Despite the recent surge of policy incentives for carbon capture projects, the world is not on track to meet the CO2 reductions expected from this technology by 2050:

- Supercharged incentives for carbon capture projects in the last year have accelerated the momentum that this market is experiencing. From the USA, increasing more than 70% the tax credits for carbon capture projects, to Europe looking into mandating 50MMTPA of CO2 storage for oil and gas producers, the policy landmark for carbon capture projects is evolving quickly to improve the conditions for this technology.

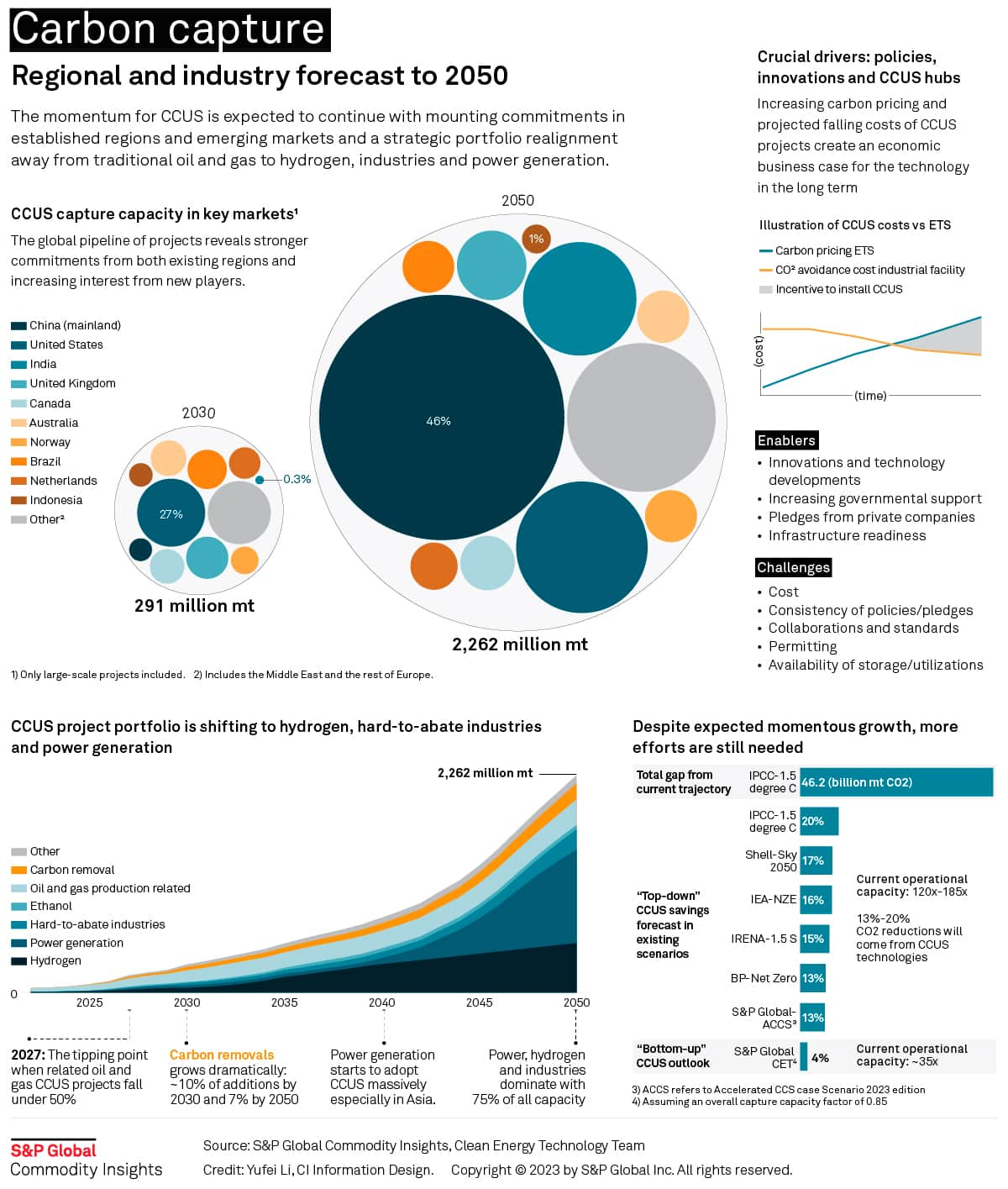

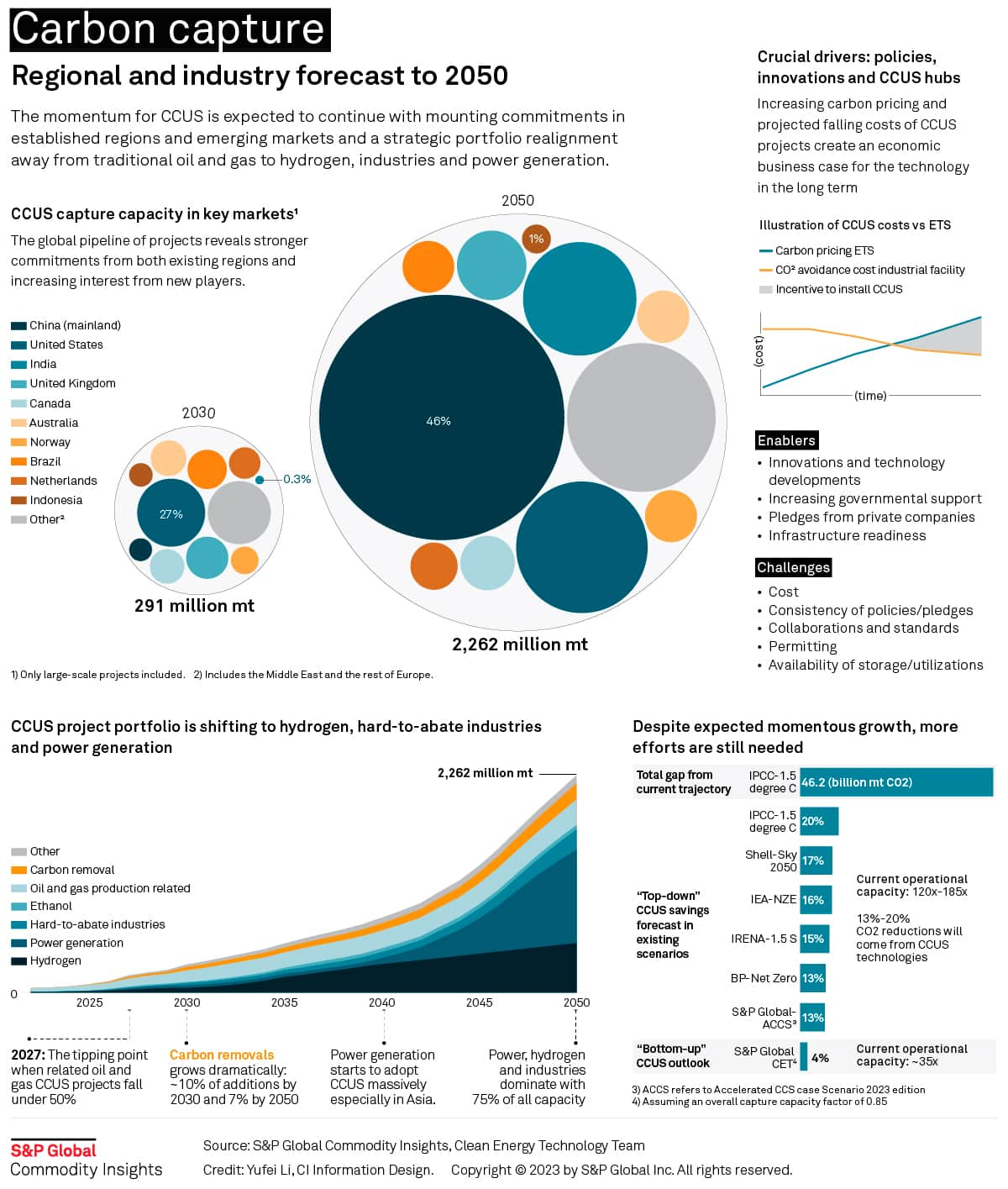

- Despite the expected momentous growth in carbon capture (see the S&P Global Energy CCUS projects analytics dashboard - part of the Clean Energy Technology service), more efforts are needed to close the gap between the projected CO2 capture capacity installations and the expected CO2 reduction amounts to meet the climate ambitions. S&P Global developed a bottom-up outlook for CO2 capture capacity installations using an "emitter-driven" methodology that incorporates: S&P analysis on country attractiveness, S&P CCUS project analytics, S&P database on emitters profile, carbon pricing and emissions, expertise of S&P's industry and regional specialists, and characterization of high-level CO2 storage capacity.

- The S&P Global Energy outlook indicates that by 2030, we will have operational projects able to capture around 25% of the 1 Gigaton of CO2/y needed to meet the Net Zero Scenario from the IEA, putting in perspective how even in the short-term we are far from meeting the climate goals. Although North America and Europe are leading the way accounting for more than 67% of the projected capture capacity installed, the CCUS industry still needs more incentives from other regions to get closer to the climate targets.

- The gap is exacerbated when the S&P Global Energy CCUS capture capacity outlook by 2050 is compared to scenarios like the IPCC-1.5 degree Celsius. Our S&P Global outlook estimates the capture capacity will reach 2.2 Gigaton of CO2/y by 2050 mainly driven by China, which translates into only 4% of the expected CO2 reductions by the IPCC-1.5-degree Celsius scenario. Although S&P outlook estimates a historical growth in capacity installations for the next three decades, the CCUS industry still needs a significant improvement in the crucial drivers like policy, technology innovations and CCUS hubs to close the gap between the expected and the needed capture capacity to meet our climate targets.

For more information regarding our CCUS market coverage, alongside the fundamental insights and data on the most important clean energy technologies, delivered as part of our Clean Energy Technology service, please click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.