Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Dec 13, 2023

By Diego Ortiz

The importance of onshore wind technology cannot be overstated in the context of Europe's climate objectives for 2030 and its decarbonization ambitions for 2050. Many of the initial wind energy projects in Europe, having reached the end of their subsidy contracts or getting close to their technical lifetime, present an opportunity for repowering. This process delivers increased renewable energy production on existing sites, often with greater community acceptance compared with establishing entirely new greenfield sites. Replacing kilowatt-scale turbines in older sites with new multi-megawatt options can significantly increase efficiency of existing assets.

However, repowering activity has been sluggish at best across Europe. In the absence of financial support from governments, rock bottom wholesale prices during the COVID-19 pandemic offered no incentive to repower older assets, and conversely, sky-high prices since 2022 have encouraged owners to keep assets operating rather than take them offline to be repowered. Now that power prices have started to fall back from their historic highs — something that is most visible in Spain due to the gas price cap— repowering is looking more attractive.

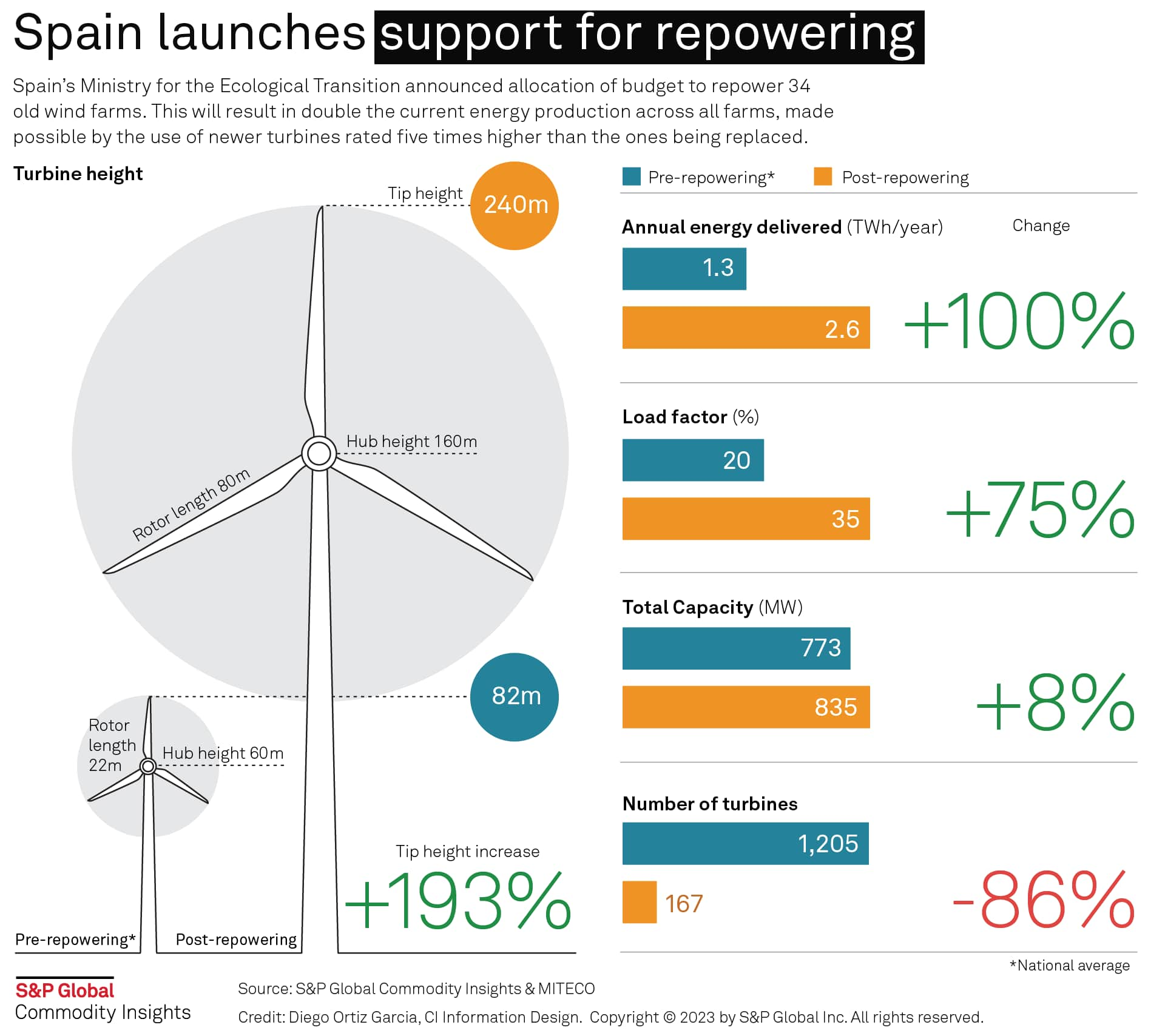

Spain has introduced new legislation to make repowering more accessible. The Royal Law Decree 23/2020, passed in 2020, allows developers to relocate renewable units within a 10-km range while staying within the designated development area. Furthermore, if the capacity is increased, grid access can be boosted by 5% while behind-the-meter capacity can be augmented, and on-site storage can be implemented. Furthermore, as of Nov. 30, 2022, Spain initiated its first auction under the "Circular Repowering" program, allocating €132.5 million in one-time support for repowering projects to fund the expenses linked to the reconstruction of those parks with new turbines.

