Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 17, 2023

On 28 February 2023, Eni announced that the acquisition of BP's Algerian assets was complete and had been approved by the authorities. This shouldn't come as a surprise since BP first announced their intention to sell their Algerian portfolio in 2020, only two years after renewing the production concession.

For ENI, this is another move towards increasing their gas portfolio, not only in Algeria, but in Africa as a whole, and a move closer to the net-zero target that they set in 2016. ENI's integrated strategy for decarbonisation, is based on three pillars:

Combining gas and renewables is the ideal bridge to a low carbon future and the promotion of gas is key to ENI's decarbonisation strategy. Gas-fired power plants are more efficient than coal ones, producing about half the carbon dioxide emissions and gas is competitively priced and reliable. In November 2018 Eni brought on stream the 10MW solar photovoltaic (PV) plant at the Bir Rebaa oil field in Algeria and in November 2022, a solar photovoltaic panels research facility was inaugurated and construction of a second 10MW PV plant started. This, together with Eni's focus on gas commercialisation show their commitment to the new strategy.

This strategy shift is further supported by the acquisition of BP's assets in Algeria. Over the past year, ENI has made bold moves towards increasing gas production in Africa, such as the Final Investment Decision (FID) on the Marine XII FLNG project in Congo, the agreement with the Libya authorities to move ahead with the "Structures A&E" gas projects (approximately 750 million cubic feet per day (MMscf/d)) and the agreements signed for the Eni-Snam partnership in the international gas pipeline connecting Algeria to Italy (the Trans-Mediterranean (TransMed) Pipeline). In addition, in November 2022 Eni lifted the first LNG cargo from the Coral Sul Floating Liquified Natural Gas (FLNG) vessel in Mozambique and in July 2022 the New Gas Consortium operated by Azule Energy (50/50 independent joint venture BP/Eni) confirmed FID for the first non-associated gas development in Angola with production to start in 2026 (~ 400 MMscf/d).

Eni has stated that Algeria is a key country for the diversification of natural gas supply and the top supplier for Italy through the TransMed pipeline. In April 2022, Eni met with government and Sonatrach officials to discuss increasing Algerian gas exports to Italy in light of the current energy crisis due to the Russian-Ukranian conflict. On 26 May 2022 Eni signed a memorandum of understanding (MoU) with Sonatrach to accelerate the development of gas fields discovered in Algeria.

