Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Dec 02, 2022

By Jaka Hardiwinangun, Joaquim Azevedo, and Stephanie Vargas Ortega

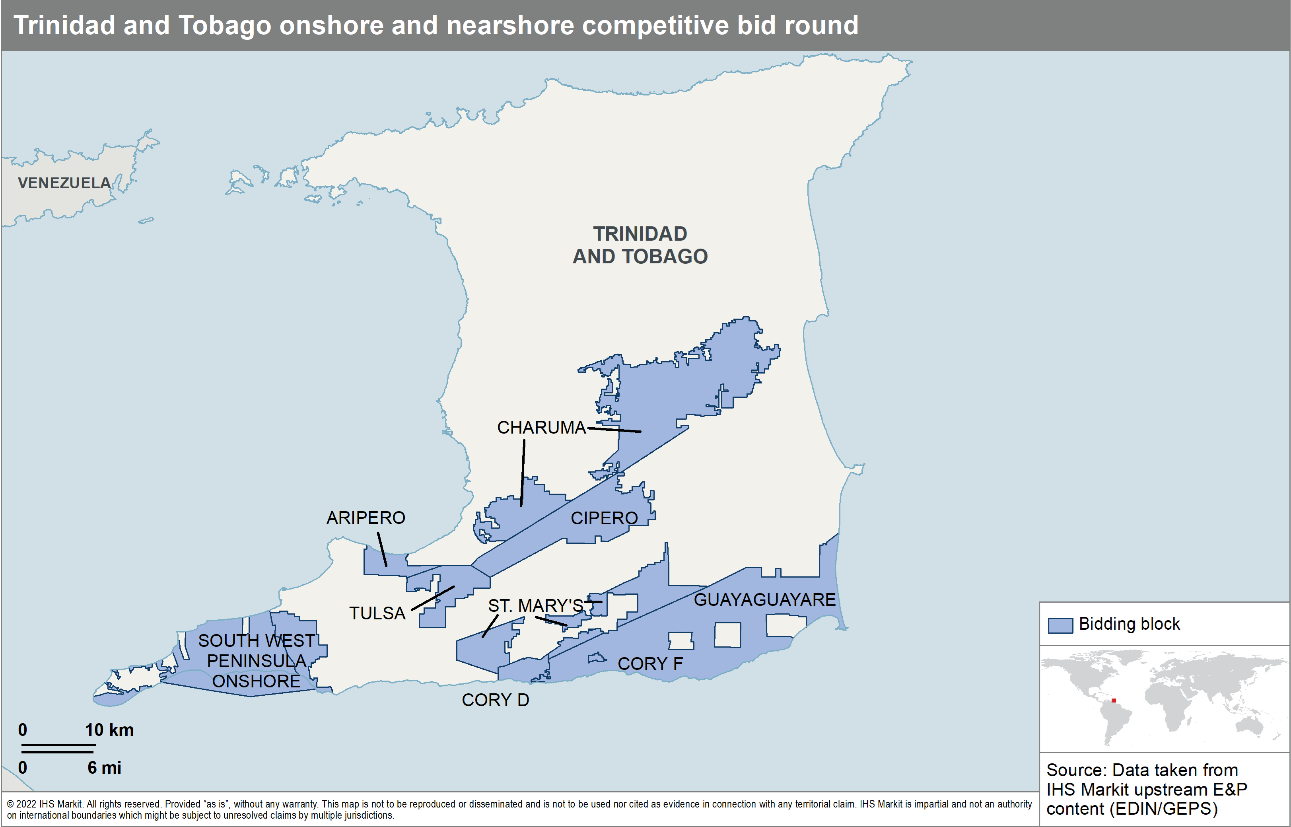

The government of Trinidad and Tobago (T&T) issued an invitation to companies to participate in its 2022 Onshore and Nearshore Competitive Bid Round in July 2022 with bid submissions due in January 2023. It closed its last onshore bid round in 2013, so the nation is intent upon seeking new investments in upstream oil and gas amidst the combined pressure of declining capital expenditure by operators that have been protecting cashflow, and upstream underinvestment due to the global energy transition.

