Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 08, 2024

By Celina Hwang and Kevin Birn

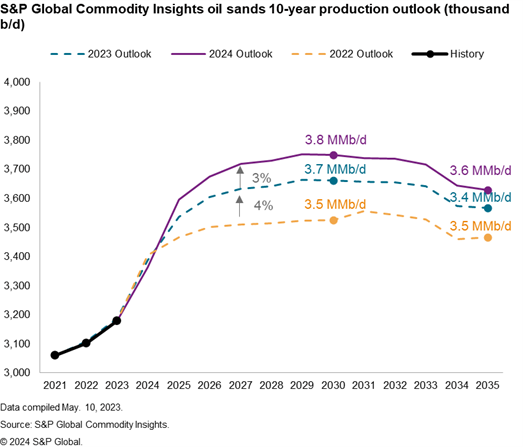

S&P Global Energy expects Canadian oil sands production to approach 3.8 million b/d by the end of the decade. This is 90,000 b/d, or 3% higher than our prior outlook and marks the second upward revision in recent years. This also marks the first time we have published our outlook to 2035 where a modest decline begins to emerge from older operations.

The increase in our outlook comes despite concerns raised by the sector that the advancing Canadian federal oil and gas emissions cap could negatively impact production. This seeming contradiction is the result of the industry's ongoing focus on maximizing output from existing assets through investments in optimization and efficiency. These projects tend to be capital efficient, quicker to complete and often contribute to greater reliability and lower cost as well as higher output. The extended period of comparatively higher oil prices has strengthened producer balance sheets and has begun to open the door to some more ambitious projects, still primarily leveraging existing infrastructure. Over the next few years, several projects should grow 20,000-50,000 b/d, either through optimizations, efficiency gains or commercialization of small-scale assets.

Despite higher oil prices, larger-scale projects with longer lead times and higher price tags have not returned. And the potential for further optimizations among producing assets exists but is not infinite. Optimizations are also harder to foresee because many are the result of learning by doing. But on balance we continue to anticipate near-term upside potential through these smaller-scale investments in optimization.

Over the longer term, there are headwinds that contribute to the plateauing of oil sands output toward the end of the decade. Closer to 2030, the inventory of potential optimizations may slow while the uncertainty posed by the proposed Federal oil and gas emissions cap is expected to add hesitation to larger scale production-focused investments. Industry is counting on large-scale carbon capture and storage (CCS) projects to help abate their emissions, but investment in CCS has the potential to compete with larger investments in incremental oil production from a capital allocation as well as project execution perspective.

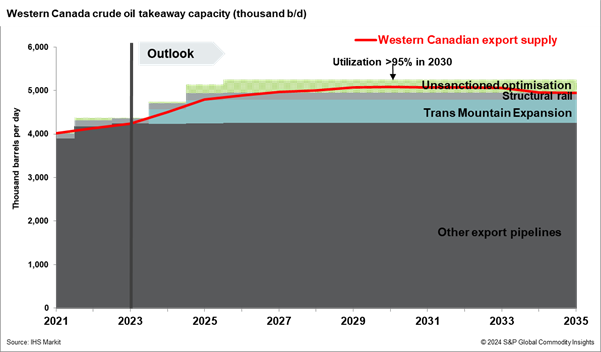

Meanwhile, higher output is raising demand for export pipeline capacity. Despite the recent completion of the Trans Mountain Expansion project (TMX), additional capacity will still be needed, likely via expansion or optimization of the existing pipeline system. Otherwise, regional oil price volatility could reemerge. By early 2026, we forecast the need for further export capacity to ensure that the system remains balanced on pipeline economics. The irony is that what was once expected to be a new age of price stability in Western Canada may not be achieved with TMX, and the region may still face a future of seasonal price volatility. The industry's ability to add new pipeline capacity has become increasingly difficult, and even harder to depend upon, which adds additional uncertainty for larger-scale oil production projects in Western Canada.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.