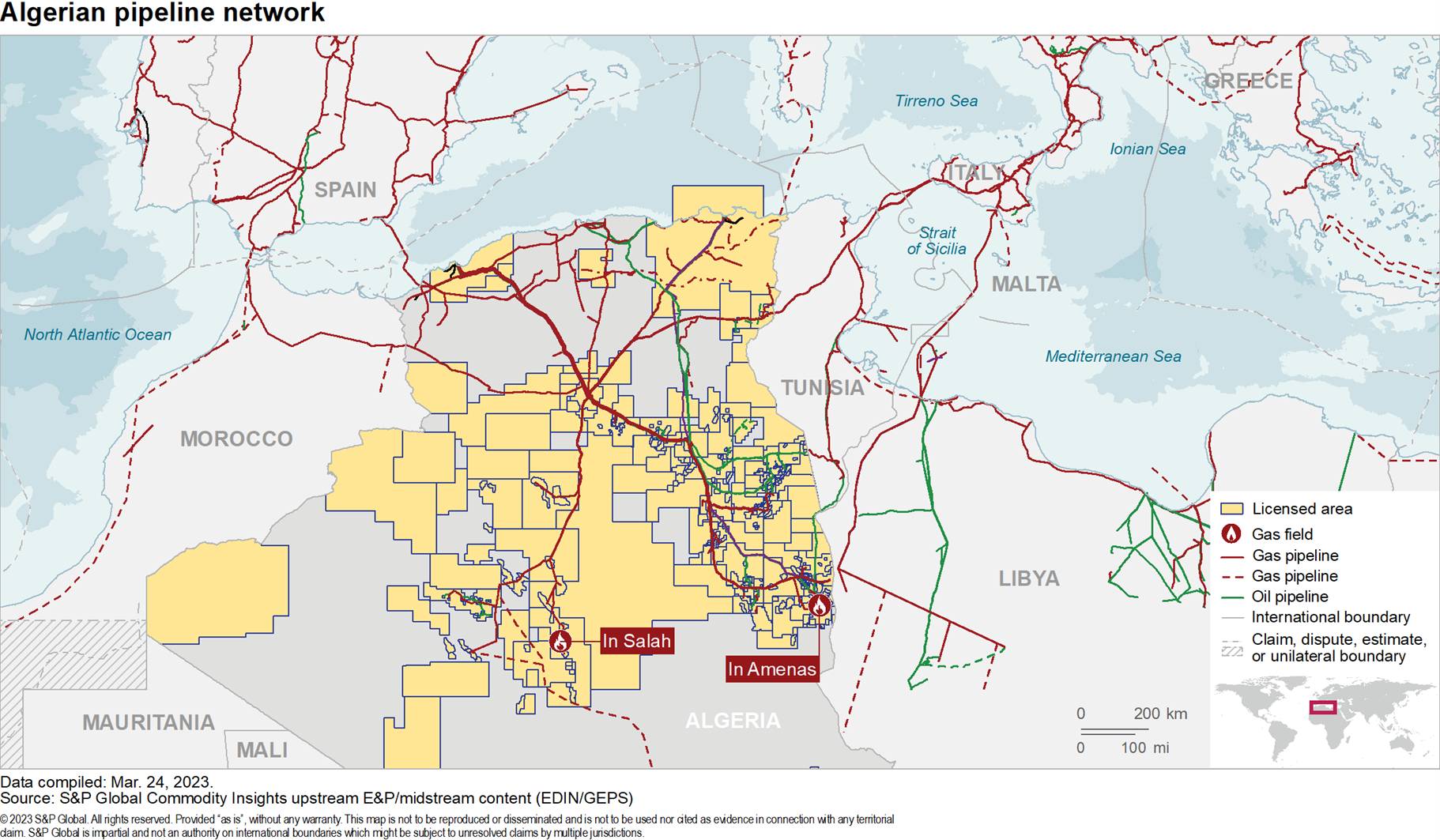

BP's portfolio in Algeria consists of the In Salah Gas Project (33.15% WI) and the In Amenas Gas Project (24.5% WI). These two massive gas projects came online in 2006 and 2004 respectively and are estimated to have contributed to the country's gas production with 1,200 MMcf/d, more than 15% of the country's gas production. The two fields/projects are estimated to have a current recovery factor of 60-70% and another 20 years of production life at healthy production rates. The net present value (NPV) of the portion of the In Amenas and In Salah gas projects acquired by Eni had NPV's of 0.5 - 0.75 billion US dollars and 0.3 - 1.3 billion US dollars respectively (@ $5 to $15/ thousand cubic feet (Mcf)).

