Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Nov 21, 2022

By Hui Min Foong

View a full list of upcoming topics in our Southeast Asia Energy Transition series.

Governments across Southeast Asia are promoting the shift from internal combustion engine (ICE) vehicles to electric vehicles (EVs). Thailand aims for 30% of new vehicles to be electric by 2030, Singapore for 100% cleaner-energy vehicles by 2040, and Indonesia for 100% of new motorcycles and cars to be EVs from 2050. As governments continue to announce new targets and solidify their EV road maps, the future of electric mobility in Southeast Asia is coming into focus.

The adoption of EVs introduces a new power demand growth sector that has the potential to reshape load profiles. With the growth of renewables, incentives are needed to sync EV charging with peak renewable generation timings. While the pace of change will depend on policy support and individual market characteristics, the overarching trend of gradual vehicle electrification is clear.

The rise of electric vehicles (EVs) impacts power systems in two main ways—introducing a new power demand growth sector and providing a potential load-balancing effect. The rate of EV growth directly determines the scale and pace of these power system impacts.

The decision to select EVs over internal combustion engine (ICE) vehicles is influenced by many factors, such as policy support, technology costs, price parity between ICE vehicles and EVs, and overall country-level decarbonization efforts. Policy measures can include both pull and push factors, such as subsidies or other fiscal incentives for EVs or outright ICE vehicle bans. Shifting the EV adoption curve forward or back by several years can drastically impact the size of power demand from EVs in a given year, especially during the rapid growth stage along the adoption s-curve of new technologies.

Electric motorcycles will take the lead in markets like Indonesia and Vietnam, where motorcycle ownership far exceeds car ownership. Compared with markets with higher car ownership, markets with high motorcycle ownership could experience a faster switch to EVs and therefore see an impact to power systems in the nearer future.

Electric motorcycles have smaller battery sizes compared with electric cars, making charging quicker and more convenient. The simple fact that the batteries are smaller in electric motorcycles reduces the major stumbling blocks of excessive battery prices and charging times faced by EVs.

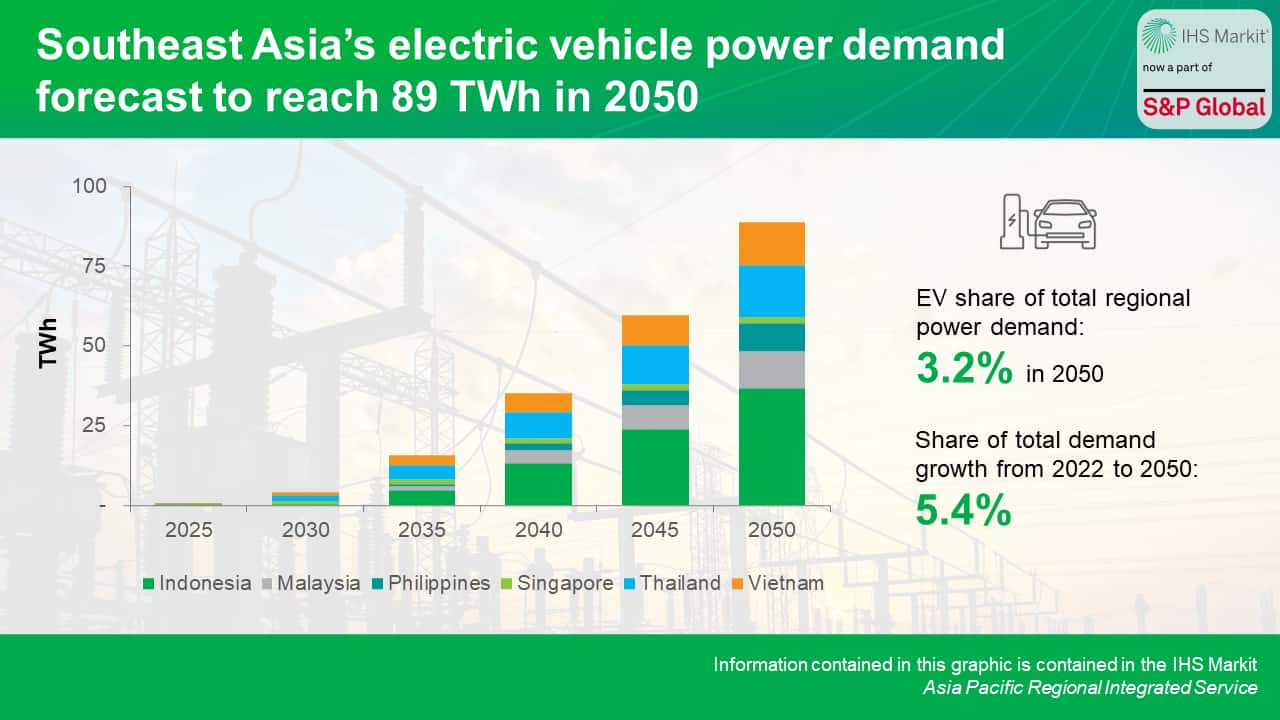

EVs present an emerging demand subsector forecast to reach 89 TWh in the region by 2050, from a negligible amount today. Under current conditions, the share of EVs in the region is forecast to reach just about 27% by 2050, following an s-curve adoption pattern. There is headroom for total EV power demand to be even higher depending on the rate of EV adoption, as mentioned earlier. While higher EV penetration is forecast in markets like Singapore and Thailand, Indonesia's EV power demand retains the largest share in the forecast owing to the sheer size of the market and vehicle population.

