted in a negative overall balance for most years (see chart below).

In the meantime, the Milei administration is pushing to enshrine pro-market oil and gas reforms into law to foster enduring policy certainty for investors. A political consensus between the federal government and the provinces to continue efforts to attract private investment into the upstream sector is likely to facilitate Argentina's long-term hydrocarbon production growth.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.