The bid round contains eleven blocks within the mature Trinidad Basin, with ten onshore blocks in central to southern onshore acreage of the island of Trinidad and one block located off the southern coast. About 13 Bboe (billion barrels of oil equivalent) of recoverable resources have been found in the basin, of which over 60% is gas. The Trinidad Basin has proven its potential over time, especially offshore, where 80% of the total recoverable resources have been found. The bidding blocks are expected to target medium crude >25° API oil, as well as gas and condensates from Cretaceous to Quaternary-age reservoirs. The average field size, based on recoverable 2P resources in onshore T&T is close to 40 MMboe; in contrast to 130 MMboe when considering T&T offshore fields.

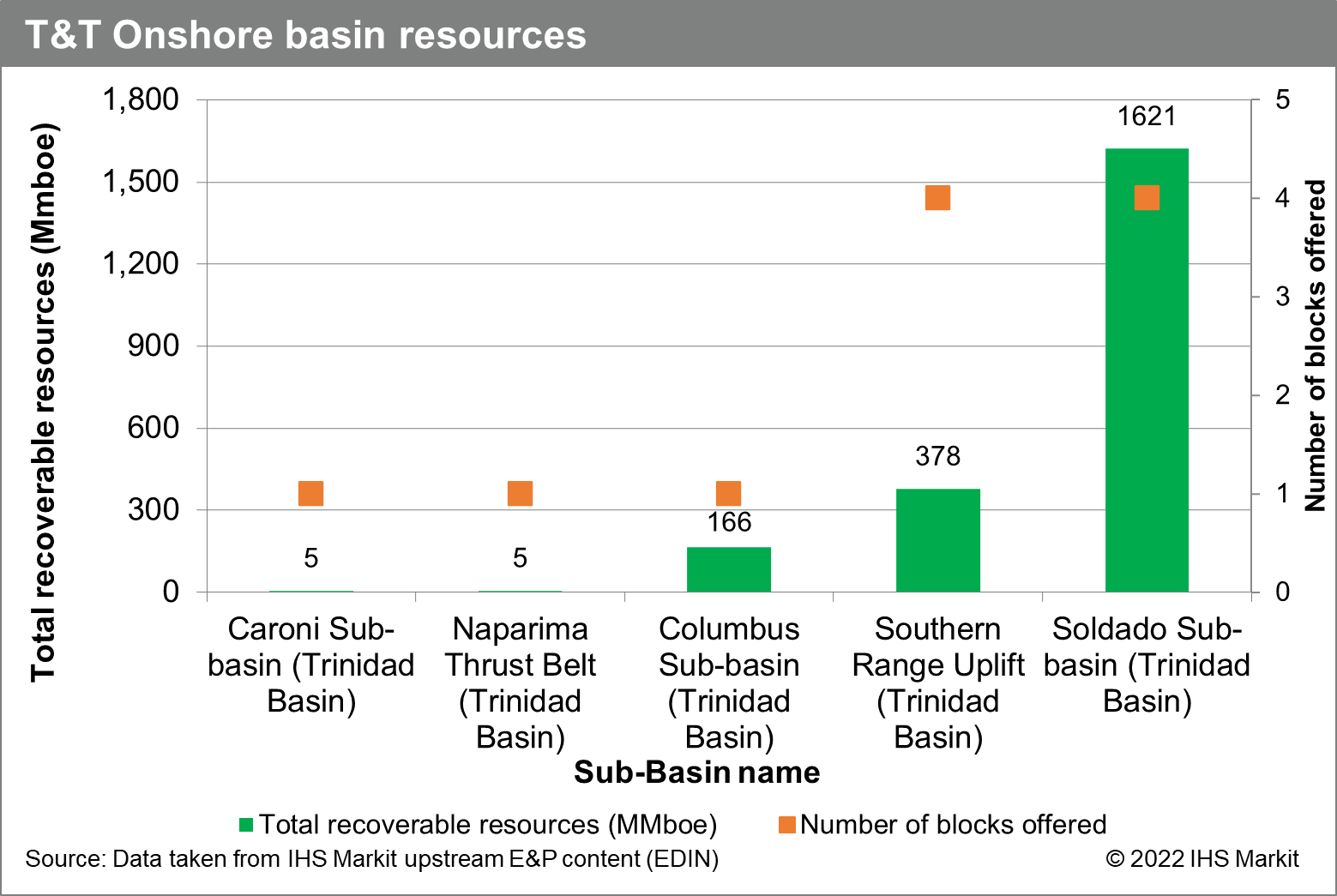

The Trinidad Basin is subdivided into five sub-basins: The Soldado sub-basin, the largest sub-basin onshore; Columbus sub-basin, the largest offshore sub-basin; followed by Southern Range Uplift sub-basin, Naparima Thrust Belt sub-basin, and Caroni sub-basin.

In the last five years, only six fields have been discovered onshore. These fields have an average recoverable 2P resource of 18 MMboe, which represents the 50th percentile in the total distribution for currently producing fields onshore T&T. The majority of the new discoveries are situated within the Ortoire block, in the Soldado sub-basin, and account for 90% of the reserves discovered in this period of time.

The T&T 2022 Onshore and Nearshore bid round is a concession regime, under the 2022 Exploration and Production license model contract. This fiscal term has some standard concession regime fiscal terms like royalties, bonus and fees, as well as upstream specific corporate income taxes (named Petroleum Profit tax and Unemployment Levy) and windfall taxes (Supplemental Petroleum tax).

Specifically, royalties are charged at a fixed rate of 12.5% over gross revenue, while the Supplemental Petroleum Tax is a step function that is triggered when oil prices are over USD 50/bbl, charging a minimum of 18% over the oil gross revenue (reduced by the royalties), and going up to 40% when oil prices are USD 200/bbl or higher. The T&T government is looking to review the Supplemental Petroleum Tax for small onshore asset, starting 2023, with an increase in the price threshold. The proposed change has yet to be turned into law as an amendment to the Petroleum Taxes Act Chap 62:01.