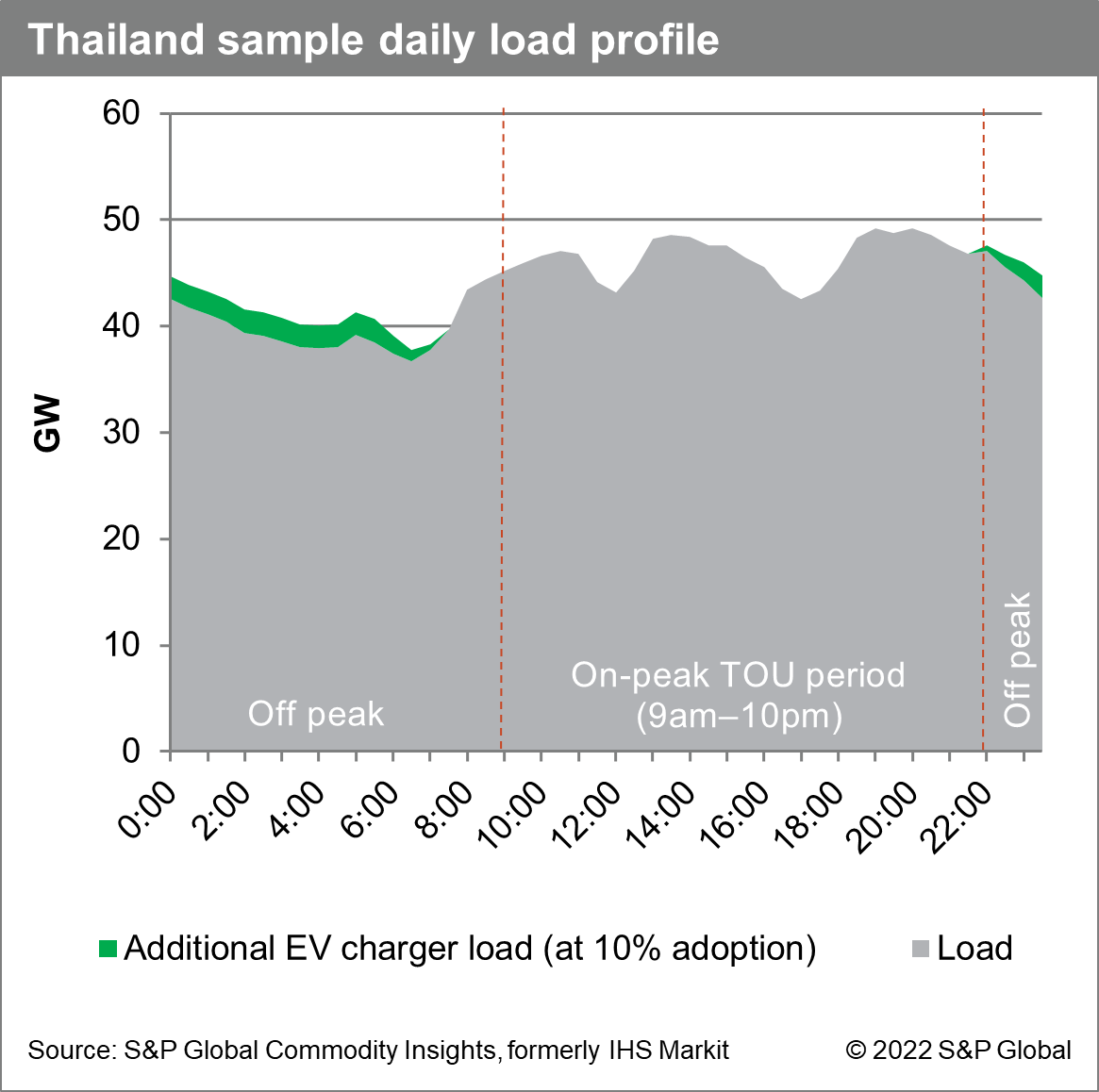

EV charging has the potential to change the shapes of load profiles. Overnight charging results in higher load at night and may be the preferred option, especially in markets like Thailand where off-peak nighttime power tariffs are about half that of on-peak prices. Higher loads at night and a flatter load profile can reduce the amount of ramping up and down required and hence results in a higher overall utilization rate of power plants.

The extent of potential price reductions from using off-peak pricing is significant—in Thailand, TOU tariffs are 2.6 baht per kWh off peak versus 5.8 baht per kWh peak for residential use under 12 kV. This means that charging an electric car could cost 5,200 baht instead of 11,600 baht (US$148 versus US$330) each year, on an average annual power consumption level of 2,000 kWh.

Solar and wind are forecast to reach 33% of total generation in Southeast Asia by 2050. As renewable penetration grows, the available power supply at any given hour will be increasingly influenced by the level of solar irradiance or wind speed at the time. These environmental conditions vary on an hourly basis and also more generally on a seasonal month-to-month basis. Without optimization systems in place, this variability will likely result in a mismatch between peak EV charging times and peak renewable power output timings. Emissions reductions from EVs can only be maximized if they are charged on renewable power. Hence, price incentives are needed to align EV charging periods with peak renewable generation timings, if EVs are to run on cleaner energy.

This post is an abstract of a featured topic from the S&P Global Energy series on energy transition in Southeast Asia, where we deep dive into various aspects of the region's power sector energy transition.

Sign up for updates of strategic reports that will answer some of the thorniest questions on energy transition in the region, drilling deeper into each of the markets we follow.

Learn more about our Asia-Pacific energy research.

Hui Min Foong is a research analyst in the Gas, Power and Climate Solutions team, focusing on Southeast Asia power and renewables.

Posted 21 November 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.