Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jan 11, 2023

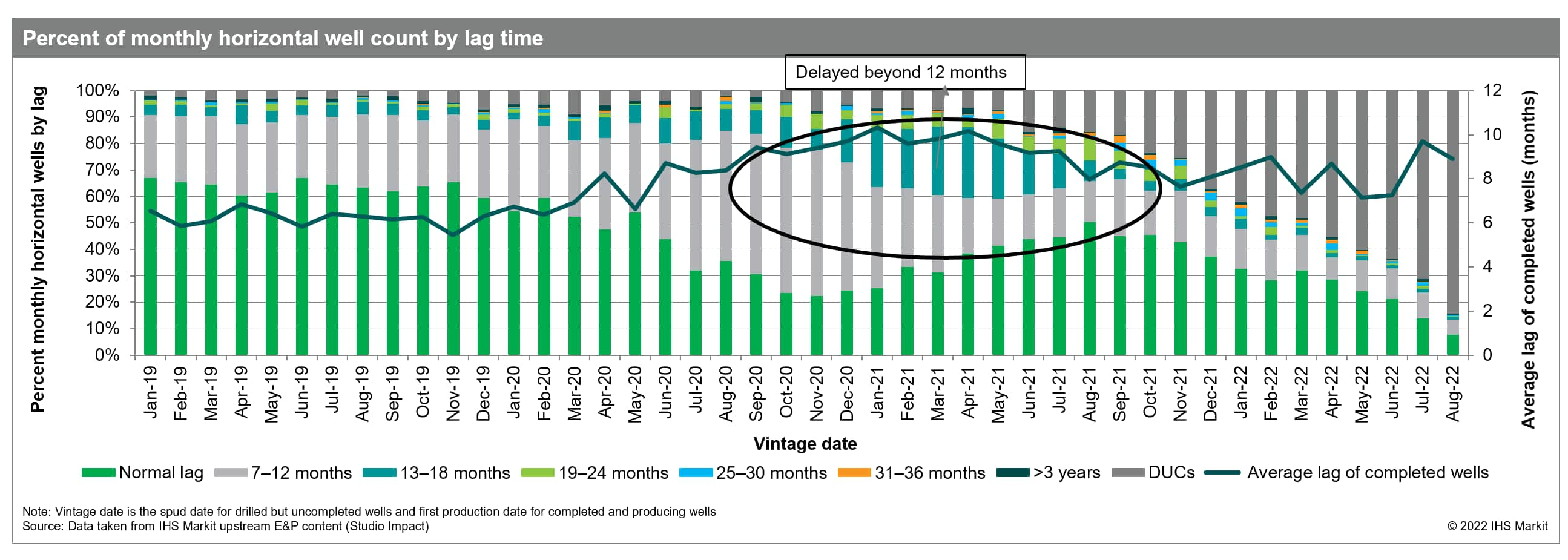

Drilled but uncompleted well (DUC) backlogs provide flexibility in operations and have been a key asset to support producers as they transition to a return-focused business model. A pad of oil and gas wells is generally completed within 6 months after commencing drilling on the first well, but some pads are not completed in a normal lag time due to takeaway constraints, service sector constraints, and economics. The number of DUC wells naturally increases when the average time to complete a well rises. During the pandemic, operators built up a large inventory of drilled but uncompleted (DUC) wells, as producers were unable to exit drilling rig contracts but fled shorter duration completion agreements. They reduced budgets and deferred completions to await better prices. Operators accumulated more than 8,000 net DUCs in 2020 as drilling outpaced completions.

In 2021 and early 2022, as crude oil prices started to recover, many operators started completing backlogged DUCs. The capital-efficient DUCs (bringing a DUC onstream requires only 65% of the total well spend as drilling capital is sunk) allowed operators to grow production while demonstrating capital discipline and returning cash to investors. The average rig count in 2021 rose to only 515 rigs from an average of 422 in 2020. However, in the first half of 2022, as the number of DUCs started falling, operators increased capital spending to bring drilling activity more in line with completions. The rig count in 2022 rose to more than 800 rigs, and we forecast that to average 761 in 2022, an increase of 246 rigs from the 2021 average.

Cost inflation and tightness in service sector capacity are limiting the rate of completions and increasing the lag time of the drilled wells. DUC inventories have begun to rebuild in some plays in the second half of 2022. As of October 2022, there are 4,900 net DUC wells in the major oil and gas plays with 70% in Class 1-3 and 38% in top two class acreages.

The nature of the DUC has changed in the past three years, as operators readjust to a post-lockdown, returns-focused business model. Only 35% of 2019 spuds showed drill-to-complete lags of more than six months. Post-pandemic, in 2021, the average lag increased such that 45% of wells had a greater than six months lag.