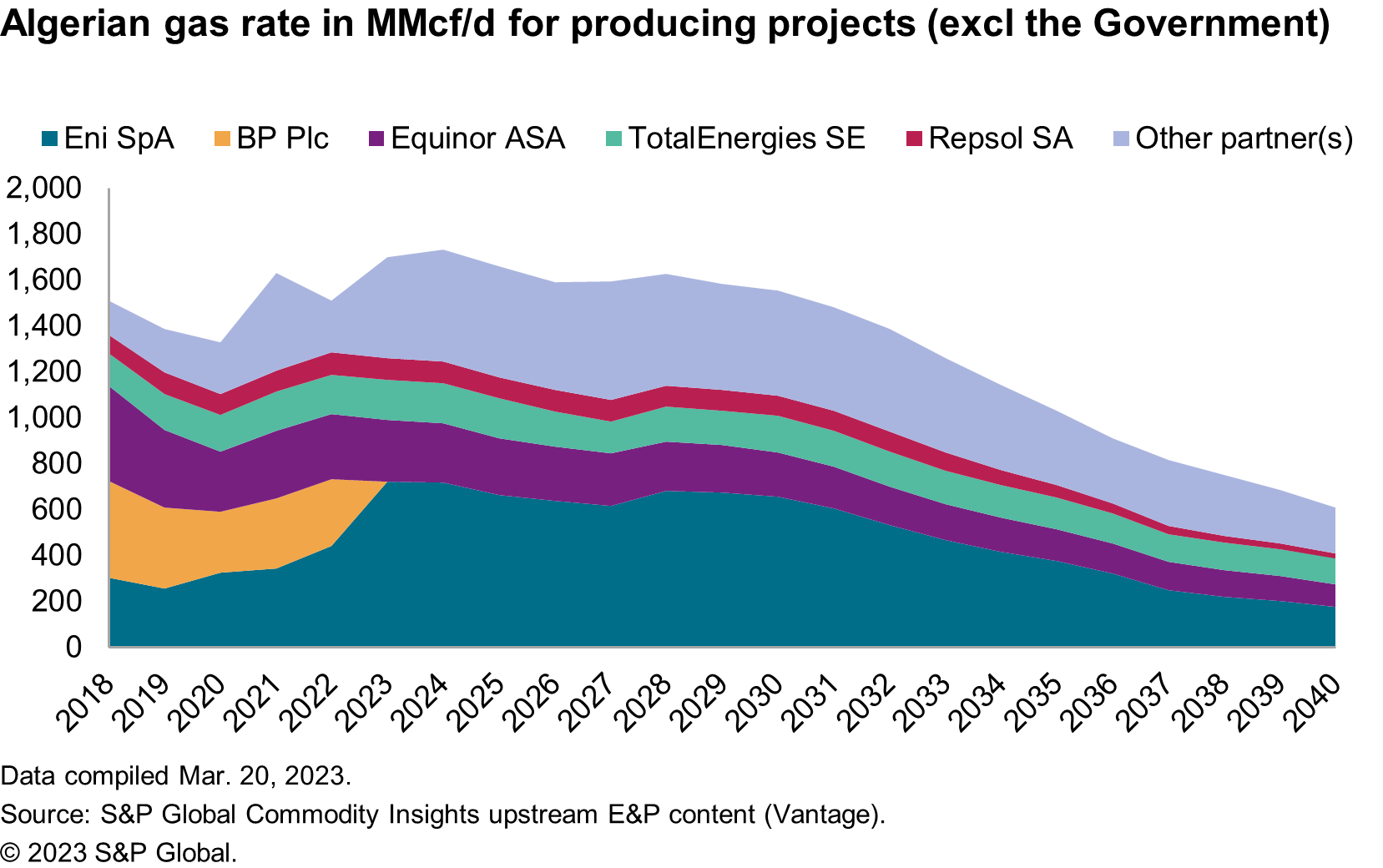

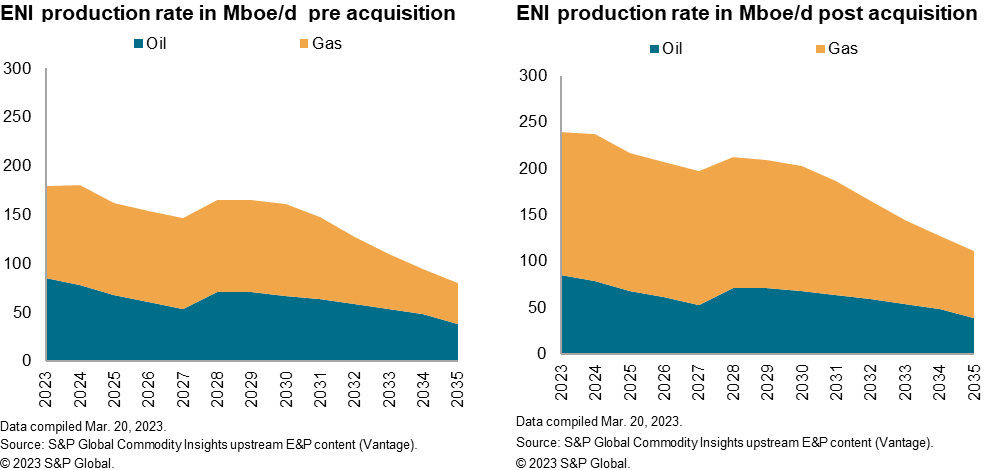

The acquisition of BP's portfolio is estimated to increase Eni's gas production in Algeria, by ~60% and their operatorship in gas projects will almost triple, bringing more than 40% of the country's gas production (excluding the government which accounts for 80%) under ENI's control. ENI is already operator of the Bir Rebaa Nord, Erg El Ouar and In Amedjene Nord gas projects and the recent Berkine Sud project which started production in 2022.

Eni and BP were the top two gas producers in Algeria in 2022, with BP contributing 16% and Eni contributing 26%. This means that after the acquisition Eni will have 42% of the gas production from independent oil companies (IOC's) and become the dominant gas producer in the country. It was reported in December 2022 that Eni may buy Neptune Energy as well which currently operate the Touat Gas Project in Algeria with a capacity of 505 MMcf/d.

In 2022, Eni SpA had a gas/oil production split in Algeria of ~50%, however after the acquisition the gas production will increase to around 64% of the total production.

Not only will the acquisition of these assets strengthen Eni's position in the gas industry of Algeria, but it is also in line with the company's decarbonisation strategy and their goal of carbon neutrality by 2050. Eni's progressive decarbonisation strategy has a target of an overall 43% reduction in emissions per barrel produced by 2025 compared to 2014.

Eni has clearly stated its intent to focus on gas in Africa, with increasing gas production for energy generation a key bridge to decarbonising their portfolio. The acquisition of BP's assets in Algeria is putting this strategy into action and more deals like this one can be expected in the near term from Eni as they continue to actively implement their decarbonisation strategy.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.