As a result of that 34 onshore wind projects will replace 1,205 old wind turbines with only 167. This will result in an 8% increase in nameplate capacity, to 800 MW, and nearly double the current energy production (average capacity factor will increase from 20% to 35% for turbines of 0.6-5 MW that are replaced). Budget was fully used demonstrating interest from developers.

While onshore wind assets have a design life span ranging from 20 to 30 years, they can continue to operate far beyond with reactive maintenance, until a prohibitively expensive repair needs to be done. Most wind turbine manufacturers offer "lifetime extension" programs, which guarantee an additional approximate decade of operation, often accompanied by a modest boost in energy yield. This can include partial repowering when the substructure of the tower and foundation is untouched. The cost of such extensions varies but generally remains under 10% of the initial capital expenditure. Decisions to undertake these extensions are often made around the 10th year of operation to facilitate the gradual amortization of the additional costs while the asset continues to receive support.

In contrast, repowering involves replacing old wind turbines with new, larger and more efficient ones. This implies the full decommissioning of old tower substructure and foundation and building new ones to welcome the bigger turbines. This option has significant advantages. Many early wind projects were set up in areas with abundant wind resources. When you replace an old turbine, you can generate 4 to 5 times more energy in the same space with fewer turbines. Moreover, the overall cost can be 5%-20% lower compared with starting a completely new project. Depending on the rules and regulations, such as the need for a new planning permit, repowering can be made easier and allow for additional capacity. For instance, in Spain, the permitting process remains unchanged as long as the new capacity does not exceed 105% of the original capacity.

However, in most markets, repowering faces challenges. Developers often need to go through a long and more stringent process than when they initially set up the project. This means that a significant portion of existing wind farms may find it difficult to undergo repowering due to stricter regulations, height restrictions or limitations in grid capacity, which can restrict the potential for upgrades. This is why many wind asset owners choose to invest in life extension programs instead of repowering.

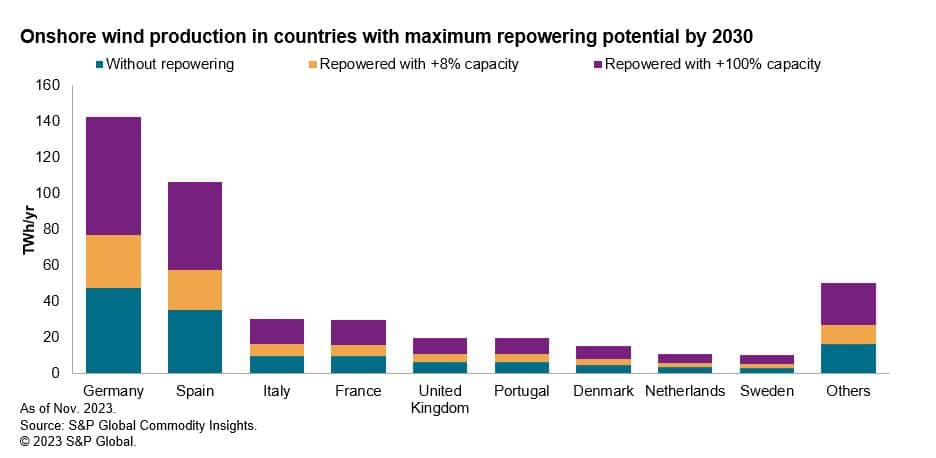

By 2030, a total of 83 GW of onshore wind capacity will be more than 20 years old across Europe. Without repowering, these aging assets would generate approximately 146 TWh annually before closing eventually. However, by following Spain's example, where 8% is added to the original capacity, the energy output could increase to 236 TWh. If a more ambitious approach is taken by doubling the capacity during repowering, then the energy production could reach 437 TWh, nearly triple that of the non-repowered fleet, all without requiring additional land. However, increasing capacity would necessitate a substantial investment in the grid to accommodate this expansion. This investment could pose a barrier, leading many countries and developers to opt for reducing the number of turbines and maintaining the current capacity instead.The repowering of wind could be an opportunity to add solar capacity or storage to optimize the use of the connection by adding assets behind-the-meter that can produce at different times to the wind farm.

Repowering demonstrates some activity across Europe, particularly for older projects that are beginning to incur high maintenance costs. However, this activity remains limited; in most markets, a repowering project encounters similar challenges to those faced by a greenfield project, and developers will opt to maintain the status quo as development is often arduous and time-consuming. As certain markets begin to adapt regulations to welcome this untapped potential, the momentum for repowering could increase. The Spanish auction represents only a fraction of its overall wind fleet, indicating the need for greater support to make repowering truly impactful. A genuinely enabling framework is required to fully capitalize on this opportunity. We anticipate that repowering activity could grow significantly in the 2020s and 2030s. Achieving European climate goals necessitates a substantial expansion of onshore wind capacity.

Further details are available for subscribers here. If you are not a subscriber, to learn more about our EMEA Gas & Power coverage, more information is available here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.