Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 02, 2023

By Ankita Chauhan

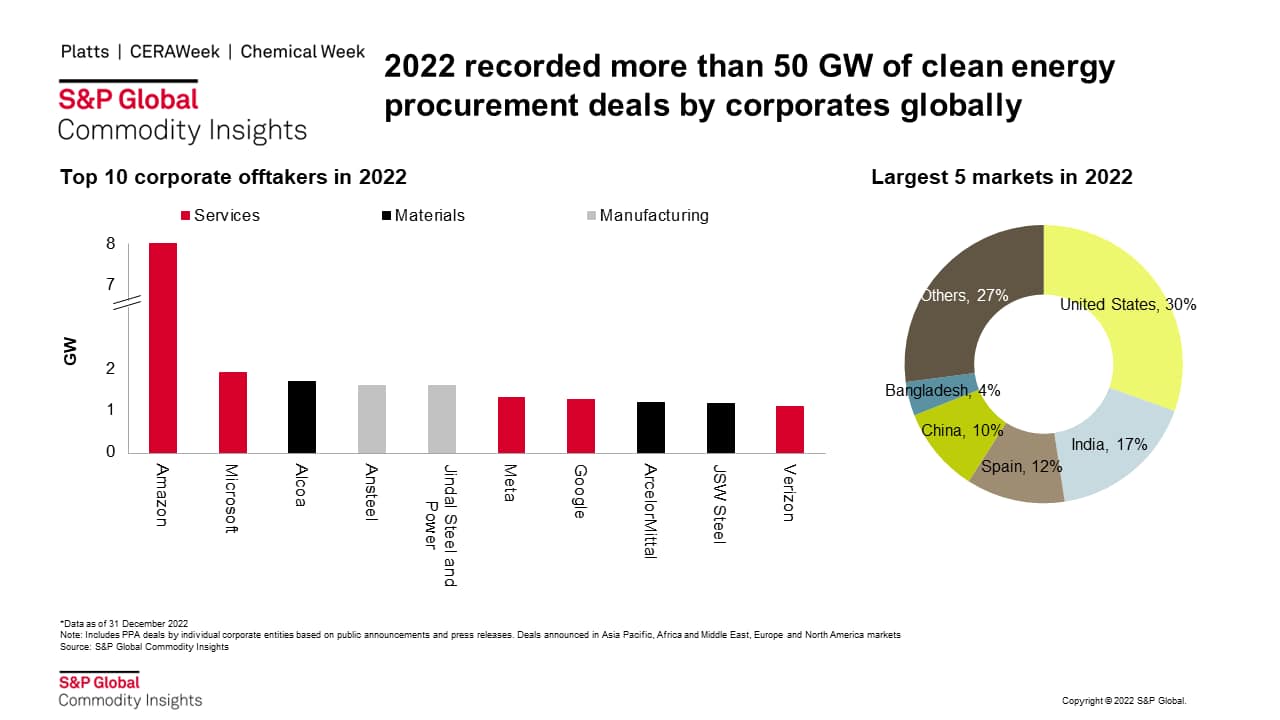

Corporate clean energy procurement (CEP) announcements hit an all time high in 2022 with more than 51 GW of deals, growing by 60% year on year. During 2017 to 2022, more than 142 GW of corporate renewable deals have been recorded with roughly half of them coming from North America. In 2022, however, Asia Pacific emerges as the largest region with 38% of the total CEP deals recorded, with North America as the close second with 31% share. Solar constitutes half of the CEP deals in 2022, followed by onshore wind and hybrid renewable projects with 22% share each and rest from others.

While the growth of CPPAs announced in North America remains static in 2022 year-on-year, other regions show growth with Asia Pacific growing three times the volumes in the same period. The growth in Asia is driven by policy and market reforms in key markets to allow corporate renewable procurement and growing corporate demand for renewables in industrial segments including manufacturing, materials, and services.

More than 400 companies have announced 100% renewable procurement targets globally with two-thirds of the companies announcing such targets are headquartered in Asia Pacific. About half of the companies announcing 100% renewable targets in 2022 came from manufacturing sector including majority 80% headquartered in Asian markets including South Korea, Taiwan, and Japan.

United States, India, Spain, mainland China and Bangladesh are the five largest markets for corporate PPAs in 2022. In India, demand is mainly driven through open access regulations with corporations entering direct PPAs with renewable developers. On the other hand, green power trading and green electricity certificate (GEC) trading continued to grow the CEP market in mainland China. Bangladesh which enters the largest five markets in 2022 for the first time on the back of an announcement from apparel sector to install 2 GW of on-site solar projects. This announcement reflects the rising corporate demand for renewable energy to meet sustainability targets, as well as procure cheap electricity from solar in view of rising energy prices.

S&P Global is tracking more than 60 markets for renewable procurement by more than 1,700 corporations globally. Service sector including the technology giants such as Amazon, Meta, Google, and Microsoft have played a significant role in renewable procurement historically, accounting for over 40% of the contracted capacity during 2017-22. But the pool of buyers also continues to diversify, with manufacturing, materials, and retail sectors accounting for an increasing share of contracts signed in recent years.

Amazon has emerged as the largest off taker of renewable energy in 2022 with about 8 GW of PPAs announced across different regions. While the company announced the highest PPA capacity of over 5 GW in its home market in the United States, it signed deals in several new and emerging markets to procure renewable energy in 2022. These new markets include Brazil, India, and Indonesia where Amazon has contracted a total of 1 GW of renewable energy capacity.

Second largest corporate in 2022, Microsoft Corporation, also comes from the services sector with more than 1.5 GW of new CEP deals taking its total renewable procurement to about 5 GW between 2017-2022. Microsoft also has multinational presence with CEP deals in at least 5 different markets announced in 2022 including Ireland, Canada, and India.

There are key regulatory reforms in several emerging markets leading the way enabling corporate PPAs. Among these reforms include -

To learn more about our corporate renewable procurement research, visit our Clean Energy Procurement page.

Ankita Chauhan is an associate director at S&P Global Energy, focuses on renewable energy research for South Asian markets and global clean energy procurement.

Posted on 2 March 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.