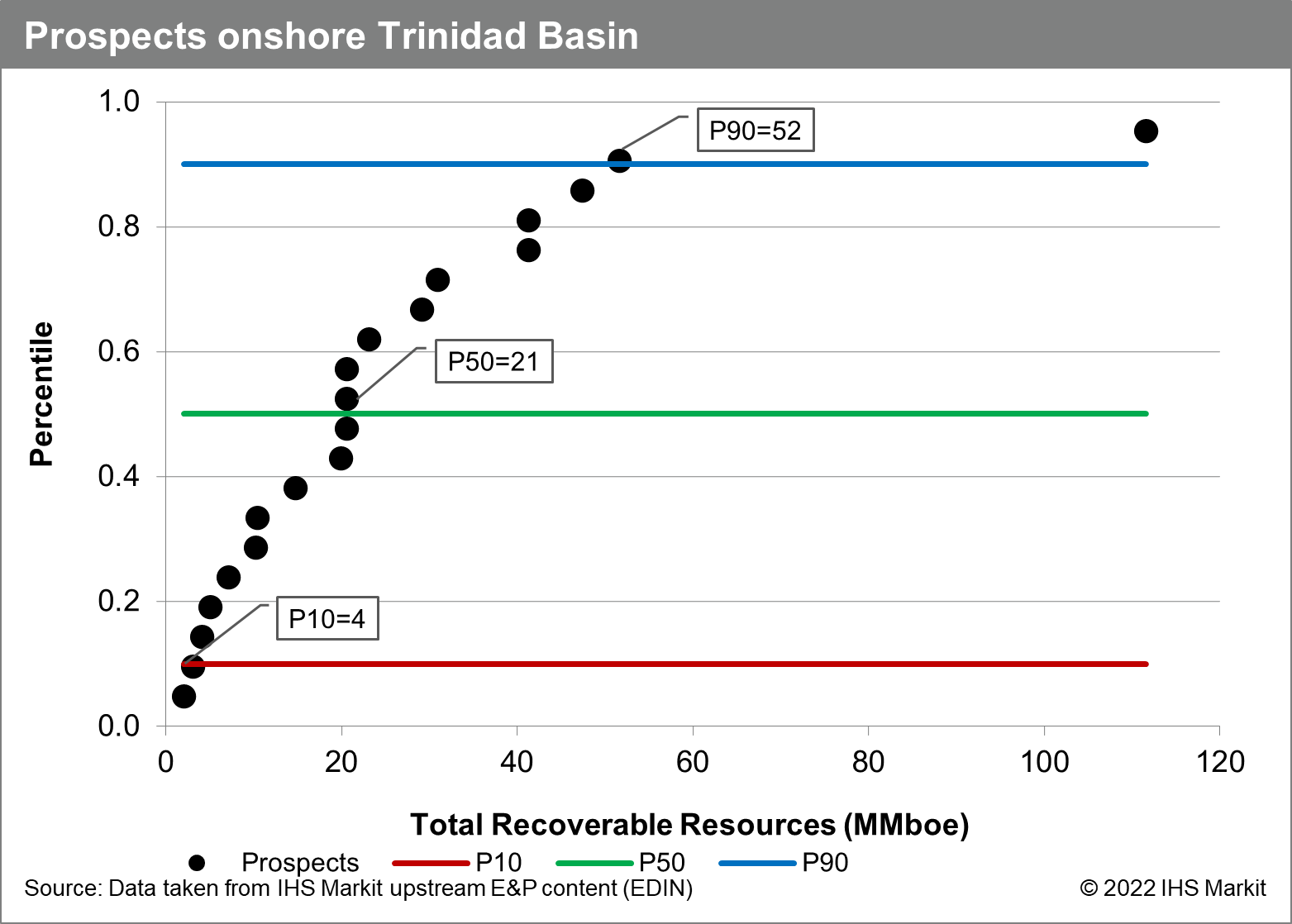

S&P Global has identified several prospects within its comprehensive global database, where blocks have been offered in the Trinidad sub-basins. A total of 19 prospects with Original Hydrocarbon in Place ranging from 10 to 540 MMboe have been used for a hypothetical economic analysis of a type-prospect onshore.

S&P Global Vantage has calculated the net present value (NPV) for the hypothetical development of a type-prospect located in the South West Peninsula Onshore block with an oil price ranging from USD 65/bbl to USD 125/bbl. Considering a starting date in 2028 and recoverable resources of 21 million barrel of oil equivalent (50th percentile), the NPV discounted at 10% could range from negative USD 9 million to USD 98 million .

Taking into account the field size distribution of expected resources from prospects, required investment and valuation results, smaller independent oil companies (IOC) could be more interested in participating in this bid round. Especially small IOCs with assets already producing in the Trinidad Basin which could benefit from facilities already in place to handle production.

There remain opportunities to increase oil and gas production from onshore assets based on the economic viability of the type-prospect in the medium and high oil price scenarios (USD 95/bbl and USD 125/bbl). Nevertheless, this could be a challenge for possible bidders, in view of the uncertainty surrounding commodity prices nowadays.

Economic valuation relies on forecasted commodity prices and biddable signature bonus, given that T&T Royalty/Tax offers a stricter concession fiscal regime compared to some other Latin American oil and gas peers. The ongoing discussion about a change in supplemental petroleum tax could prove to be an additional factor to increase the value of the offered blocks. Potential bidders must be aware of economic sensitivity on critical variables such as recoverable reserves, production forecasts and capital expenses.

***

Want to access upstream-related expert content? Try the Upstream Demo Hub free membership to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.