Furthermore, as DUC's were liquidated, the percent of wells that were completed between 7 and 12 months after drilling fell significantly, shifting about 20% of wells from a 7-12 months lag to a 13-24 months lag.

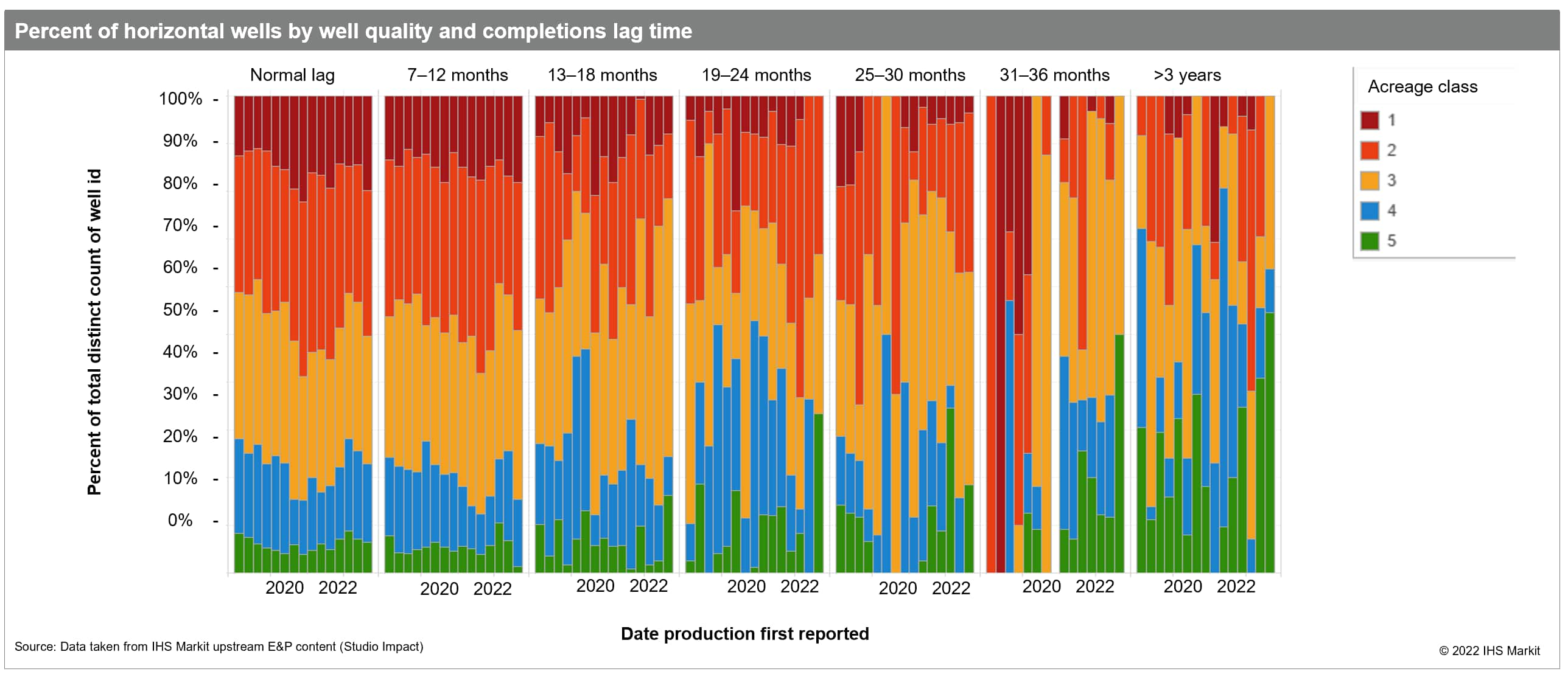

Operators optimize production growth by bringing better wells online more quickly and delaying their lower-tier locations. The quality of delayed wells is generally lower than those completed within the first year of drilling. Only a quarter of wells completed more than 24 months after drilling occurred on Class 1 or 2 acreages, while almost half of the wells brought within 12 months of drilling are in Class 1-2 acreages.

Subdued activity levels exacerbate the long lag times. Rig growth for global operators stayed at 25% of 2019 levels until mid-2021, while production continued to grow as they relied more on DUC conversions. Unconventional plays where 2021 drilling activities stayed at 40% or below 2019 levels, showed a drastic increase in completions delays. Operators in these plays heavily relied on the DUC backlogs to maintain or grow production in 2021.

Although DUC backlogs continue to get liquidated, service sector constraints and cost inflation are aggravating the lag times between drilling and completions and delaying production growth from the rise in activities.

This article is from the detailed "Drilled but uncompleted wells: Extended lag time from drilling to completions to slow down 2023 supply growth" report available only to our subscribers. Learn more about Plays and Basins service.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.